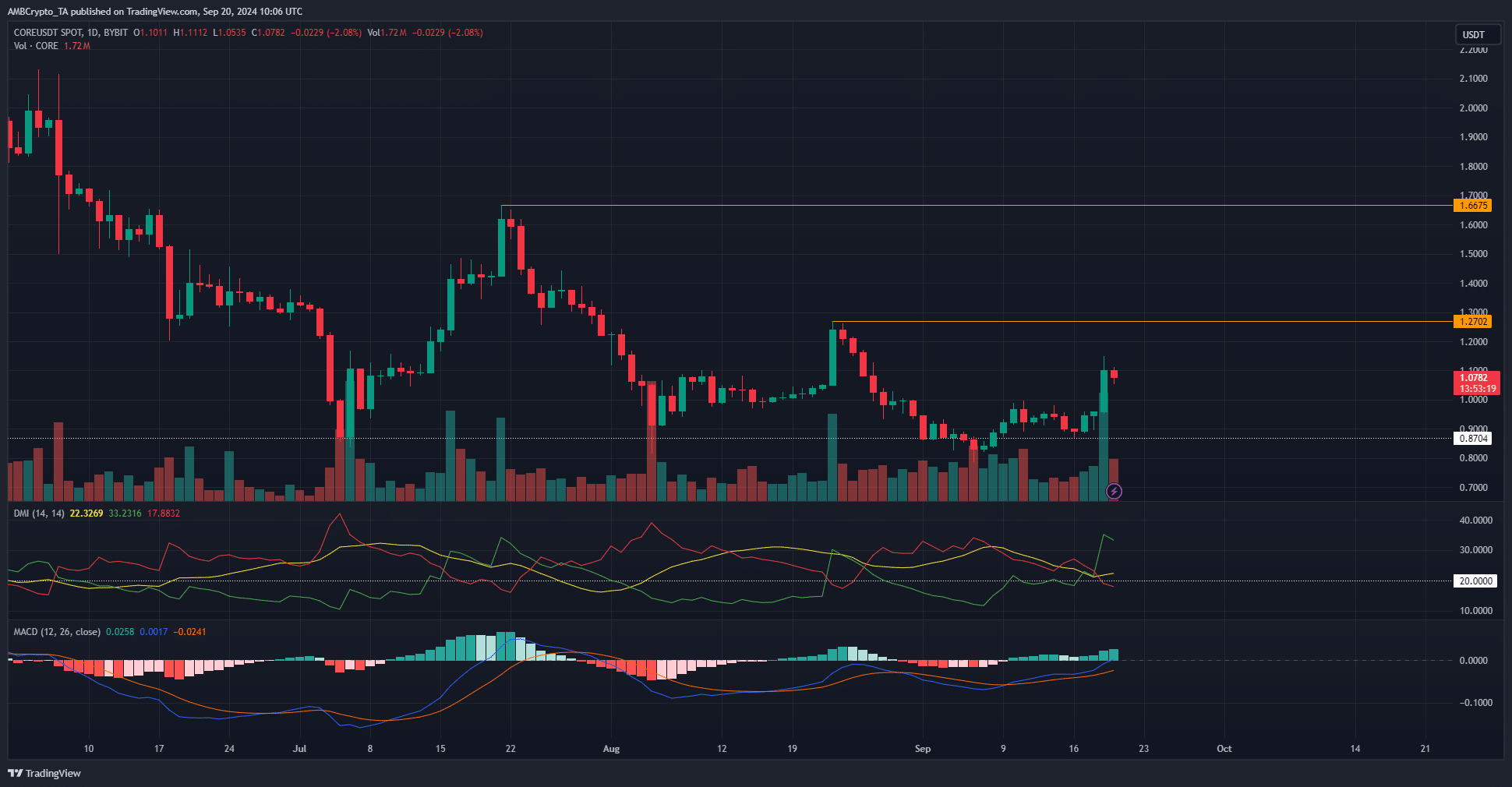

- Core crypto’s market structure on the daily chart remained bearish.

- The 32% gains posted earlier this week could see a minor retracement.

As a seasoned researcher who has navigated numerous market cycles and trends, I find myself intrigued by Core crypto’s recent performance. The daily chart suggests a bearish core structure, yet the bullish trajectory this week has been nothing short of impressive. If history is any guide, a minor retracement could be on the cards after such substantial gains, but the $1 region presents an enticing buying opportunity.

Core cryptocurrency saw another uptrend as it surpassed the significant $1 barrier, a psychological milestone. Both the market direction and trading volume indicated that the bulls were in control.

Testing the $1 area again might offer a chance to buy, with potential for an additional 30% increase in value for Core cryptocurrency.

The long-term Core crypto downtrend is unbroken

On the 16th of September, we saw an upward cross of the daily Moving Average Convergence Divergence (MACD) over the zero line, suggesting a change in momentum. Meanwhile, both the trading volume and the price have been consistently rising since that date.

This was a positive sign in the short term and increased the chances of more gains.

As a crypto investor, I’ve noticed an encouraging sign: the Directional Movement Index suggests a bullish trend is on the horizon. The green +DI line and the yellow ADX line are both hovering above the 20-mark, indicating a robust upward trajectory that’s underway.

For the near future, the market signals and movements indicate a potential bullish trend; however, the long-term descent is ongoing. A possible return to the $1 level might offer a chance for purchases with an aim at $1.27.

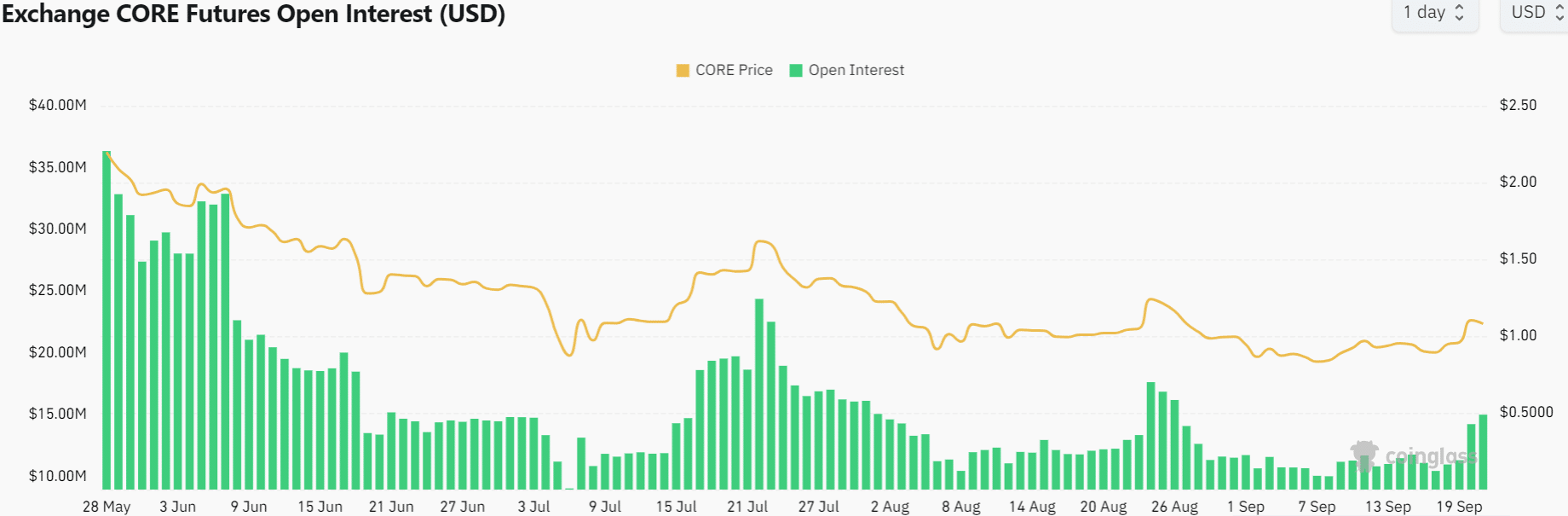

Futures data agrees with bullish outlook

Over the past few weeks, there’s been a consistent decline in the Open Interest. However, it experienced a surge towards the end of August, and it has risen again over the past couple of days.

Between the 17th and 20th of September, the OI significantly increased from $10.46 million to $15 million. This surge was accompanied by a 23.25% rise in price, indicating that investors had become more optimistic, choosing to hold onto positions for potential future profits.

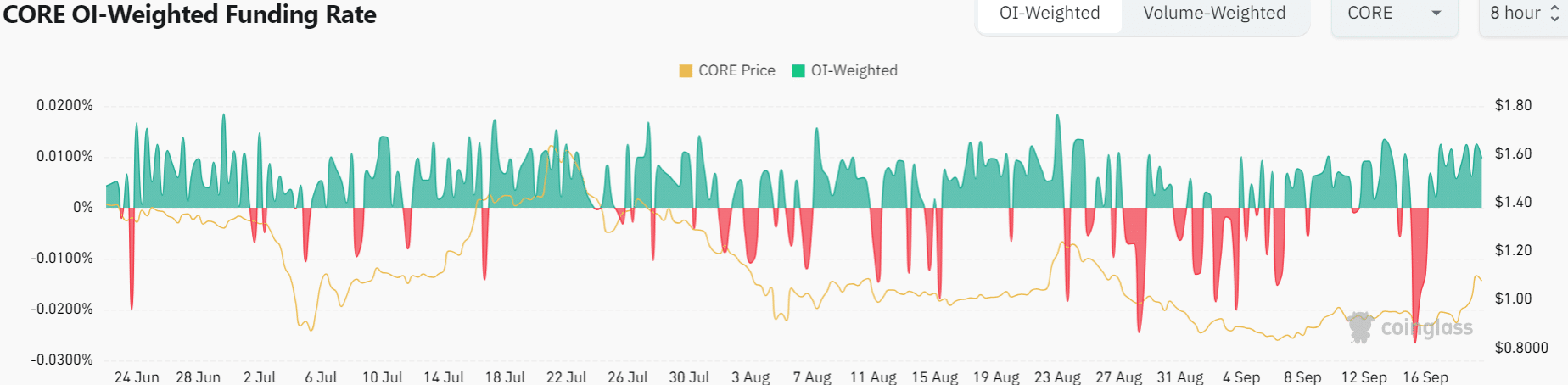

On September 16th, the OI-funding rate plunged significantly into negative zones. However, it bounced back into positive regions on the 17th, and the prices started to rebound as well.

Read Core’s [CORE] Price Prediction 2024-25

This showed that speculators were entering long positions.

Based on the analysis of future data, there’s an optimistic outlook for the near future. A small drop down to $1 might offer a good buying chance, potentially leading to a rise in price back up to around $1.27.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-09-21 04:07