- ATOM has shown strong resilience amid the recent market-wide rally, reclaiming key levels such as the 200-day EMA.

- Derivates data showed mixed sentiment, with a slight edge for the bears.

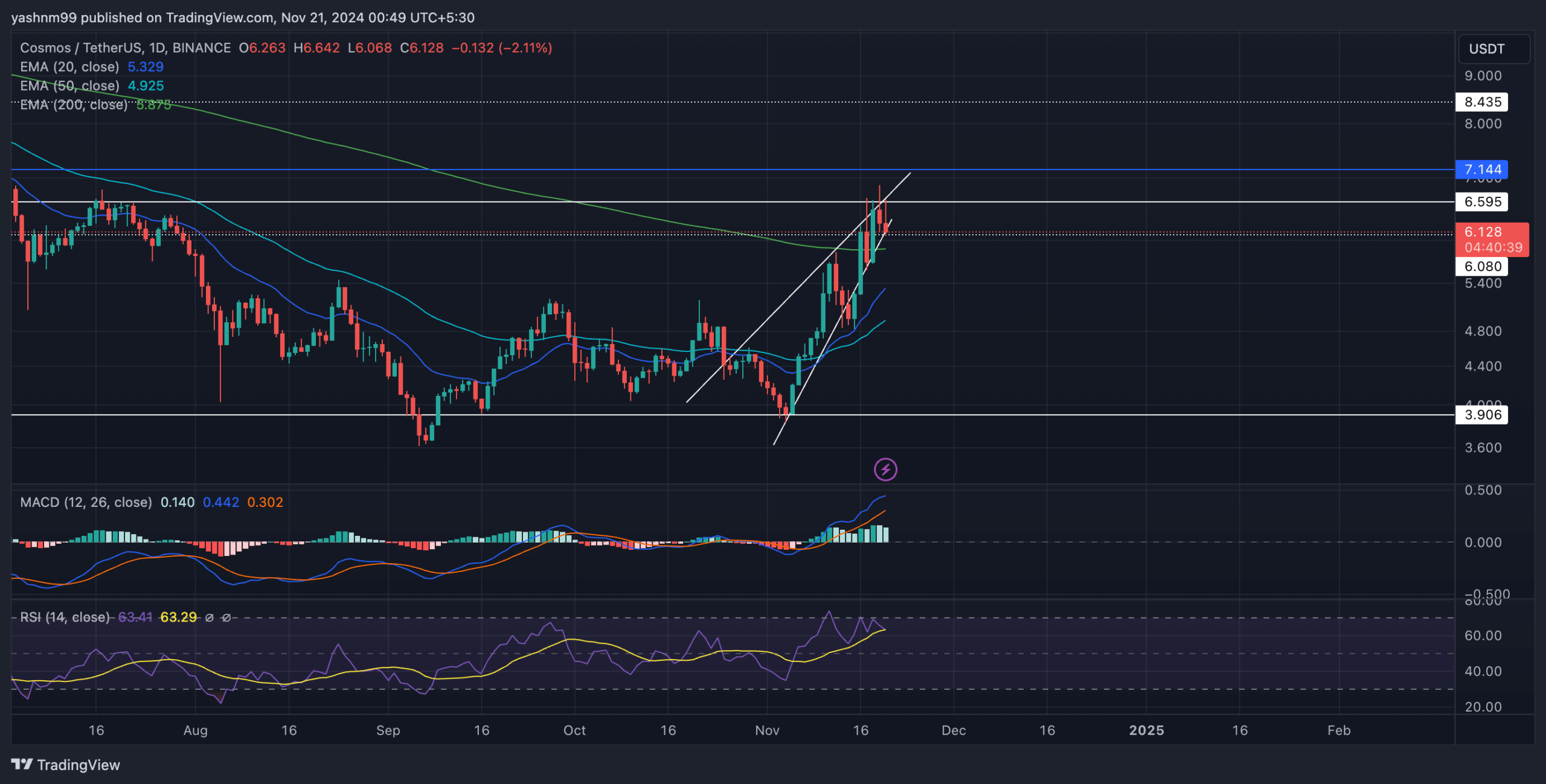

As a seasoned researcher with years of experience navigating volatile markets, I find myself intrigued by Cosmos [ATOM]’s recent performance. The altcoin has shown remarkable resilience and strength, managing to reclaim key levels such as the 200-day EMA in just two weeks. However, it’s crucial to remember that a rising wedge pattern often signals a temporary peak, so we must tread carefully.

In just two weeks, Cosmos (ATOM) experienced a significant surge of approximately 65%, driven by the overall positive market trend. This altcoin achieved substantial growth and moved beyond its 200-day Exponential Moving Average (EMA), reinforcing a bullish perspective for the future.

Traders using ATOM need to focus on significant price points now, as the market’s movement seems to be hovering near a vital resistance area.

Recent price action and EMA overview

The pattern in ATOM’s price movement suggests a developing uptrend, signaling increasing buyer interest. However, this pattern also hints that the current surge might be approaching a short-term zenith. At the moment of reporting, ATOM was being traded at $6.18, under a significant resistance level at $6.59 and experiencing substantial pressure from the upper limit of the emerging wedge.

During the recent surge, the 20-day Exponential Moving Average (EMA) at $5.33 and the 50-day EMA at $4.92 have served as strong foundations, allowing ATOM to surpass its 200-day EMA at $5.88. This movement above the long-term EMA suggests a possible change in the market trend towards a bullish one.

As a crypto investor, if we successfully breach the ongoing pattern and end the day trading above $6.59, it might pave the way for potential growth. It’s important to mention that should this happen, the next significant resistance lies at $7.14.

Yet, a drop beneath the present wedge formation might contradict the temporary bullish outlook, as price support could emerge near the EMA levels and approximately at $5.33.

The MACD experienced a bullish intersection, as the MACD line surpassed the Signal line in an optimistic region. This indicates persistent buying activity. Meanwhile, the RSI was at 64 after flipping from the overbought zone. At this point, buying pressure is predominant, yet it also implies a possible adjustment if bulls can’t push prices beyond the present resistance level.

As an analyst, if ATOM were to drop below its 200-day Exponential Moving Average, I’d identify the $4.9-$5.3 range as the immediate support for this altcoin. Conversely, should we see a successful move upward, the first significant resistance would be encountered at $6.59, which aligns perfectly with the upper boundary of the ascending wedge. A break above this level could potentially lead us toward the next resistance at $7.14.

Derivative data revealed THIS

Over the past 24 hours, ATOM’s trading activity dropped by approximately 35%, showing a more reserved approach from traders. Meanwhile, Open Interest dipped by around 4%, suggesting that some traders chose to wrap up their positions during the recent market fluctuations, potentially in an effort to lock in profits.

In simpler terms, the balance between long and short market positions slightly favored short positions, suggesting a market sentiment that leans towards neutral or slightly bearish, as suggested by the long/short ratio of approximately 0.932.

Read Cosmos’ [ATOM] Price Prediction 2024-25

Instead, let’s look at the data from Binance and OKX which shows a positive outlook for ATOM/USDT. The long/short ratios are currently 3.288 on Binance and 2.94 on OKX, indicating that traders on these platforms expect the rally to persist as they are heavily long.

Keep a close eye on Bitcoin‘s price fluctuations too, since the overall market mood is expected to impact the next direction of ATOM.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-21 11:03