- BTC has declined by 2.44% over the past 24 hours.

- Bitcoin’s NUPL suggest a potential to a record high of $130k-$160k.

As a seasoned researcher with years of experience in the volatile and intriguing world of cryptocurrencies, I find myself continuously astounded by the rollercoaster ride that Bitcoin (BTC) provides. Over the past 24 hours, BTC has dipped by 2.44%, a minor setback in the grand scheme of things considering its astronomical growth over the past year.

Bitcoin (BTC) has found it challenging to keep up an uptrend after reaching $108,364. After that, the cryptocurrency experienced a downward trend, dipping as low as $92,118. Consequently, over the last few weeks, BTC’s price has remained stable between approximately $92,000 and $107,000.

Currently, at the time of writing, the price of Bitcoin stood at approximately $96,298, which represents a drop of 2.44% in its value over the course of the day.

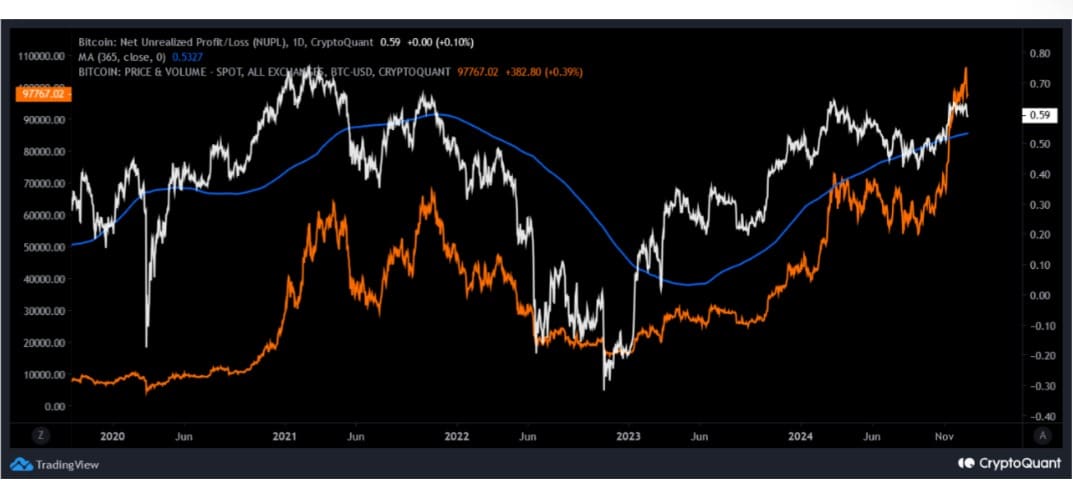

Although there have been some setbacks, stakeholders remain hopeful and view the drop as just a normal market adjustment before another surge. Furthermore, CryptoQuant analysts foresee a rally that could reach anywhere from $130,000 to $160,000 due to Bitcoin’s NUPL.

Bitcoin NUPL indicates a sustained bull rally

As an analyst at Cryptoquant, I’ve recently suggested that the Network Value to Transactions (NVT) ratio for Bitcoin implies we are approaching the final stages of its current cycle. My forecast targets a potential price range between $130,000 and $160,000.

In essence, we’re approaching a period in Bitcoin’s cycle where prices tend to surge dramatically before reaching their peak. During this phase, investors and traders are making significant profits, and the demand for speculative buying pushes prices upward.

As he explains, the incomplete profit/loss index appears to be shaping like a cup and handle chart, suggesting it could propel Bitcoin towards the projected price range of $130,000 to $160,000.

Forming a cup and handle pattern by NUPL indicates that accumulated gains might be pausing momentarily, with a minor downturn hinting at a brief pause in market enthusiasm, followed by a robust resumption of the uptrend.

Furthermore, Bitcoin managed to surpass the moving average (MA) of its Negative Upstream Price Level (NUPL) index over a 365-day period, suggesting a possible upward trend that could extend over the intermediate and long-term horizons.

What BTC charts suggest

Despite temporary setbacks in its upward trajectory, Bitcoin’s long-term outlook remains optimistic, indicating a robust potential for growth.

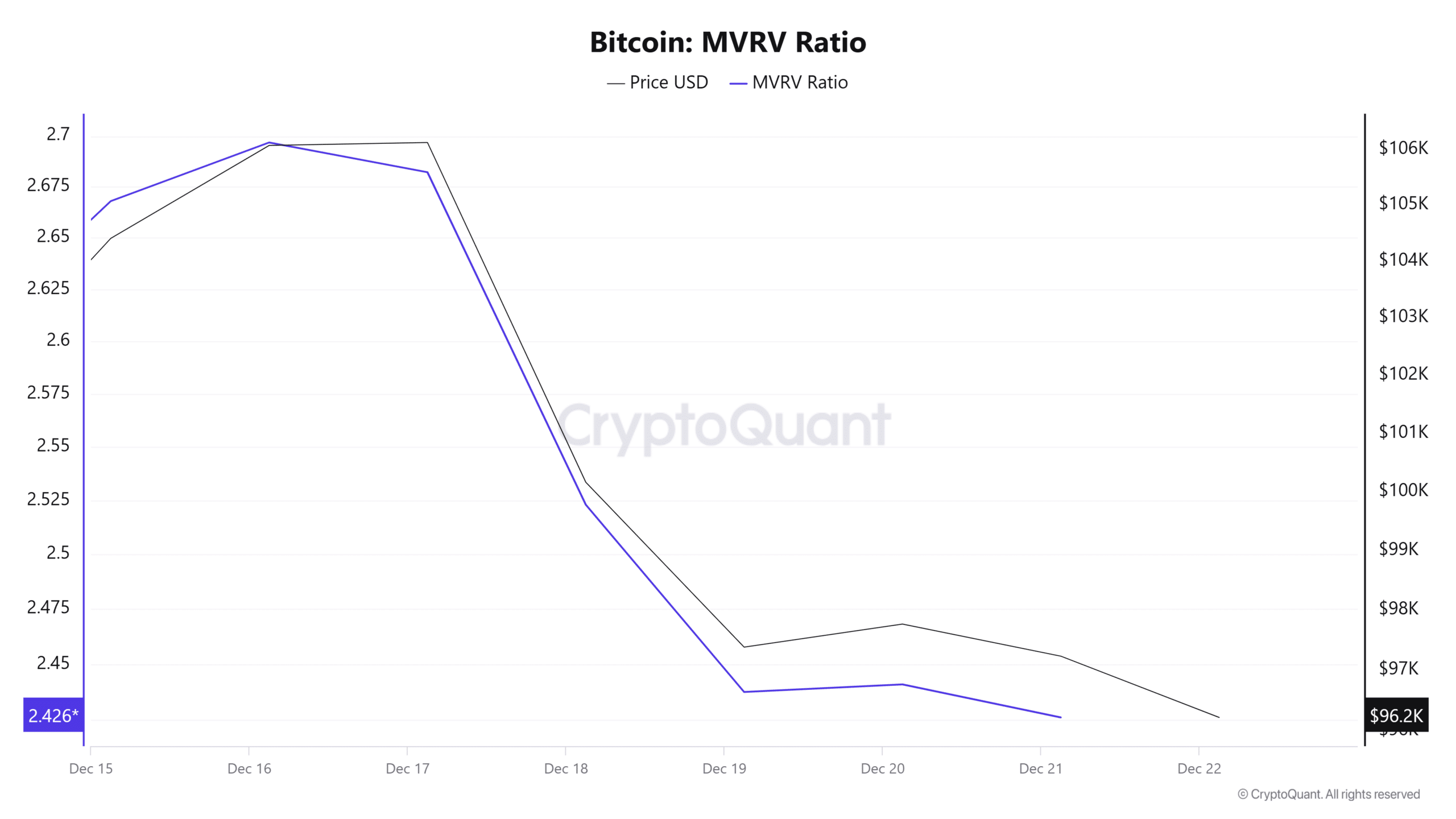

Initially, it’s worth noting that the MVRV ratio for Bitcoin has decreased to approximately 2.42 in the last seven days. Typically, when this ratio falls within the range of 2 to 3, it’s viewed as both optimistic (bullish) and neutral.

In other words, the market is neither too hot nor too cold, allowing buyers to make decisions based on an acceptable level of risk versus return. This suggests that the market may be stabilizing and could potentially experience a rise in prices.

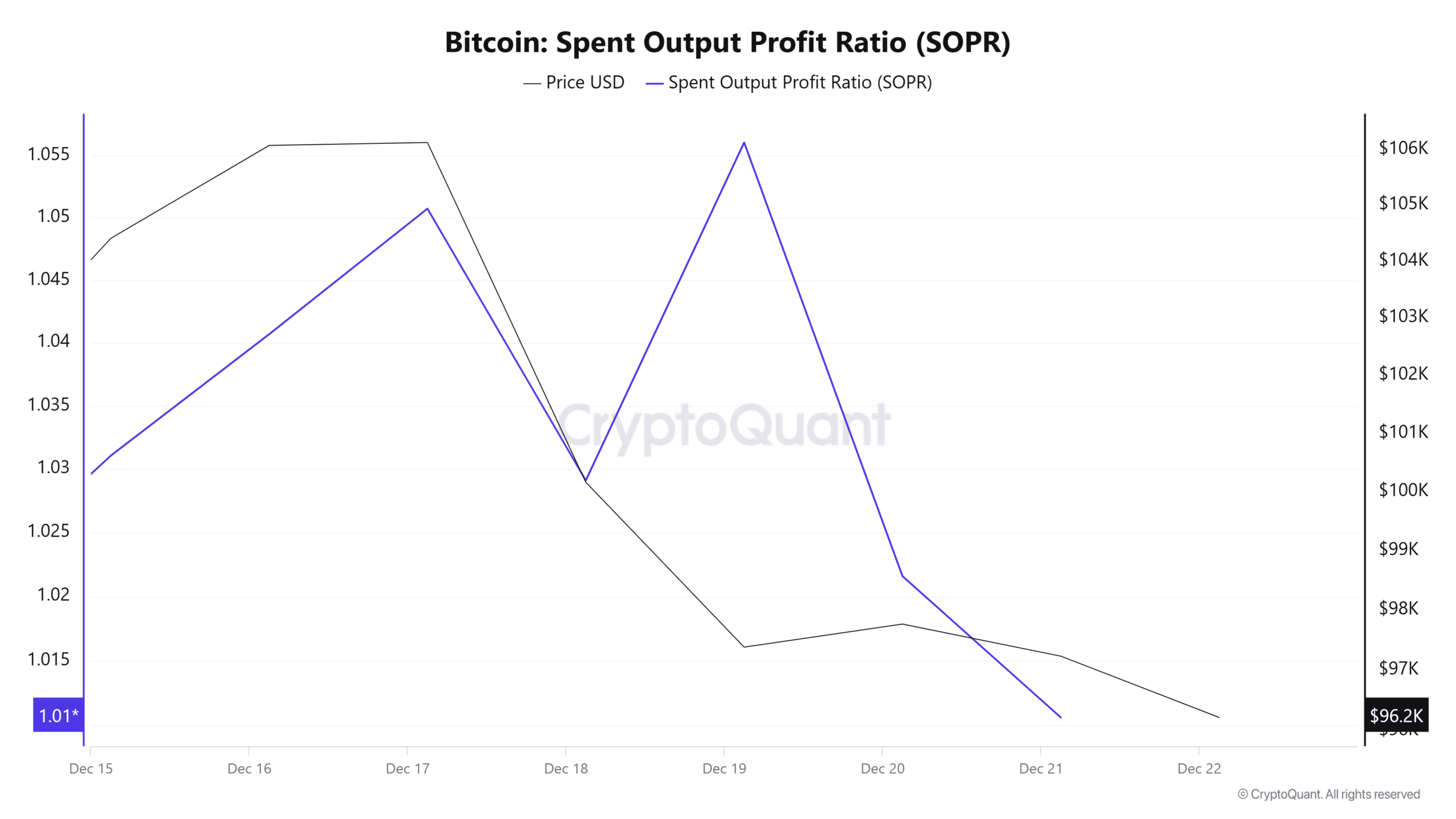

Moreover, Bitcoin’s Spend Output Profit Ratio (SOPR) has dropped but has remained steady at 1.01. When SOPR hovers around 1, it indicates that Bitcoin is approaching a neutral zone where the market equilibrium is tested. Consequently, long-term investors perceive this as a chance to gather more BTC from sellers with weaker positions.

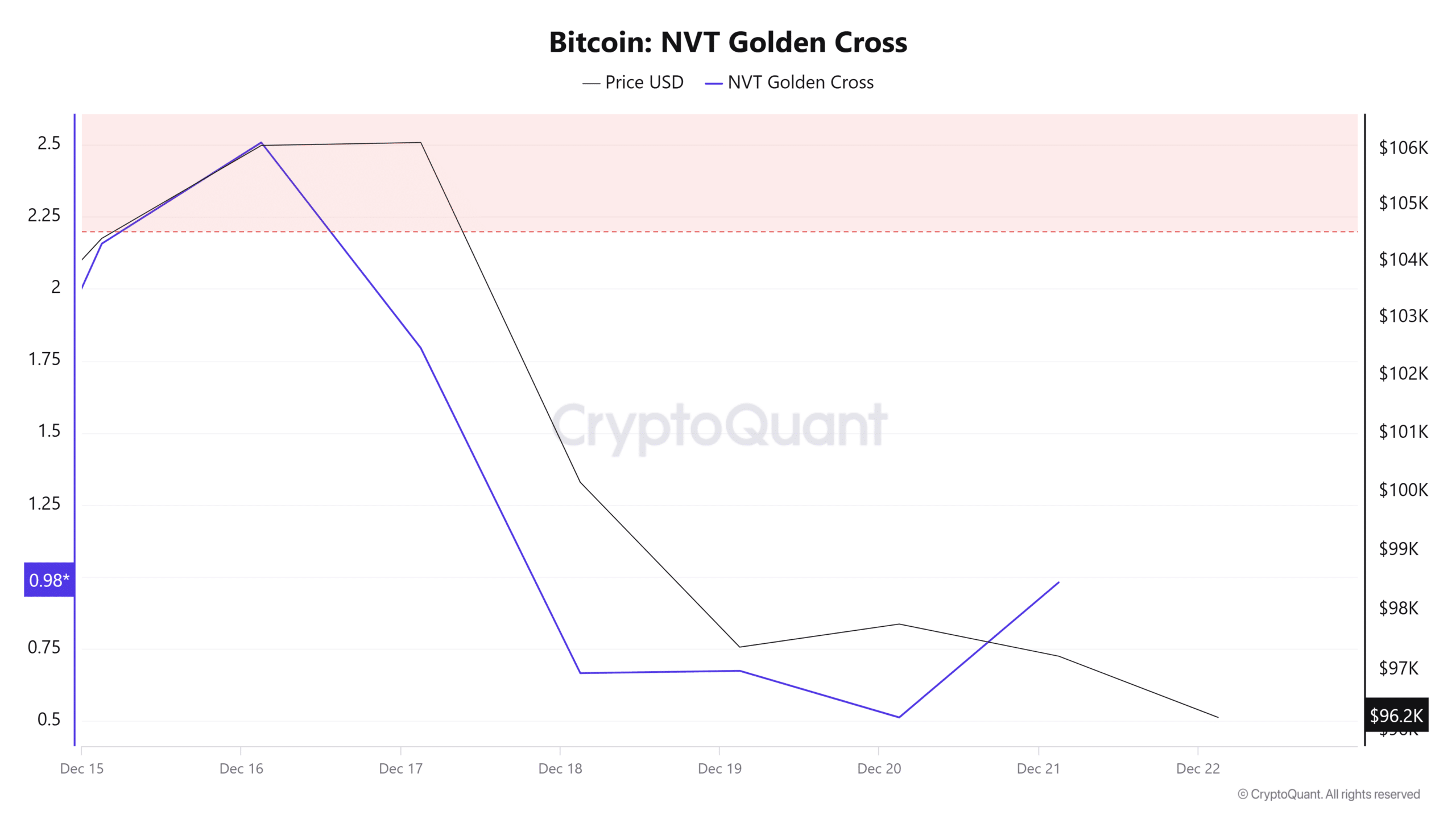

Ultimately, the NVT Golden Cross for Bitcoin has dropped to 0.98, signaling a bullish discrepancy. This suggests that despite the decrease, there’s an increase in transactional activity on the network, which is a positive sign of growing faith and confidence among users.

Read Bitcoin’s [BTC] Price Prediction 2024-25

From my perspective as an analyst, while Bitcoin has experienced a pullback recently, its underlying strengths suggest a likely rebound following this correction.

Consequently, these circumstances seem to suggest a possible shift in trend direction. If this occurs, the Bitcoin price might regain the $99790 resistance level. On the other hand, should the bears maintain their strength, the Bitcoin price could fall to around $95600.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-12-22 16:07