- The token holders were at a large loss, making recovery extra hard.

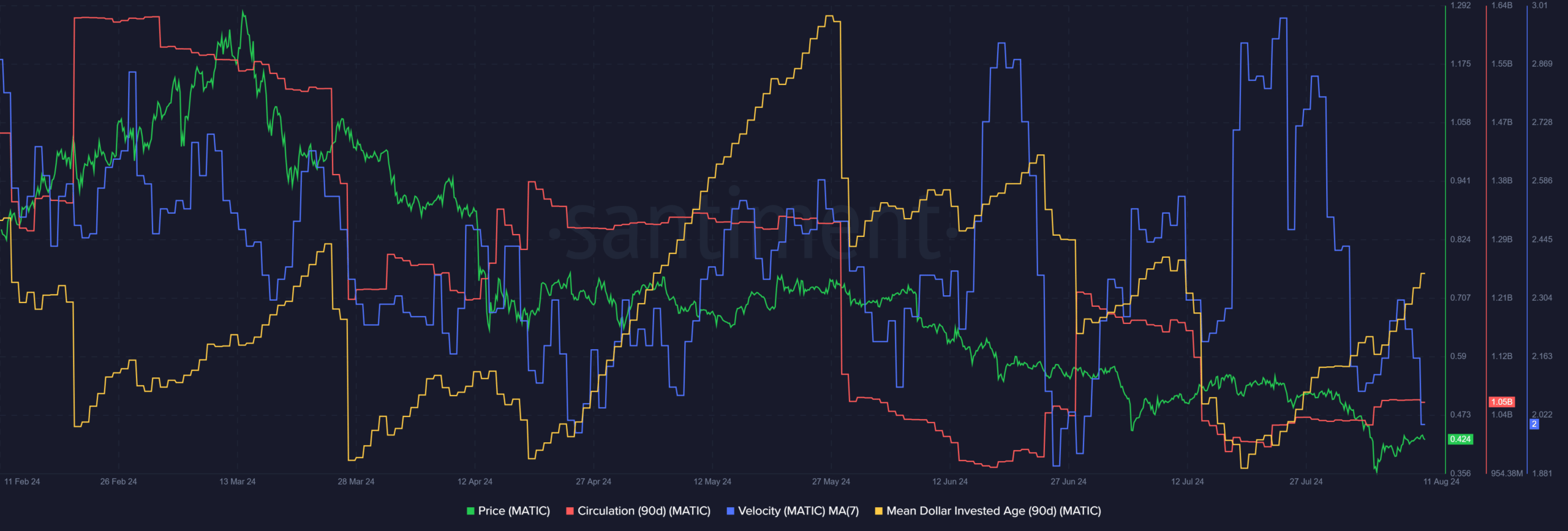

- The network MDIA showed stagnancy has begun to creep in.

As a seasoned crypto investor with battle-hardened resilience, I’ve weathered countless market cycles, and I must admit, the current situation with MATIC is testing my patience. The persistent downtrend since March has left many of us at a significant loss, making recovery feel like climbing Mount Everest barefoot.

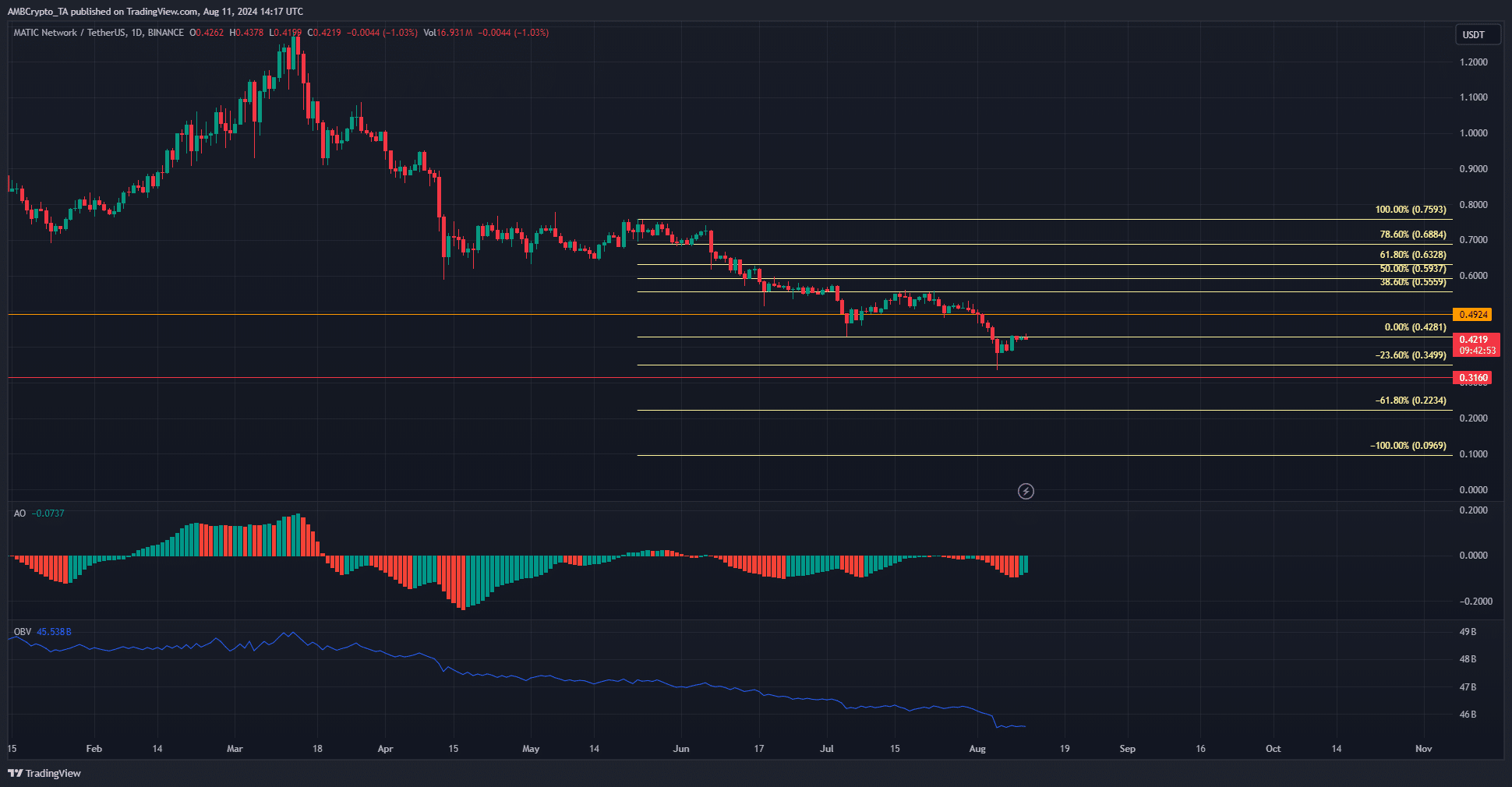

Initially slumping significantly, the cryptocurrency Polygon [MATIC] started to decline in early April on the daily chart, dipping below the $0.91 mark. As of now, MATIC is being traded under this year’s lowest value at $0.492.

In the ongoing struggle between bulls and bears, there wasn’t much progress to speak of. On the 5th of August, the token came close to matching its 2022 low of $0.316, dipping down to $0.334 on that day instead.

Network activity, accumulation not enough to halt the downtrend

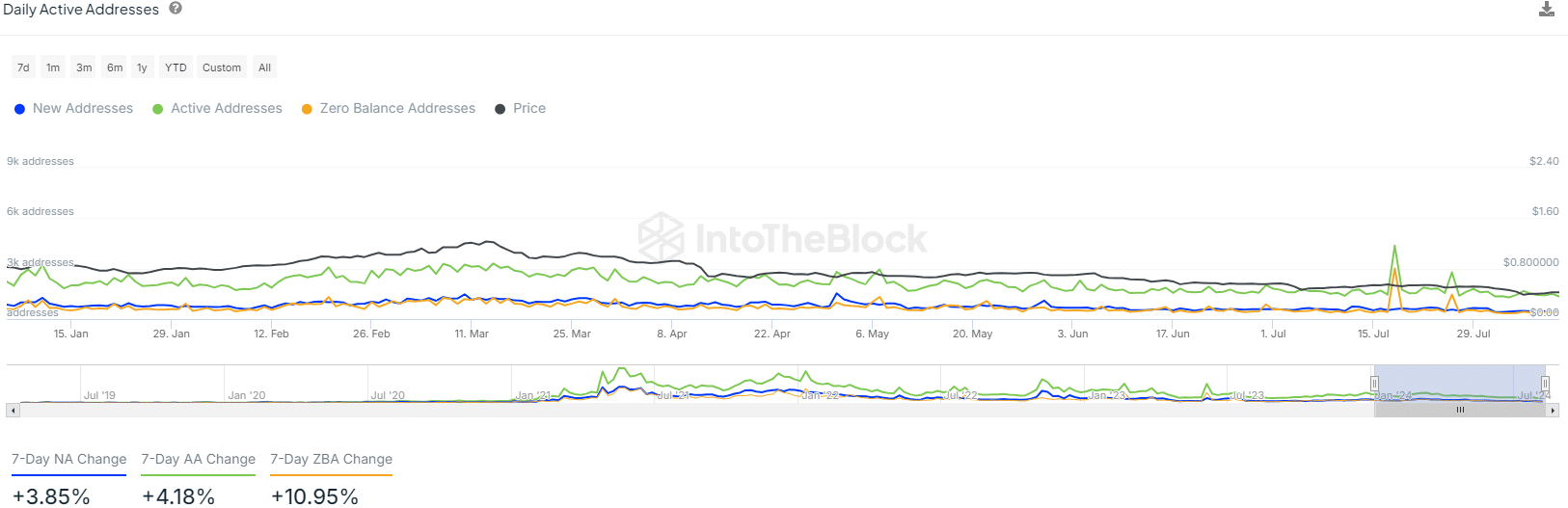

In the last fortnight, the creation of new addresses has decreased noticeably. While it remained relatively stable at approximately 600 in June and most of July, there was a significant drop in August.

As a cryptocurrency investor, I’ve noticed that the number of active addresses dipped slightly compared to the latter part of July, yet they’ve shown a minor uptick over the last week.

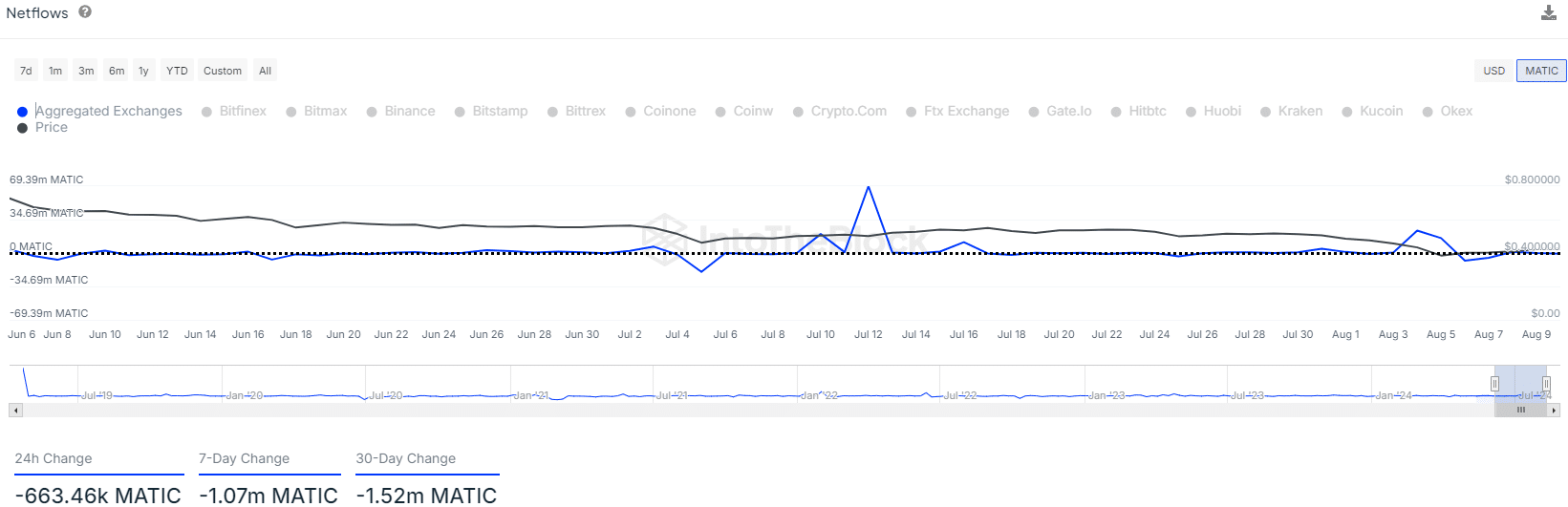

In the last month, there has been a significant outflow of MATIC from exchanges, with approximately $660,000 worth being moved out. To put this into perspective, the market capitalization of MATIC was around $4.16 billion, and its 24-hour trading volume the day before was $130 million.

Why is it extra hard for MATIC bulls to initiate a recovery?

Due to the continuous drop in value since March, those holding these assets have suffered losses. Every slight uptick offers an exit chance for them from their money-losing investment. The On-Balance Volume (OBV) showed a consistent selling force behind this trend.

For the past two months, the Awesome Oscillator has consistently fallen beneath the zero mark, indicating that bearish momentum has been predominantly driving the market.

In July, the rate at which the data was circulating decreased, but the speed at which it moved increased significantly, suggesting an increase in instability and speculative activities. Over the last ten days, however, the trend suggests that holders have become less willing to offload their assets. This pattern might imply a cautious approach towards selling.

Read Polygon’s [MATIC] Price Prediction 2024-25

This could be a sign of confidence, but all other signals remained bearish.

1) The average dollar’s investment age was rising, indicating a preference for long-term investments. A decrease might indicate more frequent token transactions, potentially boosting the chances of a price rebound.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

2024-08-12 12:07