-

SOL ETF discussions arise amid ongoing Ethereum ETF debates.

Insights from experts suggest possible approval of SOL ETFs.

As a seasoned crypto investor, I’ve seen my fair share of debates and speculations in the digital asset space. The latest discourse surrounding Solana (SOL) ETFs is an intriguing development, especially considering the ongoing Ethereum (ETH) ETF discussions.

In the midst of ongoing controversy regarding Ethereum’s [ETH] ETF approval, a new discussion has arisen: Could Solana [SOL] also see the creation of exchange-traded funds (ETFs)?

Implying that Ethereum ETF approval may be imminent, CNBC’s “Fast Money” trader Brian Kelly initiated discussion on topic X, proposing Solana as a strong contender for the next U.S.-listed spot cryptocurrency ETF. During an interview with CNBC, he voiced his viewpoint.

As a crypto investor, I strongly believe that Solana is a strong contender to be the next major player in this market cycle. Bitcoin and Ethereum have already established themselves as leading cryptocurrencies, but Solana’s unique features and potential make it an exciting prospect for future growth.

Yesterday, I came across a post from Daniel Yan, the co-founder of Matrixport, dated May 21st on X. In it, he shared an intriguing perspective that resonated with me as a crypto investor. He noted:

Optimistic remarks

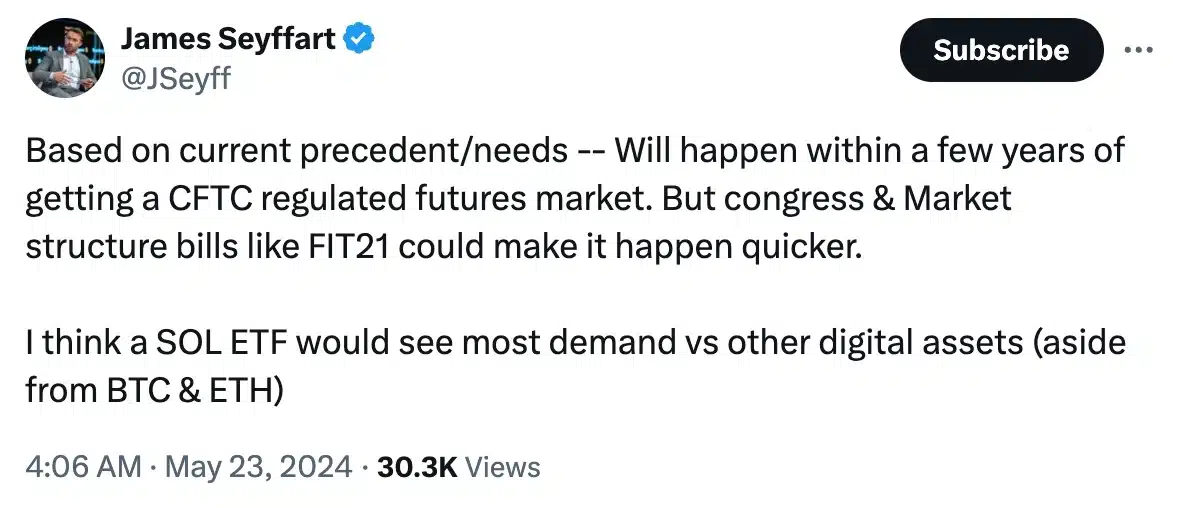

Adding to the fray was James Seyffart, ETF Research Analyst at Bloomberg Intelligence, who said,

On the other hand, Seyffart raised a warning, pointing out that while there’s enthusiasm over Solana’s ETF prospects, the Securities and Exchange Commission (SEC) has taken a different stance towards it than Ethereum. According to him,

“SEC doesn’t mince words when it comes to Solana unlike its approach with Ethereum. The lawsuits against Coin and Kraken clearly label Solana as a security, implying a potentially bumpy journey ahead.”

Joining the conversation was Nate Geraci, president of ETFStore, who added,

“There won’t be any Solar Energy ETFs available until the CME introduces solar futures trading or until Congress establishes a legitimate regulatory framework for cryptocurrencies. The approval of a Spot Ethereum ETF seems to have temporarily halted the creation of new Crypto ETFs, in my opinion.”

The debate continued as ‘The Bitcoin Therapist’ added further criticism to the discussion.

As a researcher studying the cryptocurrency market, I’ve noticed that CNBC has brought up the possibility of a Solana Exchange-Traded Fund (ETF). However, including Ethereum in the spot ETF game comes with its challenges. It could potentially lead to the inclusion of other lesser-known tokens, or “shitcoins,” as some may call them. This opens up the market to resemble more of a free-for-all casino, which some have advocated for. Personally, I prefer to keep my investments focused on Bitcoin.

Solana vs. Ethereum

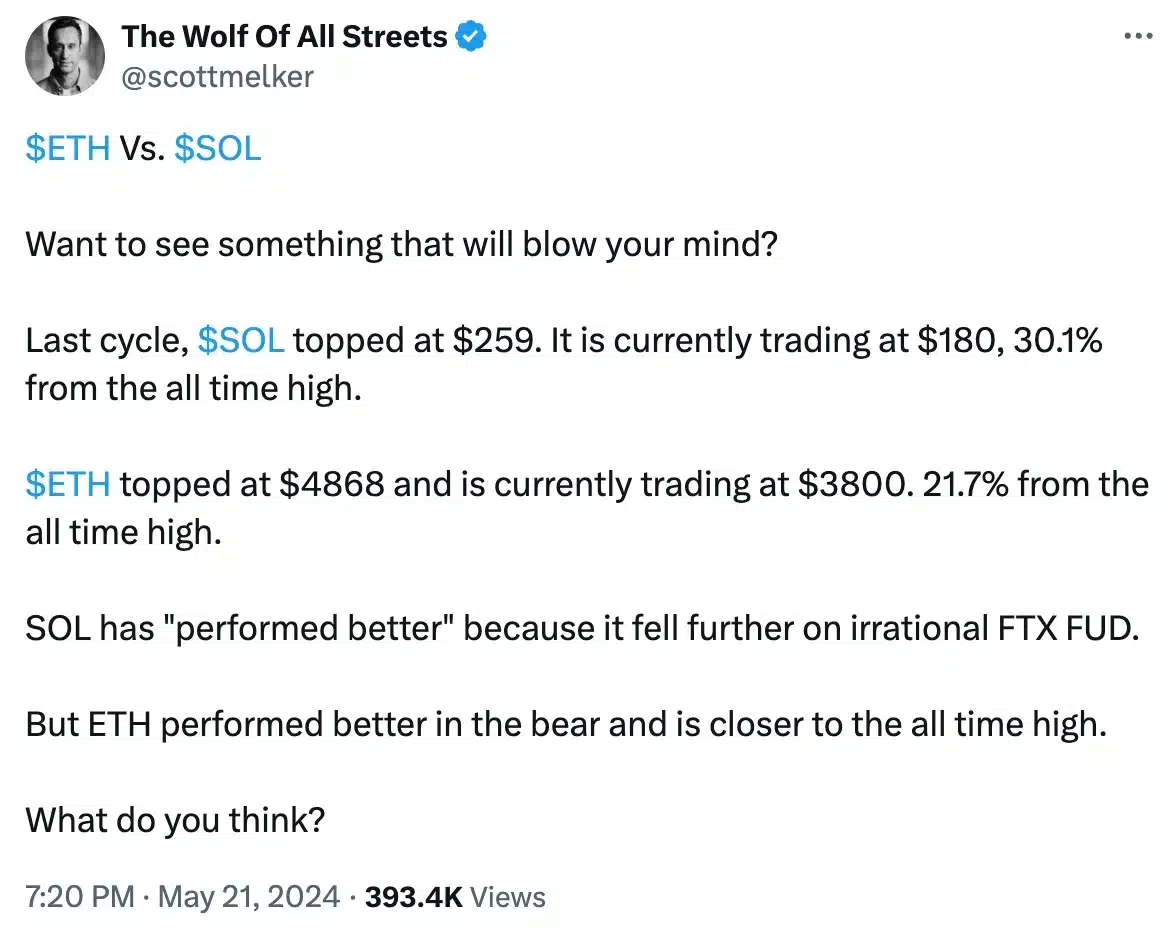

As a market analyst, I’ve observed some noteworthy advancements in the ongoing ETF discussions. Specifically, Solana (SOL) experienced a 3% decrease in price within the last 24 hours at the time of my analysis. Conversely, Ethereum (ETH) displayed positive gains during the same period.

As a researcher studying the comparisons drawn by “The Wolf of All Streets,” a pseudonymous crypto investor, let me describe one way to paraphrase his analysis of the similarities between two major altcoins. Instead of saying “he analyzed,” I would say “I will examine” or “in my research, I will explore.”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-23 17:12