-

A whale offloaded 594K SOL since January, adding pressure to Solana’s already volatile price movements.

Solana’s Head and Shoulders pattern hints at a potential drop to $122, raising concerns among traders.

As a seasoned analyst with over two decades of experience under my belt, I have witnessed countless market cycles and have learned to read between the lines when analyzing digital assets. The current state of Solana [SOL] is intriguing, to say the least.

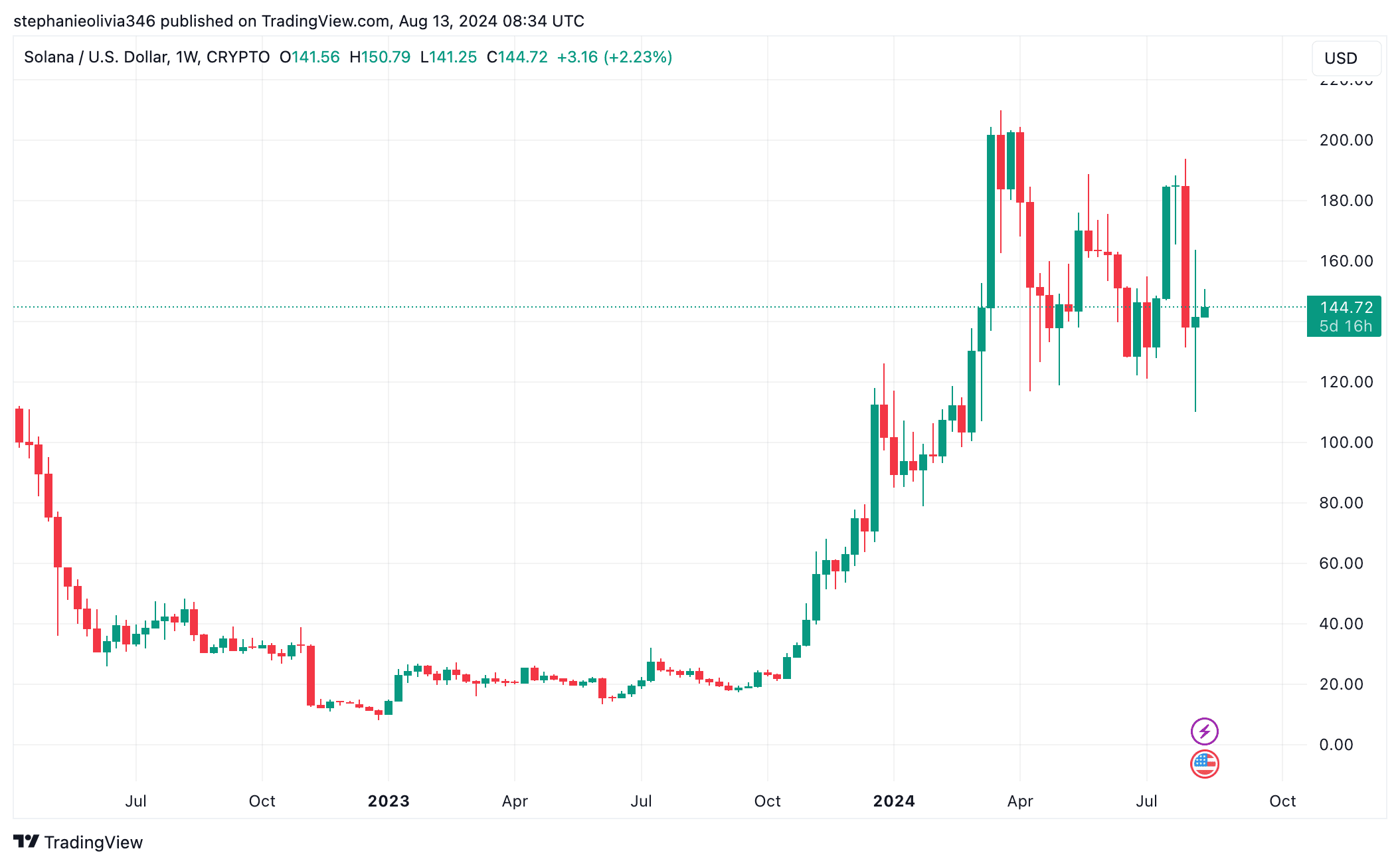

In the latest trading periods, Solana (SOL) has experienced volatility due to conflicting investor feelings, with its value bouncing between a resistance level of approximately $150 and a support zone near $142, indicating a period of consolidation within that range.

Currently, one Solana coin is being traded for $145.84, which represents a decrease of 1.11% in the last 24 hours. However, over the past week, its value has risen by 3.08%. At present, there are approximately 470 million Solana coins in circulation, giving it a market capitalization of around $68.16 billion.

In the meantime, based on technical analysis, it appears Solana might be shaping a Head and Shoulders pattern in its hourly chart. This pattern, as explained by Ali on X, could signal an upcoming price adjustment.

Ali stated,

In the hourly chart, Solana might be shaping a “head and shoulders” pattern, indicating a potential decrease. If this pattern holds, a fall below $141 could initiate a correction, pushing the price of SOL down to around $122.

As a crypto investor, I’m closely watching the significant level at approximately $141.90 – the potential neckline of the pattern. Should the price dip below this support, such a move might indicate the confirmation of the pattern and potentially trigger more bearish momentum.

Predicted drop point for this bearish trend could be around $122.50, which equates to approximately a 13.40% decrease from the neckline.

Whale activity and market dynamics

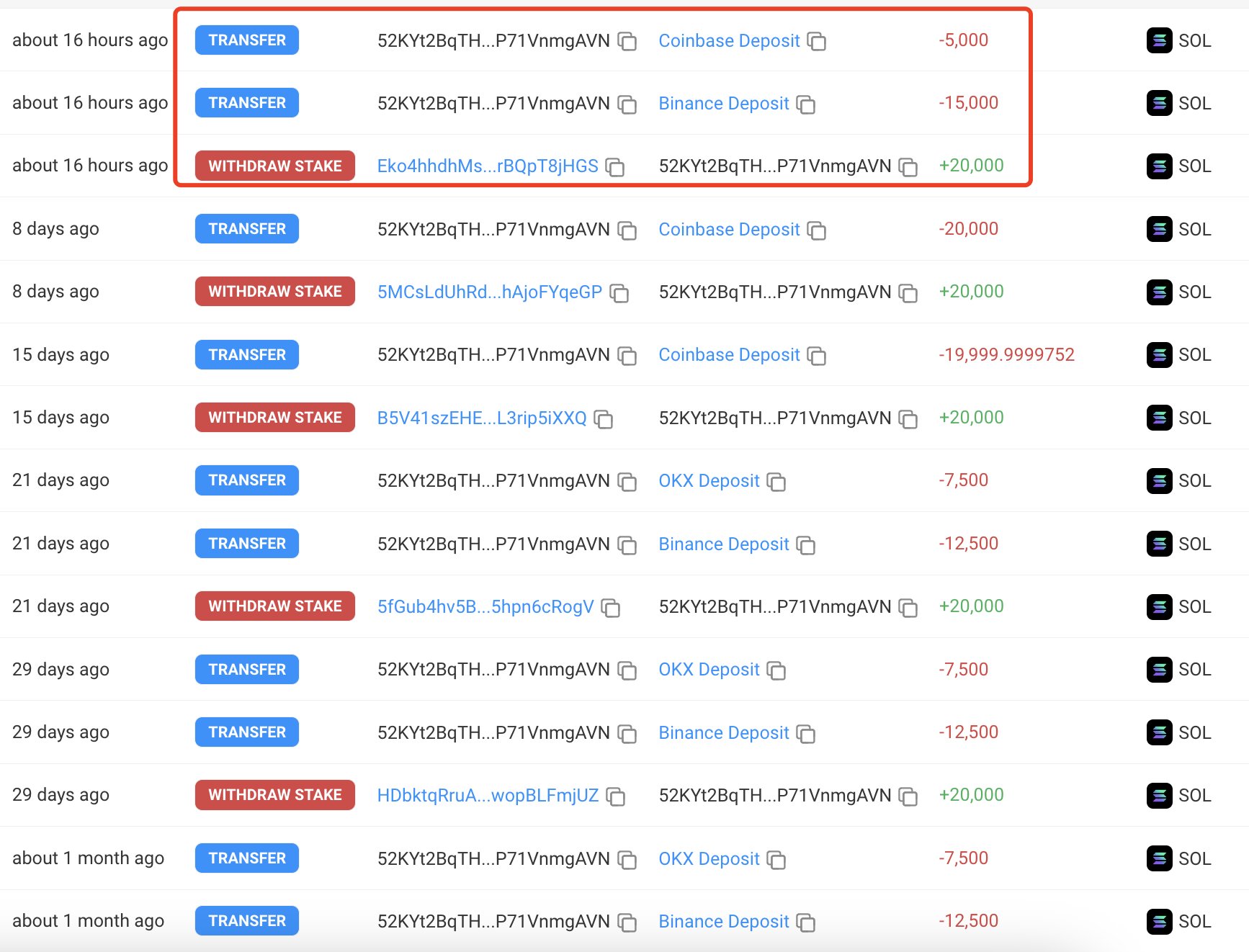

It’s possible that the recent fluctuations in Solana’s price could be due to considerable trading by large investors, or “whales.” According to a report from Lookonchain, one such whale has offloaded approximately 594,000 SOL, worth around $86 million, since January 2024.

The sales have remained steady, as a significant amount of SOL is regularly transferred to prominent platforms like Coinbase, Binance, and OKX once a week on average by a large investor (referred to as a “whale”).

The latest sale occurred just 16 hours ago.

Indeed, consistently offloading significant quantities of SOL by a major investor might exert downward force on the value of the asset, sparking worries regarding market equilibrium and stability.

Concerns raised about Solana’s network and operations

In addition to market transactions, there’s been some chatter about Solana’s network performance and management structure. Dave has highlighted a number of potential problems in a sequence of posts, which could impact the network’s future.

Among these issues are recurring transaction glitches, manipulative trading by automated systems and APIs, as well as apprehensions about Solana’s validator criteria, which allegedly lean towards more affluent participants.

Furthermore, Dave pointed out that the number of transactions per second (TPS) for Solana could potentially be deceiving. This is because the network counts both successful and unsuccessful transactions, as well as votes, when calculating its TPS, resulting in a higher-than-actual figure.

Additionally, it’s worth noting that Solana’s circulating supply has grown by approximately 59.09 million coins within the last year, leading some to question the long-term viability of its current market value.

Potential price movements and liquidity concerns

AMBCrypto notices a potential zone of low trading activity around the $140 mark, which could potentially pull prices downward. In the past, this location has acted as a turning point, as demonstrated by the price shift observed on August 7.

Is your portfolio green? Check the Solana Profit Calculator

Despite a strong interest and bullish sentiment, the low demand and persistent bearish pressure might cause Solana to dip below $140. This could result in a potential downward trend towards the $130 level, with possibilities of falling even lower.

Keep a close eye on these ongoing trends since they might have a significant impact on Solana’s temporary price trend. This is due to the interplay of technical indicators, large investor actions (whales), and broader network issues.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-08-13 20:08