- CBOE receives request for Solana based ETFs from VanEck and 21shares.

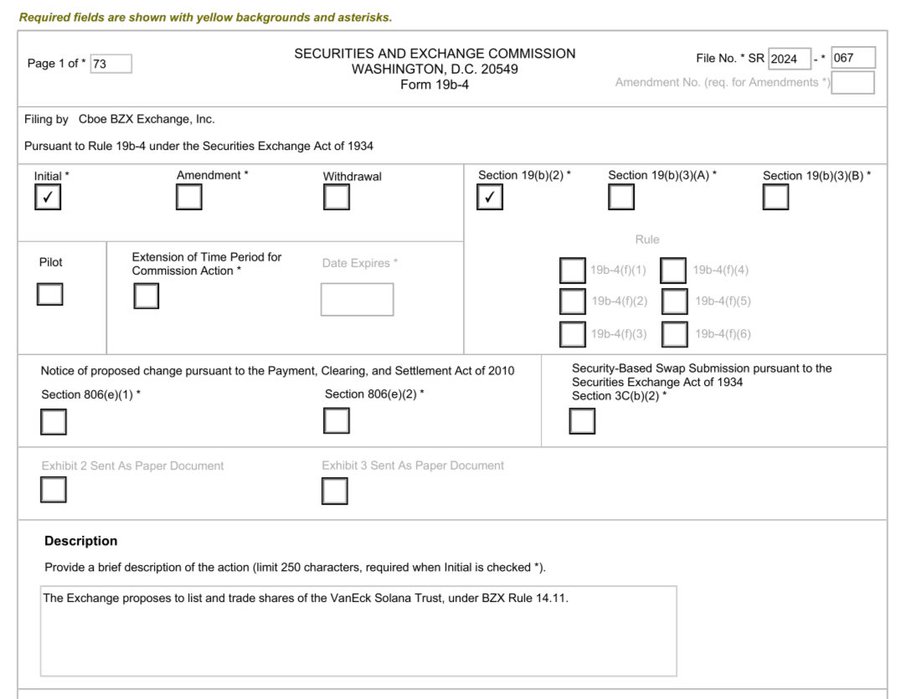

- CBOE submitted 19b-4 filing with SEC for Solana ETFs.

As a researcher with a background in digital assets and experience following the crypto market closely, I’m excited to see the recent developments surrounding Solana (SOL) ETFs. The request from VanEck and 21Shares for CBOE to list SOL-based ETFs is a significant step forward for the Solana ecosystem.

Following the filing of an S-1 form a month ago, VanEck and 21Shares are preparing for the listing of their products on CBOE (Chicago Board Options Exchange). Based on recent reports, CBOE has petitioned the SEC to permit the introduction of a Solana (SOL) ETF by both VanEppk and 21Shares.

Mathew Sigel, the Head of digital assets research at VanEck, shared updates regarding X through a tweet of his.

As a researcher at Vaneck US, I’m thrilled to share that we’ve submitted our 19b-4 filing to list and trade the first Solana exchange-traded fund (ETF) in the United States on CBOE. We’re eagerly anticipating the SEC’s review process and are excited about the potential opportunity to bring this innovative investment vehicle to market.

As a crypto investor, I’m excited about the recent development where the CBOE (Chicago Board Options Exchange) has submitted a 19b-4 filing with the Securities and Exchange Commission (SEC) for a Solana-based Exchange Traded Fund (ETF). If the SEC approves this request, they will have approximately 240 days to make a decision on accepting or denying the proposal.

Rob Marrocco, the head of CBOE global markets, expressed that with the Security and Exchange Commission’s (SEC) approval of Bitcoin (BTC) and Ethereum (ETH), and Solana (SOL) being the third most actively traded cryptocurrency, there is a growing demand from investors for Exchange-Traded Funds (ETFs).

As a researcher, I’ve come across the Chicago Board Options Exchange (CBOE), which currently offers Exchange-Traded Funds (ETFs) based on Bitcoin (BTC) and Ethereum (ETH). According to their official reports, they have listed ten different BTC ETFs available at present.

Five Ethereum-based ETFs are also being proposed by them, with SEC approval anticipated as early as this week. The Ethereum ETFs are in anticipation of receiving regulatory blessing from the Securities and Exchange Commission.

Impacts of SOL ETFs on crypto markets

SOL ETF approval will impact the crypto community and Solana investors.

As a market analyst, I would highlight that my observation is that the influx of institutional investors into the SOL ETF (Exchange-Traded Fund) could significantly boost both financial resources and market presence for the Solana ecosystem.

Institutional investors entering the market significantly impact SOL‘s price growth, increasing liquidity, and boosting competition with Bitcoin at similar levels.

As a crypto investor, I’ve witnessed firsthand how the approval of the Bitcoin ETF this year sent prices soaring to an all-time high (ATH) of around $73,000. Although we’ve experienced some decline since then, numerous metrics suggest that we’re on track to hit the $100,000 mark before the end of the year.

Additionally, the green light given to SOL ETFs indicates a shift in traditional financial markets towards embracing digital assets. This acceptance is expected to boost adoption and seamless integration of digital assets into mainstream finance.

Read Solana’s [SOL] Price Prediction 2024-25

The Solana community expresses enthusiasm towards the proposed ETF, viewing it as a significant advancement with the potential to generate profits and pave the way for other cryptocurrency ETFs.

As a financial analyst, I would explain it this way: Investing in a Solana Exchange-Traded Fund (ETF) can add legitimacy to the altcoin and attract more investments. However, this increased engagement with regulatory bodies may lead to heightened scrutiny. Such scrutiny could potentially impact the very essence of blockchain technology – its decentralized nature.

Read More

- OM PREDICTION. OM cryptocurrency

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Christina Haack and Ant Anstead Team Up Again—Awkward or Heartwarming?

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

- Serena Williams’ Husband Fires Back at Critics

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Five Nights at Freddy’s: Secret of the Mimic Release Date Announced in New Trailer

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

2024-07-09 18:15