-

SUI has outperformed SOL on key fronts.

Some market commentators believe that its growth could derail SOL.

As a seasoned crypto investor with over a decade of experience under my belt, I must admit that the recent surge of SUI has caught my attention and piqued my curiosity. With its impressive outperformance on key fronts such as transaction counts, throughput, and cost efficiency compared to Solana [SOL], it’s hard not to be intrigued by this up-and-coming Layer 1 platform.

Sui [SUI] seems ready to eat into Solana’s [SOL] market share amid massive growth on key fronts.

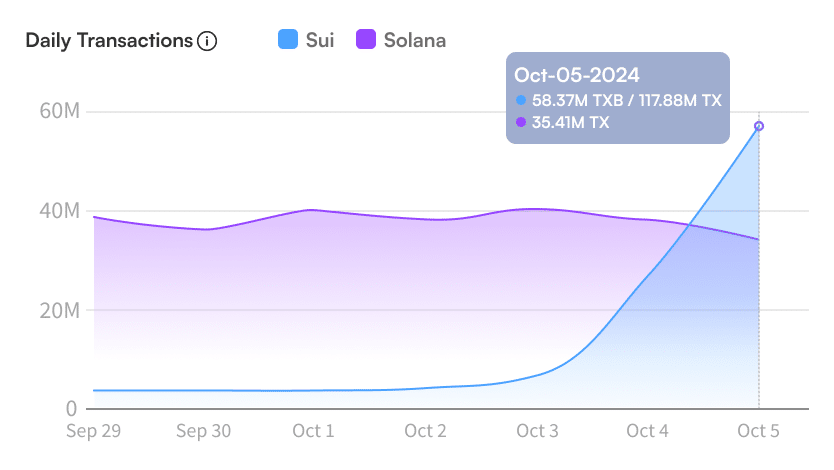

On the 5th of October, the Layer 1 platform surpassed Solana in terms of the number of transactions it processed. Specifically, it completed more than 58 million transactions, compared to Solana’s 35 million transactions on that exact same day.

SUI’s aggressive growth

Reacting to the growth, Adeniyi Abiodun, one of the Sui insiders, said,

“With no failed transactions, no sandwich attack, and swaps still sub-second!”

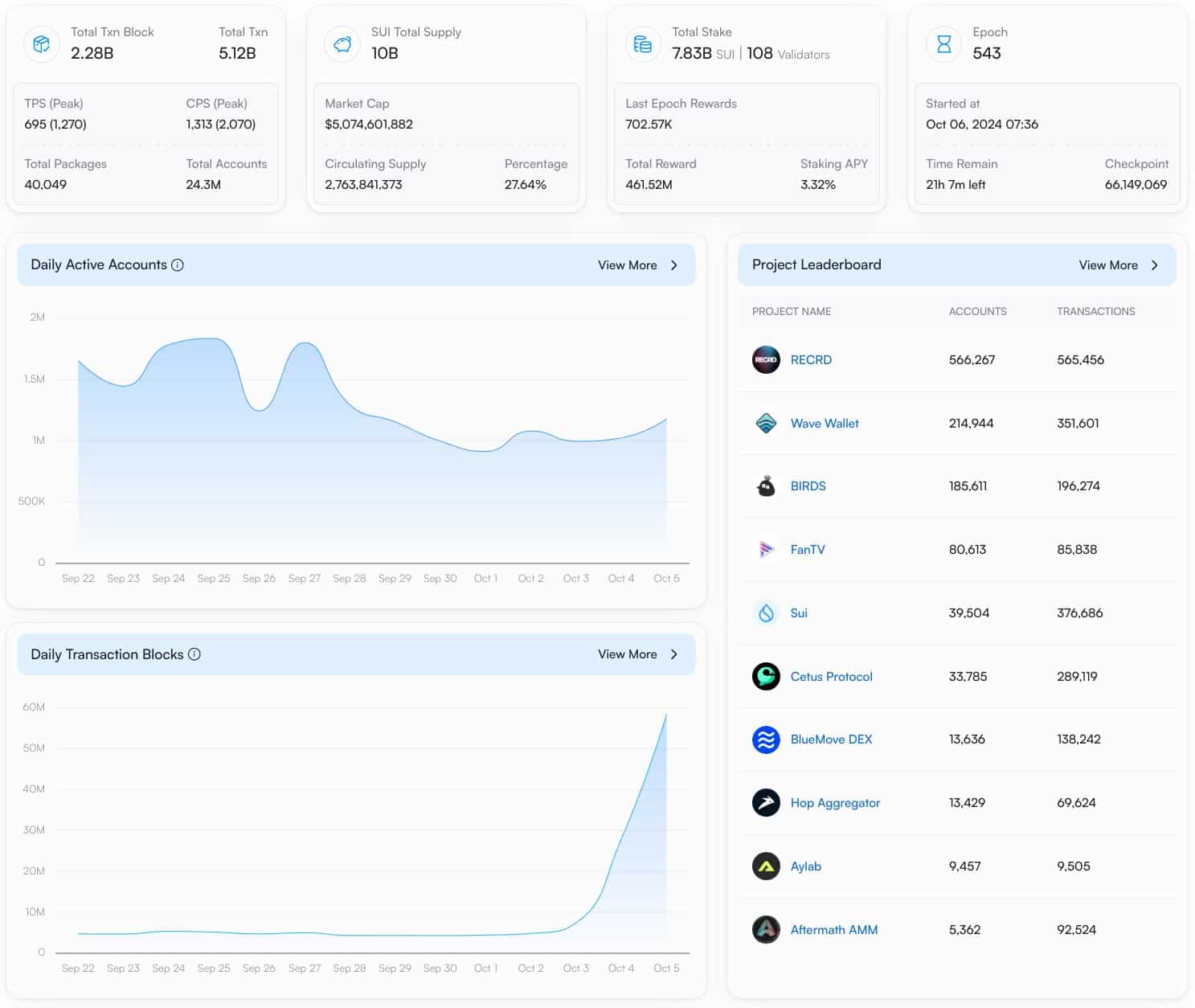

On the other hand, SUI has seen significant expansion in various areas as well. Currently, it surpasses Solana’s transaction speed, managing 756 transactions per second (tps), while Solana records 726 tps.

More notable traction was also noted across Ethereum-based outflows and average costs. SUI’s weekly Ethereum outflows stood at $55 million, while SOL bled $69 million over the same period.

When it comes to user fees, SUI emerged as a more budget-friendly option compared to Solana (SOL). On average, SUI’s fee was only $0.00018, while Solana’s was $0.0044. Essentially, SUI met all the criteria that made Solana an attractive choice over Ethereum [ETH].

In a way, some market commentators have deemed its aggressive traction a threat to Solana’s dominance. Some even doubted whether SOL could hit $1000 amid Sui’s massive growth.

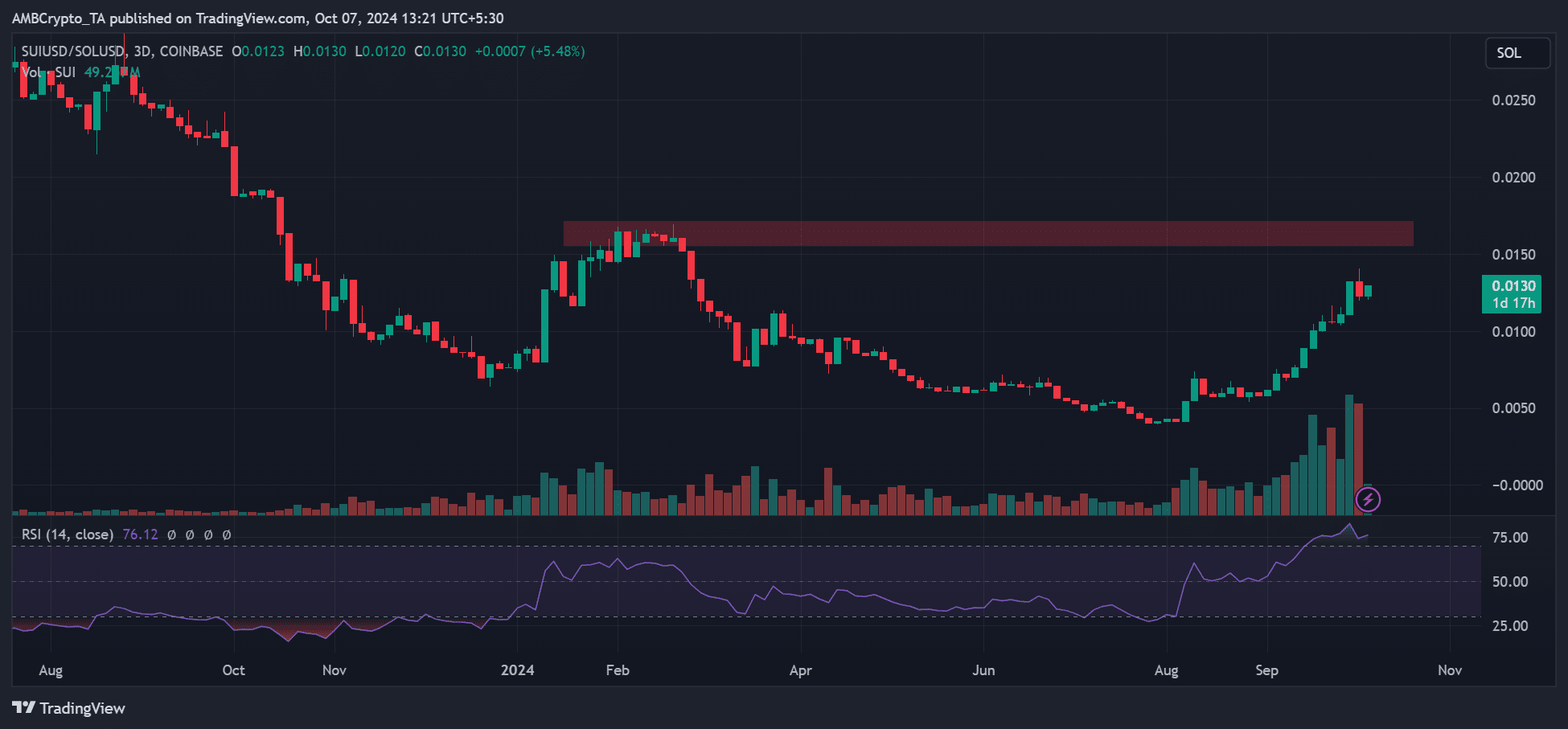

It’s noteworthy that the growth was evident not only in terms of performance but also in price trends. The comparison between SUI and SOL (represented by their ratio) has consistently climbed upwards since August.

Is your portfolio green? Check the Sui Profit Calculator

The price of SUI surged by an impressive 200%, rising from 0.003 to 0.013, highlighting its strong upward trend. Currently, the SUI price is holding steady just shy of $2, on the verge of reaching a new pricing level.

On the other hand, the total value locked (TVL) on the Solana network surpassed that of Sui. The Solana network attracted $5.5 billion in TVL compared to Sui’s $1 billion, suggesting that more investors continue to invest in the Solana network over Sui.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-07 18:15