-

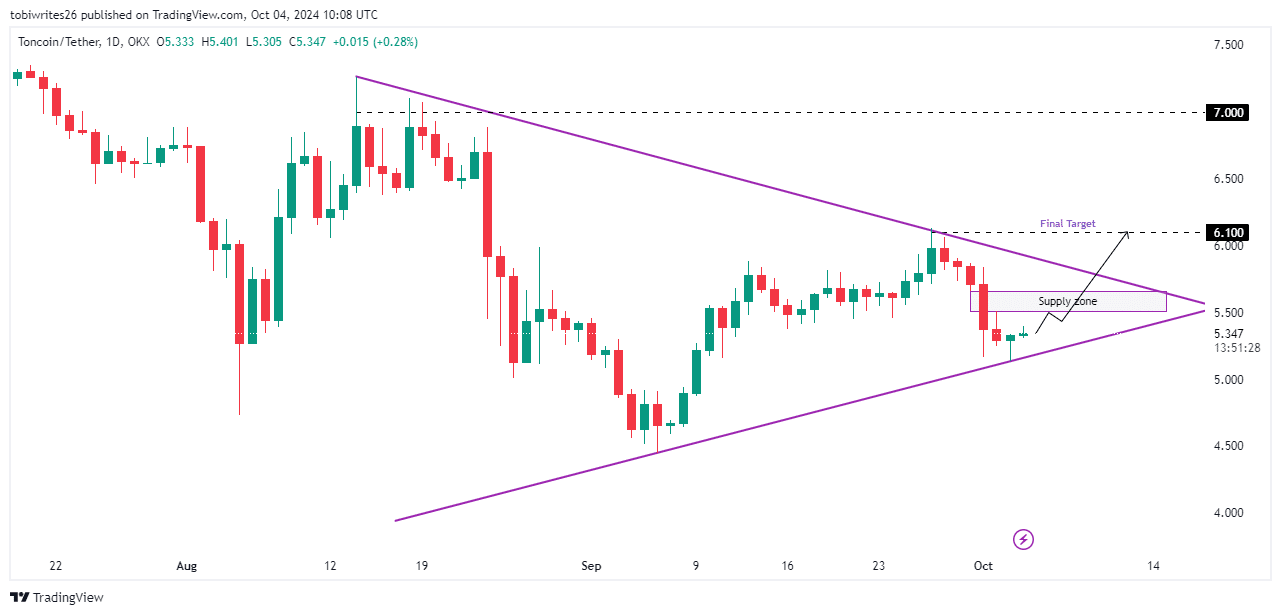

TON was navigating a large symmetrical triangle formation, suggesting a potential price move that could propel it toward $7.

A nearer-term rally to $6 is conceivable but contingent on overcoming substantial selling pressure.

After years of observing and analyzing market trends, I have learned to read patterns like a seasoned cryptocurrency researcher. The symmetrical triangle formation TON is navigating now is a bullish sign that catches my attention. It suggests a potential price move towards $7, which is quite appealing given the current trading price of $5.135. However, as I’ve learned in this game, every bull run has its bear traps, and TON seems to be approaching one at the moment – the supply zone between $5.510 and $5.657.

After a market-wide drop that lowered Toncoin‘s [TON] value by 8.0% over the last week to $5.135, this cryptocurrency is exhibiting signs of rebound. In fact, it has climbed by 2.41% in just the past 24 hours, fueled by robust support levels, and its price trend seems to be going upwards.

Although TON aims to achieve a near-term milestone of $6.1, it faces potential hazards that might lead to additional drops. AMBCrypto offers a comprehensive evaluation of TON’s chances for an uptrend.

Evolving patterns in TON’s market dynamics

Previously, I’ve found that TON‘s decline could primarily be linked to breaking through a resistance line and an ascending trendline. Yet, the situation has evolved, and currently, it appears to be trading within a broader symmetrical triangle formation.

At the moment, Toncoin is being traded within a symmetric triangle, which is often seen as a bullish sign. The rise in its market value lately can be attributed to bounces off the support line of this pattern, causing two successive days with bullish candles.

As a crypto investor, I’ve noticed the current surge in the market, but I can’t help but feel a sense of caution. TON is nearing a potential supply zone, roughly between $5.510 and $5.657. If this support doesn’t hold up against the selling pressure, there’s a possibility that its price could drop even further.

Conversely, breaking past this level could propel TON towards a target of $6.1.

Has AMBCrypto examined if this upward trend will persist and if it’s possible for the short-term goal of $6.1 to be reached.

Sustained upward momentum in TON trading

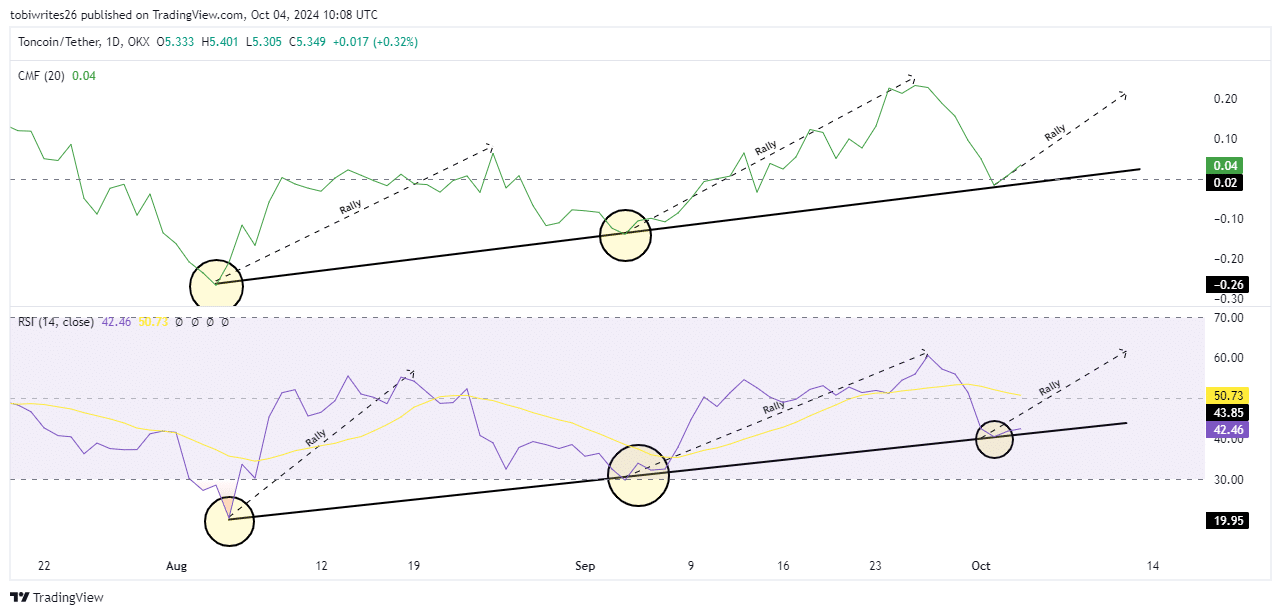

As an analyst, I’ve observed a surge of interest among traders in obtaining TON. This is evident through two significant metrics: the Chaikin Money Flow (CMF) and the Relative Strength Index (RSI), both pointing towards a growing momentum.

The CMF is an important technical tool that assesses the flow of money into and out of an asset. A CMF value above zero that is trending upward indicates a growing buying interest, a trend currently mirrored in TON’s market activity.

In much the same way, the Relative Strength Index (RSI), a tool that gauges the rate of price fluctuations, seems to be in line with this ascending trend. At present, it stands at 42.54 and is on an upward trajectory, indicating that TON may have reached its peak for a substantial surge, especially after it crosses the 50 mark.

Due to the rising flood of funds and growing optimism among investors, it’s more probable than not that TON will surpass its projected supply limit.

Capital trends favor a bullish outlook for Toncoin

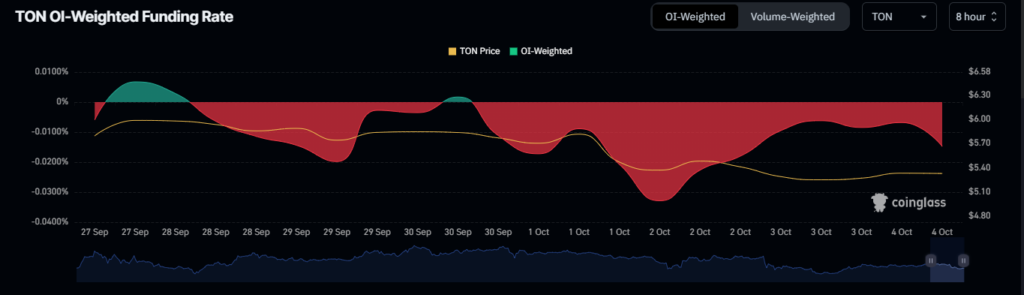

By examining the Open Interest (OI) Weighted Funding Rate, it appears that the current market feeling leans significantly towards optimism, suggesting a clear preference for investments flowing into a bullish trend.

Read Toncoin’s [TON] Price Prediction 2024–2025

The chart showing the OI-weighted funding rate suggests that TON is gradually moving out of a bearish phase, implying more long-term investors are stepping into the market.

Entering the “bullish area” suggests that TON has a strong potential to meet its near and far price goals of $6.1 and $7.0 respectively.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-10-04 20:39