- CREAM’s trading volume surged by 378.65% in 24 hours and drove the price near $75.

- Almost all the holders of the crypto are whales but Cream Finance’s TVL has been underwhelming.

As an analyst with experience in the cryptocurrency market, I’ve been closely monitoring the recent developments surrounding Cream Finance (CREAM) and its price surge. The sudden increase in trading volume by 378.65% in just 24 hours, driving the price near $75, is a noteworthy observation.

The price of CREAM, the indigenous token for DeFi platform Cream Finance, has astonished the crypto market with a 65.25% increase in value over the past week. This unexpected price hike occurred amidst a general trend of declining or stagnant prices for many other cryptocurrencies.

As an analyst, I’ve observed that at the current moment, the price of CREAM is $72.25 and its market capitalization stands at $133.40 million. Nevertheless, it’s noteworthy that Cream Finance isn’t included in the top 100 cryptocurrencies by market cap. This suggests that its influence in the crypto market may be relatively small.

For those unfamiliar, AMBCrypto explains what the project entails in this article.

What is Cream Finance?

Cream Finance plays a role in the Yearn. finance (YFI) community, but it offers more than individual lending services. It provides institutions and other protocols with access to its liquidity pool.

Cream Finance operates as a decentralized and open-source platform, providing services to users on various blockchain networks such as Binance Smart Chain, Ethereum, Polygon, and Fantom.

As a researcher delving into the intricacies of the decentralized finance (DeFi) ecosystem, I’d like to share an intriguing fact: CREAM was born following a significant update, referred to as a hard fork, in Compound Finance’s underlying protocol back in 2020. In the crypto realm, a hard fork signifies a substantial alteration to a blockchain network’s rules and regulations.

Whenever an upgrade occurs, any preceding blocks and associated transactions lose their validity. Simultaneously, users and nodes must update to the most recent version in order to ensure compatibility with the new upgrade.

In some instances, a hard fork results in the creation of a new token. On other occasions, it does not. With respect to Cream Finance, the 2020 split gave rise to the development of the CREAM cryptocurrency.

Using CREAM, users have the ability to deposit, lend out, and borrow assets within the platform. Notably, the CREAM token itself is not the only asset supported on the network. Other cryptocurrencies such as COMP, ETH, YFI, several stablecoins, and a few additional tokens can also be utilized with Cream Finance.

“This group” is driving the price higher

Based on the latest price surge, AMBCrypto observed that Cream Finance failed to disclose any significant advancements. Nevertheless, utilizing IntoTheBlock’s statistics, we identified a rise in the trading activity of prominent investors.

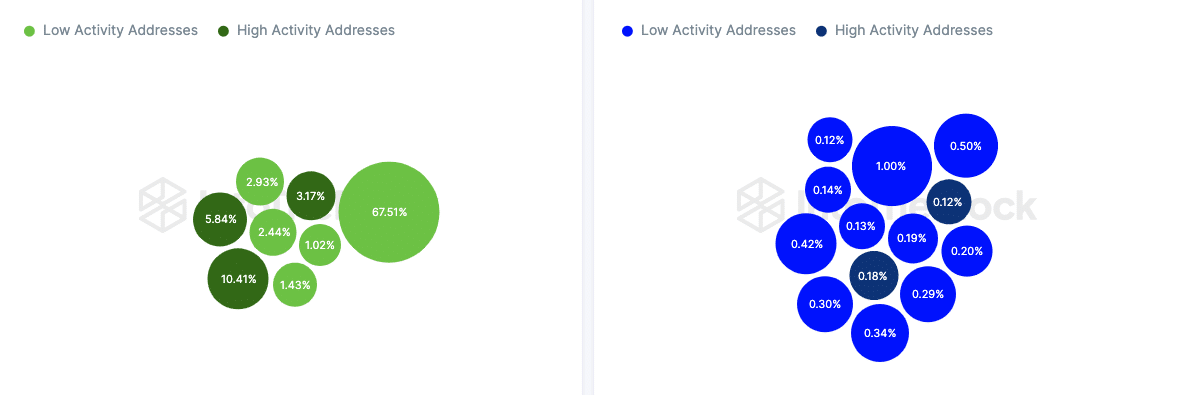

The ownership of a significant dollar value’s worth of cryptocurrency is typically held by whales. Usually, these whale-held tokens account for approximately 1% of the entire circulating supply.

Based on current figures, approximately 94.74% of CREAM token owners can be categorized as whales. Among these large-scale investors, around 19.42% participated in a total of 1,362 transactions during the previous 24-hour period.

This number is indicative of significant whale presence and can have a substantial impact on prices. It appears that Cream Finance’s superior performance versus other projects may be attributable to this high level of whale involvement.

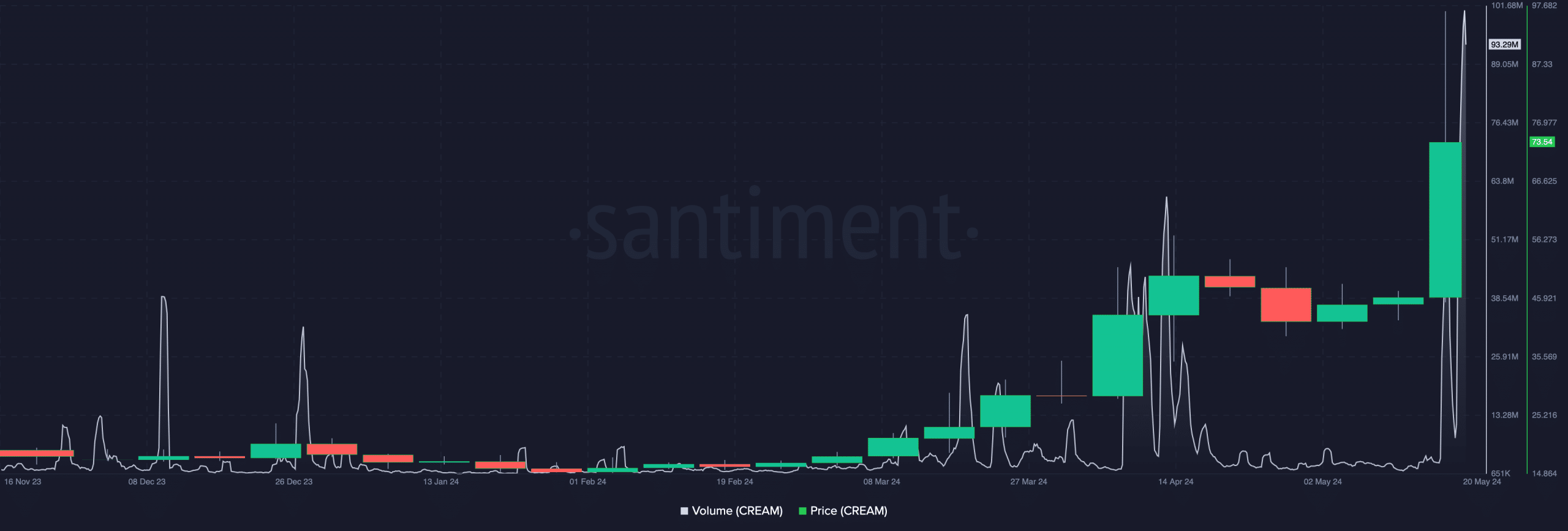

In the past 24 hours, there’s been a significant surge in trading activity for CREAM, with a remarkable 378.65% increase in volume as of now.

I analyzed the data from Santiment and found that on the 19th of May, the trading volume exceeded $100 million. As a result, CREAM’s closing price hovered around $75.

A short while after, the token’s price dropped, signaling that certain investors were cashing out their gains. The trading volume saw a minor decrease, but it may not be substantial enough to trigger a significant price decline of more than 10%.

If the volume keeps climbing as the price goes up, CREAM may cause an additional price hike of around 15%, potentially reaching a new high of $83.95.

A decrease in trading activity might indicate weakening power for the token. If that’s the situation, the price may drop down to $53.59, which is a previously identified significant level.

Is CREAM dependable?

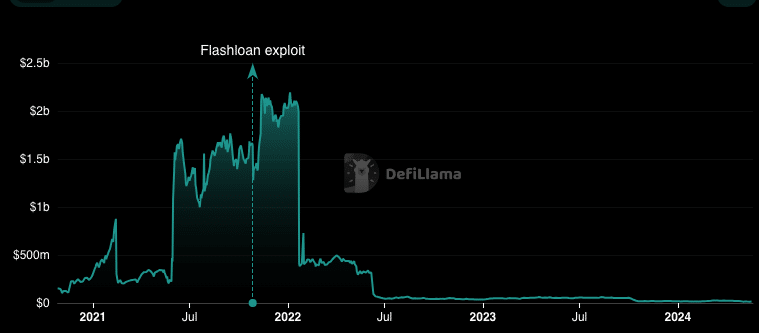

In spite of the astonishing rise in prices, the Total Value Locked (TVL) gave a bearish indication. The TVL serves as a gauge for a protocol’s vitality.

When the metric grows, it signifies that market players are contributing assets to the system. Conversely, a decrease in the metric suggests a significant withdrawal of assets by market participants.

In this situation, it’s possible that the involved parties have lost faith in the system’s ability to deliver desirable returns based on past experience with Cream Finance, which had over $2 billion in total value locked according to DeFiLama’s assessment for 2021.

After a significant incident known as a Flash Loan attack in 2021, the metric’s previous vibrancy has faded. In simpler terms, a Flash Loan attack refers to exploiting a loophole within a protocol to borrow funds without collateral from a lending platform.

Realistic or not, here’s CREAM’s market cap in ETH terms

As an analyst, I’ve come across instances where malicious actors exploit Decentralized Finance (DeFi) systems to manipulate markets and pilfer depositors’ assets. Regrettably, this is the unsavory reality that recently befall Cream Finance, with its Total Value Locked (TVL) standing at just over $15 million at the time of reporting.

As a researcher studying the relationship between total value locked (TVL) and cryptocurrency prices, I’ve found that while TVL itself may not directly impact prices, it does provide valuable insights into user behavior. When the TVL decreases, it suggests that users are becoming less confident in interacting with the protocol, which could potentially contribute to downward price pressure. Conversely, an increasing TVL might indicate growing user trust and confidence, possibly leading to upward price movements. However, it’s essential to remember that this is just one factor among many influencing crypto prices.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-05-21 12:08