- Crypto.com dropped its suit against the SEC the same day its CEO met the new President-elect.

- The lack of spot demand in recent days could be a sign of losses to come.

As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself at a crossroads with Cronos [CRO]. The recent events surrounding Crypto.com, its CEO’s meeting with the President-elect, and the subsequent dismissal of the lawsuit against the SEC have certainly stirred the pot.

Over the past month, the native token of the Cronos chain, Cronos [CRO], which is also one of Crypto.com’s offerings, has been holding steady below the $0.2 level.

Prior to November, the token had been experiencing a prolonged downtrend, dipping below its $0.083 support level.

On December 17th, Crypto.com’s Chief Executive Officer, Kris Marszalek, journeyed to Florida for a meeting with former President Trump. As a result, the token saw a surge of 16% in value within just a few hours.

On the very same day, the exchange chose to drop its own lawsuit against the Securities and Exchange Commission (SEC), aiming to collaborate with the new administration in establishing a regulatory system for the industry.

Should you buy CRO crypto or sell it?

In just one week following the U.S. Presidential election, CRO skyrocketed by 210% and reached the $0.2 milestone. After that, its value fluctuated within a span of approximately $0.17 to $0.2.

The trading volume during the rally was high and has fallen during the consolidation.

– This event wasn’t out of the ordinary. The situation suggested that a delay might be necessary before seeing further growth. The technical signs pointed towards a bullish trend, and the Cash Movement Factor (CMF) stood at +0.23, indicating a significant flow of capital into the market.

Meanwhile, the RSI remained above neutral 50 but did not form any divergence yet.

Revisiting the price range between $0.16 and $0.17 presents a potential buying chance for investors. If the price surpasses $0.2, it would be an optimal situation for investors, but traders could utilize a test of this resistance level to realize their profits.

Short-term sentiment is not consistently bullish

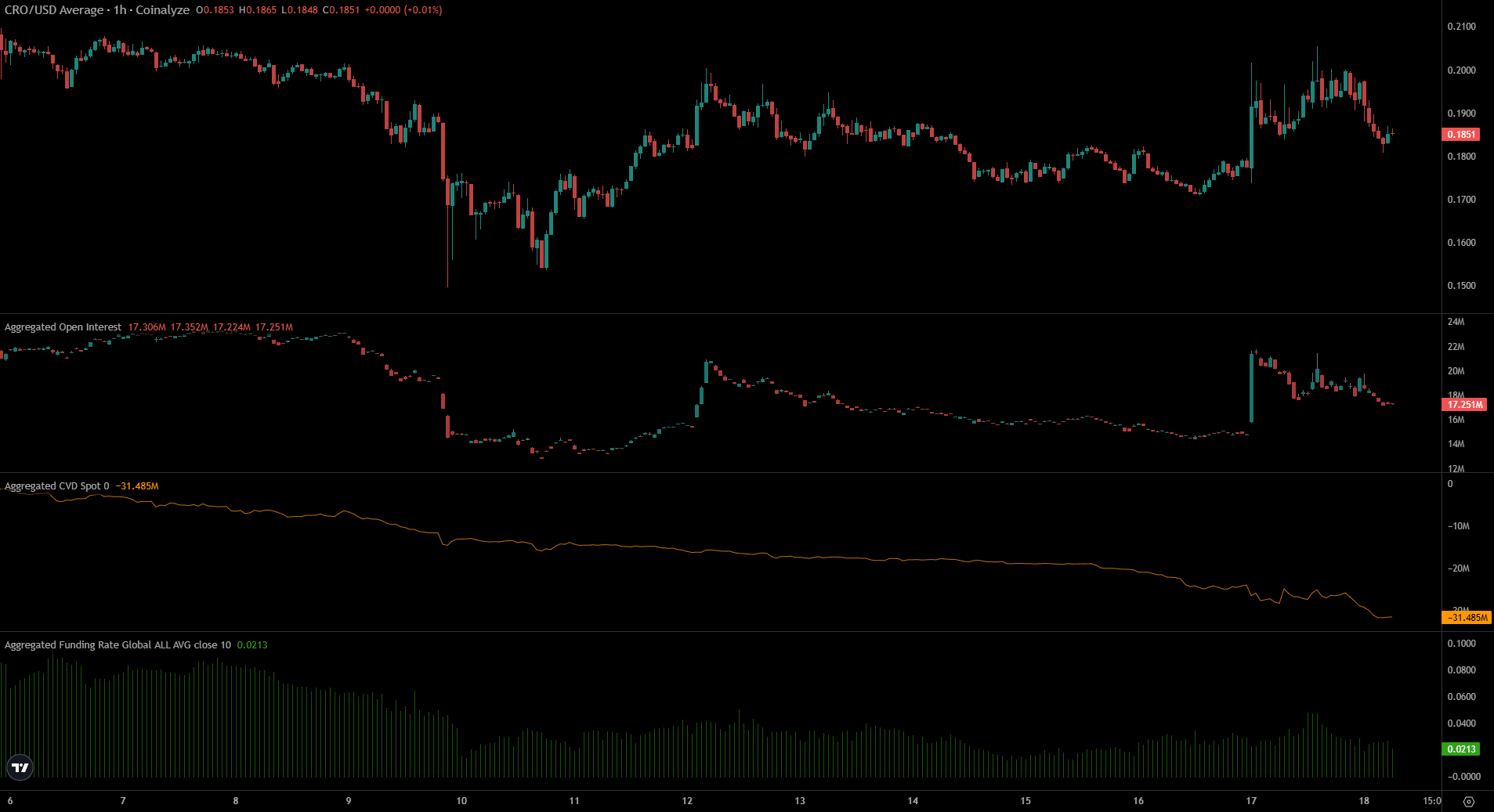

Recently, AMBCrypto noted a significant rise in Open Interest during specific trading periods over the last week.

Additionally, these events occurred during periods of significant trading activity, as seen on the 12th and 17th, with evidence visible in both the provided price chart and Coinalyze data.

Read Cronos’ [CRO] Price Prediction 2024-25

After those powerful movements, the OI often diminished, indicating that speculators rushed in for swift profits but were equally prompt to depart.

The spot CVD was in a downtrend as well, showing sustained selling over the past few days.

Read More

2024-12-18 16:07