- Large holders, or “whales,” who own a significant portion of CRO, have started offloading their holdings.

- Meanwhile, derivative traders are increasingly placing bearish bets, signaling expectations of a continued decline.

As a seasoned crypto investor with a knack for navigating volatile markets and a portfolio that includes CRO, I find myself cautiously watching the recent developments unfold. The past month has been a rollercoaster ride for Cronos, with impressive gains followed by signs of reversal.

Following a strong, nearly one-month-long increase where Cronos [CRO] experienced a significant gain of 137.39%, it seems the momentum is starting to slow down. Most recently, there was a weekly decline of 4.78%, suggesting a possible change in direction for the asset.

In the last day, it was reported by AMBCrypto that derivative traders helped in a 3.03% price increase. Yet, this temporary rise is overshadowed by ongoing whale activity, which raises concerns about CRO’s short-term outlook. Consequently, smaller investors may face potential losses as a result.

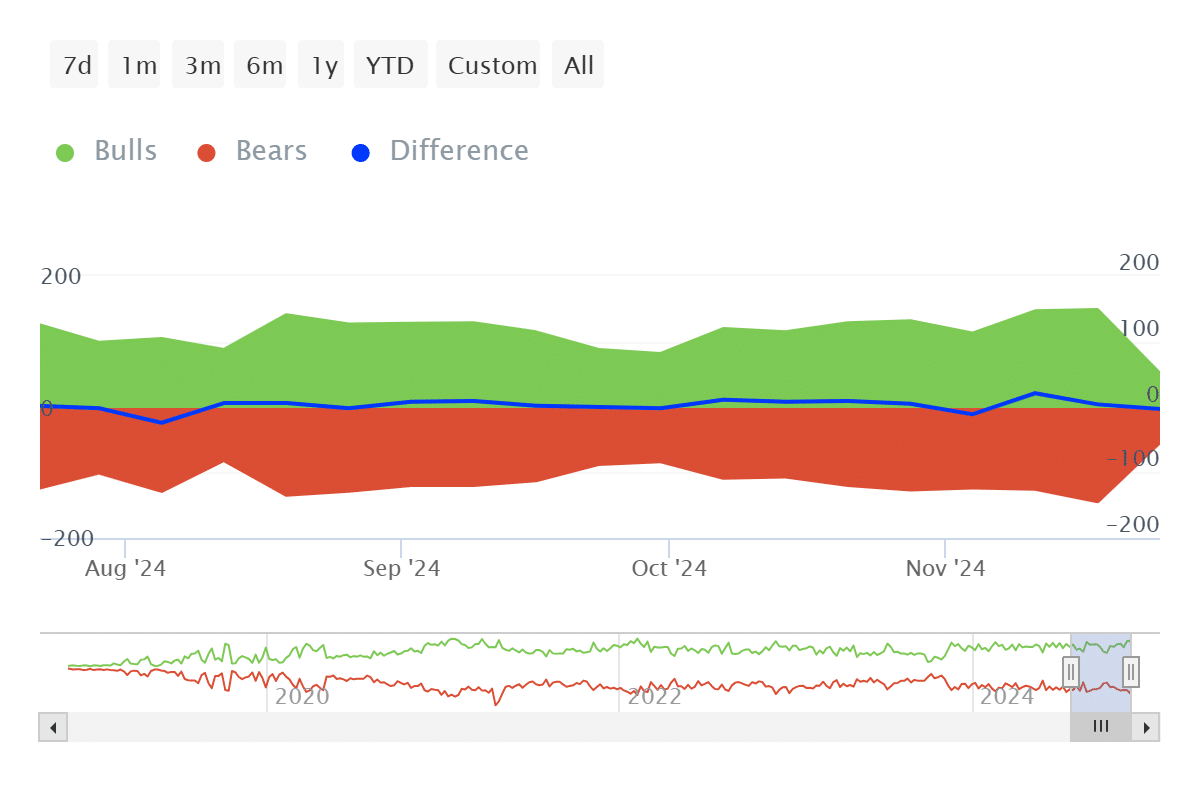

Bears outnumber bulls, signals potential downside for CRO

Currently, as I’m typing this, data from IntoTheBlock indicates that the CRO market is showing a predominantly bearish trend, which could mean increased potential for the price to decrease.

Over the last week, we saw approximately 144 bullish market movements versus 115 bearish ones, a small gap suggesting a minimal potential for a downturn. Yet, the overall market trends present further worries.

Cryptocurrency news platform, AMBCrypto, points out an unfair distribution of asset possession where large investors, or ‘whales,’ have a substantial market influence. This lopsided control intensifies market volatility and exposes smaller investors to unexpected price fluctuations.

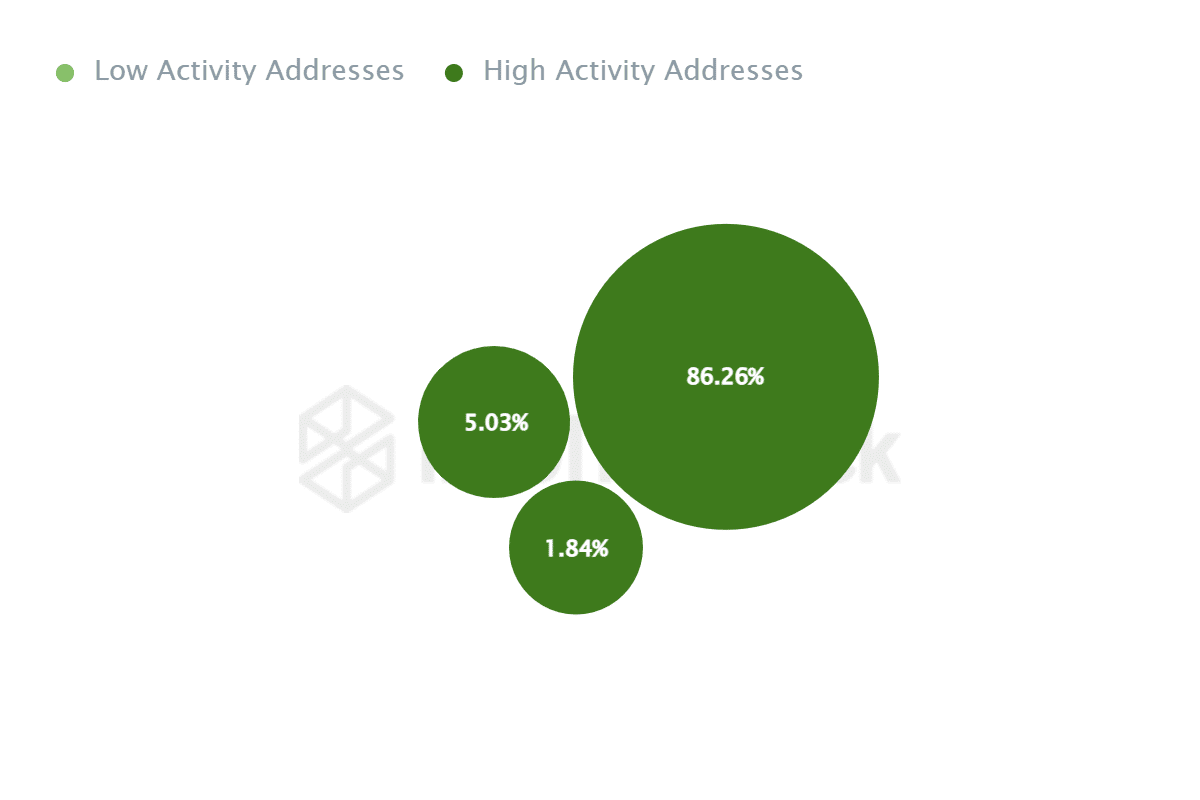

Whales dominate CRO, and downward risk heightens

Further analysis reveals that three highly active whale addresses control over 93% of the circulating supply of CRO. At press time, these whales hold 93.13% of the total supply, distributed as follows: 1.84%, 5.03%, and a staggering 86.24%.

The large number of more than 300 transactions carried out during the given period clearly demonstrates their active behavior. This level of activity could potentially threaten the stability of CRO’s pricing due to its substantial impact.

Furthermore, there’s been an increase in trading activity for CRO, as evidenced by the 73.16 million CRO tokens exchanged within the past 24 hours.

Given the surge we’re seeing, along with the appearance of whales and indications of a bearish trend, it appears that CRO may be at risk of reversing its recent small increases and potentially experiencing drops.

Why is CRO up?

The significant increases in CRO’s value lately can be attributed mainly to speculative investors who are wagering on its rise, causing the price to react accordingly.

A long-to-short ratio of 1.0912 confirms bullish dominance, with more long positions pushing the price higher.

If the level of whale activity increases significantly, it might cause a shift in the direction of CRO, potentially counteracting the bullish trend that has been driven by derivative traders.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Gold Rate Forecast

- Meta launches ‘most capable openly available LLM to date’ rivalling GPT and Claude

- How to Get to Frostcrag Spire in Oblivion Remastered

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

2024-11-29 23:35