- Crypto.com’s new roadmap spurred a rally in Cronos.

- The futures market points to a dominant bullish sentiment.

As a seasoned crypto investor who has weathered market storms and witnessed bull runs, I find myself intrigued by the recent surge of Cronos [CRO]. The unveiling of Crypto.com’s ambitious roadmap certainly spurred a rally that sent CRO soaring, albeit temporarily.

Notably, after Crypto.com revealed an expansive plan for its future, the value of Cronos (CRO) increased significantly by more than ten percent.

The announcement propelled it upwards by over 35% according to CoinMarketCap.

At the time of writing, CRO exchanged at $0.085, down by 1.20% in the past day.

Its 24-hour trading volume also dropped by 46.70%, settling at $40.48 million.

Unpacking the roadmap

In a more detailed exploration, AMBCrypto uncovered that Crypto.com intends to roll out additional features like stock trading, banking solutions, and improved card services within their platform.

From Q4 2024 onwards, Crypto.com is planning to initiate the Level Up program and provide Cronos AI development tools as a means to increase user interaction and improve the platform’s capabilities.

Here’s a more conversational way of expressing that information:

Throughout 2025, Crypto.com will enhance accessibility and investment options.

In Q1, they aim to expand their exchange services to include the U.S. and international markets, enhance fiat onboarding and offboarding processes, and introduce incentives in the form of Bitcoin [BTC], stock trading, ETFs, and individual multi-currency accounts.

In Q2, we’ll introduce a system that optimizes rewards, provide investment opportunities for income generation, offer secure storage solutions for institutions, enable trading of stock options, and enhance our credit card services with updated features.

In the third quarter, we’ll roll out several new features including our unique stablecoin, Cortex AI, Cronos One, foreign exchange commodities trading, derivative products, and swift international money transfers.

By Q4, offerings will include margined derivatives, a Cronos ETF proposal, the Singularity API, international accounts, and a 10% travel rebate program.

CRO’s market dynamics in the crypto sphere

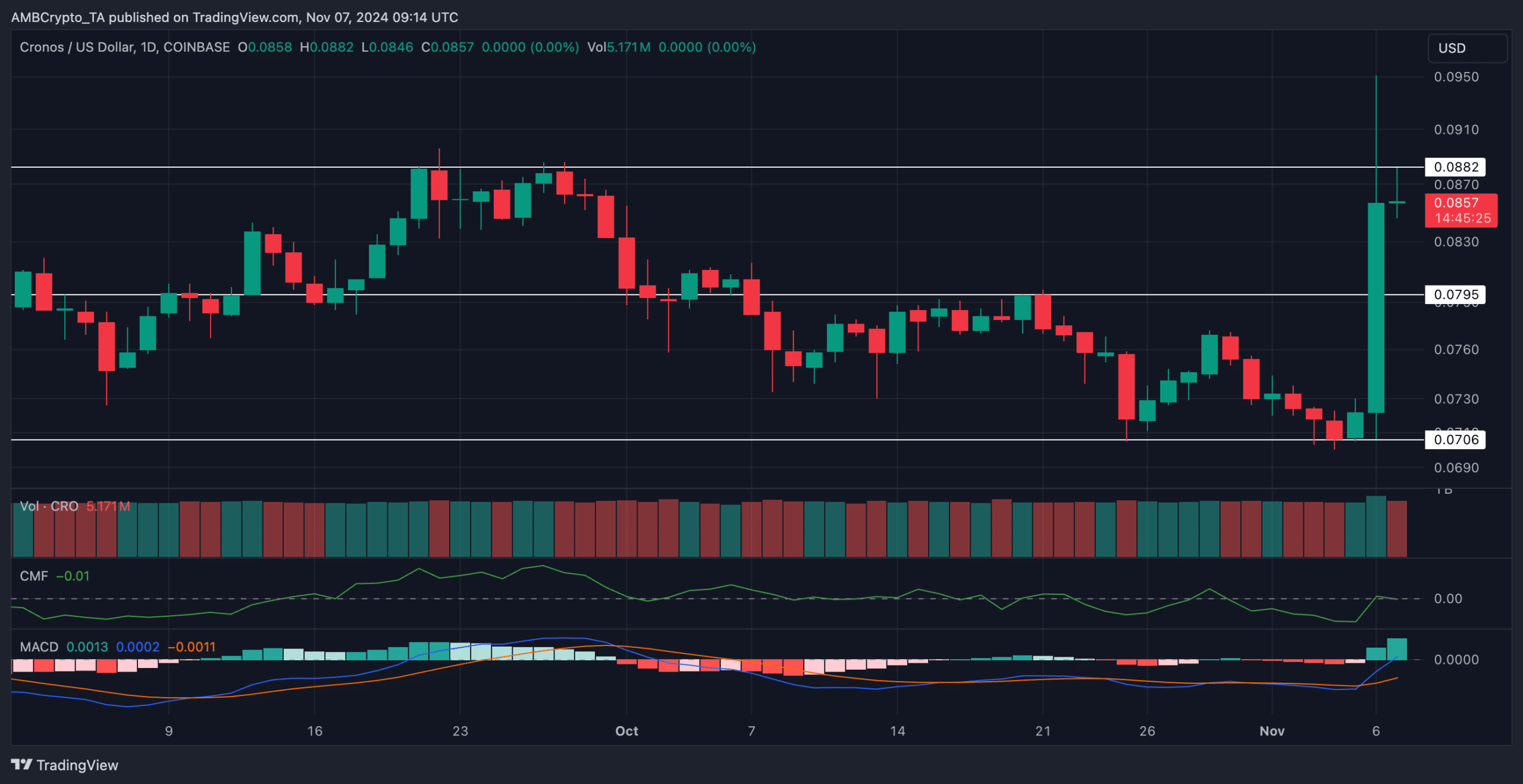

On the day-to-day graph, the trajectory of CRO took a significant turn for the better. The token climbed steadily from $0.070 to reach a high of $0.095, effectively ending the prolonged downward trend.

The rise was preceded by a continuous decline triggered by a rejection at $0.088 in late September.

The downward trend became more pronounced as efforts to surpass the $0.079 mark were unsuccessful, resulting in a decline to approximately $0.070 by the end of October.

Despite the surge, technical indicators suggested caution.

In simpler terms, the Crowd Momentum Factor (CMF) was at -0.01, suggesting that the buying power among traders was less strong. Meanwhile, the Moving Average Convergence Divergence (MACD) displayed a bullish signal where its lines crossed and turned positive. However, the signal line’s position below zero suggests that the current trend remains weak.

Based on the prior refusal at approximately $0.088, it might be challenging for the price to break through this level. Overcoming it would require a strong wave of purchasing power.

Derivative data findings

It’s worth noting that the futures market showed some improvement. As per Coinglass data, there was a 7.63% rise in Open Interest (OI), which suggests an uptick in investor participation.

Furthermore, the dominance of short liquidations over long indicated upward pressure.

A long/short ratio of 1.38 strongly suggested a prevailing optimistic market outlook, implying continued bullish trends might persist.

CRO’s next targets

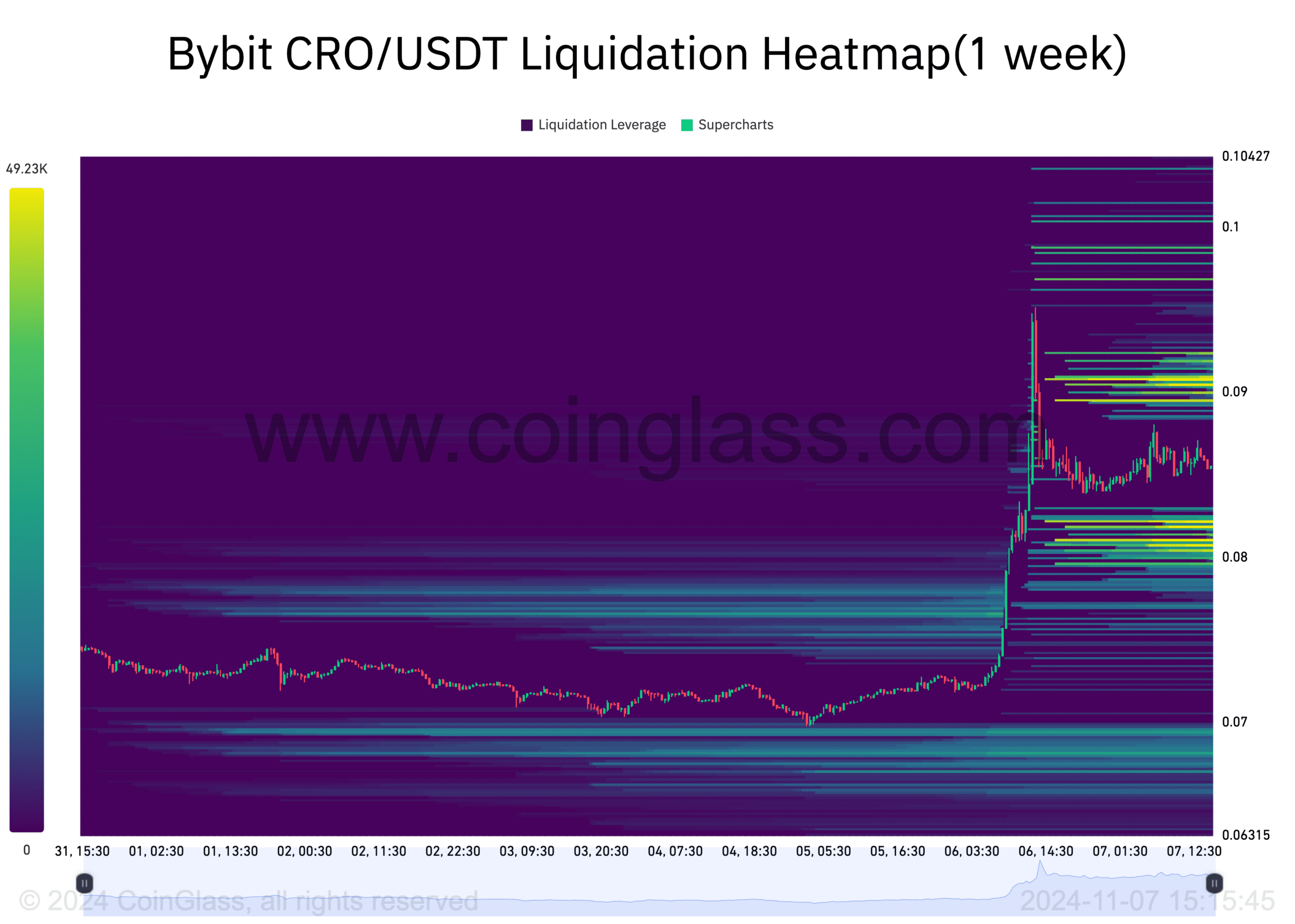

To assess the potential of a given token, AMBCrypto scrutinized the one-week liquidation map from Coinglass for insights.

It showed significant liquidity clusters for CRO in both upward and downward directions.

On the upside, a notable band of liquidity was observed around the $0.090 level.

If the bullish trend continues, this could indicate a significant point for price adjustments, possibly leading to a reversal or dip in prices.

On the flip side, the $0.080-$0.082 range served as an attractive area. Dropping into this zone could potentially trigger a bounce back.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-11-08 08:08