-

CRV bounced from record lows with a 43% spike.

However, traders are abandoning long positions in favor of short positions.

As a seasoned researcher with a knack for deciphering the intricacies of the cryptocurrency market, I find myself cautiously optimistic about Curve DAO (CRV). The 43% surge over the past week has certainly piqued my interest and the surging buying activity is hard to ignore. However, the sharp drop in funding rates and the increase in short positions suggest that we might be witnessing a correction or consolidation phase.

Over the last seven days, the price of Curve DAO [CRV] increased by 43%, fueled by substantial trading volumes due to a surge in purchasing interest.

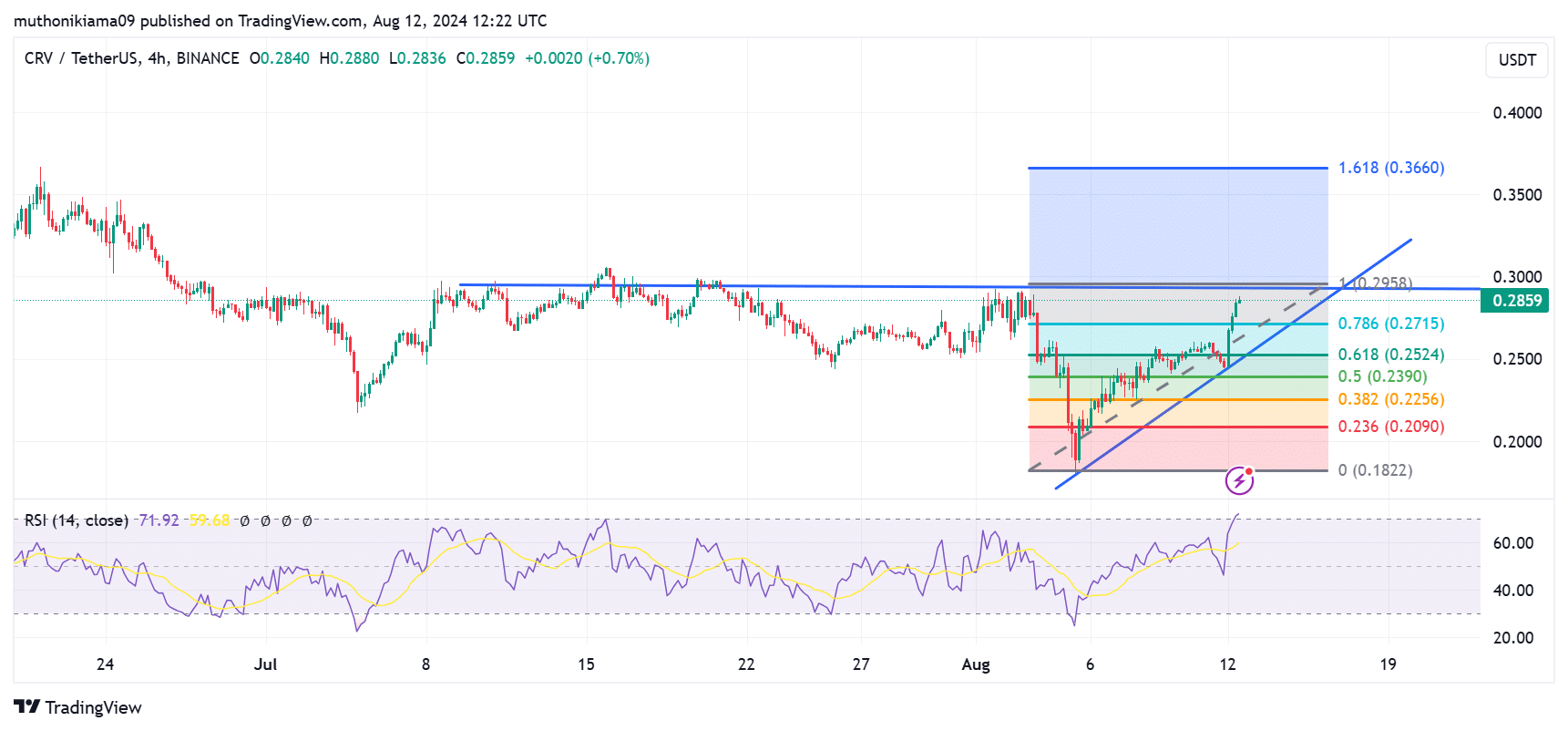

Over the past week, the CRV price has been gradually increasing, moving up from its all-time low of $0.18 to $0.28 at present. While this represents a significant improvement, the token could still encounter more challenges due to the pessimistic atmosphere prevailing in the broader market, which may continue to pressure its price.

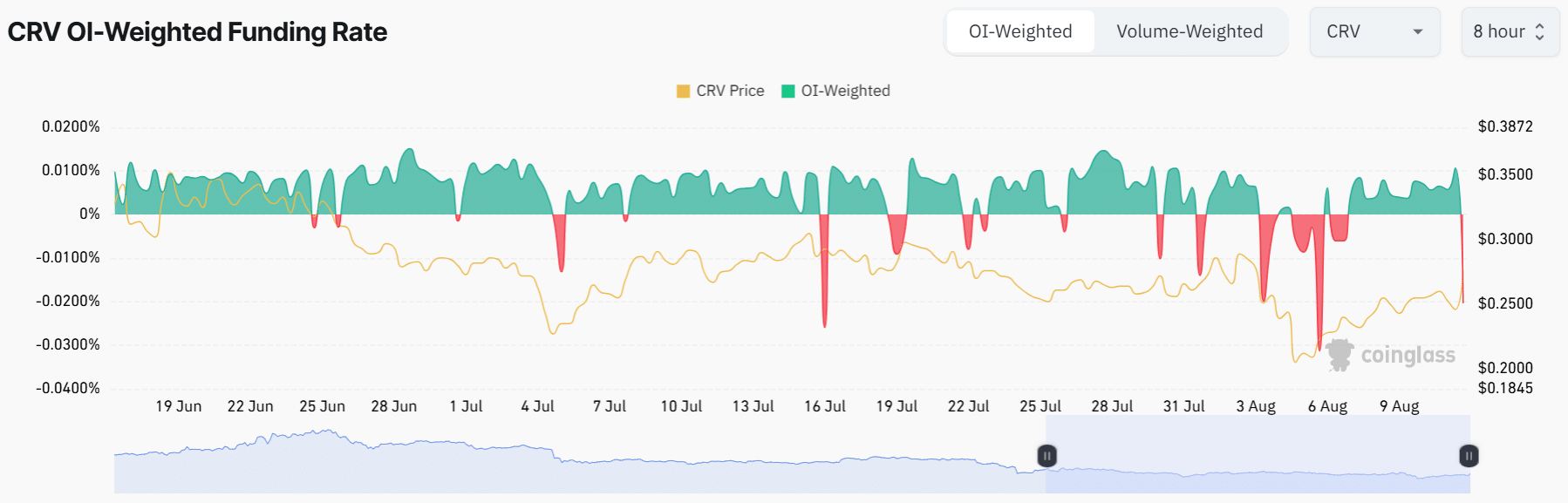

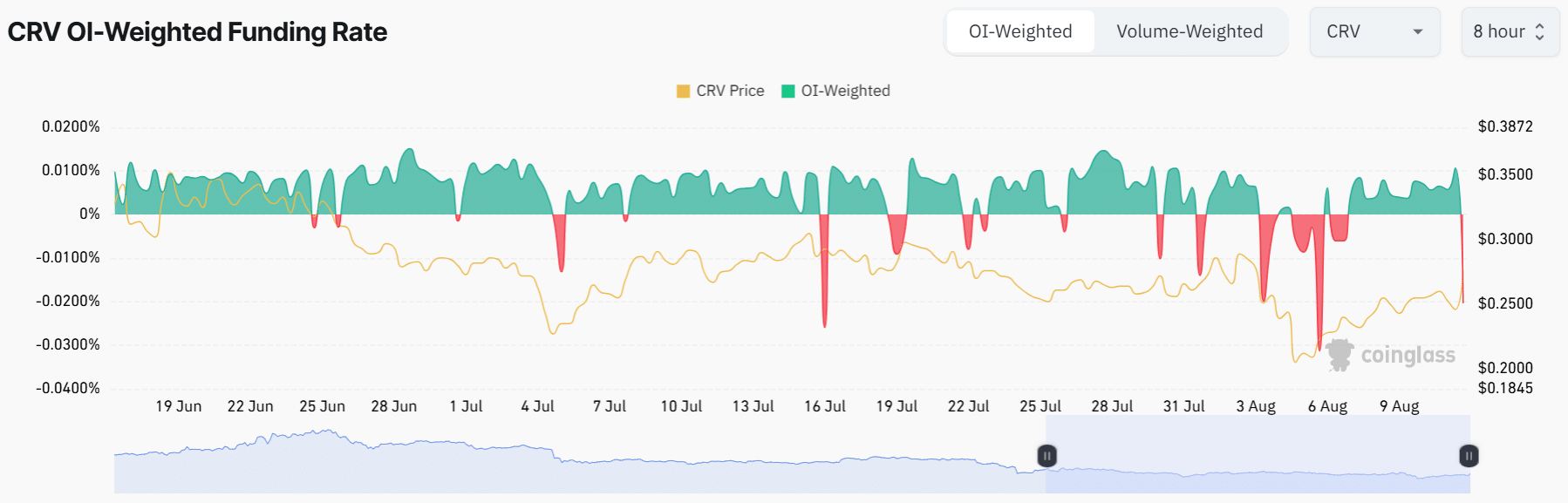

Funding rates post a sharp drop

According to data from Coinglass, there was a significant decrease in funding rates that went below zero, suggesting that traders are preferring to take short positions instead of maintaining long positions.

The changing feelings among traders indicate that CRV might have reached its peak, potentially setting up for a price adjustment or stabilization period.

As a seasoned trader with over two decades of experience in the financial markets, I have seen countless cycles of market euphoria and subsequent corrections. The recent sharp drop in funding rates for CRV is a clear signal that this cryptocurrency has become overheated and may be due for a cool-down period.

However, there is still a need for caution because the open interest has increased from $67 million to $100 million per Coinglass. While this is often seen as bullish during an uptrend, the same might not be the case for CRV due to the negative funding rates.

In situations where there’s a lot of ongoing bets (open interest) despite unfavorable borrowing costs (negative funding rates), it typically means more traders are betting on the asset falling (short positions). This trend indicates that pessimism about the market, or being ‘bearish,’ is on the rise.

How high can CRV go?

CRV trading volumes have jumped by 175% in the last 24 hours, according to CoinMarketCap data.

As a seasoned trader with years of experience under my belt, I’ve found that when the Relative Strength Index (RSI) on a four-hour chart for a cryptocurrency like CRV reaches 72, it often signals that the market is slightly overbought. This means that buyers have been actively purchasing more than usual, which could potentially lead to a correction in the near future. While I’ve seen instances where such overbought conditions didn’t result in an immediate pullback, I always exercise caution and consider adjusting my strategy accordingly. It’s essential to remember that market trends can be unpredictable, but understanding technical indicators like RSI can help make more informed decisions when trading cryptocurrencies.

On the other hand, the Relative Strength Index (RSI) is pointing upward, implying that buyers are still active in the market and there could be further price increases ahead.

If CRV reaches and rebounds from a potential breakout point at $0.285, this pattern suggests a continued bullish trend. If the bulls are strong, CRV might reach its next goal at approximately $0.36, which is based on the 1.618 Fibonacci Level.

Based on insights from analyst Credible Crypto regarding token X, there appears to be potential for additional growth, possibly doubling the current price.

If the investors who bought at the recent low (weak hands) decide to sell, it could cause a decrease in price, potentially reaching the Fibonacci level of 0.236, which translates to approximately $0.209. In simpler terms, if those who purchased recently decide to sell, there might be a drop in price down to around $0.209.

Read More

2024-08-13 13:12