- Curve DAO token was still sulking far, far away from its 2021–2022 glory days, despite a November that made it look like it had finally found its mojo.

- The short-term momentum was as bullish as a bull in a china shop, and a 12% price jump was practically begging to happen.

Curve [CRV] had strutted its stuff with a 19% gain in a week, and the bulls were eyeing the $0.55 resistance like it was the last slice of pizza at a party. But alas, the DeFi token had already wiped out most of its November and December 2024 gains faster than a kid with a melting ice cream cone. 🍦

The weekly chart revealed that even though Curve had flexed its muscles in November, the long-term downtrend was still lurking like a grumpy old troll under a bridge.

Yes, there was a bullish structure break on the weekly chart, which made investors puff out their chests like proud peacocks. But let’s be honest, it might be too little, too late. In a bull run, the early birds are the ones who get the worm—and the worms are usually gone by the time the latecomers show up. 🐦

Bitcoin [BTC] had a rough December, tumbling below $92k in February, and CRV followed suit with the enthusiasm of a lemming jumping off a cliff. This, of course, left CRV investors feeling about as cheerful as a wet sock. 🧦

Reduced selling pressure meant Curve had a chance of recovery

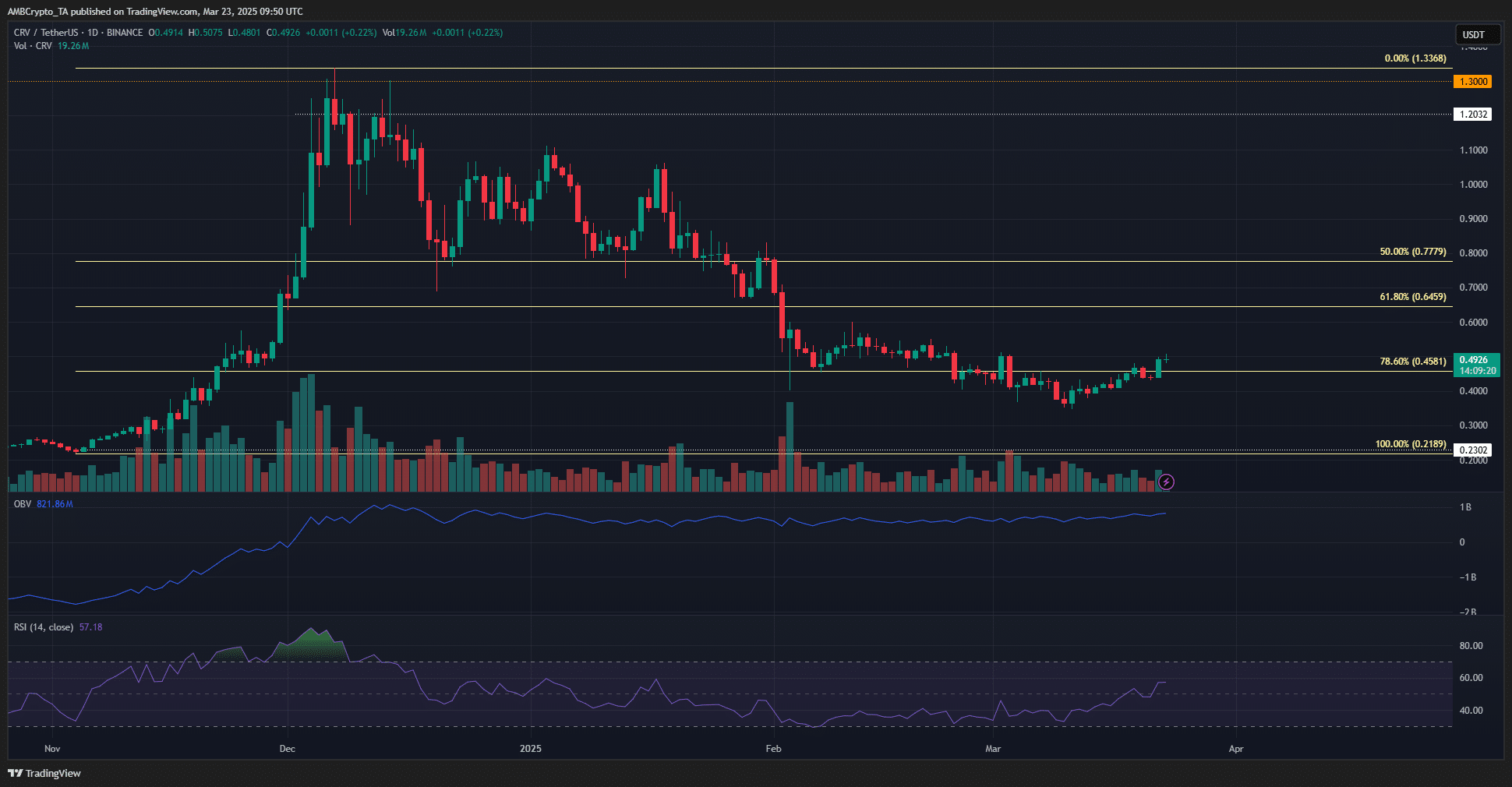

Zooming into the 1-day chart, the OBV (On-Balance Volume) hadn’t fallen much compared to its December levels. In fact, it had been making higher lows for the past three months, like a determined little ant climbing a hill. 🐜

The slow push upward was a sign that selling volume had taken a nap during the deep retracement. This meant a recovery could pop up faster than a jack-in-the-box. 🎪

Despite the OBV’s positive vibes, the bulls had their work cut out for them. The RSI had climbed above the neutral 50, signaling a bullish momentum shift. But the $0.55 local resistance was still standing in their way like a bouncer at a nightclub. 🚧

The daily market structure was as bearish as a grizzly in a bad mood, and only a breach of $0.55 could change that.

Further up, the Fibonacci retracement levels were the key resistances to conquer. And let’s not forget, BTC’s trends in the coming weeks could have a big say in CRV’s performance—like a puppet master pulling the strings. 🎭

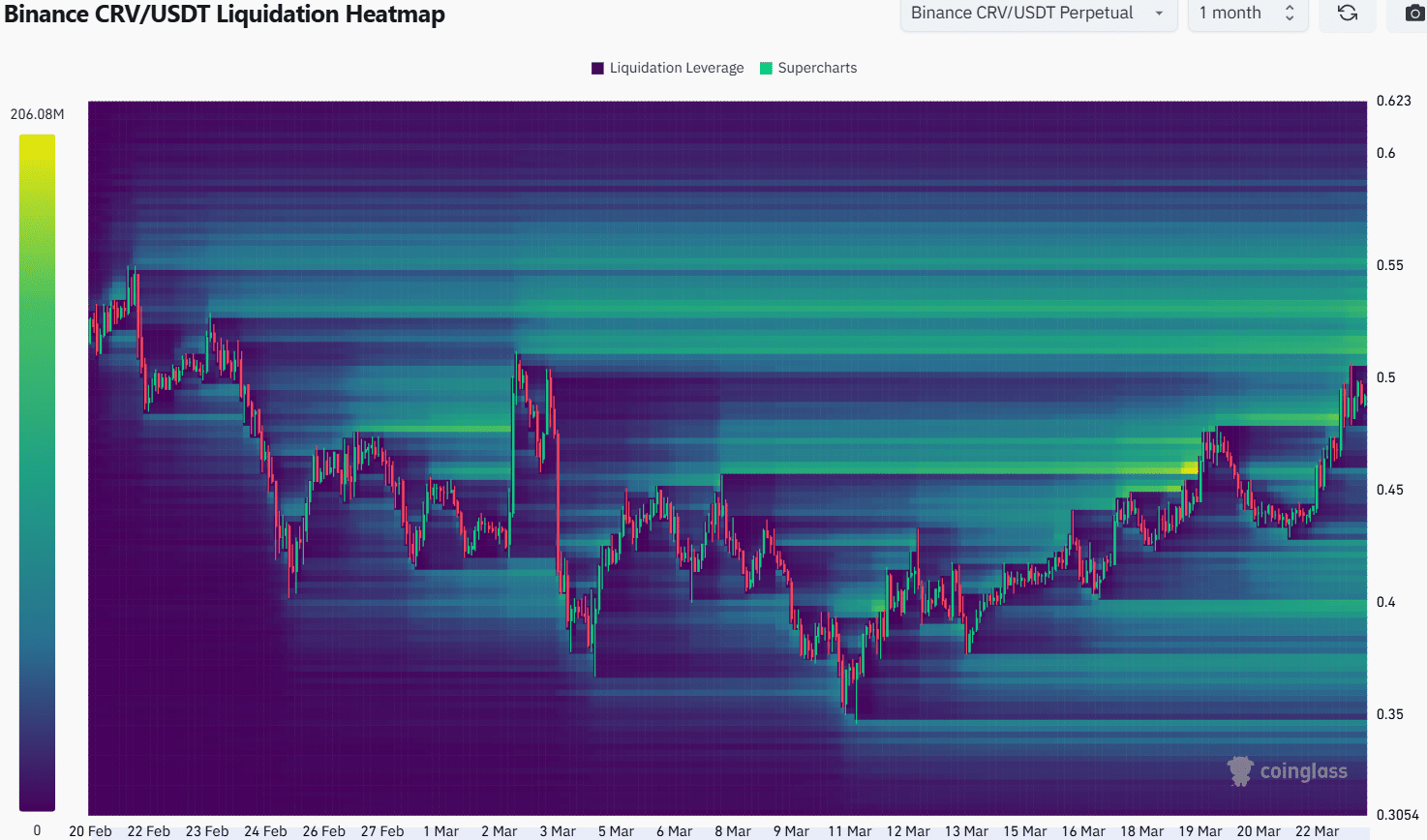

The 1-month liquidation heatmap showed that the $0.5-$0.55 zone was packed with liquidation levels, like a crowded elevator. These levels could lure Curve prices higher in the coming days, like a siren’s song. 🎶

It was likely that a move to $0.55 would be followed by a minor retracement—because nothing in crypto ever goes smoothly, does it? 🤷♂️

The shorter-period liquidation heatmaps would be worth keeping an eye on to see how deep such a dip could go. Based on the evidence, a move to $0.55 would likely be followed by a dip toward $0.47—like a rollercoaster that just can’t decide if it wants to go up or down. 🎢

If the buying volume surges higher, a breakout beyond $0.55 would become more likely, and a pullback to $0.47 would be less likely. But let’s face it, in the world of crypto, anything can happen—and usually does. 🎲

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-03-24 00:11