- The altcoin market cap is rebounding, and the Altcoin Season Index suggests a bullish breakout is imminent.

- Chainlink shows mixed performance, but its open interest is rising, indicating growing market interest.

As a seasoned researcher with years of experience in navigating the intricacies of the cryptocurrency market, I find the current state of the altcoin sector particularly interesting. The rebounding altcoin market cap and the bullish breakout suggested by the Altcoin Season Index have me excited about potential opportunities in the coming weeks and months.

As a crypto investor, I’ve noticed a positive trend since October began. After hitting rock bottom at less than $800 billion earlier this month, the collective value of altcoins seems to be recovering, signifying a promising revival in the market.

Specifically, in recent times, the worldwide total value of altcoins (excluding Bitcoin) has been steadily increasing and is currently estimated to be around $906 billion, as I am writing this.

Altseason is here?

During this current phase, a well-known cryptocurrency analyst, often referred to as ‘Moustache’, from platform X, anticipates that the altcoin market may be about to surge.

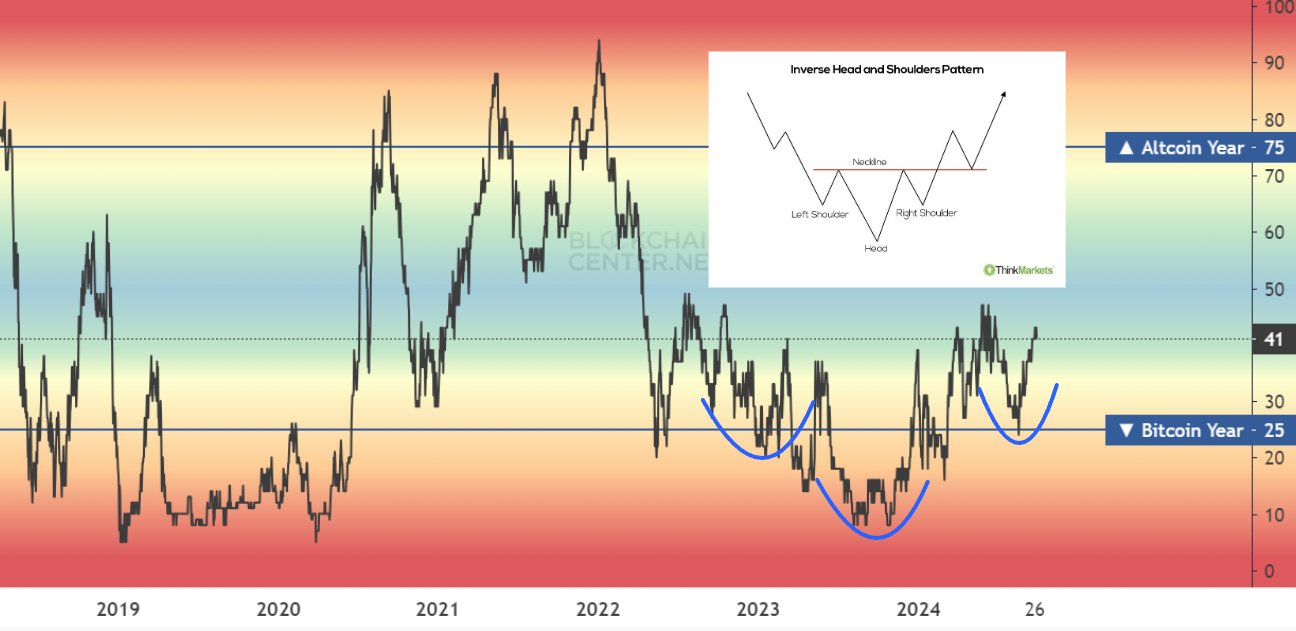

In a recent post, Moustache shared that the Altcoin Season Index, which measures the relative performance of altcoins against Bitcoin, appears to be forming a bullish Inverse Head & Shoulders pattern.

This common signal in tech analysis, often seen as a powerful predictor, is approaching the point of breaking out, which could lead to substantial fluctuations in the altcoin sector.

As an analyst, I’m highlighting that the upcoming period could offer significant potential for profits. The index appears to be wrapping up its bullish structure, which might signal a shift in trend direction towards an upturn.

In the realm of technical analysis, an Inverse Head & Shoulders configuration is generally interpreted as a positive sign, frequently indicating a shift from a decline to an upward trend. This pattern usually features three dips: a “head” sandwiched between two “shoulders,” with the “head” being the highest point among them.

If the cost surpasses the line drawn between the highest points of both shoulders (the peaks), it frequently indicates a possible surge beyond that level, suggesting an uptrend. For the altcoin market, this rise might indicate a transition from the existing contraction to a broader upward trend, potentially leading to substantial increases in various altcoins.

Mustache’s observation about the Altcoin Season Index matching this trend implies that investor feelings might soon lean towards altcoins rather than Bitcoin, possibly signaling a change in where money is moving.

As an analyst, I recognize that these technical indicators present a promising outlook. Yet, it’s equally essential for me to evaluate the independent performance of various altcoins to gain a comprehensive understanding of the overall market trends.

Assessing altcoin performance: Chainlink as a use case

To foresee if the altcoin market is set for a comeback, it’s crucial to examine certain altcoins like Chainlink (LINK), one of the leading cryptocurrencies in terms of market capitalization.

Although LINK saw a drop of about 5.5% over the last seven days, it still exhibits a generally optimistic trend, as it has climbed by nearly 16.3% during the past month. Additionally, LINK has demonstrated positive momentum in the recent 24-hour period, with its price rising approximately 2%, reaching $11.56.

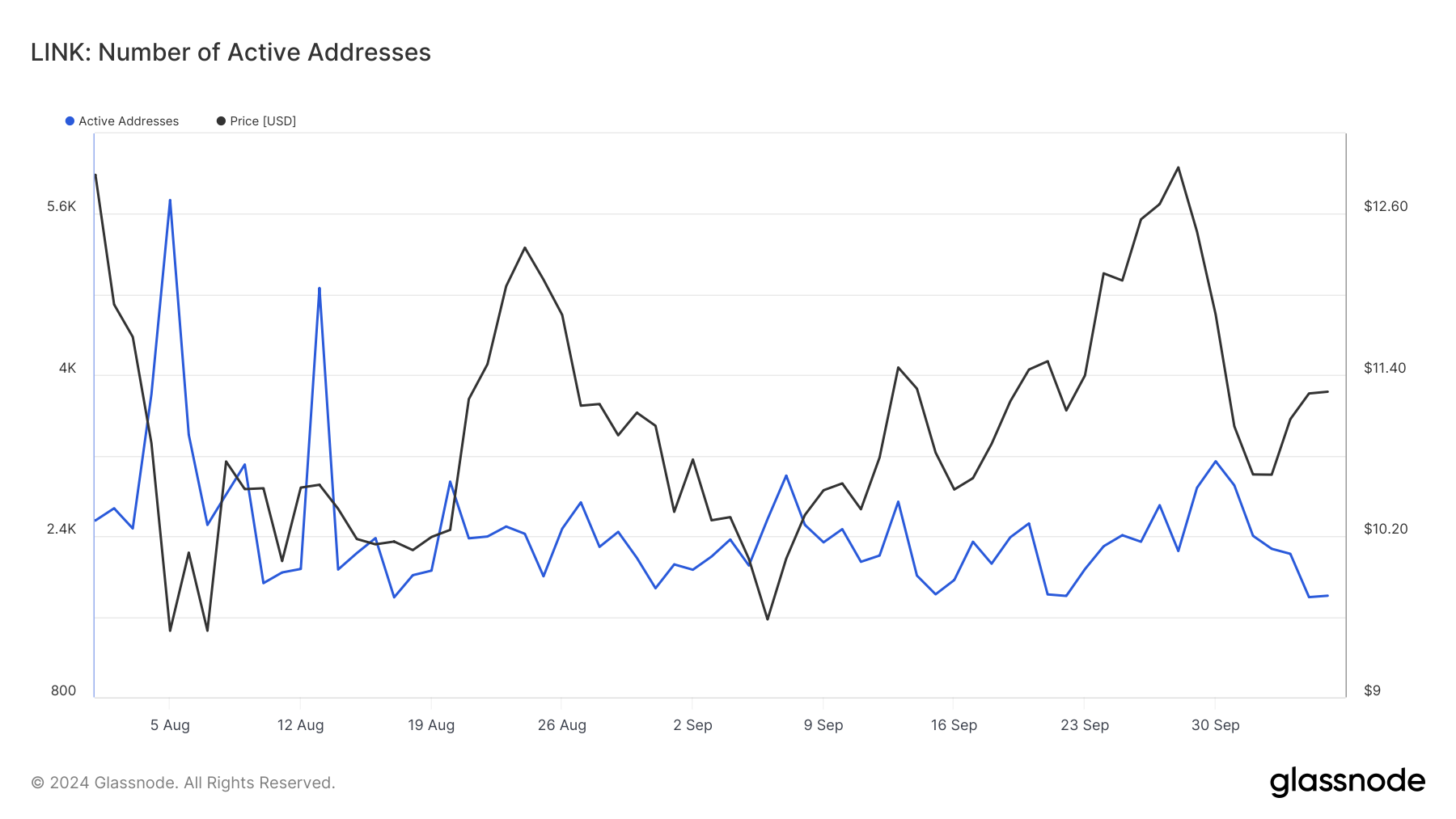

Exploring the essential aspects of LINK sheds light on its market mood and actions. The data provided by Glassnode suggests that there’s been a decrease in the number of active LINK addresses, an important indicator reflecting involvement from individual investors.

As a crypto investor, I noticed that we hit a peak of approximately 5,738 active addresses back in August. However, since then, the number has dropped significantly to roughly 1,809. This downward trend could be indicative of less retail involvement and engagement, which might be reflective of broader patterns in the retail participation of altcoins.

On the positive side, the open interest for LINK appears to be on an upward trend. As per information from Coinglass, this open interest has grown around 4%, resulting in a value of about $165.86 million.

Read Chainlink’s [LINK] Price Prediction 2024–2025

As an analyst, I’ve noticed a significant increase in the open interest volume associated with derivative contracts. This metric, which measures the total number of open positions, has swelled by approximately 31.96%. Currently, it stands at a substantial figure of $198.27 million.

An increase in open interest might be a sign that more investors are showing interest and confidence in the asset, possibly strengthening the argument for an upcoming surge of altcoins.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-10-07 15:36