As a seasoned trader who has seen the crypto market rise and fall countless times, I can confidently say that arbitrage has been both my savior and my downfall. It’s like playing a never-ending game of whack-a-mole, where the moles are price discrepancies between exchanges.

The emergence of cryptocurrencies added a whole new market of money-making opportunities that many prefer over traditional stock exchanges. Bitcoin, Ethereum, Dogecoin, and thousands of other cryptocurrencies offer different chances of making profits.

A vital takeaway from the cryptocurrency market is its extreme price fluctuations and ever-changing characteristics, which are essential aspects to bear in mind when pursuing potential arbitrage chances.

Unraveling the Secret of Crypto Arbitrage: A Strategy for Quick Profits

Key Takeaways:

- Crypto arbitrage is a trading strategy that uses market differences to seek marginal gains between buying and selling prices.

- Cross-platform and intra-platform are two ways to carry out crypto arbitrage trades.

- Arbitrageurs search for and buy a coin at a low price on a platform and then sell it at a high price in another market.

- The development of crypto arbitrage apps and bots made the process easier, saving time and offering higher returns.

What is Arbitrage Trading in Crypto

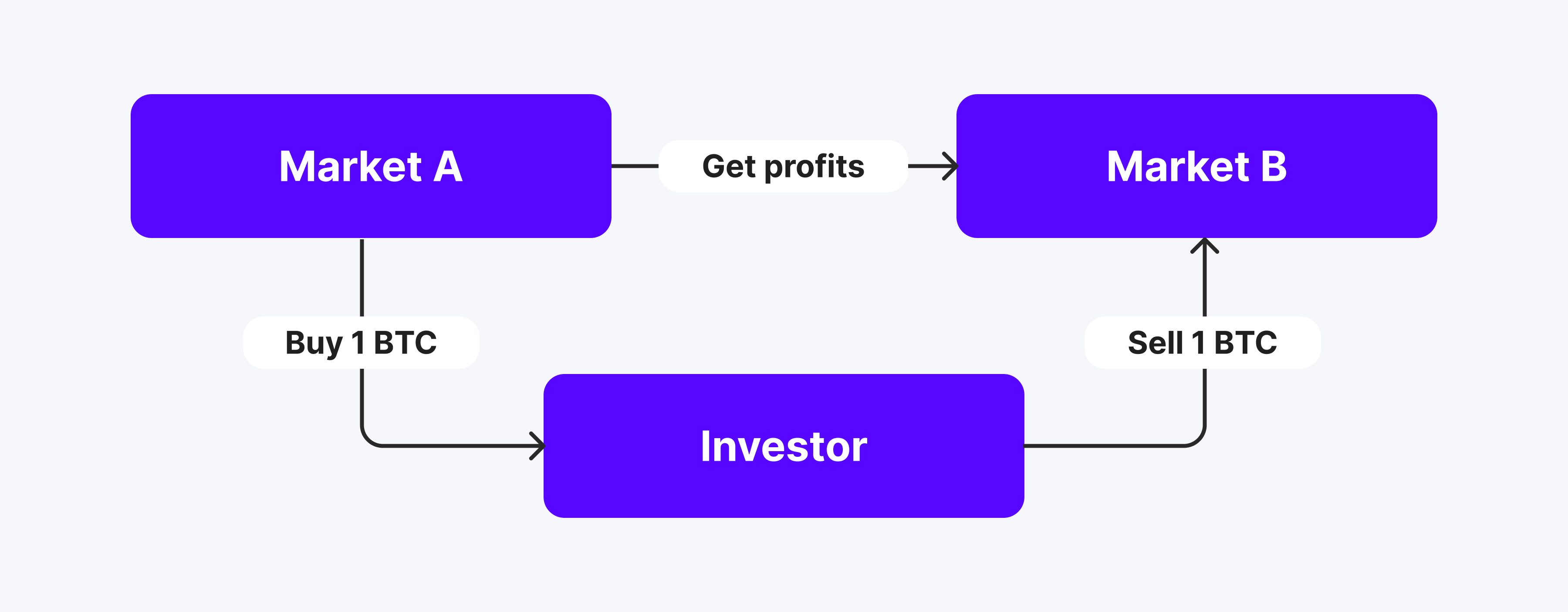

A common approach in trading, known as arbitrage, involves capitalizing on inconsistencies in prices across various markets or locations. By identifying slight differences in prices, an investor can profit from these discrepancies by buying low where the price is lower and selling high where the price is higher.

As a researcher, I’ve noticed that the subtleties in market rebalancing, driven by natural forces, can lead to small discrepancies. However, consistently placing large, similar orders over time can significantly amplify these minor differences, yielding notable returns.

In turbulent market conditions, characterized by frequent changes and dramatic price swings, the need for recalibration occurs often due to intense demand and volatility, thereby magnifying this discrepancy.

As a crypto investor, I engage in arbitrage by buying and selling virtual coins across different digital exchange platforms that host various blockchain networks. The proliferation of both decentralized and centralized exchanges, along with crypto brokers, has expanded the scope for such activities within the crypto market.

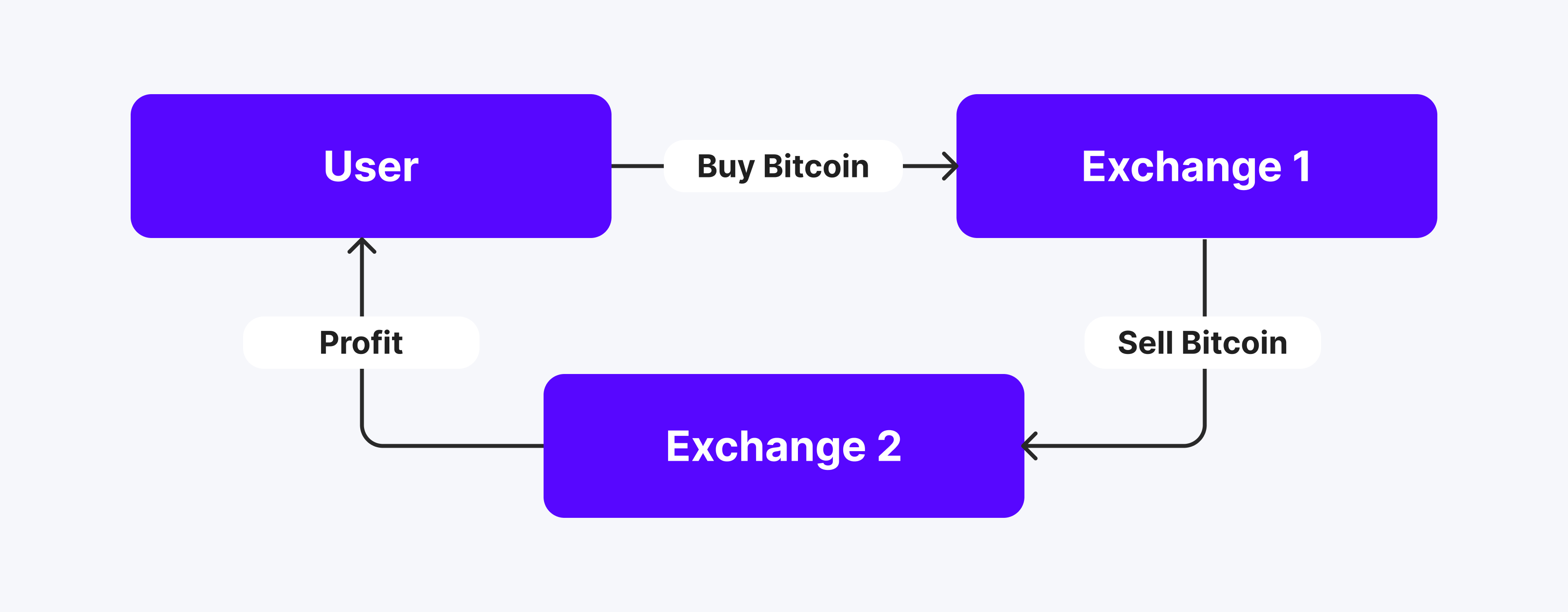

How Crypto Arbitrage Works

Cryptocurrency arbitrage means locating someone selling cryptos at a cheaper rate, purchasing the digital currency from them, then reselling it on another platform where its price is higher. In essence, you’re capitalizing on the differences in pricing between various exchanges to make a profit.

In crypto markets, opportunities for arbitrage emerge due to high market volatility, rising demand, and a vast array of virtual currencies, tokens, and DeFi assets. With more than 20,000 cryptocurrencies created across various blockchains and ecosystems, the chances for potential arbitrage trades multiply.

While it’s a method that can be quite intricate, calling for expertise to identify profitable cryptocurrency arbitrage chances and carrying out trades at opportune moments, many traders resort to using automated bots and scanning tools instead.

Risk and Rewards of Arbitrage Trading in Crypto

Engaging in a cryptocurrency arbitrage strategy can yield substantial profits when executed properly. Yet, it’s crucial to note that this method is best suited for experienced traders due to various factors. Now, let’s weigh the advantages and disadvantages of cryptocurrency arbitrage:

Advantages

- Arbitrageurs can achieve quick returns by locating discrepancies and executing orders quickly.

- The vast number of crypto assets increased the chances of finding an arbitrage opportunity.

- The availability of crypto arbitrage bots and scanners lowered the barriers for new traders to engage in this strategy.

- Traders can conduct arbitrage crypto trading independently of other current market positions without affecting their balance.

Disadvantages

- The crypto market is highly volatile, and arbitrage opportunities can disappear within seconds.

- Most price discrepancies are tiny, and traders can only make considerable profits by trading a significant amount of assets minus the trading fees and taxes.

- Crypto arbitrage scanners can be technically inaccurate and mislead traders into unprofitable transactions.

- Locating market opportunities requires constant monitoring, which can be tiring and time-consuming.

Fast Fact:

As a researcher delving into the world of digital assets, I’ve come across these intriguing entities known as arbitrage bots. These are complex automated tools, crafted with Python, designed to identify price discrepancies across various trading platforms. Once detected, they swiftly relay this information to smart contracts, ensuring prompt execution and maximizing the profit opportunities presented by these temporary disparities.

Types of Crypto Arbitrage

In the expanding, decentralized marketplace, traders now have multiple options for carrying out their arbitrage tactics. Today, let’s explore some of the most effective cryptocurrency arbitrage trading methods.

Cross-Exchange

In simple terms, cross-exchange arbitrage trading means spotting slight differences in the pricing of the same cryptocurrency on various online platforms where it’s traded, then capitalizing on these discrepancies by buying from the platform with a lower price and selling on the one with a slightly higher price.

As a seasoned cryptocurrency trader with years of experience under my belt, I’ve noticed that the prices for buying or selling Monero can vary significantly between different exchanges. For instance, one platform might sell XMR at $160.20, while another may buy it at $160.30. This discrepancy is often due to differences in liquidity and demand on these platforms, which I’ve learned can be exploited by savvy traders to earn a profit from the price difference. However, it’s crucial to keep in mind that such opportunities come with their own set of risks, as market conditions can change rapidly and unexpectedly in the world of cryptocurrency trading. So while this strategy has potential rewards, it’s essential to approach it with caution and a solid understanding of the market dynamics.

An alternative method for crypto exchange arbitrage involves identifying two trading platforms located in different regions, each utilizing distinct cryptocurrencies, and exploiting minor disparities in buying and selling prices to execute profitable trades.

Intra-Exchange

On a single trading platform, it’s possible to capitalize on price discrepancies that occur among various financial products, such as distinct types of trades for the same commodity like Bitcoin. This can manifest in instances where the immediate (spot) trade and future contracts are priced differently.

As a long-time cryptocurrency enthusiast with years of experience trading digital assets, I’ve learned to appreciate the nuances between spot markets and futures contracts. Spot markets provide me with the current value of Bitcoin (BTC) and the cost to acquire the coin immediately or through a cash settlement. In contrast, futures contracts let traders speculate on the price they believe the asset will be worth at a future date that we both agree upon. While I’ve found success in both markets, understanding their differences has played a significant role in my overall trading strategy and has been instrumental in maximizing my returns.

When the deadline for an option’s validity nears, if the difference between the strike price and current market price widens significantly, traders have an opportunity to exploit this gap by engaging in arbitrage trading.

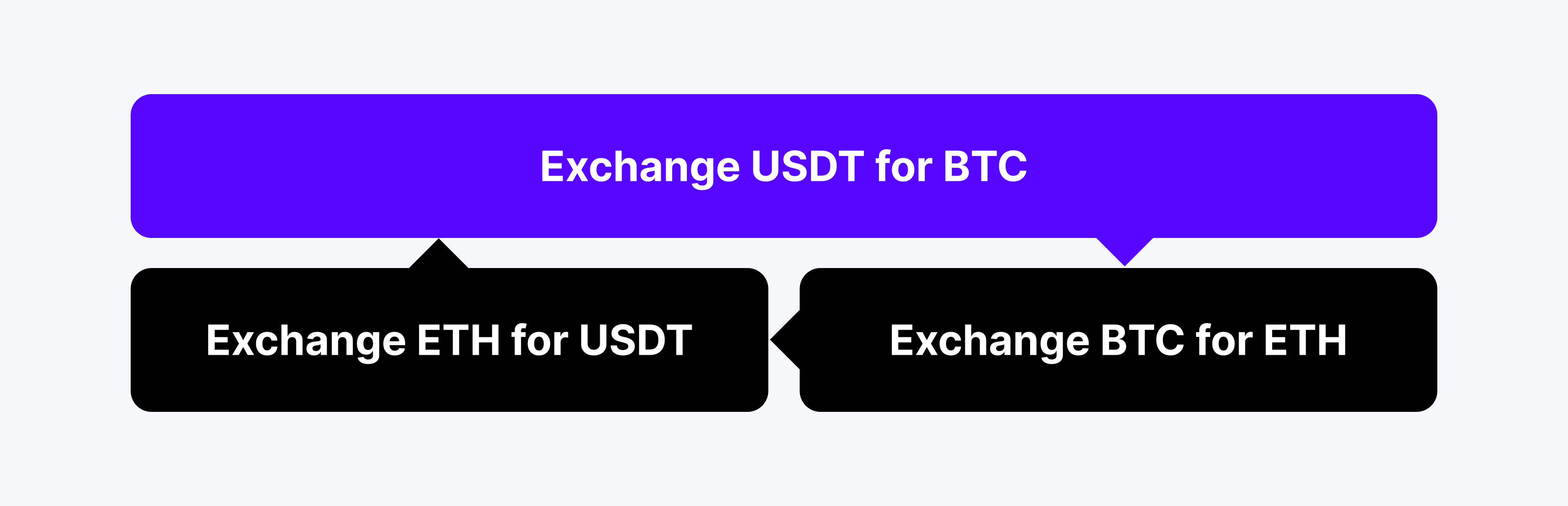

Triangular Arbitrage Crypto

In the method known as crypto triangular arbitrage, a trader doesn’t directly swap one cryptocurrency for another, like Tether (USDT) to Ethereum (ETH). Instead, they introduce Bitcoin (BTC) as a middleman and perform three trades: first, exchanging USDT for BTC, second, converting BTC into ETH, and finally, swapping the ETH back into USDT.

By taking advantage of minor price discrepancies and operational differences among the three digital currencies, traders can seize profit opportunities through strategies like buying two coins simultaneously (buy-buy) and then selling one, or purchasing one coin and immediately selling two (sell-sell). This practice, known as arbitrage, allows them to capitalize on price variations between multiple assets.

As a seasoned trader with years of experience under my belt, I have learned that diversifying investments is key to success. Recently, I decided to use $30,000 USDT from my trading account to purchase BTC, which netted me 0.45714346 BTC. With the goal of expanding my portfolio, I then utilized these acquired BTC to buy ETH, resulting in 8.65981059 ETH. After some careful analysis and market research, I decided it was time to sell my ETH for USDT, receiving a return of 29,996 USDT. Although the process of buying, holding, and selling digital assets can be complex and unpredictable, this particular trade proved profitable and allowed me to further diversify my investments.

In this case, a trader experienced a loss of 4 USDT in this particular triangle deal, indicating that it wasn’t successful triangular arbitrage. To achieve a profitable result, traders should thoroughly examine the price relationships among the three coins before proceeding with any trade.

P2P Arbitrage in Crypto

Direct asset swapping between market participants is enabled by peer-to-peer networks, eliminating the need for traditional trading. Cryptocurrency P2P software simplifies coin ownership by requiring minimal involvement from the platform itself.

Nevertheless, discrepancies might occur between Peer-to-Peer exchange rates and the value of coins, providing opportunities for traders to perform arbitrage transactions leveraging these price fluctuations.

Is Crypto Arbitrage Profitable?

The profitability of crypto arbitrage strategies depends on multiple factors. Markets must have sufficient discrepancies to create enough buffer to buy the needed assets, exchange them on another platform, and realize gains before the market rebalances the gaps.

Revising the sentence in a simpler and conversational manner: Crypto arbitrage finders and scanner tools make it easier to discover profitable arbitrage opportunities in the cryptocurrency market. Some of these platforms even offer automated bots that scan, evaluate, and suggest entry points for potential trades.

Consequently, it’s mainly seasoned investors with specialized tools, robust software, and substantial funds who can employ this strategy to achieve substantial profits.

Conclusion

Profiting from crypto arbitrage means conducting thorough study and evaluation to spot pricing differences between various exchanges, which you then leverage by purchasing a cryptocurrency at a lower cost on one platform and reselling it at a higher rate on another.

The variation in prices is a result of normal market fluctuations, with various trading platforms having unique demand, liquidity, and user bases. These factors can cause slight price discrepancies, which in turn present attractive trading possibilities.

Even though there are crypto trading bots and analytical tools available for arbitrage trading, it’s advisable that experienced traders with substantial resources delve into this strategy.

Read More

2024-08-01 16:56