- Mark Yusko predicted a likely bear phase in mid-2025 after BTC taps $150K.

- On-chain metrics showed extra room for growth for BTC.

As a seasoned researcher with over two decades of experience in the financial markets, I find myself intrigued by Mark Yusko’s prediction of a potential bear market phase for Bitcoin (BTC) in mid-2025. His insight into historical trends associated with parabolic rallies is certainly noteworthy and warrants careful consideration. However, I am cautiously optimistic about the near future of BTC, as on-chain metrics suggest there may still be room for growth before a potential market top.

Based on the prediction made by Mark Yusko, the CEO and founder of Morgan Creek Capital, a potential bear market phase for cryptocurrencies may begin as early as mid-2025.

In a recent interview with Cointelegraph, Yusko stated,

“We have another bear market starting mid-2025, and we enter crypto winter again”

Yusko anticipates that the market will reach its peak once Bitcoin [BTC] reaches around $150K, following which it may decline based on previous patterns seen in parabolic surges. Furthermore, he mentioned this prediction by referencing historical market trends.

A value of around $150,000 might be achievable. This represents a 50% increase over the estimated fair value. Regrettably, it seems we may reach this point, and subsequently experience a downturn in the market, often referred to as a “bear market”.

According to Yusko, establishing a U.S. Bitcoin national reserve could potentially hasten the achievement of the $150,000 target. It’s worth noting that some analysts have speculated that the price of Bitcoin could reach $1 million if such a reserve comes into existence. However, Yusko expressed caution regarding this high price projection.

BTC cycle status

The number of bullish predictions for Bitcoin has risen significantly since it surpassed the $100,000 mark. Some analysts predict that Bitcoin could reach this level as early as March 2025, while others believe it might happen during the third or fourth quarter of 2025.

Is Yusko’s mid-2025 deadline for his bear call aligned with the current outlook, or does the data from on-chain metrics suggest a different scenario?

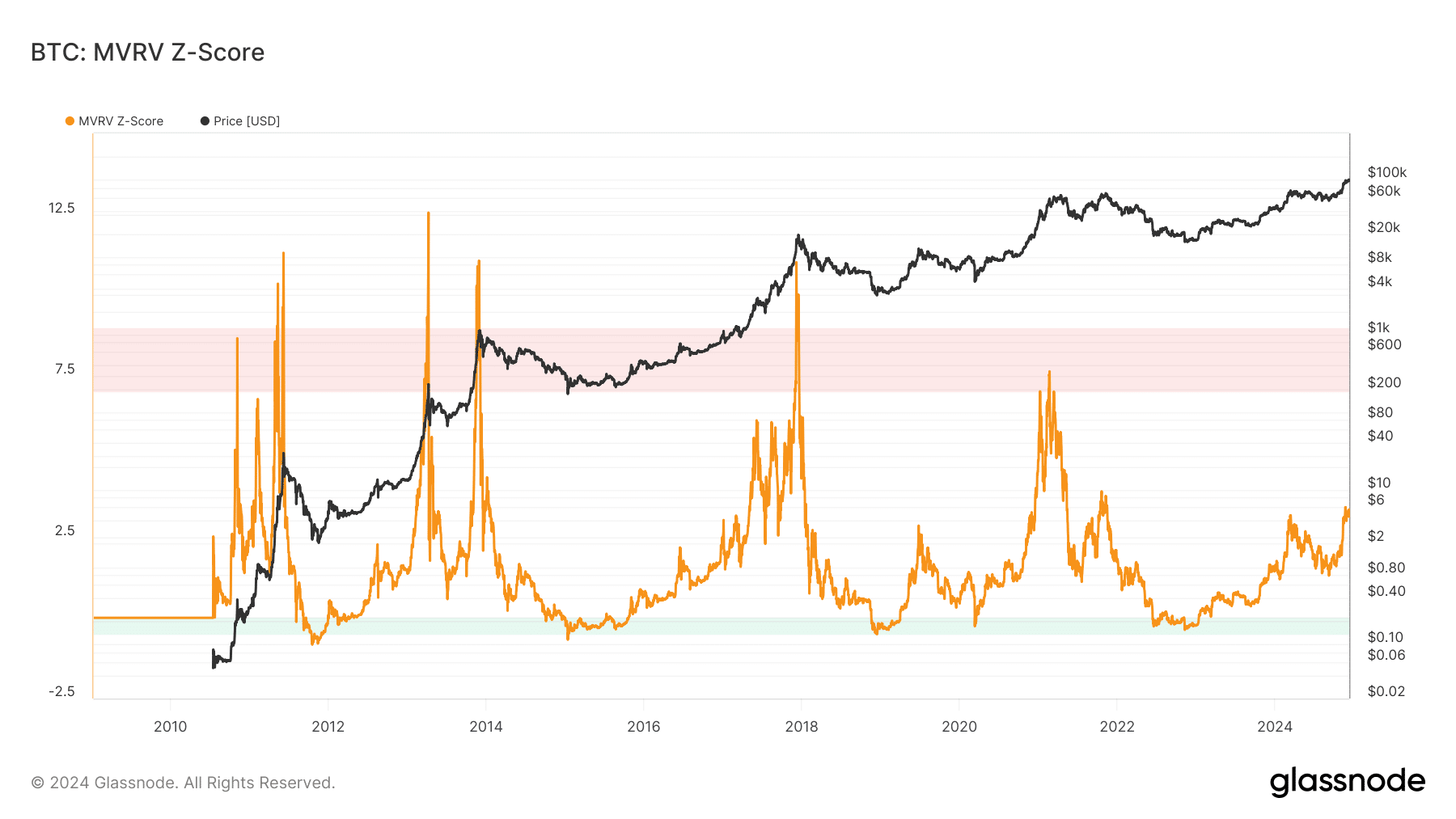

One of the top indicators, the MVRV-Z score, showed enough headroom for BTC growth before topping. The valuation metric correctly marked the last cycle tops when it crossed 7 (upper band).

At present, we’re observing a repeated sequence similar to December 2020, appearing thrice. Previously, this pattern peaked at 7 (in March 2021) and 4 (in October 2021) in the recent cycle.

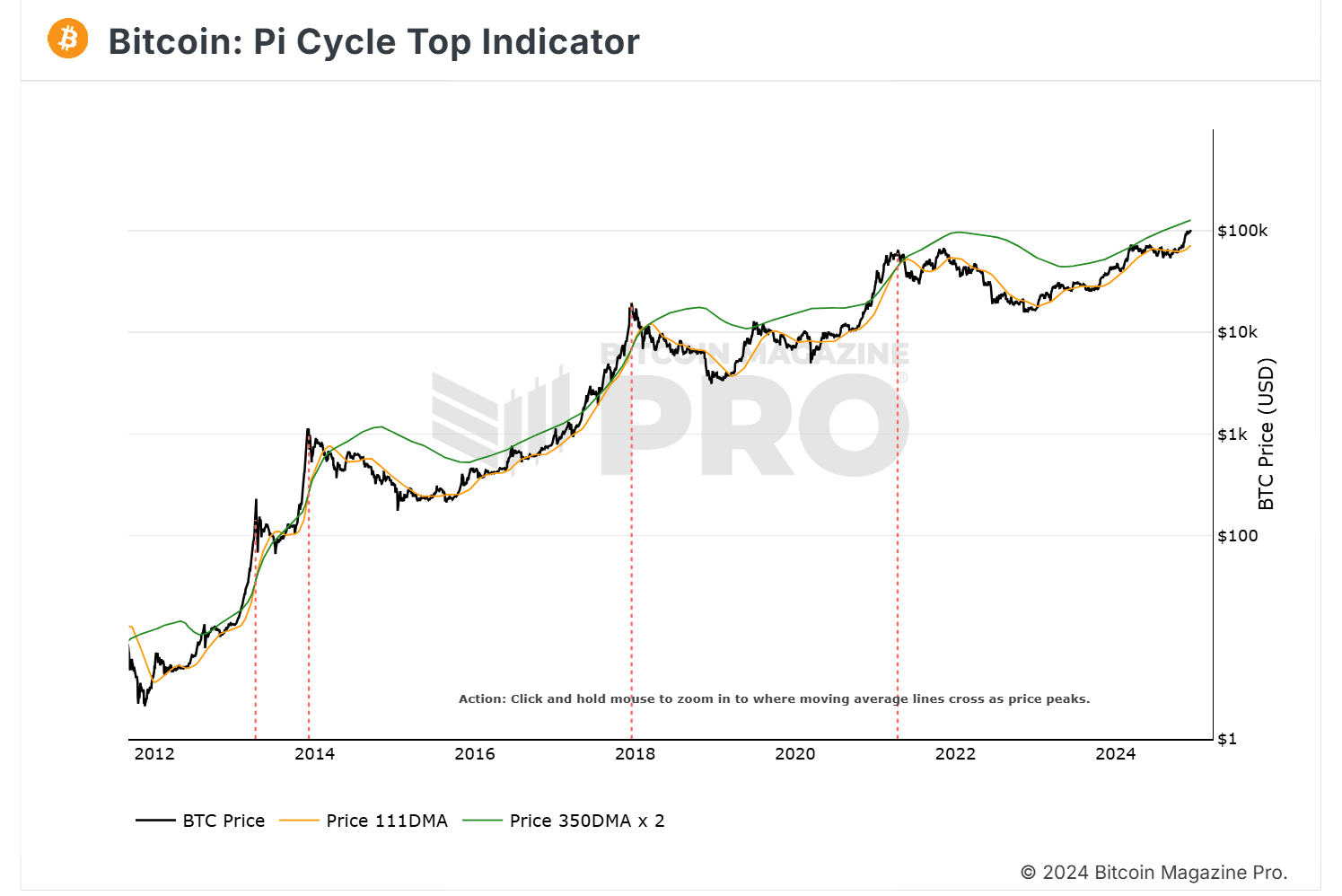

At present, there’s a significant distance between the two long-term moving averages in the Pi Cycle Top indicator, which is typically a sign of more potential growth before a probable peak.

Historically, a BTC top and overall ‘bear market phase’ always begin the year after the halving.

Read Bitcoin [BTC] Price Prediction 2024-2025

Some experts suggest that Bitcoin’s future market cycles may not be as severe as those in the past, primarily due to the growing involvement of institutional investors.

However, it’s yet uncertain when exactly Bitcoin will reach its peak in 2025 or how severe the upcoming bear market will be. Nonetheless, based on on-chain indicators, Bitcoin still has potential for growth.

Read More

2024-12-10 23:35