-

A bullish flag pattern appeared on the weekly altcoin market capitalization chart.

The Bitcoin rainbow chart suggested that BTC was in the “still cheap” phase.

As a seasoned researcher with years of experience navigating the unpredictable seas of the crypto market, I can confidently say that the current state of affairs is reminiscent of a cat on a hot tin roof – tense and potentially explosive. The bullish flag pattern on the weekly altcoin market capitalization chart and the Bitcoin rainbow chart suggesting BTC as “still cheap” are undeniably intriguing indicators.

2021 has seen several rises in the cryptocurrency market, yet none have endured for a significant time. Typically, these price surges were preceded by adjustments or downturns. Nevertheless, the final three months of this year could present a distinct scenario.

It appeared that conditions were favorable for a prolonged upward trend in the market, as various signs suggested a possible cryptocurrency bull market in the near future. Let’s delve deeper into these indications pointing towards an imminent bullish phase in the crypto sector.

Bitcoin to lead the next crypto bull run?

Bitcoin (BTC) took investors by surprise this year as it achieved an all-time peak of over $72,000 in the first quarter. Ethereum (ETH), the dominant altcoin, likewise experienced a bullish surge during that period; however, it fell short of testing its record high significantly.

Regardless, Bitcoin quickly fell from that point and appears to be facing some challenges. For example, over the past 24 hours, its value decreased by 5% and is currently being exchanged at approximately $59,097.36.

Just like ETH, its value dropped by 7%. Currently, each ETH is worth approximately $2,458.85.

Looking ahead, there’s a possibility that the coming months could take a different turn, given that Bitcoin may be gearing up for a significant surge, based on past trends. Historically, Bitcoin tends to build up bullish energy following a few months after its halving event.

Indeed, every time Bitcoin undergoes a halving event, it tends to reach a new all-time high afterwards. For example, following the second halving on July 9th, 2016, Bitcoin displayed a bullish trend and eventually peaked at a record high in December 2017.

Following its third reduction in May 11th, 2020, Bitcoin exhibited a surge in bullish activity around October 2020 and reached a new all-time high shortly afterward. Given that the last halving occurred in April 2024, there was a strong possibility of another bull run happening in Q4 of 2024.

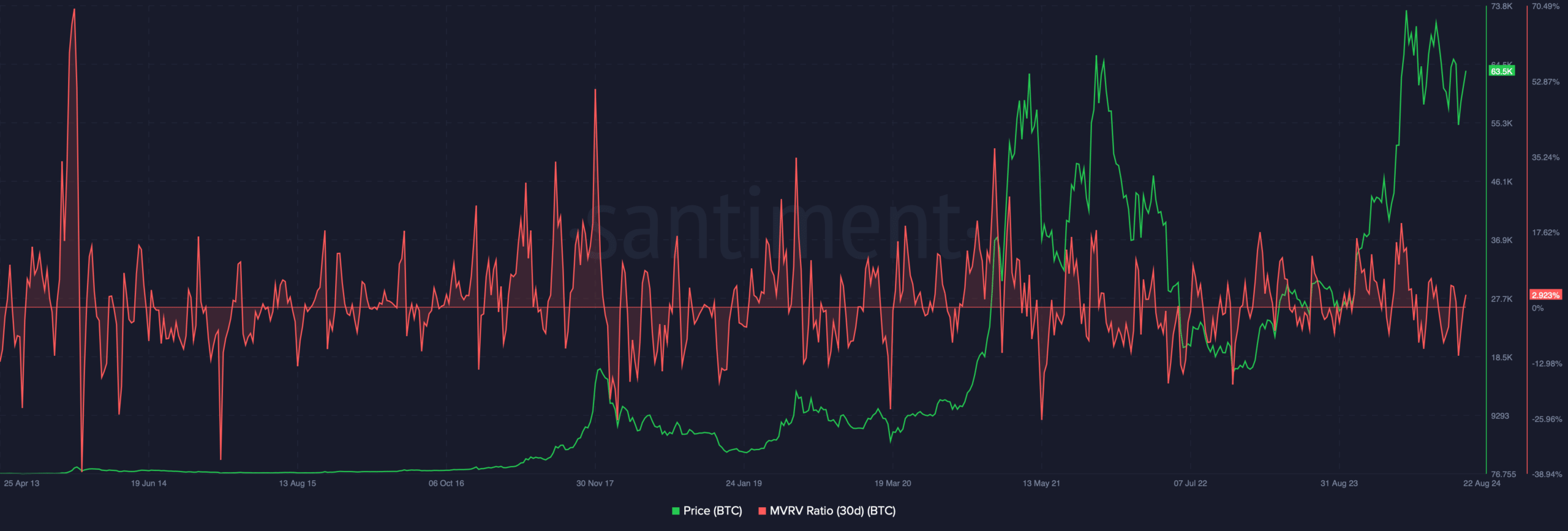

Another interesting metric to keep an eye on is the MVRV ratio. A close look at the metric suggests that it goes above 30% each time BTC reaches an ATH.

Currently, the MVRV (Market Value to Realized Value) ratio for Bitcoin stands at approximately 2.92%. This figure indicates a potential upcoming rise in Bitcoin’s price within the next few months, as such high ratios often precede market upswings.

Additionally, AMBCrypto’s examination of the Bitcoin Rainbow Chart found that Bitcoin (BTC) is currently in the “relatively inexpensive” stage. This tool also advises potential investors to think about purchasing the cryptocurrency before it becomes more bullish.

Altcoins are also planning a rally soon

Typically, Bitcoin (BTC) leads the cryptocurrency market due to its size. So, if Bitcoin experiences a bullish surge, it’s likely that other altcoins will follow suit and become bullish as well.

Nevertheless, it’s worth noting that altcoins possess a secret advantage, suggesting a potential surge in price. A closer examination of the weekly altcoin market capitalization graph by AMBCrypto reveals a bullish flag formation.

Starting in March, a bullish trend appeared, and ever since then, the total value of altcoins has been holding steady within this pattern. Should a bullish breakout occur over the next few months, investors can expect a significant surge in the overall value of altcoins.

Indeed, if there’s a surge or breakout, the cumulative value of altcoins might regain the level of $1.24 trillion first, and then potentially continue its path to reach its all-time high (ATH) of approximately $1.58 trillion.

Despite a potential dip in the near future, with the possibility of the market cap falling to its support level of $702 billion, there’s hope for recovery. The market cap chart could bounce back from this point and trend upward, aiming for the upper boundary of the bullish flag pattern.

The Altcoin Season Index, in relation to Bitcoin, stayed strong with a reading of 24, suggesting that the conditions are still more favorable for Bitcoin over altcoins. Typically, a value above or equal to 75 signals an “altcoin season.”

Why memecoins have great potential

Instead of focusing solely on well-known cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), investors should not underestimate the potential of meme coins, as they have shown impressive growth trends in recent months.

Besides popular meme cryptocurrencies such as Dogecoin [DOGE] and Shiba Inu [SHIB], coins built on the Solana platform, known as Solana meme tokens, are currently experiencing a surge in popularity.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As a point of reference, the price of dogwifhat [WIF] has skyrocketed over 800% since it was introduced in 2024. Meanwhile, POPCAT, a recent addition to SOL‘s meme-based platform, has demonstrated exceptional performance with its value increasing by an impressive 4184% since its launch.

Consequently, as we keep tabs on the performances of leading market cap cryptocurrencies, it’s equally important to observe how Namecoin fares during the upcoming crypto market rally.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-29 03:04