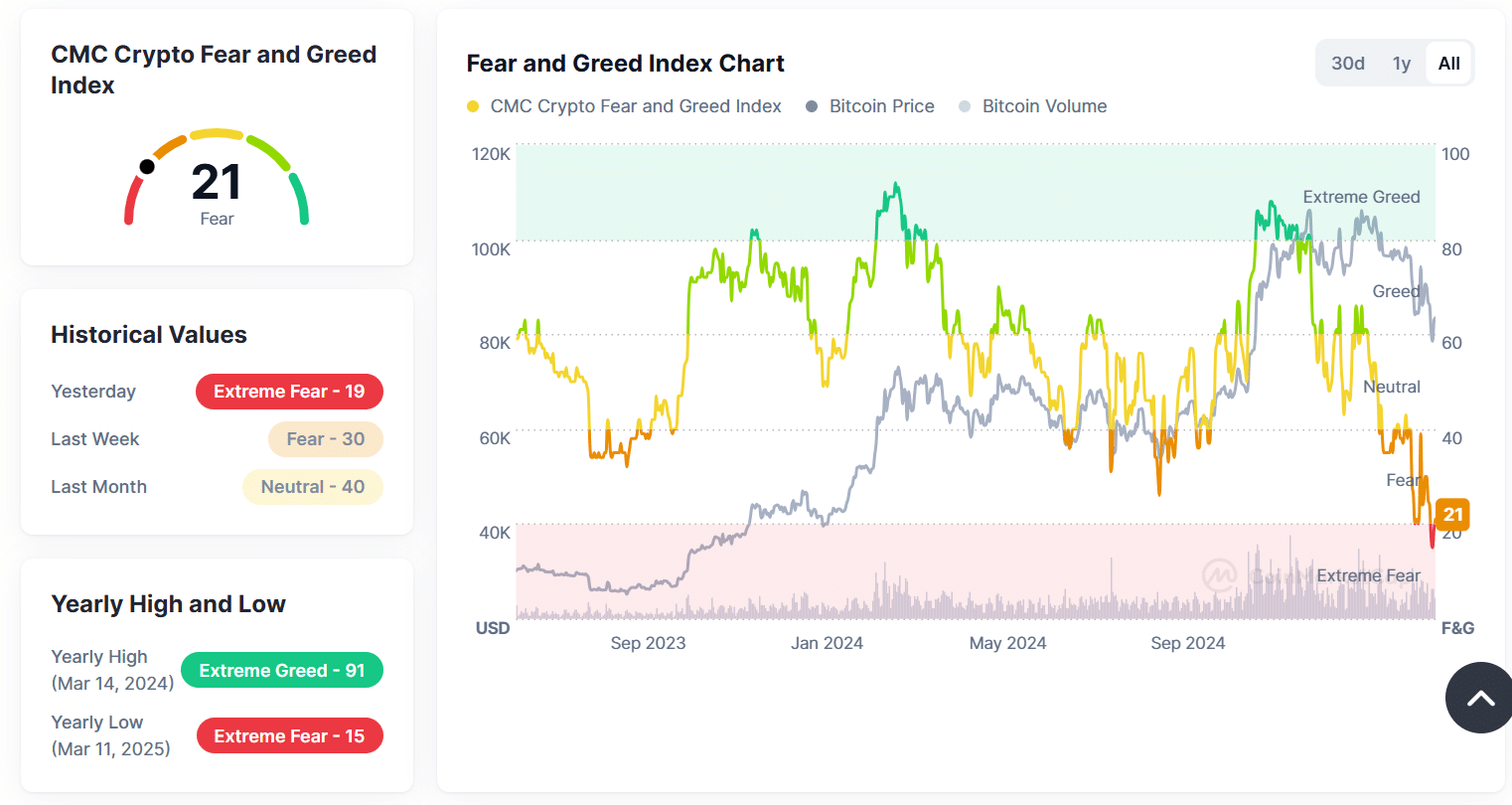

- Oh dear! The Fear and Greed Index has taken a nosedive to 21, sending shivers down the spines of market participants.

- ETF net flows are as mixed as a fruit salad, with BTC enjoying a smidgen of inflows while ETH is left to wallow in outflows.

It appears the cryptocurrency market is in a bit of a pickle, with the Crypto Fear and Greed Index plummeting faster than a lead balloon.

This alarming drop is a reflection of the growing uncertainty, driven by significant ETF outflows, a dwindling market capitalization, and the broader economic malaise that has everyone clutching their pearls.

Crypto Fear and Greed Index Takes a Tumble

The crypto market sentiment has taken a significant hit, akin to a butler dropping a tray of fine china, as the Fear and Greed Index has plummeted to 21, indicating extreme fear among investors.

Just last month, the index was a more cheerful 40, showcasing a sharp decline in confidence as market conditions have taken a turn for the worse.

This drop aligns with a broader market correction, much like a bad haircut, reflected in the crypto market cap and ETF net flow trends over the past 30 days.

Market Cap Suffers Major Declines

The total crypto market cap now stands at approximately $3 trillion, with Bitcoin [BTC] and Ethereum [ETH] taking significant hits, much like a pair of hapless chaps in a game of croquet gone awry.

Bitcoin’s market cap was $1.65 trillion at press time, marking a 15.11% decline, while Ethereum has seen a more drastic fall, dropping 30.53% to $227.41 billion.

Meanwhile, stablecoins are holding their ground at $216.23 billion, reflecting a shift towards risk-averse assets in these uncertain times.

Other altcoins have also faced major sell-offs, with their collective market cap down 19.76%, leaving investors feeling as if they’ve just lost a game of bridge.

ETF Netflows Reflect Mixed Sentiment

ETF netflows provide further insight into investor behavior, which is as unpredictable as a cat on a hot tin roof.

While Bitcoin saw a modest $13 million in positive inflows, Ethereum recorded $10 million in outflows, highlighting the diverging investor sentiment between the two leading cryptocurrencies.

Over the past month, multiple days of negative flows have contributed to bearish sentiment, reinforcing the extreme fear reflected in the index.

The persistent outflows suggest investors are still hesitant to deploy capital, further weighing on market recovery, much like a heavy fog on a Sunday morning.

Implications for Crypto Markets

A fear and greed index at these levels typically signals an oversold market, but it also indicates a lack of buying confidence among investors, who seem to be as skittish as a cat in a room full of rocking chairs.

Historically, such extreme fear levels have preceded recovery phases as opportunistic traders seek to capitalize on lower prices, much like a hawk eyeing a field mouse.

However, with continued market cap declines and persistent ETF outflows, the road to recovery may still face resistance, akin to a stubborn mule.

If Bitcoin fails to hold its market dominance and Ethereum’s outflows continue, the bearish trend could persist, forcing more liquidations and deepening the market correction.

On the other hand, any shift towards positive ETF inflows and market cap stabilization could mark the beginning of a

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2025-03-14 08:12