- Exchange reserves tumble, sparking rumors of a Bitcoin scarcity—cue the drama! 🎭

- Analysts say HODLers might party while traders panic if demand keeps its cool. 🍾💸

Once upon a troubled blockchain, Bitcoin [BTC] said farewell to exchanges and moved its comfy nest to cold storage, according to CryptoQuant. Brave, defiant BTC reserves climbed heroically between 2020 and 2022, only to take a nosedive worthy of a Dostoevskian anti-hero. 🚀⬇️

HODLers, ever the romantic poets of the crypto world, keep withdrawing BTC to treasure chests, crafting their long-term ode to supply constraints.

What’s left on exchanges? Not much, my friends. Just a bittersweet handful, mentally preparing for demand’s mighty roar. Does this mean Bitcoin could moon if buyers swarm? Only if demand wears its game face. 😏

As Bitcoin flexes its upward trend into 2024-2025, the law of supply and demand starts feeling like a Shakespearean tragedy—everyone wanting more, but there’s less to get. ⚖️💔

A shrinking stash has romantics daydreaming about a spicy supply shock, one that slaps the skeptics with deja vu from bull runs of yore. 🐂✨

On-chain data screams HODL—but whispers it, too

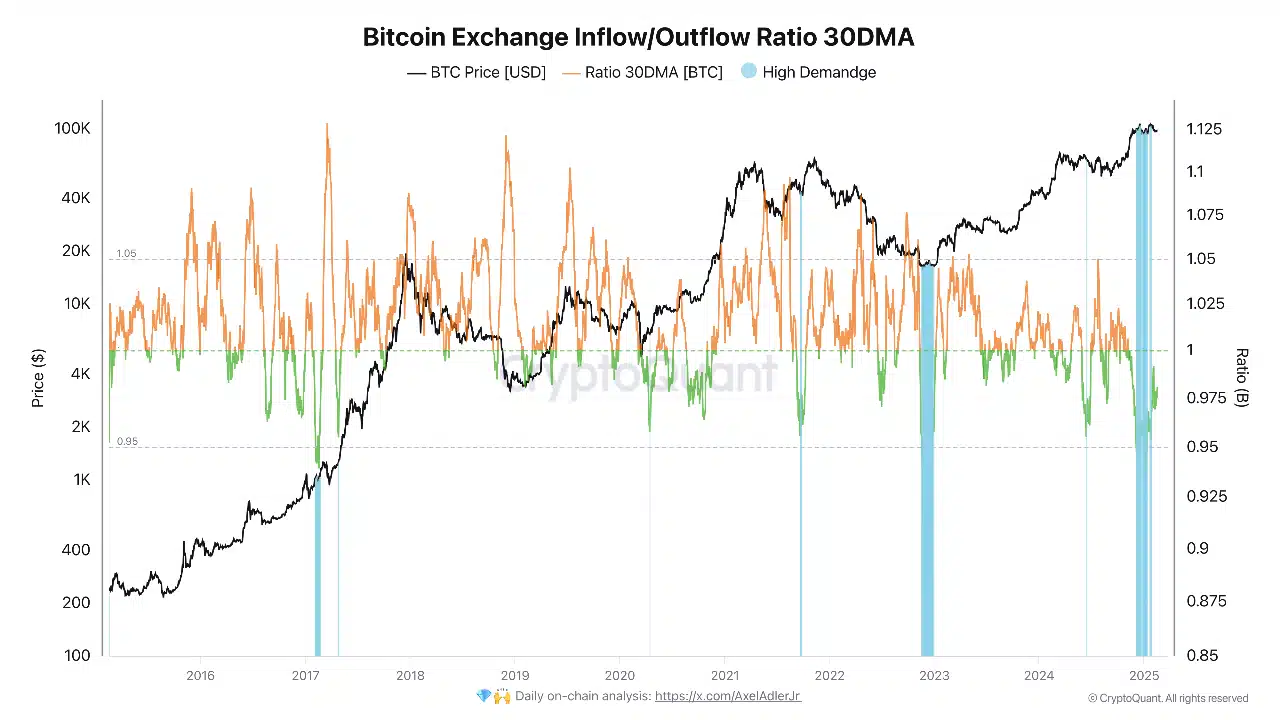

Trading between $90,000 and $105,000, Bitcoin is pulling off a humblebrag as the 30DMA Exchange Inflow/Outflow Ratio stays below 1. Translation? BTC prefers whispering “nah, I’ll stay” to exuberant buyers rather than yelling “take me now!” 📉➡️📤

This lover’s tiff between inflows and outflows could fuel a juicy post-breakup rally—especially if sellers hit the snooze button. 😊📈

But beware: some “outflows” are just centralized exchanges playing Monopoly, shuffling coins between wallets. Custodial this, OTC that—it’s like a financial soap opera. 🎩💼

Bitcoin’s a diva in a bearish outfit

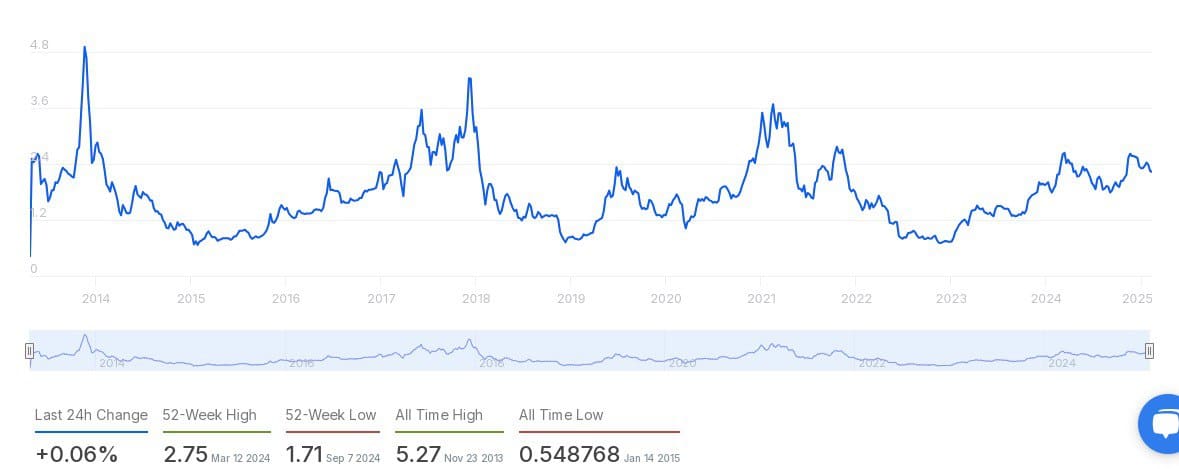

Now trading at $96,071 (cue dramatic sigh), BTC bears a smug -1.23% drop over the last 24 hours and a whole -1.43% over seven days. But dear friends, all is not lost—MVRV metrics haven’t gone full “doom and gloom” yet. 🐻☕

Market Value to Realized Value (MVRV) reflects a moody but stable temperament. It’s no 2013 optimism high, nor a 2015 depression low. Call it the steady yet sarcastic middle child of metrics. 😒

This past year, we’ve danced between caution and courage. A +0.06% change says, “Meh, no fireworks today.” 🎆❌

Big wallets and bigger appetites

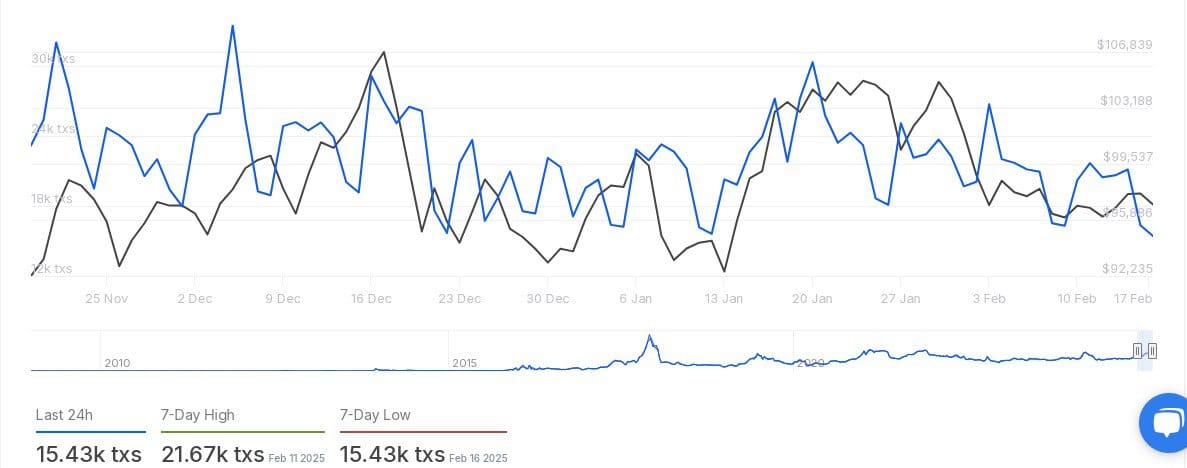

Bitcoin transactions over $100k are the cool kids of the crypto cafeteria. With 15.43k deals in the last 24 hours (a 7-day low), the buzz is quieter but still intriguing. 🤑🍽️

Back on February 11, the rich kids threw a party—21.67k transactions! But now? Everyone’s in a post-pie nap. 🥧😴

Despite this slowdown, high-net-worth individuals seem to still flirt with Bitcoin, whispering sweet nothings about future gains. 💌📈

The crystal ball of Bitcoin’s future

With exchange reserves mimicking a tightrope act, the next act looms: supply shocks and bull run fantasies. But this is crypto—one wild card away from chaos. The audience holds its breath. 🎪🎭

As the plot thickens, will Bitcoin leap, stumble, or wink slyly at anyone still watching? Only time—and wallet transfers—will tell. 😜⌛

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-02-18 07:08