Ah, the grand spectacle of Crypto US stocks! They find themselves in a most unfortunate predicament, as if they had just stepped into a puddle of misfortune after Galaxy Digital (GLXY), MARA Holdings (MARA), and GameStop (GME) decided to take a nosedive yesterday. 🥴

GLXY, in a fit of dramatic flair, plummeted over 6% upon announcing its first underwritten public offering as a Nasdaq-listed company. MARA, despite boasting a record-breaking revenue day, slid nearly 10%—perhaps it was too busy counting its Bitcoin to notice the market’s indifference. And GME? Oh, it fell over 10% after revealing a $512 million Bitcoin purchase, as if the market collectively shrugged its shoulders. 🤷♂️

Galaxy Digital (GLXY)

Behold! Galaxy Digital Inc. (GLXY) has officially launched its first underwritten public offering, releasing a staggering 29 million shares of Class A common stock. A veritable cornucopia of shares! 🍿

Out of this bounty, 24.15 million are being offered directly by Galaxy, while 4.85 million are from existing shareholders—because who doesn’t love a good share shuffle?

The firm plans to use its proceeds to acquire newly issued LP Units from its operating subsidiary, Galaxy Digital Holdings LP. The funds will be funneled into expanding AI and high-performance computing infrastructure at its Helios data center in West Texas. Because, of course, what’s better than a data center in the middle of nowhere? 🤖

Major investment banks, including Goldman Sachs, Jefferies, and Morgan Stanley, are leading this offering, which is still waiting for the SEC to give it a thumbs up. Fingers crossed! 🤞

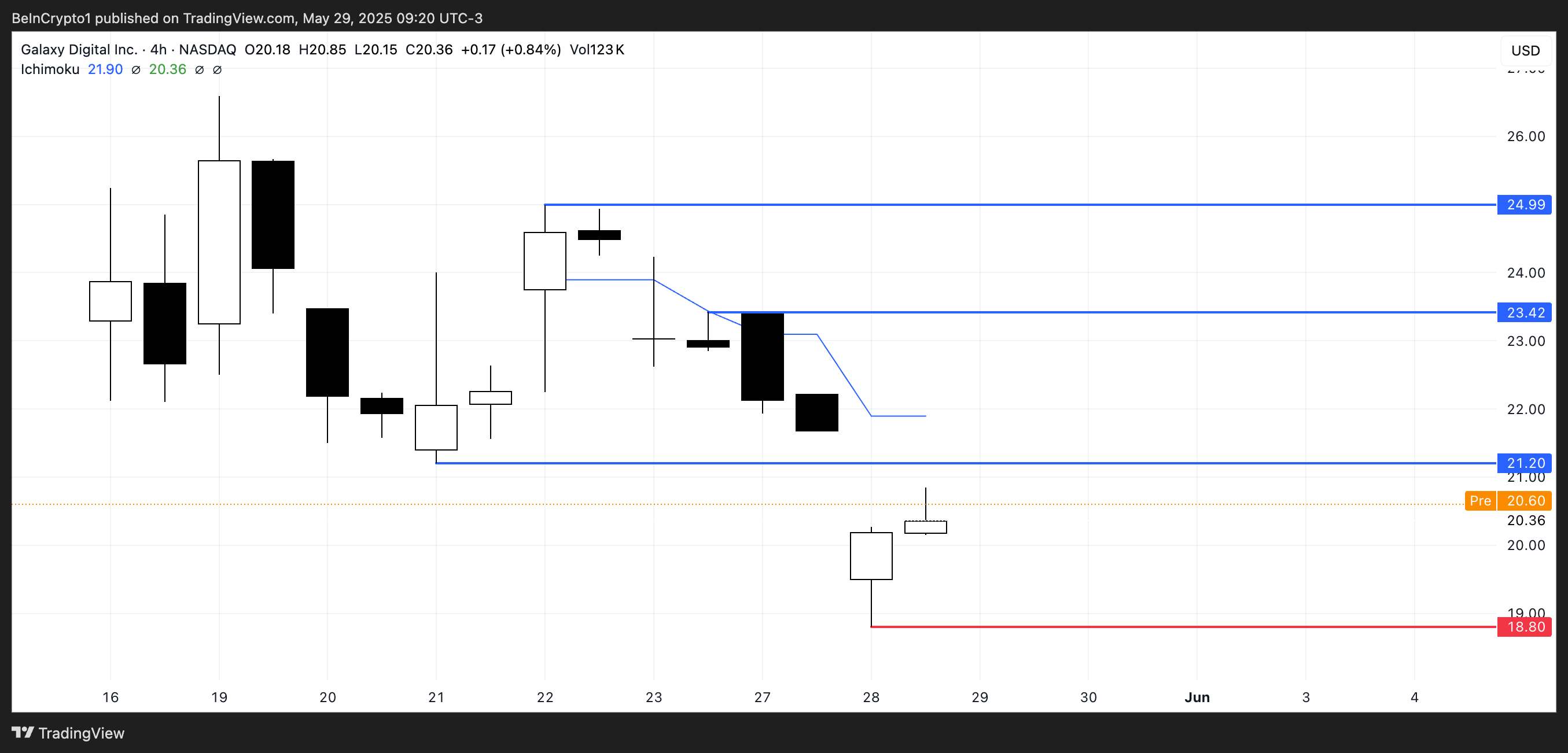

GLXY stock closed yesterday down 6.26% but is showing slight pre-market recovery with a 1.08% gain. Analyst sentiment remains as optimistic as a child on Christmas morning—TradingView shows all nine analysts covering the stock rate it a “Strong Buy,” projecting a potential upside of 35.95% with a target price of $27.71. 🎄

But beware! If the stock fails to gain traction, it could slide toward support at $18.80. However, a shift in momentum could see GLXY testing the $21.20 resistance, and a successful breakout there could open the path to $23.42. A veritable rollercoaster of emotions!

MARA Holdings (MARA)

MARA Holdings, the world’s largest publicly traded Bitcoin mining firm, recorded its most profitable day ever on May 27, reaching an annualized revenue peak of $752 million. A day to remember! 🎉

The company’s focus on vertical integration and expanding its Bitcoin treasury—now worth over $5.28 billion—has solidified its strategic position in the mining sector amid Bitcoin’s breakout above $112,000. Talk about striking gold! 💰

The stock surged nearly 10% on May 27 but gave back those gains with a 9.61% decline yesterday. It’s like a game of tug-of-war with the market! But fear not, it’s showing signs of recovery, up 2.76% in pre-market trading. 🏋️♂️

If the correction continues, MARA could retest support at $14.77, with further downside risk toward $12.63. On the upside, a momentum shift could push the stock back above $16.50, with resistance around $16.70. A classic tale of highs and lows!

According to TradingView, 13 analysts forecast an average one-year upside of nearly 38% with a price target of $20.50; among 17 analysts covering MARA, 7 rate it a “Strong Buy,” 9 a “Hold,” and 1 a “Strong Sell.” Quite the mixed bag! 🎭

GameStop Corp (GME)

GameStop (GME) has made headlines with its surprise purchase of 4,710 Bitcoin, worth approximately $512 million. This makes it the 13th largest public holder of BTC globally. Who knew they were such big spenders? 💸

The move marks a major step in the company’s shift toward digital assets, building on previous ventures into NFTs and self-custody wallets. A digital renaissance, if you will! 🎨

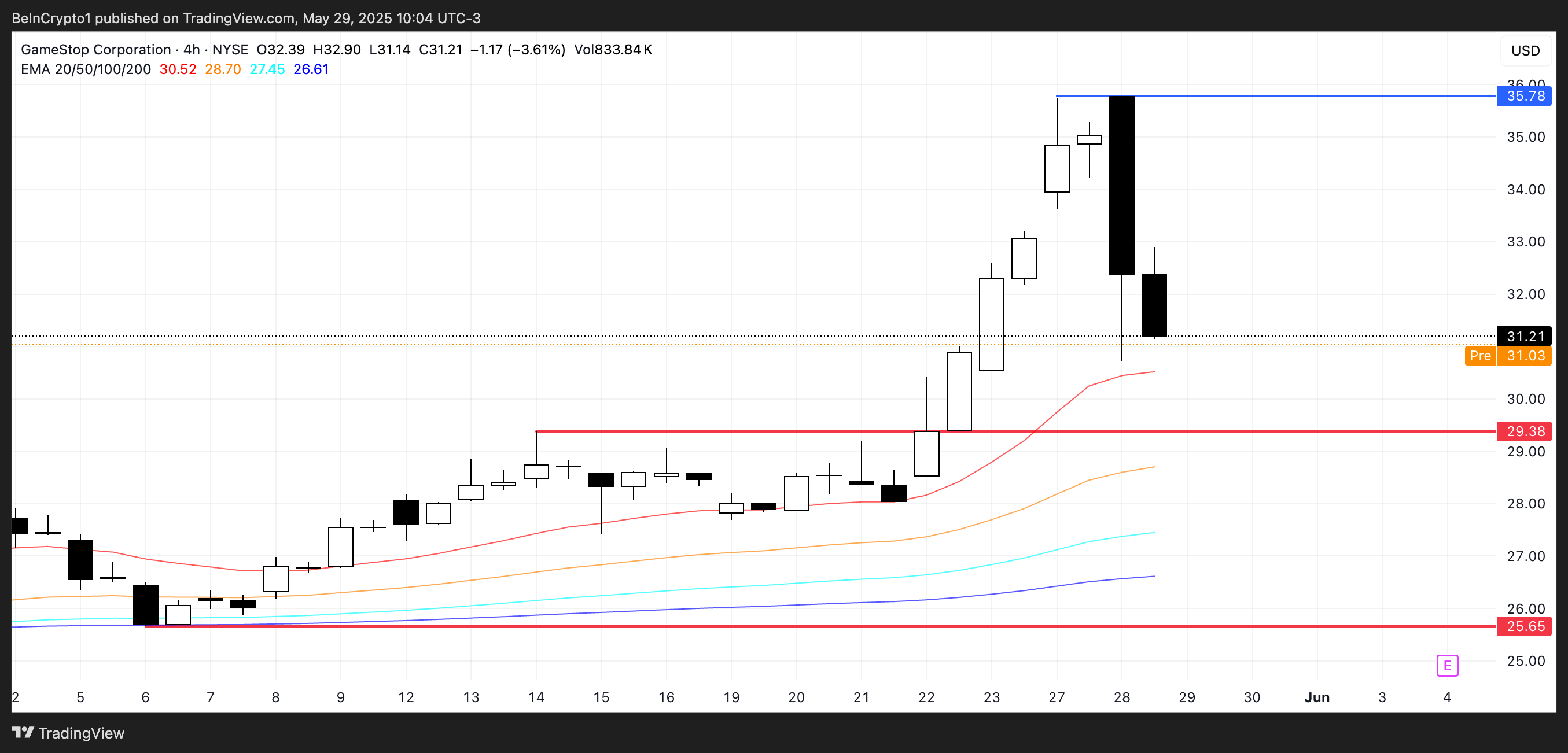

However, the announcement had little positive impact on the stock, with shares plunging 10.85% yesterday—suggesting the market had already priced in the decision after earlier disclosures. Oh, the irony! 😂

The company’s limited communication about the acquisition also drew criticism, with some calling for more transparency, similar to MicroStrategy’s approach. Because who doesn’t love a little clarity in the murky waters of finance?

GME is down another 0.32% in pre-market trading. If the correction continues, it could test support at $29.38. A sustained downtrend could bring the stock as low as $25.65 in the short term. The suspense is palpable! 😱

Despite the strategic shift into Bitcoin, investor sentiment appears cautious, focusing more on price action than long-term vision. A classic case of short-sightedness in the grand theater of finance!

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2025-05-29 17:31