Okay, folks, gather ’round! Last week’s CPI report was a real doozy, and now we’re all waiting with bated breath for the next big economic indicators. Because, let’s be real, who doesn’t love a good excuse to freak out about the economy? 😂

This week, we’ve got three US economic indicators that are going to make or break the crypto market. And, spoiler alert, Trump’s trade policies and Middle East drama are still causing a ruckus. 🤯

Retail Sales: Will We Shop ‘Til We Drop? 🛍️

First up, we’ve got retail sales data from the Census Bureau. Because who doesn’t love a good shopping spree? 💸 This data point is all about consumer spending, which drives a whopping 70% of the US economy. So, yeah, it’s kind of a big deal.

Last month’s numbers showed a modest 0.1% growth, but economists are predicting a 0.6% decline this time around. Ouch! If that happens, it could be a major bummer for the economy, but a boon for Bitcoin. 🤑

Initial Jobless Claims: Are We Headed for a Recession? 🤔

Next up, we’ve got initial jobless claims, which are basically a measure of how many people are filing for unemployment insurance for the first time. Not exactly the most uplifting topic, but hey, someone’s gotta do it. 😔

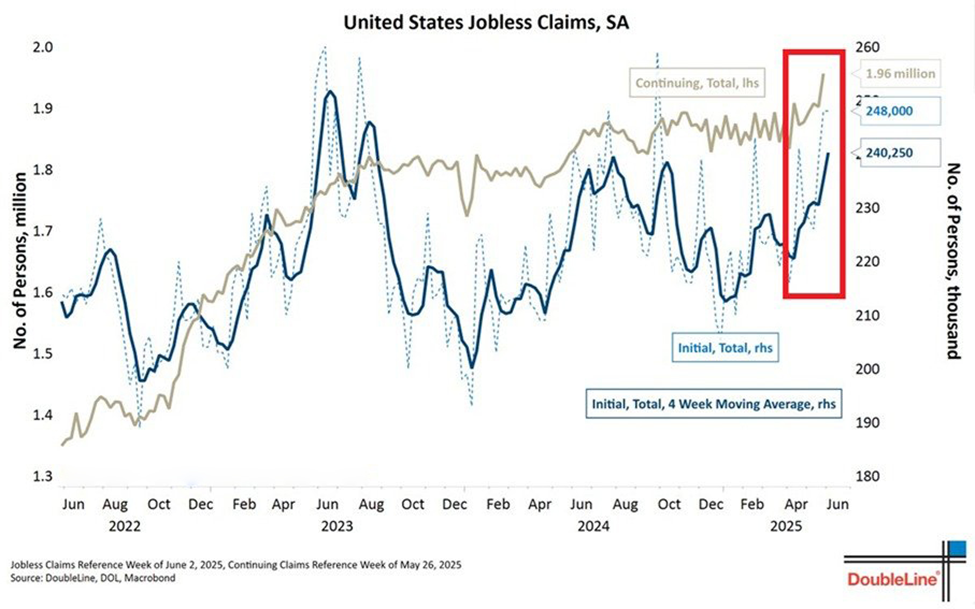

Last week’s numbers were higher than expected, and economists are predicting even more claims this time around. Which, let’s be real, is not exactly a vote of confidence in the US labor market. 😬 But hey, maybe that’s good news for Bitcoin? 🤑

“The labor market is CRACKING → Initial jobless claims hit 248K (highest since October) → 4-week average: 240K (highest since August 2023) → People on benefits: 1.96M (highest since November 2021) Weakness = Fed pivot = crypto moon,” analyst eye zen hour wrote in a post. 🚀

FOMC Interest Rate Decision: The Main Event 🎉

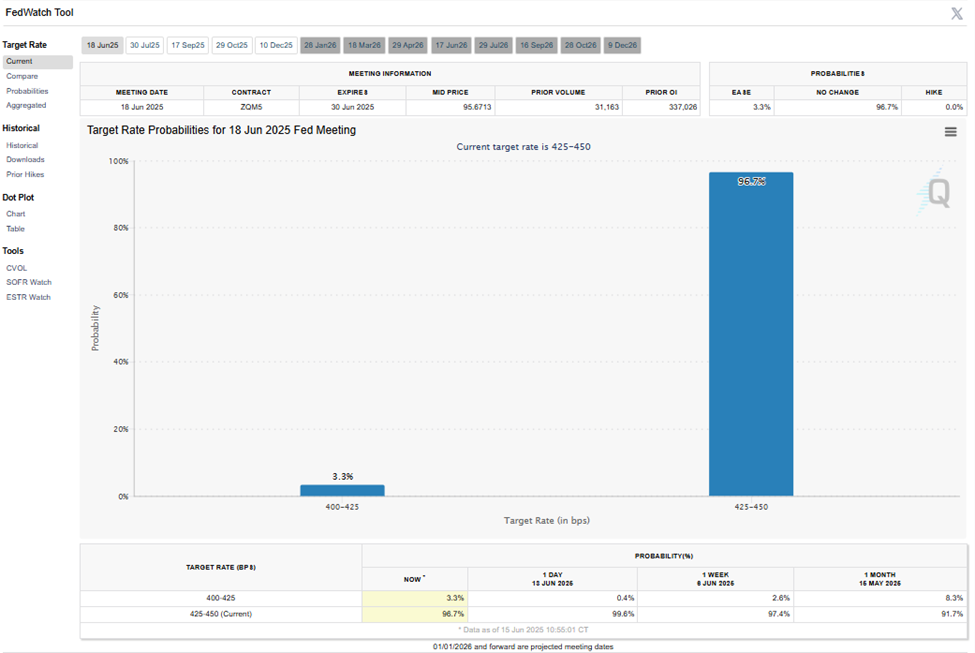

And finally, we’ve got the FOMC interest rate decision, which is basically the main event of the week. Will the Fed raise rates, lower rates, or just leave them alone? 🤔 The suspense is killing us!

Last week’s CPI data showed an increase in inflation, which could affect the Fed’s decision. But let’s be real, Trump is still tweeting about how the Fed should lower rates, so who knows what’s gonna happen? 🤷♀️

If the Fed does decide to lower rates, it could be a major boon for Bitcoin. But if they leave rates alone, it might not have as much of an impact. 🤑

As of this writing, Bitcoin is trading at $106,576, up by nearly 1% in the last 2 hours. So, yeah, it’s been a wild ride. 🎢

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-06-16 11:53