In the tumultuous dawn of Donald Trump’s spirited return to office, the very air trembled with the promise of untold riches—or perhaps just confusion—as the cryptic world of cryptocurrency shuddered beneath the weight of new tariffs. Even the crypto traders, men of steely nerves and unshakable faith in digital riches, began to squint suspiciously at their trading screens as prices receded as if frightened by the very name of “tariffs.”

Bitcoin (BTC), that stoic old veteran of market panics, along with his rowdy troupe of altcoins, found themselves cast adrift on uncertain seas. Despite Mr. Trump’s best efforts—touting himself as the “most pro-crypto president”—and with lawsuits against the likes of Uniswap (UNI), Coinbase, and Ripple cast aside by the Securities and Exchange Commission like old shoes, the market had other ideas. It seems macroeconomics holds more sway over the hearts of men (and their wallets) than the warm glow of regulatory mercy.

If anyone had imagined harmony between Trump and nations such as Canada, Mexico, or China, they were quickly awakened—by tariffs sharper than a Moscow winter. Thus, the charts below arise, like grim sentinels, bearing witness to these first 100 days of high hopes, dashed dreams, and meme coins galore.

Crypto Market Cap Retreats—To the Surprise of Absolutely No One

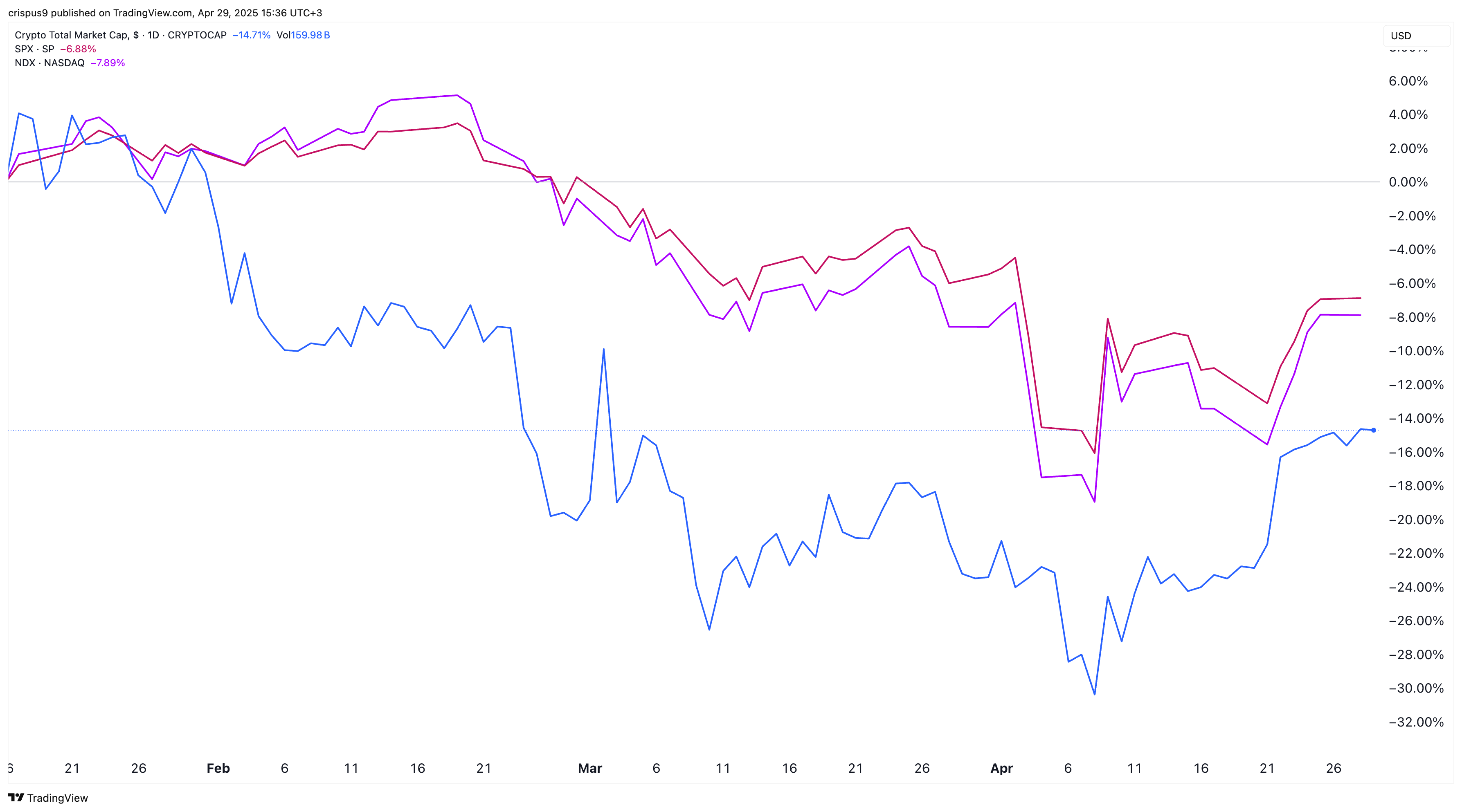

Behold! The first chart, as cold and unyielding as a Russian winter, reveals the crypto market’s dramatic underperformance compared to the humble S&P 500 and the Nasdaq 100. The cryptocurrency market, which only yesterday was soaring with the intoxicating promise of eternal wealth, has tumbled a rueful 14.7%. The S&P and the Nasdaq, apparently less addicted to drama, fell a mere 6.9% and 7.9% respectively. One cannot help but admire Trump’s insistence that he is “pro-crypto.” Clearly the markets weren’t moved (if anything, they were moved in the opposite direction).

Yet, all is not lost—like Tolstoy’s peasants enduring trials vast as the steppe, the market cap began to recover: from a meagre $2.39 trillion in early misery, to $2.9 trillion as optimism flickered anew. Is hope eternal? Or are we simply bored?

DEX Volume: From Meme Coin Mania to the Cold Showers of Reality

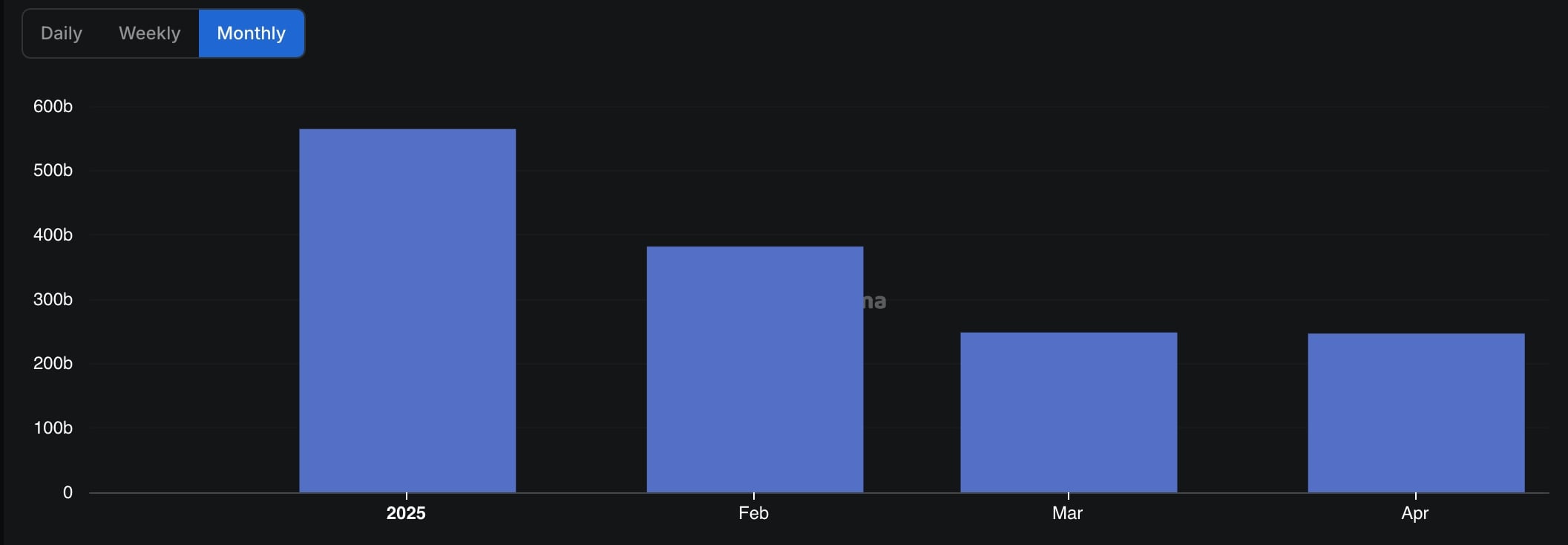

January dawned like a carnival in St. Petersburg—with decentralized exchanges (DEX) ablaze in activity, driven by an absurd rush for meme coins. There are rumors that Donald and Melania themselves launched coins, because in this new Russia—I mean, America—anything is possible.

DEX volume soared to $564 billion, which sounds impressive until one remembers it’s mostly dog coins with more bark than value. Alas, the enthusiasm did not last; reality, as ever, has the last laugh, and volume cooled to a dull $248 billion by March and April. Even the crypto faithful were forced to ask, “What exactly am I buying?”

Stablecoins: The Sanctuary for the Cautiously Paranoid

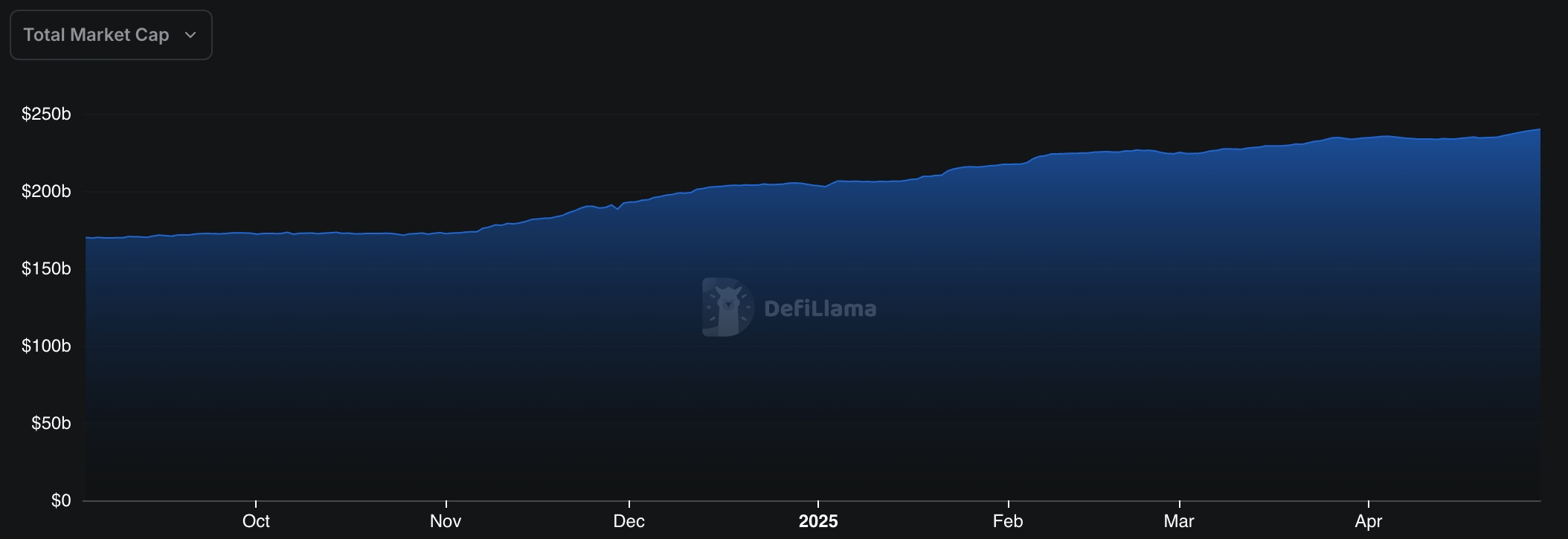

Meanwhile, stablecoins multiplied, as prudent souls flocked to Tether, USD Coin, Dai, and other digital refuges. Trump’s America, it seems, produces more stablecoins than Tolstoy’s Russia produces suspicious stares at dinner parties. Over $40 billion has been added to the stablecoin market cap since Trump’s inauguration—a tidy sum, even if it won’t buy you peace of mind. You can see them all, quietly multiplying: Tether, USD Coin, Dai, Sky Dollar, Athena—a gathering of suspicious cousins at a family reunion.

The RWA Drama, Featuring Mantra’s Grand Collapse (Cue the Balalaika)

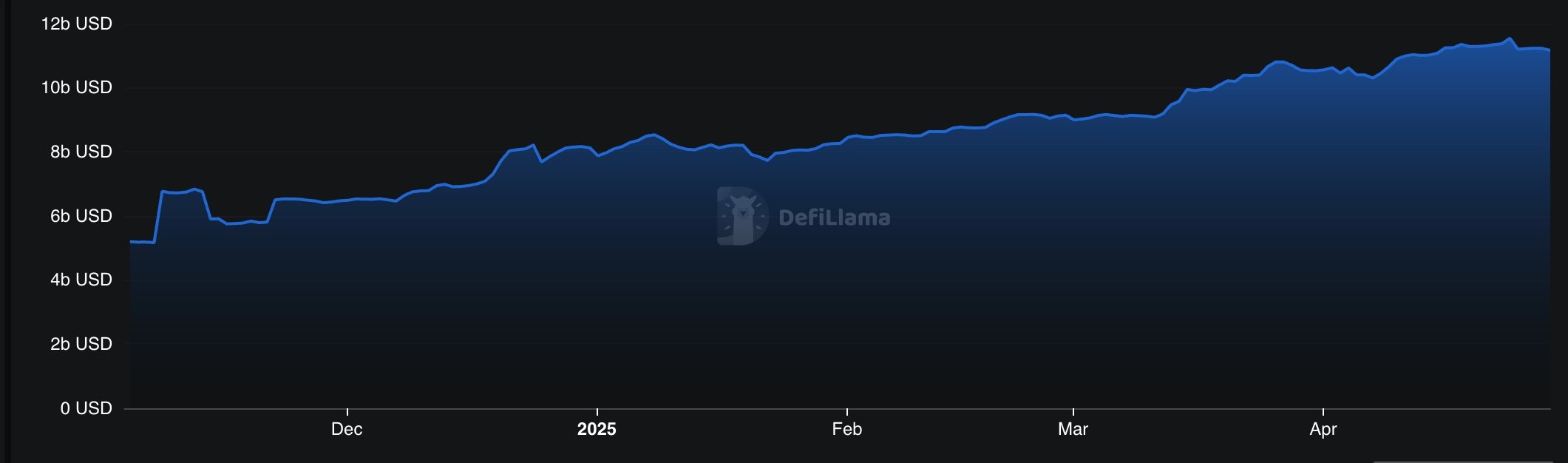

All the while, demand for real-world asset (RWA) tokens climbed, like a stubborn aristocrat up an icy Russian hill. The market exploded to $11.17 billion from a humble $7.92 billion. The titans—BlackRock BUIDL, Athena USDtb, Ondo Finance, Tether Gold, and Paxos Gold—marched onward, oblivious to the chaos around them. But every Russian novel needs a tragic turn, and so: Mantra, a stalwart of the RWA world, tumbled spectacularly, leaving token-holders clutching their wallets in existential bewilderment. Truly, all that glittered was not gold, but perhaps fool’s gold—served with a side of blockchain.

Bitcoin ETFs: The Hopeful Pilgrims (Ethereum Looks Away in Shame)

Spot Bitcoin ETFs, plucky pioneers that they are, attracted net inflows of $3.85 billion. January saw a glorious $5.25 billion, but the tide had to turn—because even in America, what goes up must come down, and down it went for two sad months before a late rebound of $2.85 billion. Whether this is true faith or collective delusion, who can say?

Ethereum ETFs, however, slumped in the corner, brooding over net outflows of $132 million. Their price fell against all rivals, from Bitcoin to Solana—a veritable Anna Karenina among coins, staring longingly across the snowdrift at happier, more successful assets.

Secure your internet browsing with a NordVPN subscription. [Learn more](https://pollinations.ai/redirect/432264)

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Quick Guide: Finding Garlic in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2025-04-29 18:02