In a world where numbers dance like marionettes, a report from the astute crypto analyst Darkfost, shared through the digital corridors of CryptoQuant, reveals that Binance has outdone itself in May 2025. This record-breaking performance is not merely a statistic; it is a testament to the rising tide of speculative fervor that propels Bitcoin into the stratosphere of bullish momentum. 🚀

Record Monthly Futures Volume Surpasses $1.6 Trillion

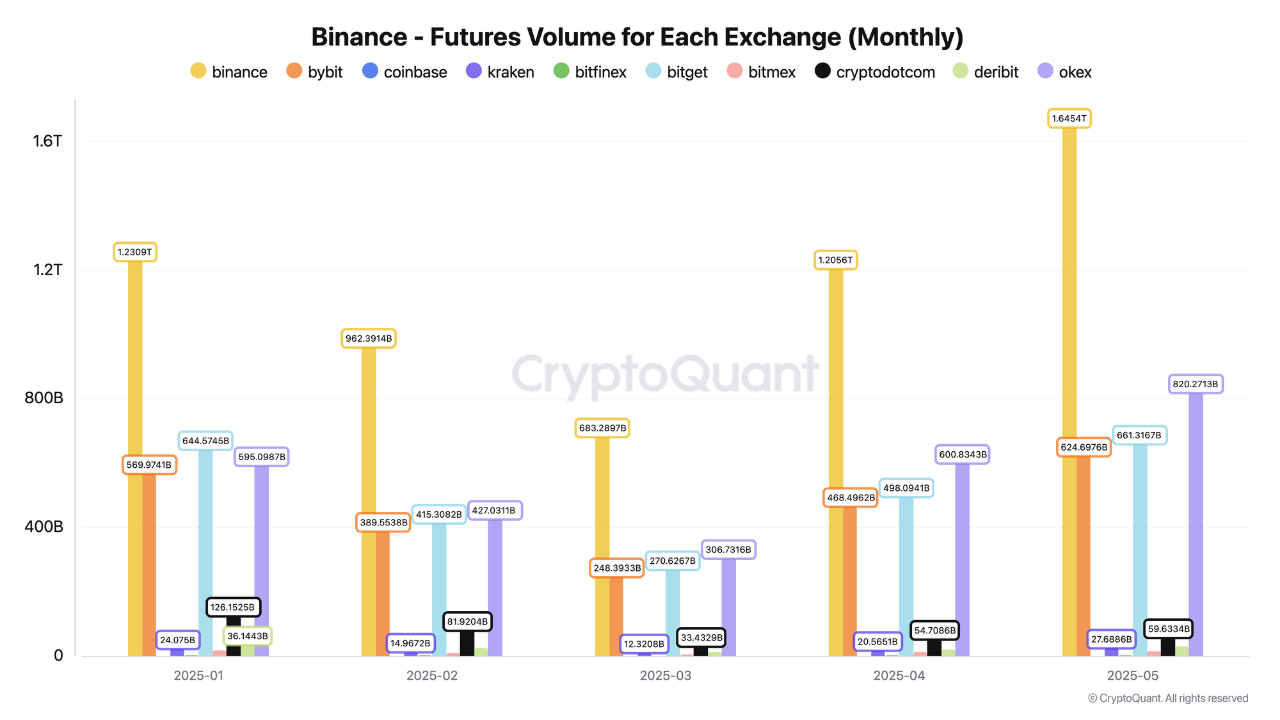

Ah, May! A month that will be etched in the annals of crypto history, as Binance shatters records with a staggering $1.6 trillion in monthly futures trading volume—the highest this year! This astonishing figure is not just a number; it reflects a surge in market engagement and a growing confidence among traders, particularly those with a penchant for high-leverage exposure to the wild whims of crypto price movements. 🎢

Darkfost, with a knowing nod, points out that this spike in volume is often a harbinger of renewed risk appetite and burgeoning bullish sentiment, especially during those euphoric upward trends. It is no wonder that Binance stands as a bellwether for market sentiment and investor positioning, like a lighthouse guiding lost ships through stormy seas. ⚓

Compliance and Market Leadership

Yet, amidst this speculative frenzy, Binance manages to don the cloak of regulatory compliance, notably with the European Union’s MiCA framework—an intricate tapestry of rules that is considered one of the most comprehensive crypto regulatory regimes in existence. This alignment with stringent guidelines adds a layer of credibility, reinforcing the platform’s allure to both retail and institutional traders. Who knew compliance could be so sexy? 😏

Speculation or Stability? The Double-Edged Sword of Derivatives

While the surge in futures trading volume signals a heightened interest, Darkfost also warns of the inherent risks lurking in the shadows of leverage-driven speculation. High open interest in futures markets can lead to rapid liquidations, triggering volatile price swings that could make even the most seasoned trader’s stomach churn. 🍽️

Nevertheless, the data paints a vivid picture: speculation is back in vogue, and Binance is leading the charge like a general rallying troops for battle. Observing ongoing trends in futures activity will be crucial for deciphering market behavior in the weeks to come, especially as crypto traders weigh the tantalizing opportunities against the lurking specter of volatility. 🕵️♂️

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2025-05-31 13:57