Ah, the grand theater of American politics unfolds once more, and this time, the spotlight falls on the crypto carnival. The US House of Representatives, in a fit of bipartisan bravado, has rammed through three bills that could either herald a new dawn for digital currencies or just another layer of bureaucratic nonsense. Call it the most “impactful” week for crypto policy, if you must, but let’s not kid ourselves—it’s probably just politicians pretending they understand blockchain. 😂

These legislative juggernauts aim at the heart of the crypto beast: market structure, stablecoin shackles, and a defiant slap against any digital dollar dreams. Together, they whisper sweet nothings about improving sentiments among lawmakers, as if Congress suddenly cares about your NFT collection. But in truth, it’s all a dance of power, with crypto caught in the middle, like a weary worker in Gorky’s tales, toiling under the weight of indifferent masters. 😏

House Blesses CLARITY, GENIUS, and Anti-CBDC Farces

First off, the Digital Asset Market Clarity (CLARITY) Act got the nod with a lopsided 294–134 vote, crossing party lines like a drunk at a wedding. Crafted to slap labels on cryptocurrencies—securities for the SEC watchdogs or commodities for the CFTC cowboys—it’s supposed to end the regulatory fog that’s plagued investors and innovators alike. A milestone, they say, but critics like Maxine Waters aren’t buying it, howling about loopholes that could leave retail folks high and dry. Imagine, clarity in crypto—might as well hunt for unicorns! 😂

Then there’s the GENIUS (Guiding and Establishing National Innovation for US Stablecoins) Act, which breezed through with even more fanfare, 308–122 in the House after a 68–30 Senate romp back in June. Now law, thanks to Trump’s signature on July 18, it slaps stablecoins with rules galore: full reserves, monthly audits, and all the anti-money laundering jazz. Tailored just for digital assets, it’s like finally putting a leash on a rabid dog—humorous, if you think about it, since stablecoins were supposed to be the calm ones in this storm. But hey, at least someone’s pretending to care about consumer protection. 😎

Bringing up the rear is the feisty Anti-CBDC Surveillance State Act, squeaking by 219–210. This one’s a real brawler, blocking the Fed from cooking up a central bank digital currency. Proponents rave about thwarting Big Brother’s snooping on your spending, while detractors moan about hobbling the US in the global CBDC race—China’s laughing all the way to the digital bank. It’s classic irony: fighting surveillance with more legislation, as if laws ever stopped prying eyes. 😂

What’s the Next Act in This Farce?

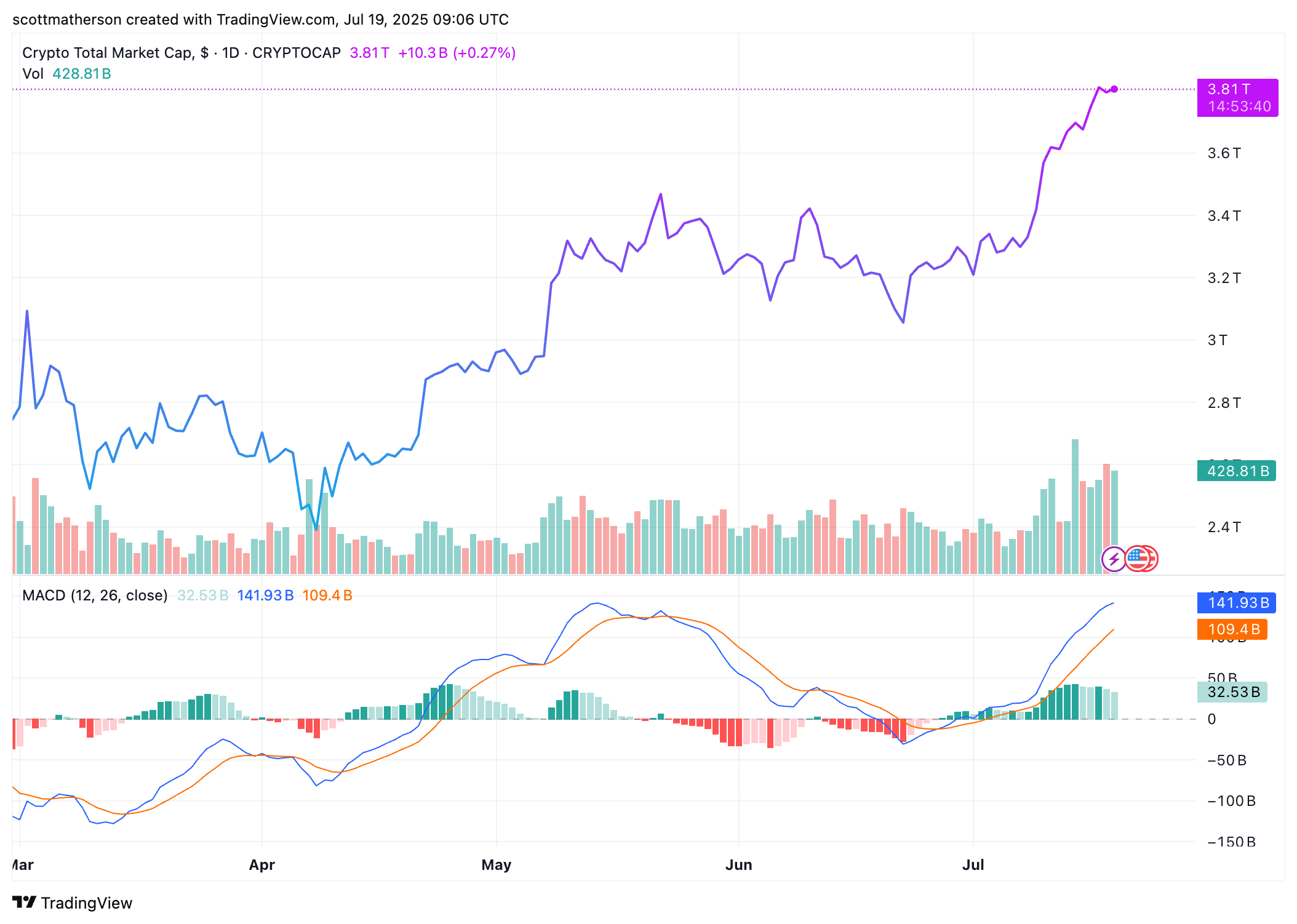

With the GENIUS Act already flexing its muscles as law, the CLARITY and Anti-CBDC bills are off to the Senate circus, where things might get sticky. Interestingly, Democrats are showing some love for crypto—over 100 backed GENIUS, and 78 cheered for CLARITY. Expect the upper chamber to poke and prod when they reconvene, but odds are good these bills slide through without much drama. Market-wise, Bitcoin‘s chilling around $118,000, playing it cool, while Ethereum flirted with $3,670 before slinking back to $3,500. Volatile as ever, just like the politicians who “support” it. 😏

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Controller Settings for ARC Raiders

- Goat 2 Release Date Estimate, News & Updates

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

2025-07-19 20:53