In the shadowed depths of the digital abyss, Tether, that mischievous sprite of the financial underworld, has once again played its hand-minting a staggering billion dollars’ worth of USDT, as if conjured from the void itself. Alongside Circle, the ever-watchful issuer of USDC, they have amassed over $20 billion in stablecoins since the catastrophic October 10-11 market crash. Ah, the dance of doom and fortune-how they waltz! 💃🕺

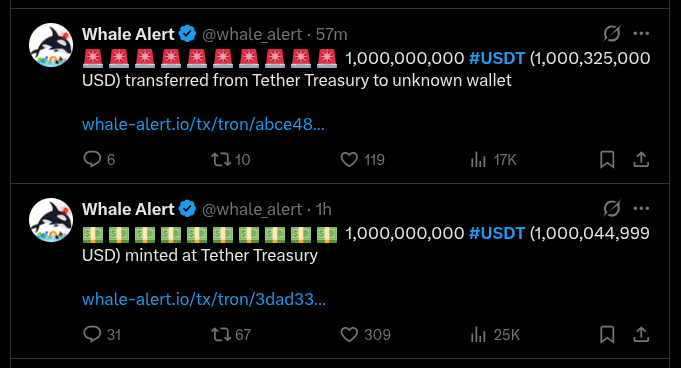

Just an hour ago from this writing, Tether, in an act of digital bravado, created another billion USDT, transferring it to an anonymous wallet on the Tron Network-presumably to haunt the market or perhaps to buy a digital donut. Data from Whale Alert confirms this caper, adding yet another chapter to the saga of crypto absurdity.

Tether’s 1 billion USDT mint and transfer, onchain activity as of December 2, 2025 | Source: Whale Alert

This latest act of monetary magick was echoed by Lookonchain, which, with a tone of mock gravity, highlighted that since the market’s historic liquidation-yes, a $19 billion purge that shook the fragile illusion of stability-Tether and Circle have minted an eye-watering $20 billion in stablecoins. It’s almost as if they’re saying, “Market crash? No problem, we’ll just print a little more cash-what could possibly go wrong?”

Tether(@Tether_to) just minted 1B $USDT!#Tether and #Circle have minted $20B in stablecoins after the 1011 market crash.

– Lookonchain (@lookonchain) December 2, 2025

What Does $20 Billion in Stablecoin Mint Mean for Crypto? 🤔

Ah, the grand paradox of the crypto cosmos-this $20 billion in freshly minted USDT and USDC reveals a peculiar truth: liquidity is alive, though perhaps only as a ghost haunting a crumbling cathedral. Stablecoins are the lifeblood, the pulse-used on every corner of the crypto marketplace to buy, sell, and pretend everything is fine.

Traditionally, a shrinking market cap for stablecoins signals an exodus of capital-investors fleeing to safe harbors or, more likely, just cashing out and walking away from the madness. But the recent surge in stablecoin issuance post-liquidation suggests that, paradoxically, the crypto ecosystem is not bleeding out but perhaps gushing inward! Investors are depositing USD to buy USDT and USDC, fueling the flames of the next speculative circus. 🎪🔥

Back in September, Tether minted 2 billion USDT during a market retracement-do you see the pattern yet? A significant mint precedes a rally, like a cosmic joke with a punchline. Indeed, in December 2024, Tether’s $2 billion magic trick kicked off an 8% Bitcoin rally-taking BTC from $99,000 to a lofty $107,000 in just ten days. Similarly, in September 2025, the 2 billion USDT mint foreshadowed a 12% surge, pushing BTC’s price from $110,500 to an astonishing $124,500-proving that in crypto, timing is everything, and the punchline is always on the unaware! 🤣

Bitcoin (BTC) one-year price chart, with Tether mints and rallies, as of December 2, 2025 | Source: TradingView

If history is a cruel teacher (and it often is), Bitcoin might soon march towards new highs, between $85,000 and $90,000-perhaps just in time for another storm, or a digital picnic. Big whales seem to prefer holding long positions rather than shorts, hinting that the next rally might be just over the horizon, whispering sweet nothings of prosperity to the hopeful.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Best Thanos Comics (September 2025)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Goat 2 Release Date Estimate, News & Updates

- Felicia Day reveals The Guild movie update, as musical version lands in London

- The Legend of Zelda Game That Changed the Timeline Forever

2025-12-03 01:36