- February 2025 was like a bad breakup for Bitcoin and Ethereum, leaving investors sweating bullets for March.

- Historical trends suggest March could be more of a dumpster fire for both BTC and ETH prices.

February 2025? Brutal! Both Bitcoin [BTC] and Ethereum [ETH] took a nosedive like they were trying to impress a bad date. Seriously, the steepest declines in over a decade! What’s next, a reality show about their struggles?

As these two heavyweights in the crypto ring try to get their act together, uncertainty is hanging around like that one friend who never leaves the party. What’s the deal with March? Is it just going to be more of the same misery or is there a glimmer of hope?

BTC and ETH performance

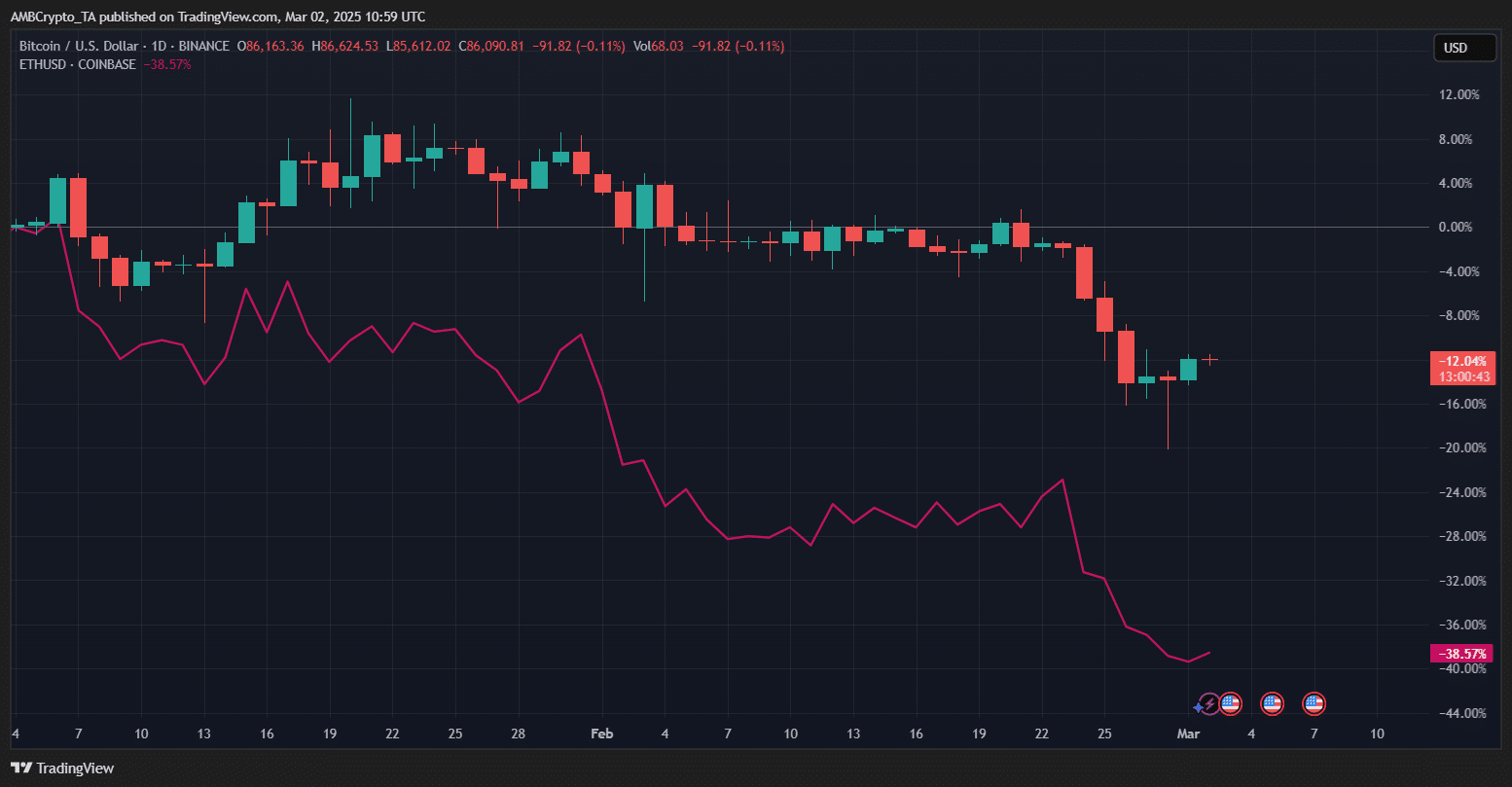

February 2025 was a rollercoaster for Bitcoin and Ethereum, and not the fun kind. BTC started off strong, like it just won the lottery, but then it plummeted over 12%. Talk about a classic case of “what was I thinking?”

Meanwhile, ETH was like, “Hold my beer,” and dropped a staggering 38%. Ouch! The gap between these two is widening faster than my patience at a slow restaurant.

While BTC found a little support, ETH’s sharp decline raises eyebrows. Is it resilient or just hanging on by a thread? Who knows!

March weakness: A historical trend

Historically, March has been about as comforting as a cold shower for Bitcoin and Ethereum. BTC’s average return? A whopping 3.42%. The median? 0.51%. Yikes! Talk about a snooze fest.

ETH did a tad better with an 8.22% average return, but the median of 1.80% screams inconsistency. It’s like a bad sitcom that keeps getting renewed.

BTC has had its fair share of March declines in 2014, 2015, 2018, and 2020. ETH? Oh, it joined the party in 2018 and 2022. What a club!

With BTC down 17.39% and ETH down 31.95% in February 2025, it’s like a warning sign flashing “Caution: Proceed at your own risk!”

Bitcoin and Ethereum: Can they rebound in March?

Bitcoin is limping into March after a brutal February, shedding 17.39%. One of its worst performances? You bet! March has historically been weak, with an average return of -0.39%. Sounds like a party no one wants to attend.

Technically speaking, BTC is struggling below its 50-day SMA ($97,570.68) and hovering near its 200-day SMA ($82,231.19). It’s like trying to climb a mountain with no gear.

The RSI at 36.85 suggests it’s still in bearish territory, but not quite in the “send help” zone. A little bounce off the $80,000 support zone is visible, but the broader trend? Downward, folks!

OBV at -92.82K shows weak accumulation. Unless Bitcoin can reclaim key levels above $90,000 with some volume support, any short-term rally could be met with a swift “no thanks” from sellers.

Ethereum? It fared even worse, crashing 31.95% — the steepest decline in its history. What a way to go!

Historically, March has been a snooze for ETH too, averaging 2.82%, but the median return of 1.18% suggests it’s all over the place. Like my

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-03-03 02:19