In the vast theater of commerce, numbers rise as if to measure the breath of nations, and the market now boasts a prodigious sum of 4.14 trillion in value. Bitcoin itself, that stubborn sentinel, has mounted beyond 120,000, a pageant of speculation that draws the gaze of millions. Yet behind the glitter there lies a warning: a correction may arrive as inexorably as winter follows autumn. 😅

The sage known as TED declares that the multitude, the retail, press forward late, while the august institutions withdraw their hands. Such a pairing invites a sudden descent; Bitcoin could fall 2-3%, and altcoins perhaps as much as 10% in a somber procession. 🤔

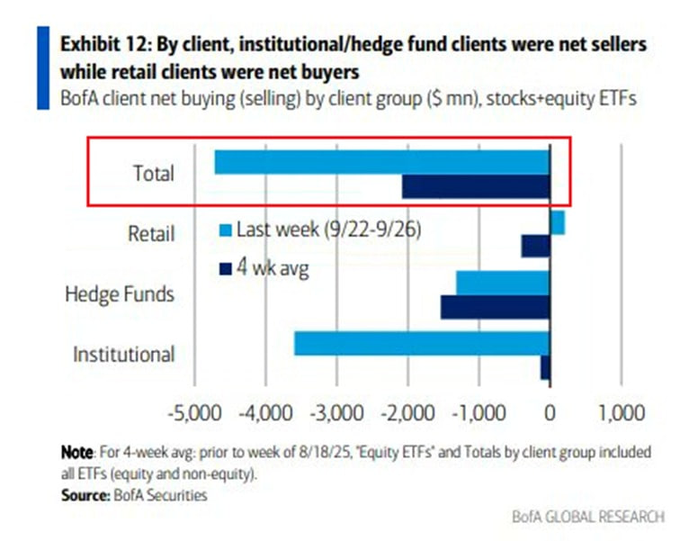

According to this TED, global data reveal a curious theater: small investors press ahead with eager purchases, while the great houses of finance move warily, their counsel bearish, as if the winter wind had touched their coats. The contrast is not mere arithmetic; it is a parable of desire against prudence.

Last week, institutions sold about $3.6 billion of stocks, hedge funds sold $1.3 billion more. In stark contrast, retail investors poured in around $200 million, and such divergence stirs the imagination to fear that FOMO may be the only constant in that bright screen.

Thus TED proclaims this as “big money selling to small money,” a familiar prelude to the great market dump, like dawn following a night of mischief. 😂

The plot thickens as a government shutdown in the United States casts a pall of silence over data. A “data blackout” cloaks the reports of jobless claims, payrolls, CPI, and retail sales; all remain on hold. Traders are left to gamble with posture and narrative, and even the Fed-proudly called data-driven-finds itself navigating fog without a compass.

Another strange omen emerges: the S&P 500 and the VIX rising together for four consecutive days, a rare alignment that in earlier cycles heralded a correction. If such a pattern repeats, the S&P might slip by as much as 1.5%, which, in the language of markets, translates into Bitcoin down 2-3% and altcoins losing 5-10%, a cascade of consequences that might amuse no one but the day’s jesters. 😅

Despite TED’s bearish forecast, Bitcoin has shown stubborn resilience, rebounding 12% from its September low of about 107,000 to trade above 120,000. ETFs are lending their support with inflows of roughly $2.25 billion this week. Altcoins follow suit, with BNB at 1,108 and XRP at 3.06, reviving talk of an “altseason.”

Yet TED remains wary, holding 70% in stablecoins, believing retail zeal grows while the smart money may already be stepping away, preparing for a swift correction that could arrive with a sigh and a shrug. 🤨

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Felicia Day reveals The Guild movie update, as musical version lands in London

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Thanos Comics (September 2025)

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Goat 2 Release Date Estimate, News & Updates

2025-10-03 15:37