Crypto Craze: Circles Ring the Bell on Wall Street! 🎉

Circle Internet Financial, that charming folks’ favorite creator of the USDC stablecoin, finally decided to march onto the grand stage of the New York Stock Exchange today. Oh, what a day! Another circus in the financial tent.

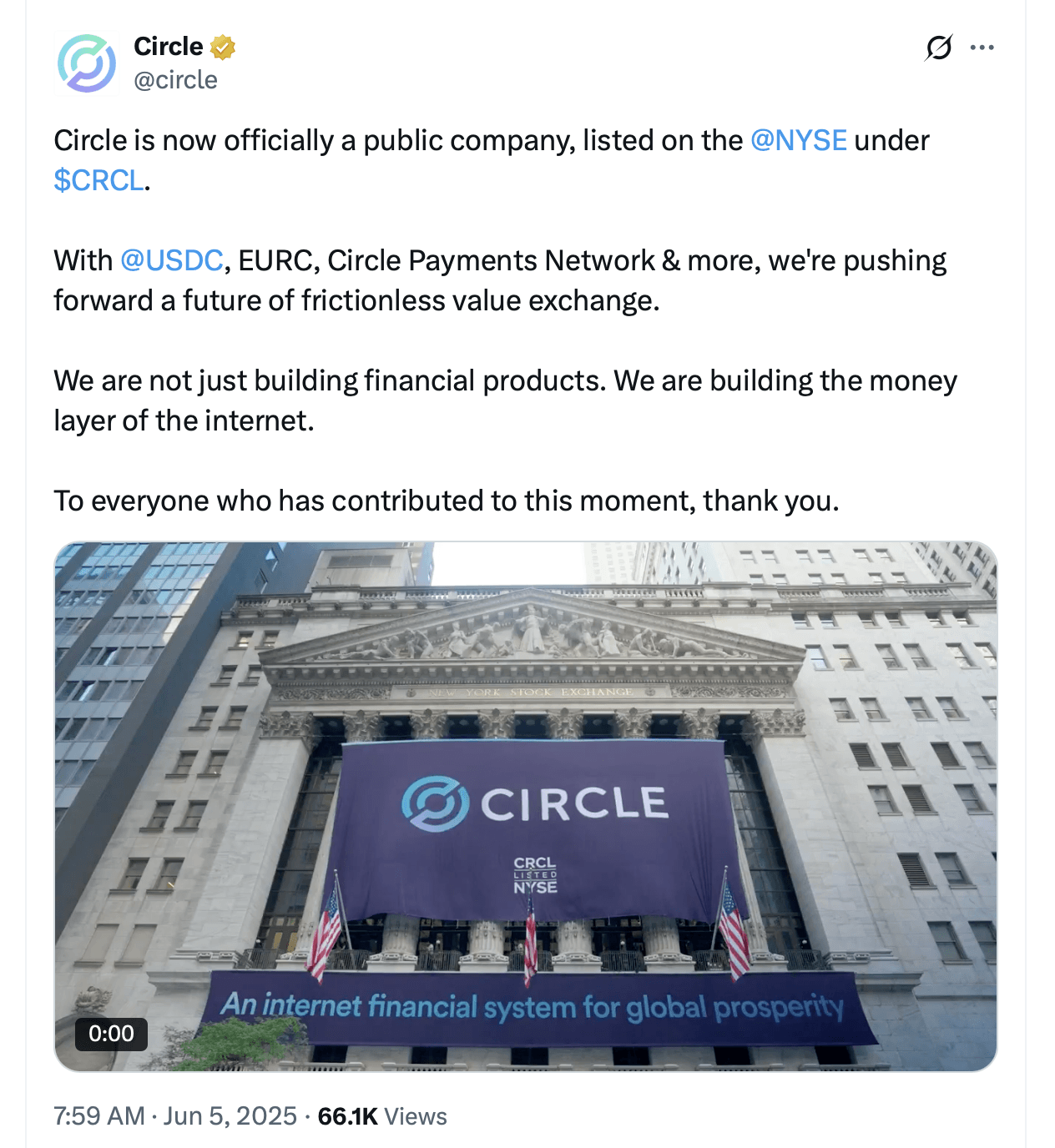

Hell’s Bells! Stablecoin Titan Circles Closes the NYSE IPO

Circle, the magnificent (and evidently well-to-do) issuer of the USDC, with its staggering $60 billion worth of digital “money,” took the plunge into the trading pit on June 5, 2025, under the mysterious symbol “CRCL.” Priced at $31 a share—well above their modest dreams of $27-$28—they managed to sell 34 million copies of their financial fairy tale, raising a cool $1.05 billion, because why not?

The so-called offering was stretched beyond the original plan—initially aiming for 24 million shares at $24-$26—suggesting that investors just can’t get enough of this cryptocurrency soap opera. The big shots at JPMorgan, Citigroup, and Goldman Sachs still have 30 days to peddle another 5.1 million shares, just in case the crowd is still hungry. The money? Mostly to pay taxes and keep the accountants off their backs; the rest will go to keep the lights on and the salaries flowing.

Coinciding with the current U.S. handout of leniency towards crypto, as if the government just got bored of its old paranoia, the listing might just give a shot of confidence to those stablecoins and tempt other crypto firms into the chaos of public markets.

Jeremy Allaire, the boss man of circles, boomed: “I am incredibly proud and thrilled to announce that Circle is now a public company on the NYSE under $CRCL! … Our transformation into a (not very) private entity is a huge milestone—yes, folks, the world is finally ready to turn to the internet’s new money system.”

Valued at about $6.217 billion on paper (fully diluted, whatever that means), the brave company earned $1.68 billion in 2024—more than the previous year’s $1.45 billion—and still dreams of more.

This event? A giant leap for stablecoins and crypto ventures alike. USDC, the second-in-command in the digital coin empire, now playing on the big stage. Analysts and pundits will watch eagerly—or nervously—how their new toy performs amid the greatest economic circus of our time.

“Circle’s exaggerated IPO shows that institutions believe stablecoins like USDC will sit at the table of modern finance forever—because, after all, USDC is ballooning into a grotesque $64 billion monster. Maybe they’re just jumping on the bandwagon as regulations loosen, under the nonchalant glow of the Trump era,” sneered James Toledano, COO of Unity Wallet, to TopMob last Thursday. The show must go on, folks.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-06-05 19:57