- Crypto thefts and ransomware surged in 2024, with record-breaking payments and stolen funds

- Bitcoin’s share in stolen funds rose while centralized exchanges became prime hacking targets too

As an analyst with over two decades of experience in the digital economy, I’ve seen the evolution of the internet from a novelty to a global force that touches every aspect of our lives. The growth of cryptocurrencies is no exception, and it’s been fascinating to watch this space mature. However, like any new frontier, there are challenges that need to be addressed.

2024 saw a significant surge in cryptocurrencies’ acceptance in mainstream markets, evident in various encouraging advancements across multiple sectors. Yet, this journey hasn’t been without its ups and downs for this investment category. As a crypto investor, I’ve experienced both the thrill of witnessing growth and the challenges that come with it.

Troubling crypto trends

Although the total level of illegal activities has dropped compared to past years so far this year, there are also concerning patterns that have surfaced.

Throwing further light on the same, a recent survey conducted by Chainalysis revealed,

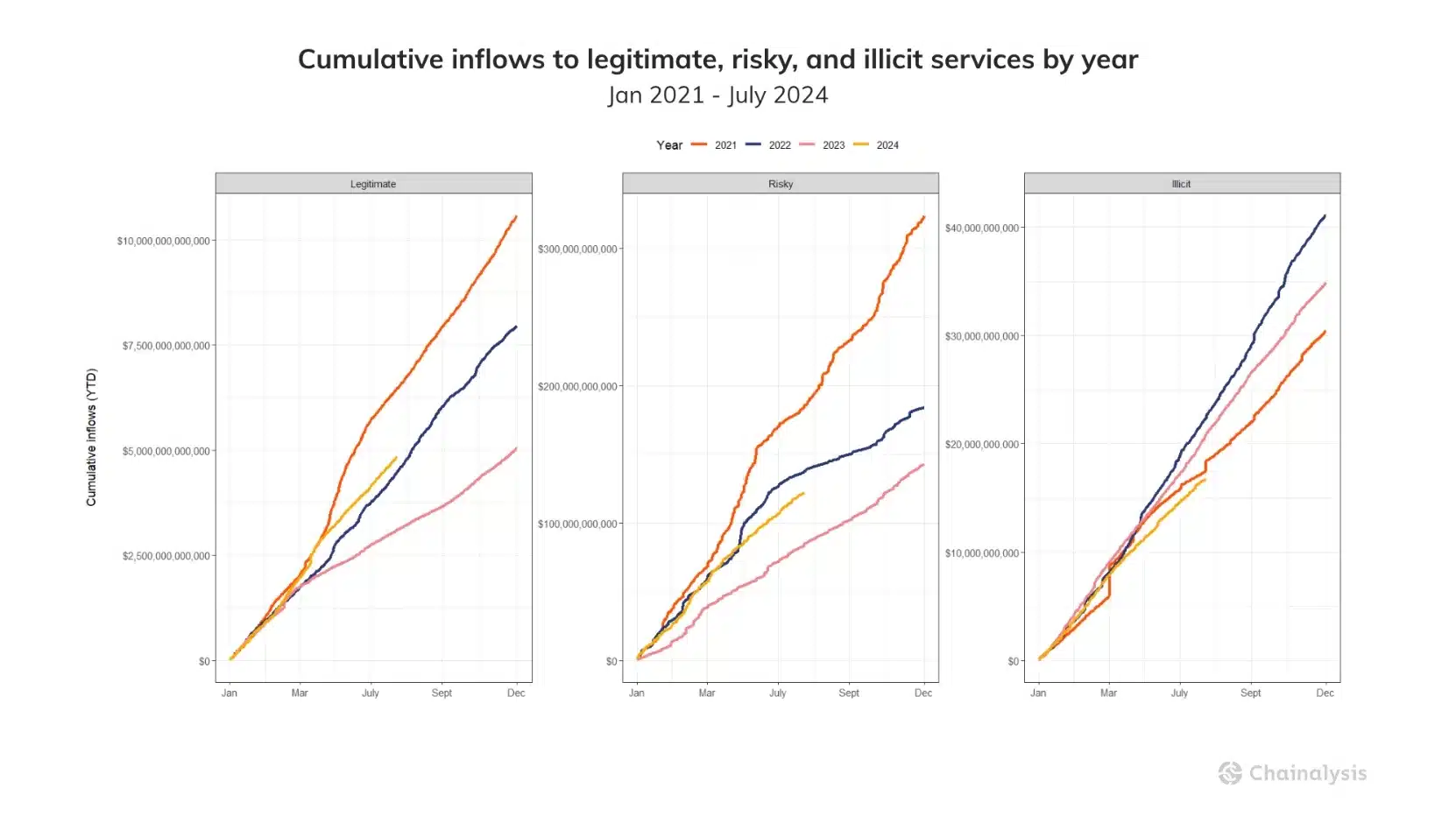

“In the year-to-date period, the total amount of illegal activities decreased by 19.6%. This figure dropped from approximately $20.9 billion to $16.7 billion, indicating that legal transactions are expanding at a quicker pace than illicit transactions on the blockchain.”

As a crypto investor, I’ve noticed an interesting trend – according to Eric Jardine, Cybercrimes Research Lead at Chainalysis, there has been a significant increase in inflows into legitimate cryptocurrency services. This is the highest level since the 2021 bull market peak. To add to that, he mentioned this growth trend continues unabated.

“It’s clear that the increase in legal transactions using cryptocurrencies is happening faster than illegal ones, showing that these digital currencies are becoming more mainstream and accepted.”

Side effects of rising crypto adoption

As much as I’m excited about the advancements in the crypto world, it’s concerning to see an increase in funds flowing towards criminal activities associated with this space. While it’s heartening to witness the growth of mainstream adoption, it seems that this progress is also attracting more malicious actors.

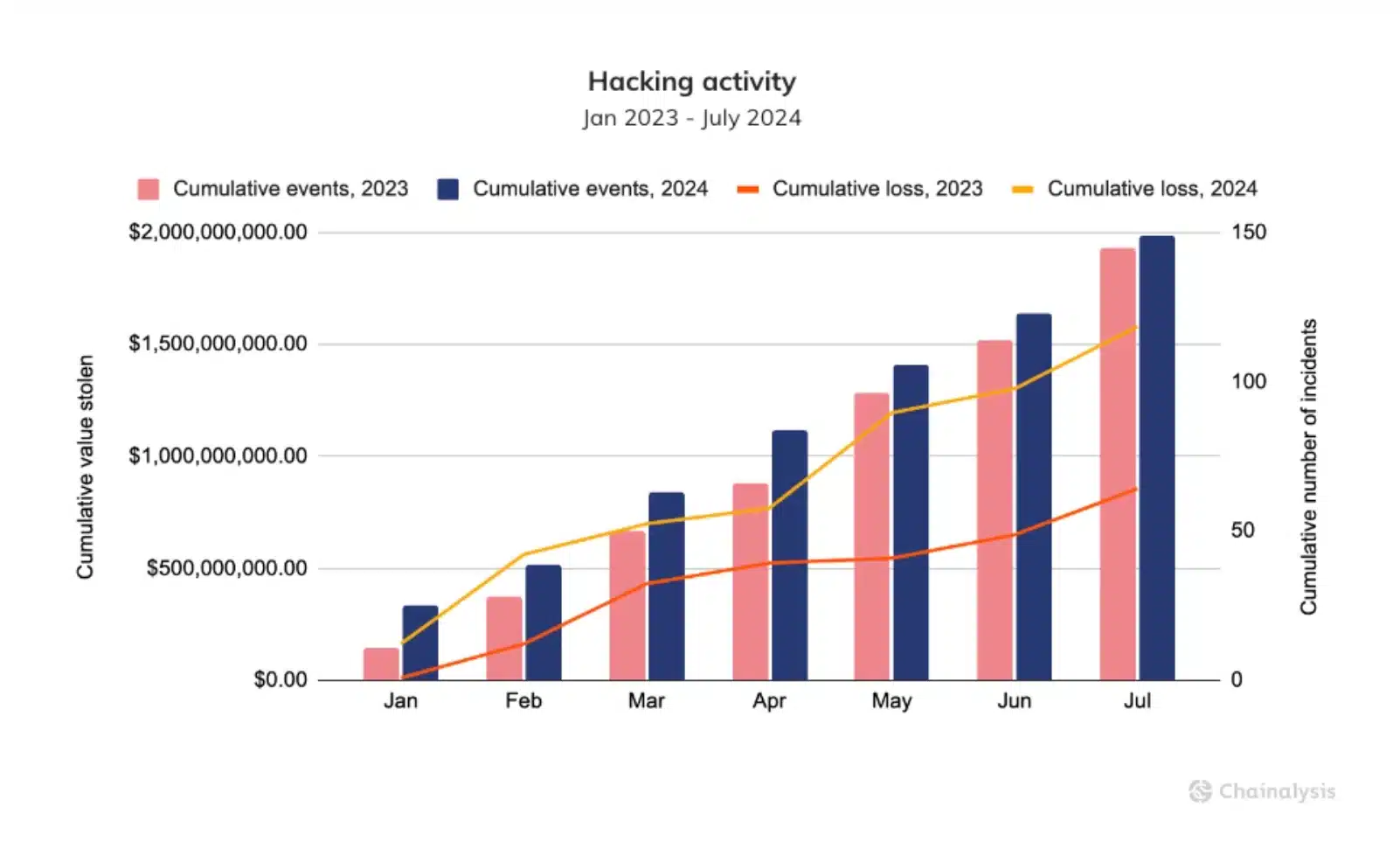

Based on the findings in the report, it appears that cases of crypto theft have increased significantly compared to last year, jumping from approximately $857 million to around $1.58 billion.

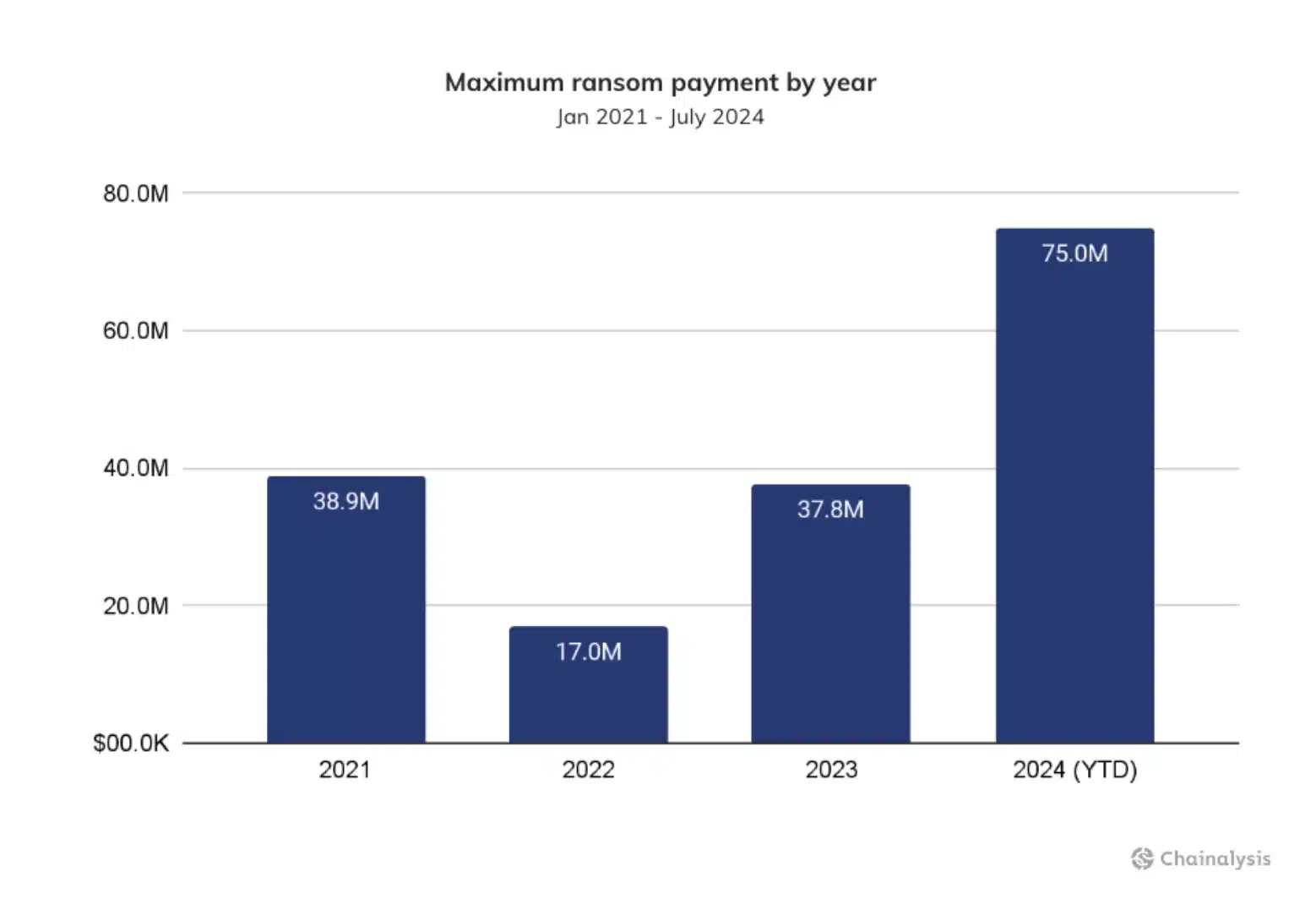

Moreover, there’s been a slight increase in the flow of ransomware payments, suggesting that this year could see a new high in such criminal activities.

2024 witnessed the Dark Angels ransomware group receiving the biggest ransom payout on record, estimated at around $75 million.

2024 saw a significant rise in hacking incidents, leading to a staggering $1.58 billion worth of stolen cryptocurrencies – a whopping 84.4% jump from the previous year. Interestingly, while the total number of events only experienced a slight uptick, the average amount stolen per incident skyrocketed by 79.46%, soaring from $5.9 million in 2023 to an alarming $10.6 million in 2024.

The increase we’ve seen is primarily due to a substantial jump in the values of various assets, most notably Bitcoin [BTC], which nearly doubled its value, rising from an average of approximately $26,141 to around $60,091.

Expressing his frustration, Jardine added,

It’s heartening to notice that the realm of cryptocurrency is steadily reducing the proportion associated with illegal activities.

Not all negative!

It’s clear that the report additionally emphasized a concerning connection between an increase in ransomware incidents and the escalating amount of money being stolen. Notably, some significant robberies have been traced back to organized criminal networks, even ones based in North Korea.

However, despite this surge in high-profile cybercrime, there is a positive trend within the crypto sector.

Based on their findings, we’ve seen a significant change in the pattern of crypto-related thefts. The proportion of Bitcoin transactions involving stolen funds has risen from 30% last year to 40% this year, suggesting a shift in the kinds of assets being targeted.

Conversely, decentralized services, particularly cryptocurrency exchanges such as DMM, have become significant points of focus due to their history of vulnerabilities. For instance, DMM suffered a loss of $305 million and had 4500 BTC stolen from its system.

It appears this change indicates that, following four years of primarily targeting decentralized systems, cybercriminals are once again opting for centralized Bitcoin trading platforms where most Bitcoin transactions take place.

Actions to strengthen security

As a significant portion of cryptocurrency-related activities occur within the blockchain network, it allows law enforcement agencies to trace and examine these transactions, thus enabling them to comprehend and dismantle criminal organizations more effectively.

As Camichel, a researcher with eCrime.ch, said,

I think it’s crucial for operations such as “Operation Cronos,” “Operation Duck Hunt,” and “Operation Endgame” to take place. These efforts aim to halt illegal activities and clearly demonstrate that wrongdoing will not go unpunished.

Read More

2024-08-17 03:04