Well, isn’t this just the plot twist nobody asked for? Cetus Protocol, SUI’s darling DeFi platform, has apparently misplaced—oh, just a casual $260 million. Users are clutching their wallets and the crypto world is collectively sweating through their T-shirts. 😬

Everything’s on pause. The platform has slammed the brakes, citing an “incident” (which is like calling the Titanic a “minor boating mishap”). This is shaping up to be SUI’s biggest blockchain blunder yet.

Cetus Protocol: Pressing Pause Like It’s Netflix

Cetus Protocol, usually busy being a decentralized exchange and liquidity provider, is now starring in its own security thriller. All smart contracts are frozen—think Elsa, but with more existential dread—while the team investigates. Cue dramatic music.

“There was an incident detected on our protocol and our smart contract has been paused temporarily for safety. The team is investigating the incident at the moment. A further investigation statement will be made soon. We are grateful for your patience,” the company posted (translation: please don’t riot).

At first, they blamed an oracle bug (classic scapegoat), but now on-chain detectives are pointing fingers at a coordinated exploit. Because of course they are.

Enter LookOnChain, blockchain’s answer to Sherlock Holmes, confirming that Cetus Protocol was indeed hacked. Over $260 million has vanished—poof! The attacker is now playing hide-and-seek with the funds, bouncing them through bridges and mixers like a caffeinated squirrel.

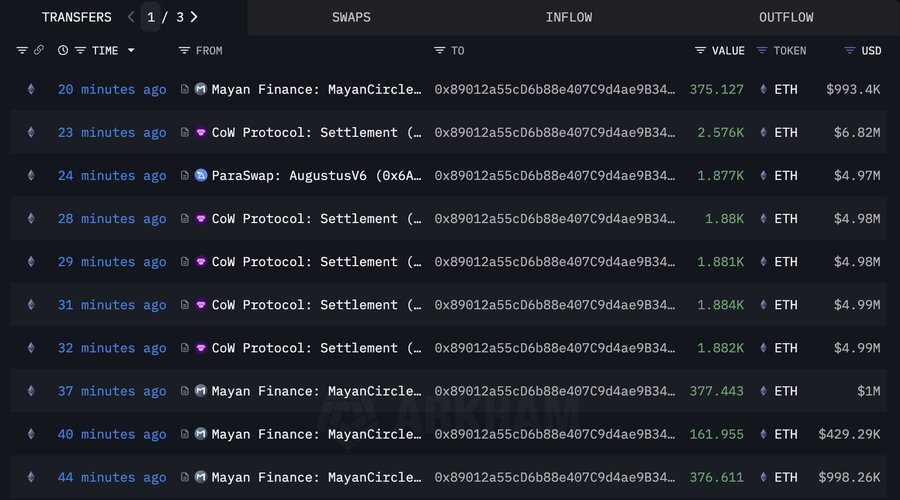

“Cetus on SUI was hacked and lost more than $260 million! The hacker is converting the stolen funds into USDC and cross-chaining to Ethereum to exchange for ETH, with ~60M USDC already cross-chained,” LookOnChain wrote. (Honestly, if only my bank transfers were this efficient.)

Panic? Oh yes. The Cetus team hasn’t released a post-mortem or technical breakdown, so everyone’s left refreshing their feeds and stress-eating digital assets. SUI markets are wobbling like a toddler on roller skates, and liquidity pools are basically ghost towns.

“The biggest LP provider on SUI was just hacked. Hopefully CETUS resolve this and fast because it is affecting the entire ecosystem,” wrote crypto analyst Gordon on X. (Translation: Help.)

Meanwhile, LookOnChain reports the hacker has already splurged over 58 million USDC to buy 21,938 ETH at an average price of $2,658. Someone’s having a shopping spree.

On-chain analysts are now playing connect-the-dots with transaction data. One theory: every last Cetus liquidity pool got drained via a multi-step exploit that toyed with token pricing and liquidity mechanics. It’s like Ocean’s Eleven, but with more code and fewer good suits.

Would you like me to break down or explain any part of this rewrite?

Read More

2025-05-22 15:51