- Ah, the Melania token, once a beacon of hope, now languishes at a mere $4.40—a veritable freefall!

- It seems our dear MELANIA has been on a slippery slope since it frolicked above the $12 mark, like a child chasing a butterfly only to trip over its own shoelaces.

On the illustrious day of January 20th, a whale—a creature of great mystery and even greater wallets—executed a transaction of considerable magnitude, acquiring 440,136 Melania Meme [MELANIA] tokens, worth a staggering $5.1M, at a princely sum of $11.60 per token. One might say, a high-stakes gamble akin to betting on a three-legged horse at the races.

Yet, as I pen these words, the token’s value has plummeted to $4.40, a decline so staggering it could make one weep for the state of modern finance.

A high-stakes bet in the market

Ah, the enigmatic dance of whale activity! It often heralds potential price shifts in the crypto bazaar. Here, the whale’s audacious purchase at $11.60 reflects a confidence that seems almost comical in light of the token’s downward spiral.

Alas, the drop suggests a dissonance between market sentiment and the whale’s lofty expectations—like a man who orders caviar and is served pickles instead.

The current floating loss hints at a lack of buying pressure to counteract this unfortunate descent. Should our whale friend choose to sell, one can only imagine the further declines that may ensue—like a domino effect, but without the delightful satisfaction of watching them fall.

Conversely, if these whales choose to hold their treasures, they might just stabilize the market. A reversal could be on the horizon, provided smaller investors decide to follow suit, like ducklings trailing behind their mother.

Decoding MELANIA’s downward price spiral

Since its glorious peak above $12, MELANIA has been on a downward trajectory, resembling a bird that has forgotten how to fly. The analysis reveals a descending channel that ultimately broke into a consolidation zone near $4.40, much like a soap opera plot twist that leaves one gasping for breath.

This consolidation suggests that sellers may be losing their grip, which could lead to a reversal if buyers decide to wade into the fray. However, should the price break below the current range, it might trigger yet another bearish leg, akin to a bad sequel that no one asked for.

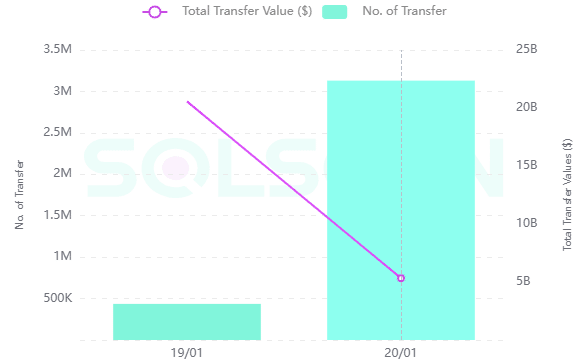

Contrasting transfers

The Solscan chart reveals a curious juxtaposition between transfer activity and total transfer value. On January 19th, the total transfer value was significantly lower, despite a moderate number of transfers—like a party with too many guests and too little food.

In stark contrast, a sharp increase in transfer value on January 20th coincided with the whale’s grand transaction, suggesting that a few large players are driving the ship, while smaller transfers reflect a waning retail interest, perhaps indicating skepticism, or as I like to call it, the “I’ll wait and see” syndrome.

Yet, sustained high transfer values could hint at institutional maneuvers, potentially stabilizing the token’s price, like a lifeboat in a stormy sea.

Concentration and risk: The impact of large holders

The token distribution chart is a sight to behold, illustrating the concentration of MELANIA among various holders. A significant portion is controlled by large wallets, including our whale friend, who recently acquired 440,136 tokens, like a kid in a candy store—only the candy is worth millions!

This concentrated ownership spells potential price volatility, as the actions of a few keyholders could drastically sway the market, much like a single sneeze in a quiet library.

Should our whale choose to hold, it may signal confidence, encouraging smaller investors to join the party. Conversely, any sell-off could exacerbate the current downtrend, leaving many to wonder if they should have stayed home instead.

A broader distribution among holders would indeed reduce volatility and promote market stability—a lesson in sharing that even the youngest among us should learn.

The recent whale activity in MELANIA serves as a stark reminder of the volatility associated with concentrated holdings. While the whale’s hefty investment demonstrates confidence, the market’s bearish sentiment continues to loom like a dark cloud over a picnic.

Read Melania Meme’s [MELANIA] Price Prediction 2025–2026

The token’s consolidation around $4.40 hints at a potential turning point, yet broader market sentiment and whale behavior will likely dictate the next movement—much like a game of chess played by the most unpredictable of opponents.

The disparity between transfer values and counts, along with concentrated token ownership, underscores the need for careful observation of market dynamics—a lesson for all who dare to tread in these turbulent waters.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Gold Rate Forecast

- Meta launches ‘most capable openly available LLM to date’ rivalling GPT and Claude

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- How to Get to Frostcrag Spire in Oblivion Remastered

2025-01-22 08:08