Well, well, well. It turns out crypto ETFs can cry too. Investors yanked $1.23 billion from bitcoin funds and $312 million from ether products last week. After two blissful weeks of “we’re all geniuses” inflows, the market flipped faster than a pancake at a Sunday brunch.

Red Week With $1.23 Billion Out of Bitcoin and $312 Million from Ether

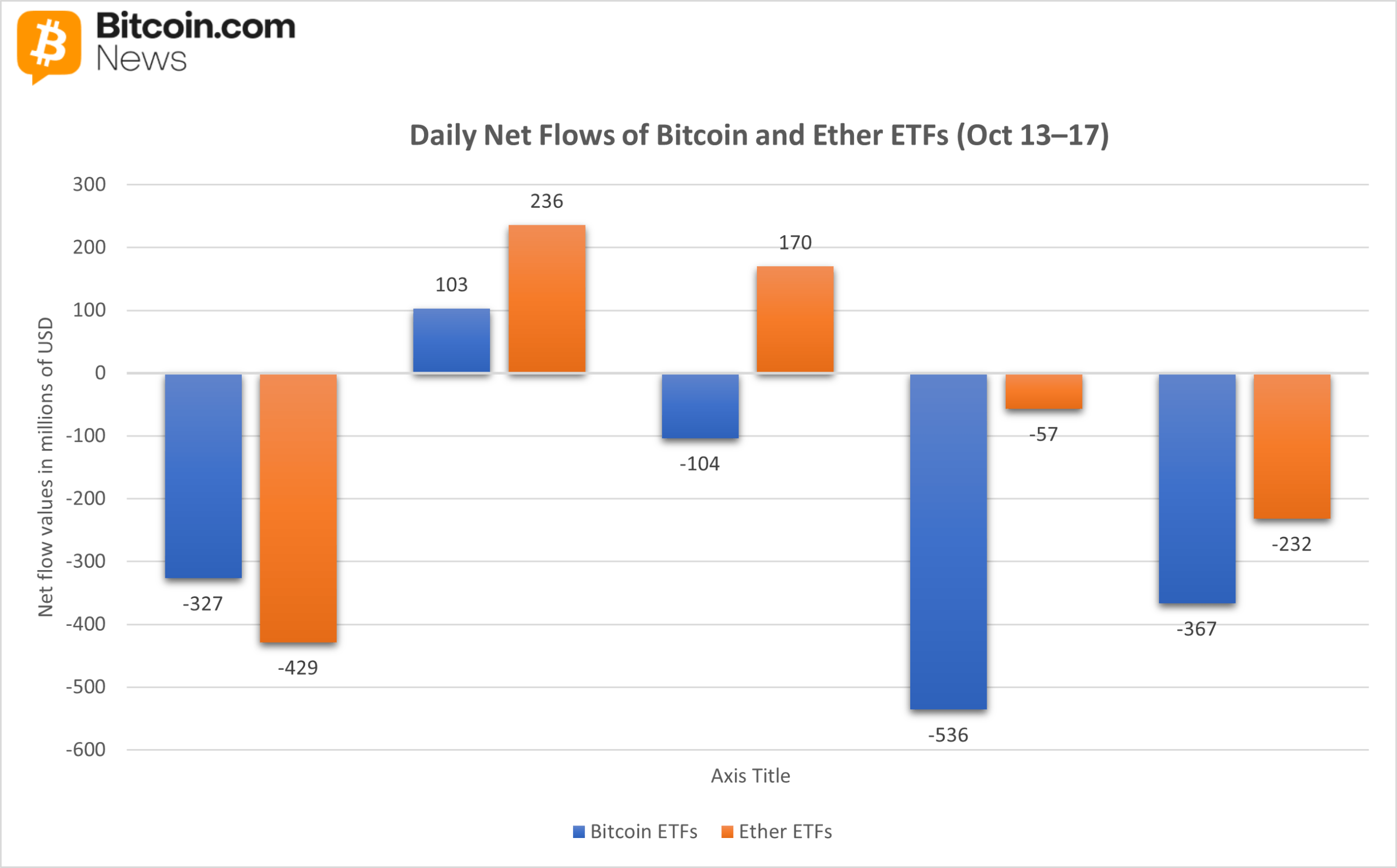

After two weeks of feeling like Warren Buffett’s long-lost cousin, crypto ETF investors suddenly remembered that volatility is a thing. Between Oct. 13 and 17, nearly every major product saw money fleeing faster than a toddler from broccoli. Both bitcoin and ether ETFs ended the week looking redder than a sunburned tourist in Miami.

Bitcoin ETFs: $1.23 Billion Exodus Across the Board

Bitcoin ETFs had a net outflow of $1.23 billion, basically the second-highest in history-which is kind of impressive if you like impressive disasters. All twelve funds closed in the red, because why not? Misery loves company.

Top redemptions: Grayscale’s GBTC (-$298.3M), Ark 21Shares’ ARKB (-$289.51M), and Blackrock’s IBIT (-$278.61M). It’s like a digital tug-of-war where the rope is made of money, and nobody’s winning.

Other funds weren’t spared: Fidelity’s FBTC (-$159.97M), Bitwise’s BITB (-$128.22M), Valkyrie’s BRRR (-$25.27M-yes, really), Grayscale’s Bitcoin Mini Trust (-$22.52M), Vaneck’s HODL (-$17.56M), and Invesco’s BTCO (-$11.10M). Meanwhile, trading volume flirted with $34 billion. Talk about busy misery.

Ether ETFs: $312 Million in Weekly Outflows

Ether ETFs weren’t spared either, losing $312 million after eight consecutive days of inflows. Blackrock’s ETHA led the exodus with $244.95 million in exits-basically ghosting the party.

Others on the “goodbye train”: Grayscale’s ETHE (-$100.96M), Grayscale’s Ether Mini Trust (-$23.95M), Bitwise’s ETHW (-$23.65M), and 21Shares’ TETH (+$7.98M, because someone had to pretend this was fun). Minor outflows came from Vaneck’s ETHV (-$3.01M) and Franklin’s EZET (-$1.59M). Fidelity’s FETH pretended everything was fine with a $94.29M inflow-bless their naive little hearts.

Trading volume hit nearly $14 billion, but net assets slid to $25.98 billion, the lowest since early September. Apparently, even institutional investors need a nap.

So, after weeks of euphoric inflows, this week’s bloodbath shows that even the pros hit the snooze button. Whether the market finds balance or dives deeper into crimson chaos depends on macro headwinds and digital asset mood swings. Buckle up. 🌀

FAQ 🧭

- How much did investors pull from crypto ETFs this week?

Bitcoin funds lost $1.23 billion; ether products lost $312 million between Oct. 13-17. - Which Bitcoin ETFs were hit hardest?

Grayscale’s GBTC, Ark 21Shares’ ARKB, and Blackrock’s IBIT accounted for nearly $866 million of the exodus. - How did Ether ETFs perform?

Blackrock’s ETHA led with $244.95 million in outflows, marking the worst week for ether ETFs since early September. - What does this mean for the crypto ETF market?

Investors are back to cautiously tiptoeing, with total crypto ETF assets sliding to multi-week lows.

Read More

- Best Controller Settings for ARC Raiders

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- How to Get the Bloodfeather Set in Enshrouded

- These Are the 10 Best Stephen King Movies of All Time

- Meet the cast of Mighty Nein: Every Critical Role character explained

- How to Build a Waterfall in Enshrouded

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- Best Werewolf Movies (October 2025)

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- 5 Reasons Zootopia 2’s Reviews Are So Great (& How They Compare to the First Movie)

2025-10-20 20:08