In the grand theater of finance, where fortunes are made and lost with the flick of a digital switch, the Bitcoin and Ethereum exchange-traded funds (ETFs) have danced their way into the hearts of investors, registering a staggering billion dollars in net inflows. This remarkable surge marks the zenith of enthusiasm since the autumn of 2024, a time when the leaves fell and so did the prices—oh, the irony! 🍂

On the fateful day of May 22, the crypto gods smiled upon us, as the net inflows for spot Bitcoin and Ethereum ETFs soared past the billion-dollar mark. It was a performance that would make even the most seasoned investor shed a tear of joy—if only they could find their wallets! 💸

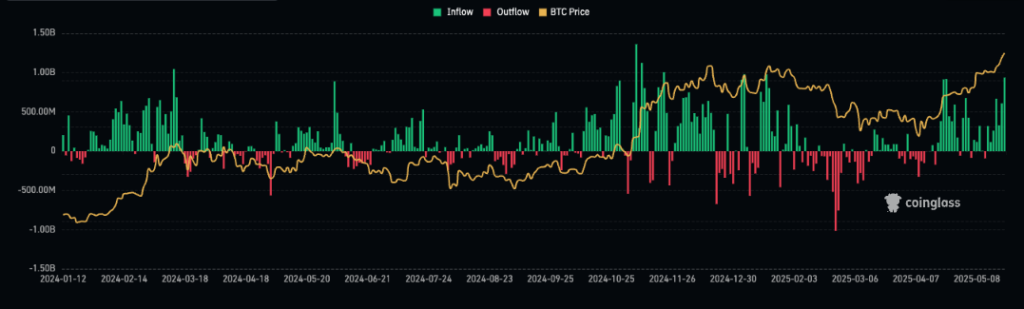

Leading the charge, the spot Bitcoin ETFs basked in the glory of a daily inflow of $934 million, their best showing since the cold days of January 17. This brings the total assets under management of these digital chariots to a whopping $104 billion. One can only imagine the celebrations in the boardrooms, where the clinking of glasses echoed like the sound of coins falling into a well. 🥂

Among the victors in this financial saga, BlackRock’s IBIT fund emerged as the heavyweight champion, clutching 651,620 individual Bitcoins as if they were golden apples. This influx of wealth has propelled BlackRock past Binance, claiming the title of the second-largest Bitcoin holder. Only Satoshi Nakamoto’s dormant wallet, with its 1.123 million Bitcoins, looms larger in this digital landscape. And let us not forget Michael Saylor, who, with his 576 Bitcoins, stands in fourth place, perhaps pondering the meaning of life—or just the meaning of Bitcoin. 🤔

Ethereum ETFs: A Five-Day Winning Streak! 🎉

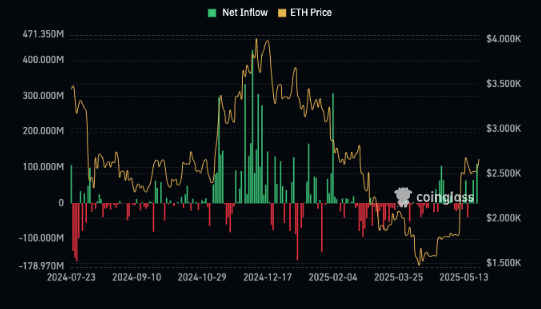

Meanwhile, the Ethereum ETFs, not to be outdone, have basked in the glow of 110 million dollars in net inflows, the largest single-day gain since the chilly February 4. The crown jewel among these funds was Grayscale’s ETHE, which raked in $43.7 million, proving that Ethereum is not just a pretty face in the crypto world. 💎

This marks the fifth consecutive day of positive inflows for Ethereum ETFs, a streak that would make any gambler proud. With a total of $10.07 billion in assets under management, these funds have flourished, buoyed by a robust 44% gain in ETH prices since the dawn of May. It seems the world has not forgotten about Ethereum, even as whispers of other tokens preparing for their moment in the spotlight circulate like gossip at a tea party. ☕

As traders leap into the fray, eager to capitalize on Bitcoin’s bull market rally, which reached a new all-time high of $111,970 on May 22, one must marvel at the resilience of the crypto markets. They stand firm, even as the stock market trembles under the weight of U.S. government debt and tariffs, proving once again that in the world of finance, the only certainty is uncertainty. 🎭

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2025-05-23 20:10