Bitcoin and Ether ETFs, the Wall Street darlings, have been on a roll, extending their inflow streaks with a whopping $988 million weekly haul. The digital gold rush shows no signs of slowing down, as both Bitcoin and Ether ETFs posted another impressive week of inflows to close out the first few days of July.

Bitcoin ETFs: A Tale of Four Green Weeks and Counting

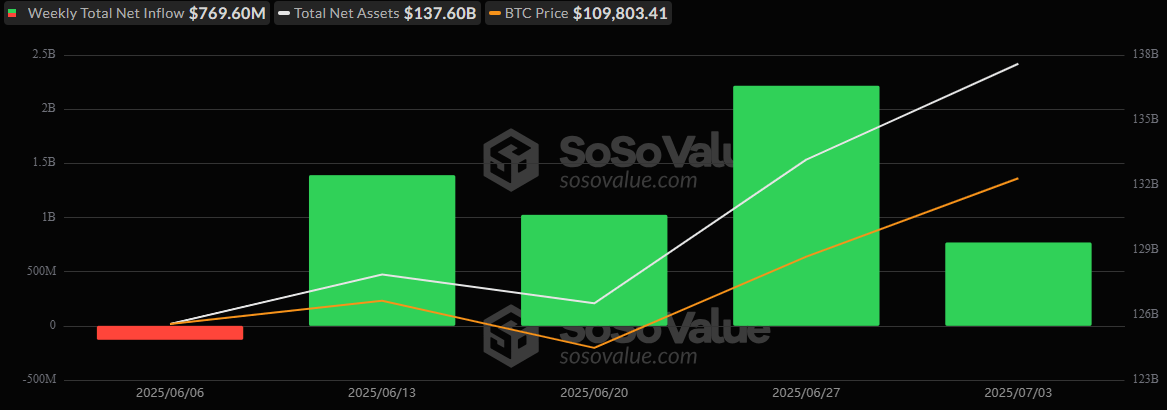

Wall Street’s appetite for digital assets is insatiable, and the numbers are nothing short of robust. With just 4 trading sessions due to the U.S. Independence Day holiday, Bitcoin ETFs saw $769.60 million in net inflows, stretching their weekly green streak to 4 weeks. Thursday, July 3, led the charge with a staggering $601.94 million, powered by inflows into the largest funds.

Blackrock’s IBIT continued to dominate with $336.85 million, while Fidelity’s FBTC followed closely at $248.36 million. Other strong performers included Ark 21Shares’ ARKB ($160.04 million), Bitwise’s BITB ($57.49 million), Grayscale’s Bitcoin Mini Trust ($22.36 million), and Vaneck’s HODL ($10.08 million).

Smaller contributions came from Invesco’s BTCO and Franklin’s EZBC, with $9.85 million and $9.51 million, respectively. Only Grayscale’s GBTC stood in the red, logging a $84.95 million outflow.

Meanwhile, Ether ETFs clocked in $219.19 million in net inflows, their 8th straight week of positive flows. Blackrock’s ETHA led the pack with $99.40 million, followed by Fidelity’s FETH at $92.03 million. Grayscale’s two ether products added a combined $16.60 million, while Bitwise’s ETHW and Vaneck’s ETHV contributed $8.33 million and $2.84 million, respectively.

Trading volumes remained high throughout the week, reinforcing strong institutional conviction in crypto’s long-term viability. With flows surging and investor sentiment firm, all eyes are on how ETFs will perform in the weeks ahead. 🤑🚀🌕

Read More

- Best Controller Settings for ARC Raiders

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- How to Get the Bloodfeather Set in Enshrouded

- These Are the 10 Best Stephen King Movies of All Time

- Meet the cast of Mighty Nein: Every Critical Role character explained

- How to Build a Waterfall in Enshrouded

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- Best Werewolf Movies (October 2025)

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- 5 Reasons Zootopia 2’s Reviews Are So Great (& How They Compare to the First Movie)

2025-07-07 20:27