So, Upbit and its big-shot parent company, Dunamu, pulled off a buzzer-beater in court. The Seoul Administrative Court said, “Hold up, no penalties for now!” after South Korea’s Financial Intelligence Unit (FIU) tried to bench them for three months. 🏀

Translation: New users can keep withdrawing and depositing crypto until at least 30 days after the final judgment. What a deal! 👏

Court Gives Upbit Some Extra Time–But Don’t Get Too Comfortable!

Apparently, Dunamu told the FIU, “Seriously? This punishment feels like a bad breakup—way too dramatic for what we did!” So, the court said, “Okay, okay, we hear you.” Judge Soonyeol Kim decided to hit the pause button and let Upbit breathe a little.😮💨

“…the effect will be suspended until 30 days from the date of the judgment of the main lawsuit. This is a measure to buy some time for Dunamu,” read the report. (Basically, a legal “take five.”)

The FIU originally slapped Upbit because—get this—they let unregistered overseas exchanges join the party without proper name tags. A big no-no, apparently. 🙅♂️

Authorities said, “Aha!” during an anti-money-laundering audit last August. They dusted off their magnifying glasses and found Upbit’s suspicious moves. 🚨

“…We deeply sympathize with the purpose of the financial authorities’ sanctions, but come on—this is more dramatic than a soap opera breakup,” Upbit sort of said, but more diplomatically. 💔

Yet, the FIU wasn’t messing around. They hit Upbit hard: “No deposits or withdrawals from new users for three months—and hey, CEO Lee Seok-woo? You’re grounded!” They even fired the compliance officer. Talk about harsh! 🔨

But Dunamu wasn’t having it. They jumped into court, waved a bunch of papers around, and basically said, “Come on, Your Honor. Can we get a timeout?” The judge shrugged and said, “Meh, fine. Everyone chill until we figure this out.” 🤷♂️

Now Upbit gets to keep the lights on like nothing ever happened—until the gavel drops for the main lawsuit. Sounds like a sitcom episode to me. 🎬

Oh, and this isn’t Upbit’s first rodeo. A couple of months ago, they got busted for over 700,000 KYC violations. SEVEN HUNDRED THOUSAND. That’s like the population of a small country forgetting their IDs. 🏴☠️

Not to mention the antitrust investigation six months ago. It seems like Upbit’s favorite hobby is attracting regulators. 🕵️♂️

Anyway, while Dunamu may be high-fiving over this temporary win, their legal therapist gets to stay on speed dial for now. The final verdict could still toss them in crypto jail—or let them off the hook. 🎢

But hey, this is huge for Upbit, the Goliath of South Korea’s crypto scene. While their competitors keep getting shut down like bad restaurants, Upbit is primed to gobble up more market share. Bet they’re loving watching Google ban 17 foreign exchanges like an overzealous hall monitor. 😎

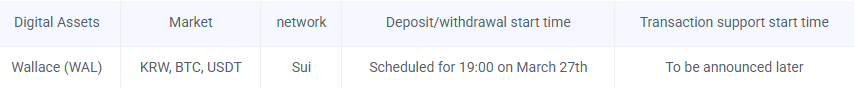

And guess what! They just launched new Wallis (WAL) trading pairs with KRW, BTC, and USDT. Who’s Wallis, you ask? Some big-brained protocol for blockchain data storage. Developed by Mysten Labs, they snatched up $140 million in funding! 💸

Sure, South Korea’s crypto market is a big deal, and this listing could supercharge WAL. But don’t forget the past pump-and-dumps. Remember ORCA and BONK? Those token parties ended faster than my interest in kombucha. 🐋➡️🤷

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-03-27 13:31