-

Bitcoin traders’ activity has declined as price consolidation persists.

Bitwise cited historically weak summer and September seasons as the cause for BTC weakness.

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself closely watching the current state of Bitcoin (BTC). The recent decline in trading activity and the persistent price consolidation have been intriguing, to say the least.

Ever since the significant drop in Bitcoin’s [BTC] price in early August, it has found difficulty maintaining levels above $60K. This subdued market activity has continued through the first half of September.

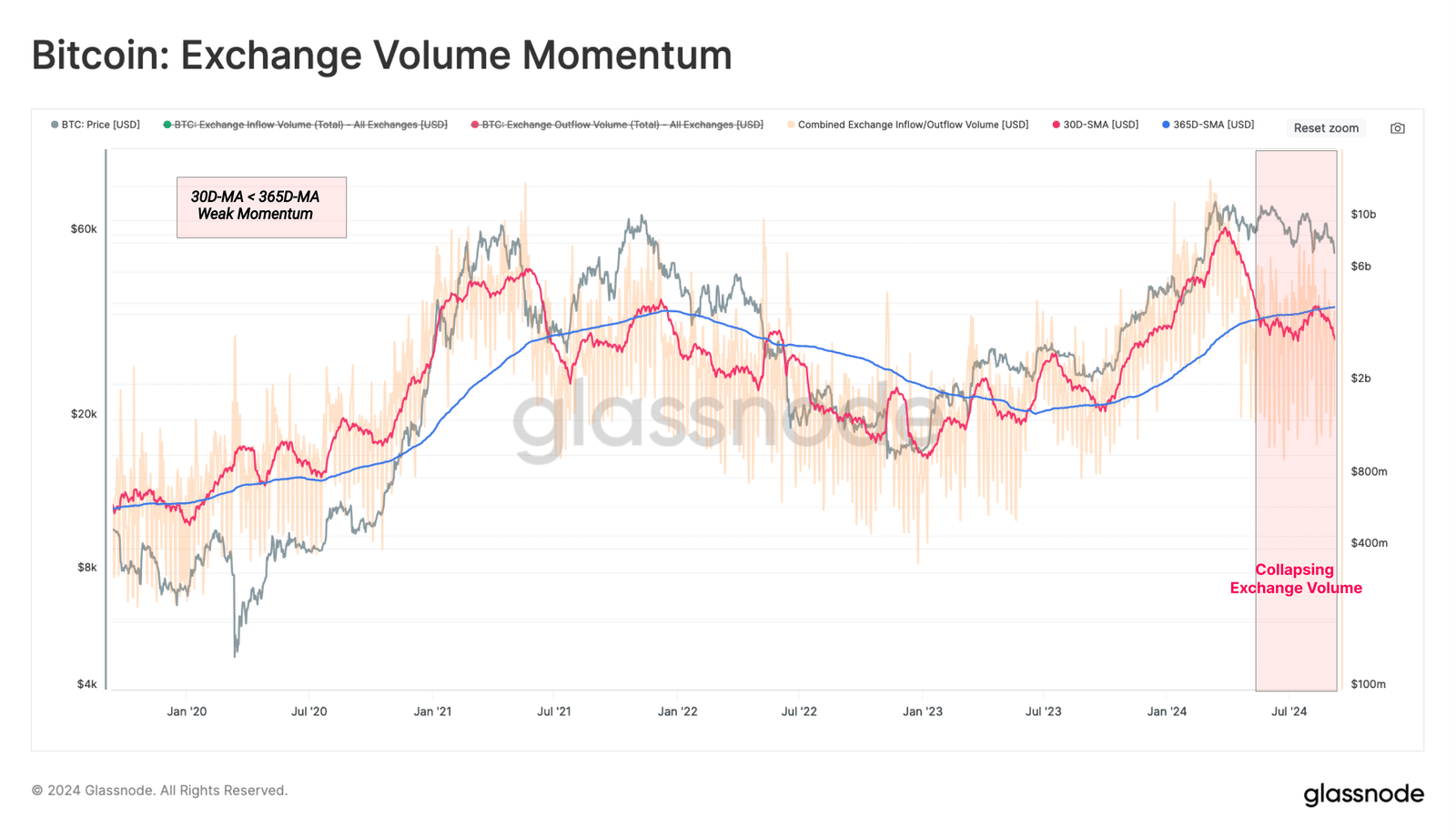

As per a Glassnode analysis, the subdued Bitcoin market activity is causing a decrease in trading enthusiasm among Bitcoin traders. The report further points out low Bitcoin exchange transaction volumes as evidence.

It’s apparent that the monthly average trading volume is significantly lower than the annual average, which suggests decreased investor interest and reduced speculative trading within the present price range.

The report added that a crypto exchange is center of price discovery and speculation activity. So, a contracting volume on this front signaled weak demand from BTC traders and investors.

BTC selling pressure intensifies

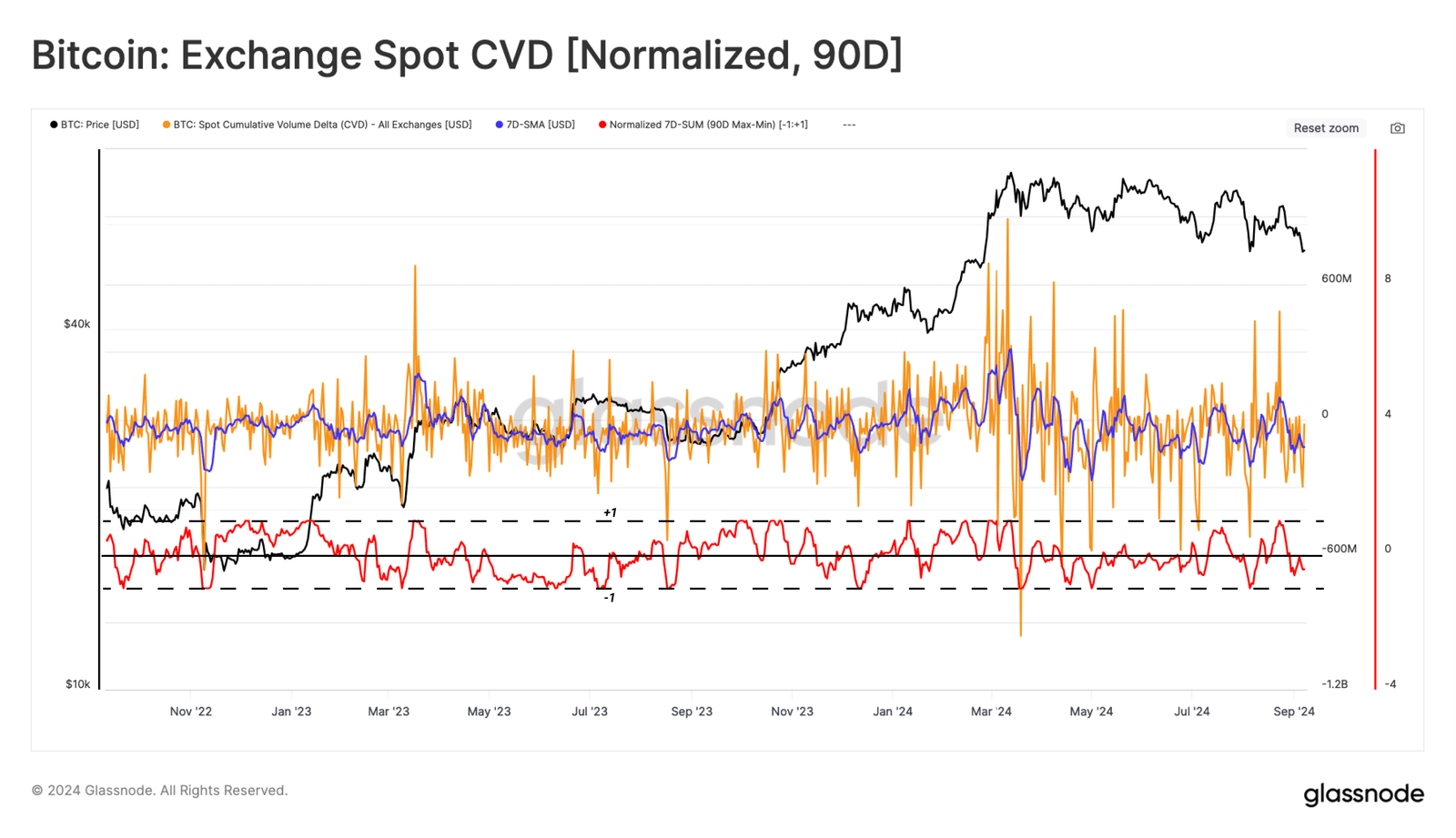

Additionally, Glassode pointed out that there was a general trend of selling pressure on the spot market throughout August and the entire third quarter.

In Q3, the Cumulative Volume Delta (CVD), a tool that measures the difference between buying and selling volumes over time, showed a heavily negative trend, indicating more sells than buys.

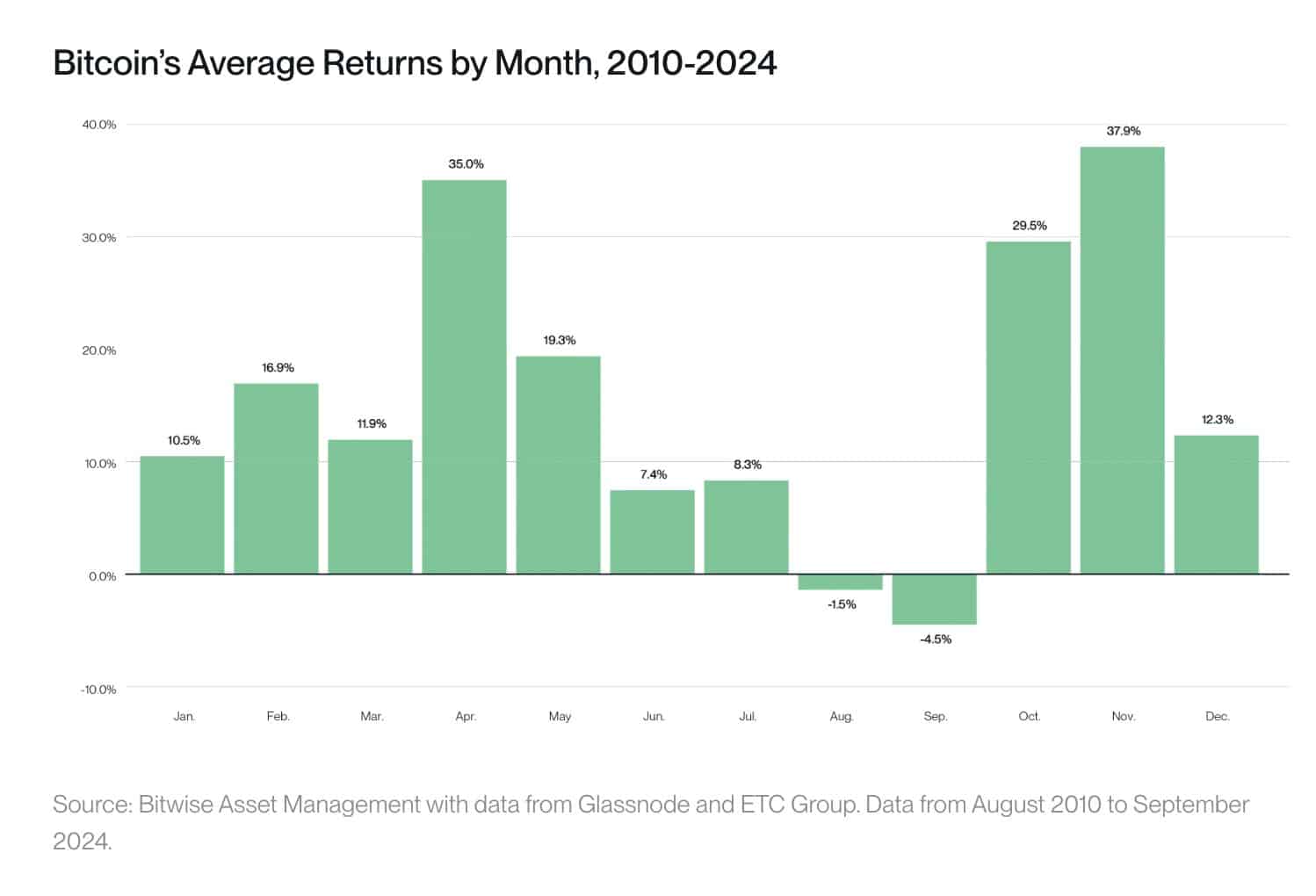

As a crypto investor, I’ve noticed that the third quarter of this year has been tough on Bitcoin, with September being especially challenging. According to Bitwise, seasonality could be the reason behind Bitcoin’s lackluster performance and the overall negative sentiment during this period.

In August and September, Bitcoin (BTC) has typically shown losses or negative returns, as the asset manager demonstrated.

Despite a consistent pattern of underperformance during the summer months for all assets, the company observed that investors tend to follow the ‘sell in May and return in November’ strategy.

Historically speaking, October often proves to be a profitable month for Bitcoin, boasting an average return of close to 30%.

If the pattern continues, it could indicate a robust recovery for Bitcoin in the last quarter. Yet, it’s worth noting that as per cryptocurrency trading firm QCP Capital, there’s an important condition to consider.

According to QCP Capital’s analysis, the latest Trump-Harris debate did not indicate a clear advantage for either candidate, potentially leading to a market response characterized by increased caution or risk avoidance.

In this election, it’s unclear who will win, and both parties have vague positions on key issues. As Election Day approaches, there could be an increase in investors shifting their money away from risky assets, leading to a more conservative or “risk-off” market trend.

Currently, Bitcoin was being exchanged for approximately $57,000, just a short while before the release of the U.S. August Consumer Price Index figures.

Read More

- OM PREDICTION. OM cryptocurrency

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Serena Williams’ Husband Fires Back at Critics

- Christina Haack and Ant Anstead Team Up Again—Awkward or Heartwarming?

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

- Five Nights at Freddy’s: Secret of the Mimic Release Date Announced in New Trailer

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Solo Leveling Arise Amamiya Mirei Guide

2024-09-12 12:07