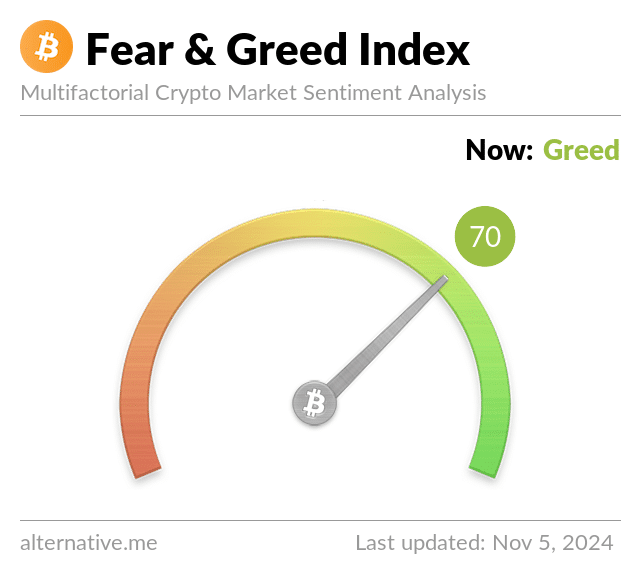

- At press time, the crypto market still flashed ‘GREED,’ despite election worries

- Prediction sites favoured a Trump win, with Options traders eyeing $60k, $70k, and $80k targets

As a seasoned researcher with years of experience observing and analyzing market trends, I must say that the current state of the crypto market is as unpredictable as ever, much like a game of chess against an AI with a mind of its own. The fact that the Crypto Fear and Greed Index is still flashing “Greed” despite the election worries is quite intriguing. It’s as if the market is saying, “Don’t worry, be greedy!

Currently, there’s palpable apprehension in the market as Election Day in the U.S. arrives. Despite Bitcoin [BTC] experiencing a dip from its record high to $68k, the Crypto Fear and Greed Index remains at “Greed” levels, indicating a sense of optimism or excitement among investors. As of this writing, the index stands at 70.

Bitcoin speculators remain positive

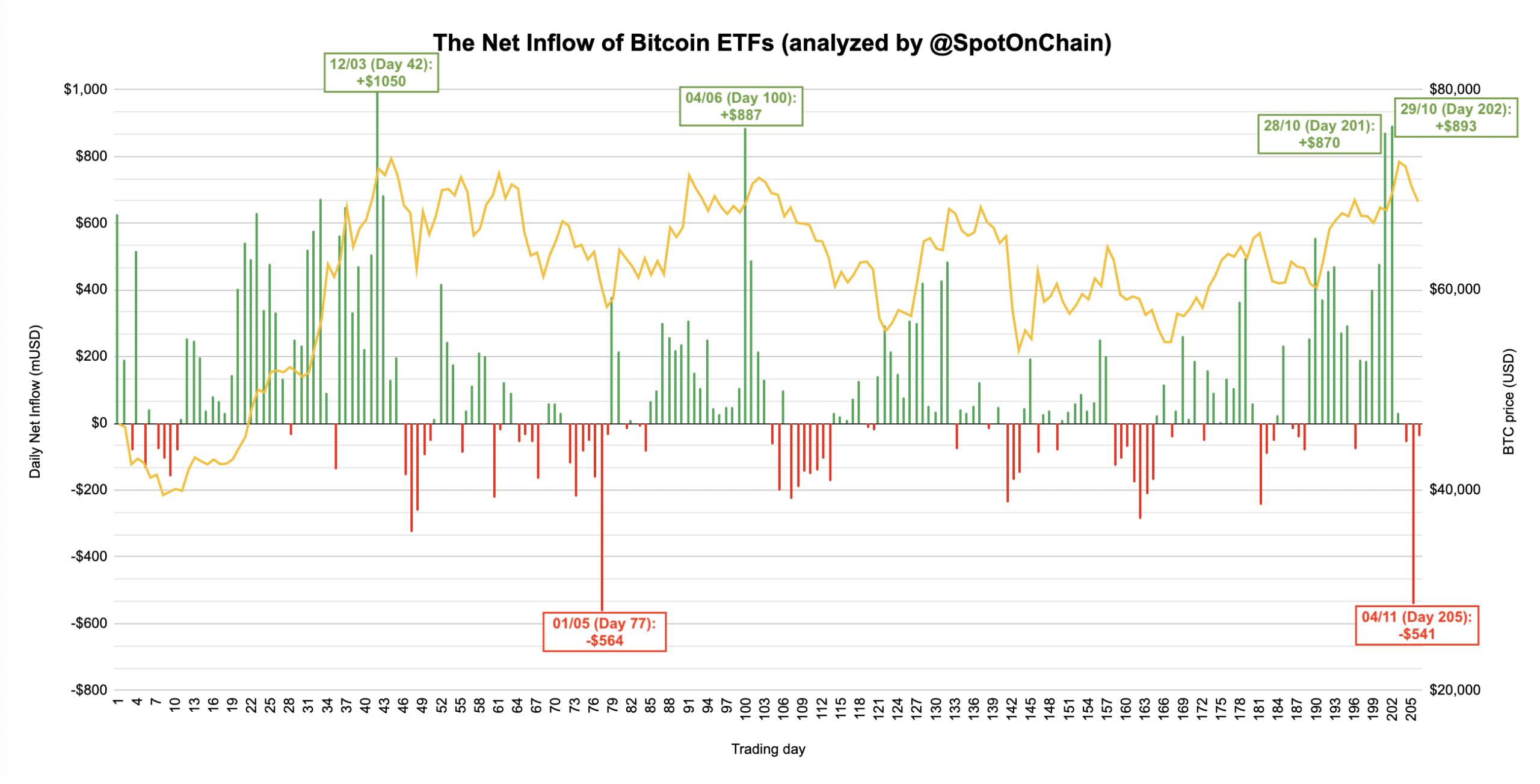

Despite the sell-off in Bitcoin (BTC) ETFs on Monday, speculators remained unfazed. In total, these products experienced a daily net outflow of approximately $541 million, with 21Shares’ ARKB and Bitwise’s BITB leading the way.

Based on information from Spot On Chain, the sale of these products on Monday represented one of the second-largest single-day withdrawals. This trend was similar to a widespread market risk reduction among U.S. equities before the election.

It’s plausible that the strong lead shown by Trump on various forecasting platforms and advanced models may have contributed to the optimism observed within the Bitcoin and cryptocurrency markets.

It’s important to mention that while crypto trading firm QCP Capital has warned that the market may be undervaluing possible risks following the election, or if Kamala Harris were to win.

Part of the firm’s election commentary read,

As a crypto investor, I’m observing that the market is anticipating a fluctuation of approximately 3.5% in BTC price on the night of the election itself. However, it seems that traders might be undervaluing post-election risks. The current calmness beyond the November 8 expiry date suggests that markets are expecting a swift resolution, which could potentially lead to underestimating potential delays or disputed outcomes.

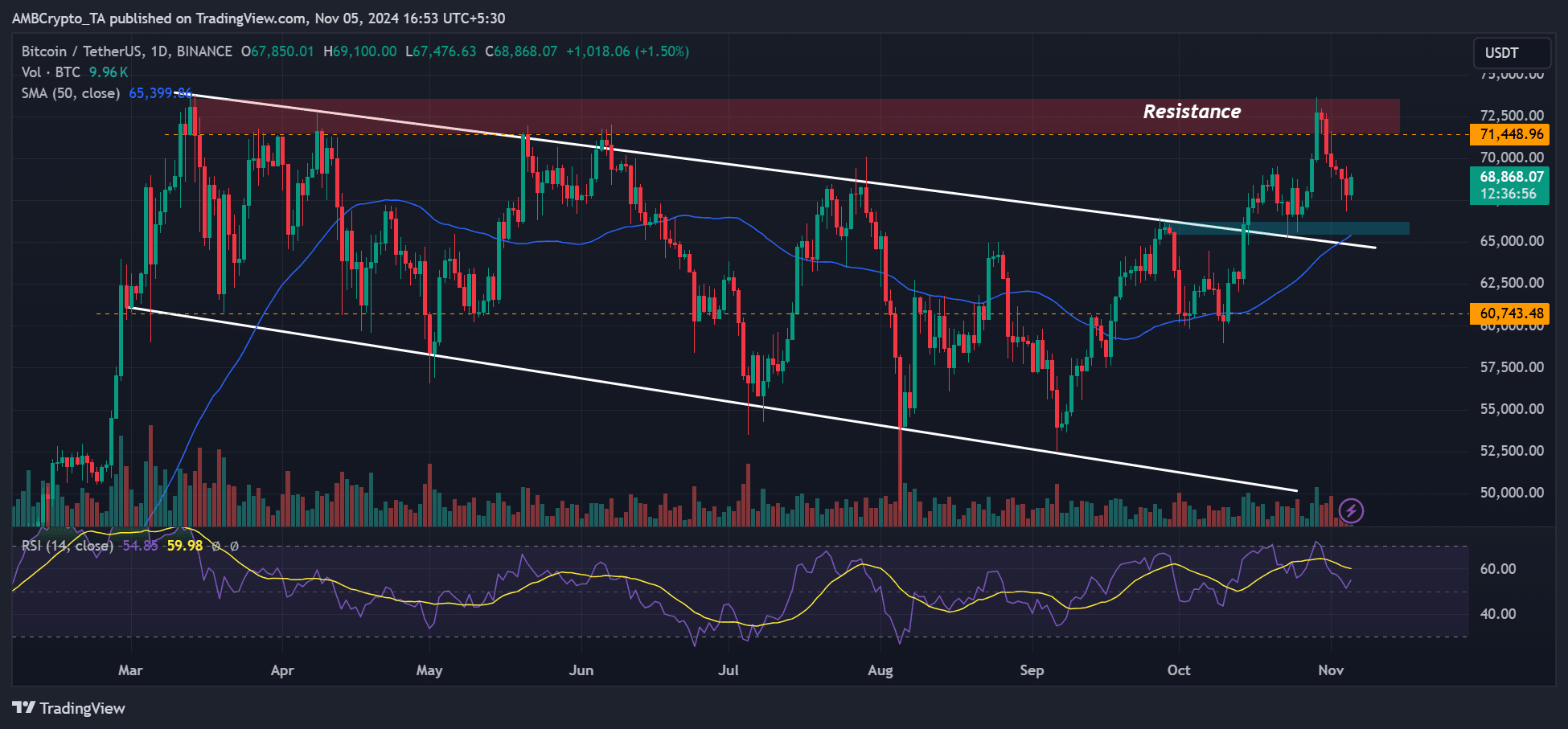

The firm anticipated erratic BTC price swings when polling results stream in. For its part, Amberdata projected that the price swings could be $6k-$8k in either direction.

It added that a Harris win could push BTC to $60k, while a Trump win could trigger a new ATH for BTC ($75K/$77K).

That said, over the weekend, the Options market saw large funds favor bullish outcomes with upside targets of $70k —$85k.

Recent Deribit data indicates that participants in offshore markets are aiming for prices between $72,000 and $75,000. This bullish outlook is due to substantial purchases of call options (anticipating price increases) from European and Asian markets on Monday, according to their latest report.

The T-1 Option with an oversized flow moves up Jack IV. In the APAC-Euro market, 1,500 calls for November 72 and 75,000 calls were purchased. As Bitcoin reached 69,300 USD at the US market opening, 1,000 funded November 29 60k Puts were simultaneously bought, with this position being financed by purchasing 1,500 November 80k Calls and an additional 1,500 November 64k Puts.

As a crypto investor, I’ve noticed a surge of interest in put options (essentially betting on downside movements) with a target of $60k, mirroring Amberdata’s predictions if Harris were to win the election. This suggests that some investors are preparing for potential price declines should Harris become president.

It appears that option traders are anticipating Bitcoin to maintain its value above $60k, regardless of who emerges victorious. If the downward trend continues, it’s worth keeping an eye on the $65k mark as a significant level.

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-11-06 09:43