- Greedy sentiment from last week quickly soured after Bitcoin’s swift price drop.

- The bearish weekly structure showed further lows can’t be ruled out.

As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I have seen my fair share of market swings – from the exhilarating highs to the crushing lows. Last week’s greedy sentiment quickly soured after Bitcoin’s swift price drop, serving as a stark reminder that this market can turn on a dime.

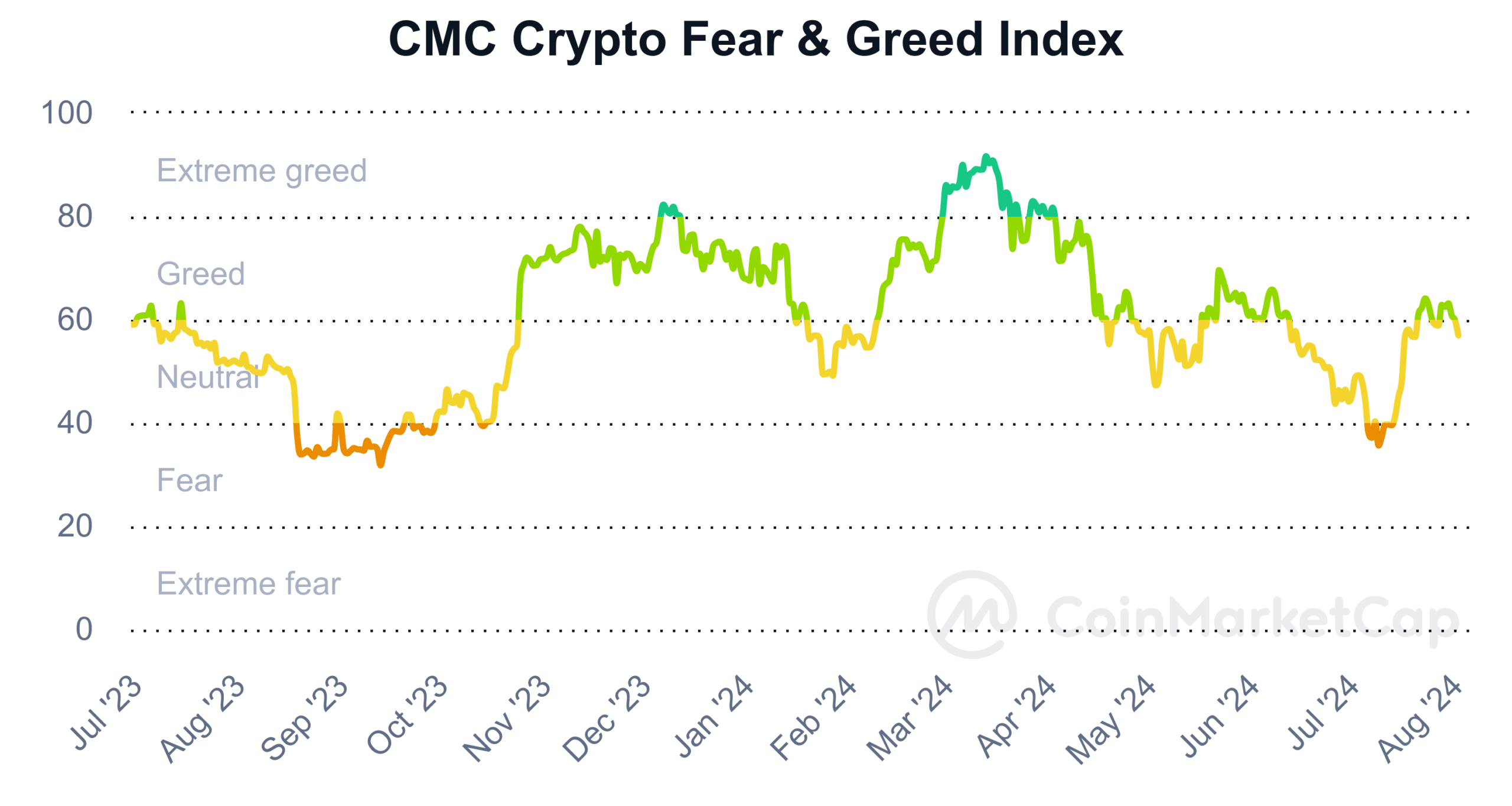

At the moment, the value of Bitcoin (BTC) has dropped approximately 9.74% since its peak on Monday. As for the Crypto Fear and Greed Index, based on data from CoinMarketCap, it currently stands at 56, indicating a neutral stance.

This Index gives an idea about the sentiment in the crypto market.

Extreme fear can be a signal to buy, and extreme greed can be a sell signal. Some sites use factors such as market volatility, momentum, social media, and Bitcoin Dominance to calculate the index values.

The rejection from $70k follows a bearish structure

In simpler terms, when the market closed below $56.5k on the 1-week chart, it signaled a shift towards a bearish trend. Despite a subsequent rise in July to reach $69.5k, it failed to surpass the previous lower high at $72k.

Such a move was required to achieve a bullish market structure break.

On July 29th, instead, the value of Bitcoin peaked at an impressive $70.1k. However, it subsequently experienced a severe drop following this peak, as indicated by data from Coinglass, which showed that a significant $343 million in liquidations occurred within the past 24 hours.

As an analyst, I find the potential Fibonacci retracement levels at roughly $56,100 and $52,000 intriguing as possible buying opportunities in the upcoming weeks. Nevertheless, considering the current market conditions, it seems unlikely that we’ll reach the $52,000 level for testing.

The long-term investor has little to fear from volatility

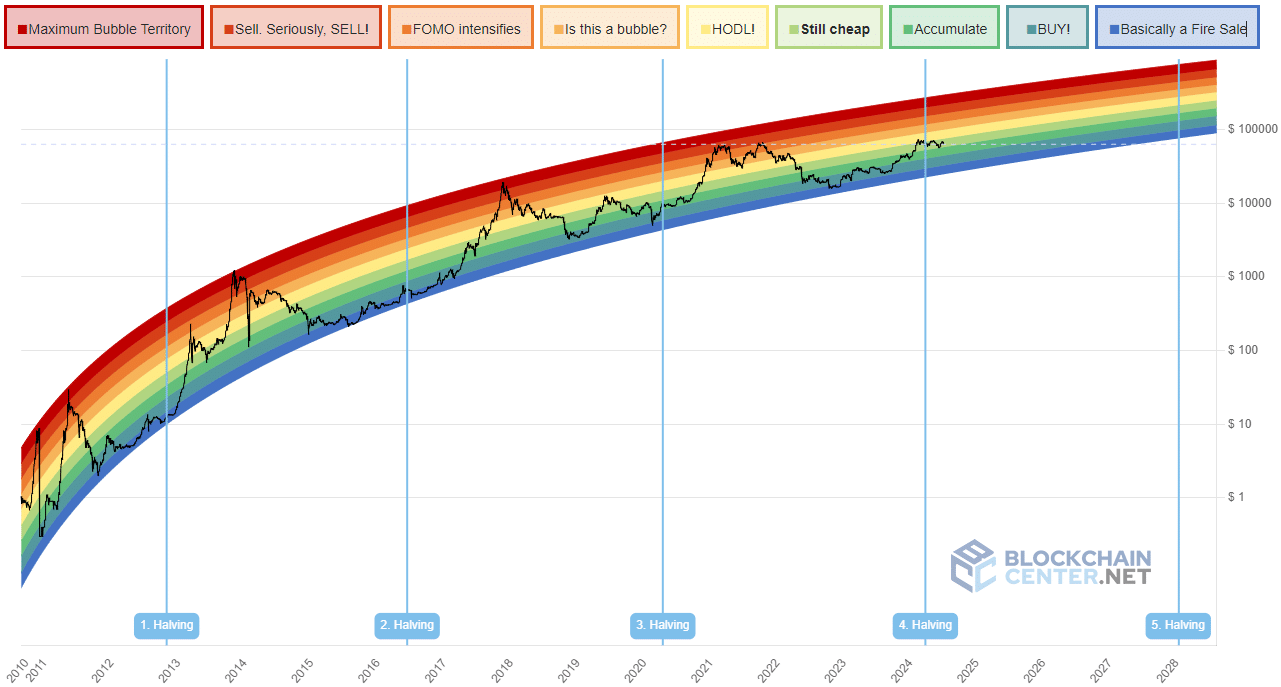

Individuals who are more patient with their investments might find these price decreases appealing. Drops in price often lead to a panic-induced floor, so a fall below $60k might be advantageous. The Bitcoin Rainbow graph suggests that it is still considered reasonably priced within this range.

When the Crypto Fear and Greed Index hasn’t reached levels lower than 30 or higher than 70, it suggests that a significant trend shift may not occur immediately.

At the current moment, the impartial assessment indicates that further discomfort may be required for a genuine increase to start.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

2024-08-02 10:15