- Bitcoin was oversold and extremely imbalanced, but an immediate price bounce is not guaranteed.

- A defense of the $50k support zone and some stabilization could persuade investors to bid despite the risky conditions.

As a seasoned market analyst with over two decades of experience under my belt, I’ve witnessed countless market cycles and learned that every dip is another opportunity for those with a cool head and a long-term vision.

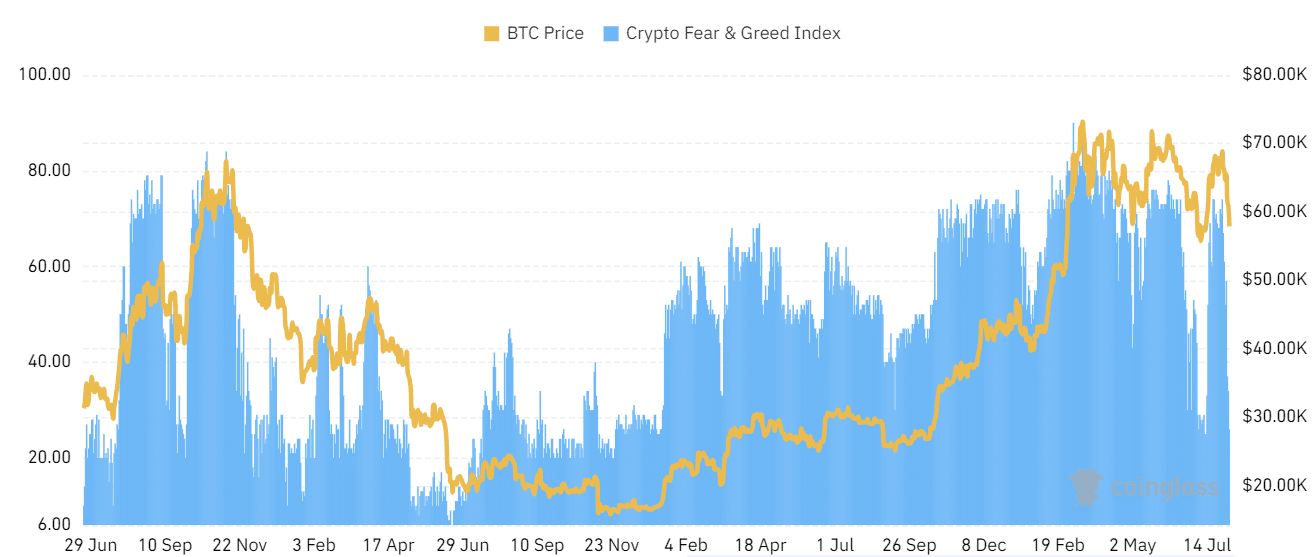

Yesterday, prior to our report, the cryptocurrency market was in turmoil as the price of Bitcoin [BTC] hovered slightly above $60k. Since then, the lowest point reached has been $49k, and there’s a possibility that prices might drop even more during today’s trading session in New York, causing unease among investors.

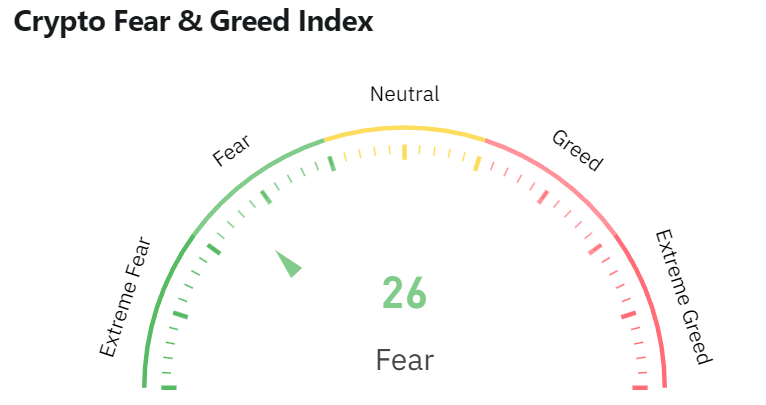

On Sunday, the Crypto Fear and Greed Index stood at 31, indicating a prevailing sense of fear among investors. Historically, when the market is fearful, it can present excellent buying opportunities. Could we witness yet another such chance on Monday?

Fear and Greed Index plummets after crypto prices incite alarm

Starting from the 29th of July, there has been a decrease in the total market capitalization of the top 125 altcoins (excluding Ethereum and Bitcoin), amounting to approximately $163 billion, which represents a fall of around 28%.

The two giants haven’t fared well either, losing 37.85% and 30% respectively at their lowest.

As I analyze the data at present, the index indicates a level of “apprehension” set at 26. It’s worth noting that such high levels of apprehension are not common in the crypto market during the year 2024. In fact, readings as high as this have only been observed on certain days over the past two months.

More recently, on July 13th, the index dropped to 25. At that time, Bitcoin’s price stood at approximately $57,800. Two weeks afterward, its value surged to around $68,800.

If history repeats itself, Bitcoin might hold on to the $50k support and climb higher.

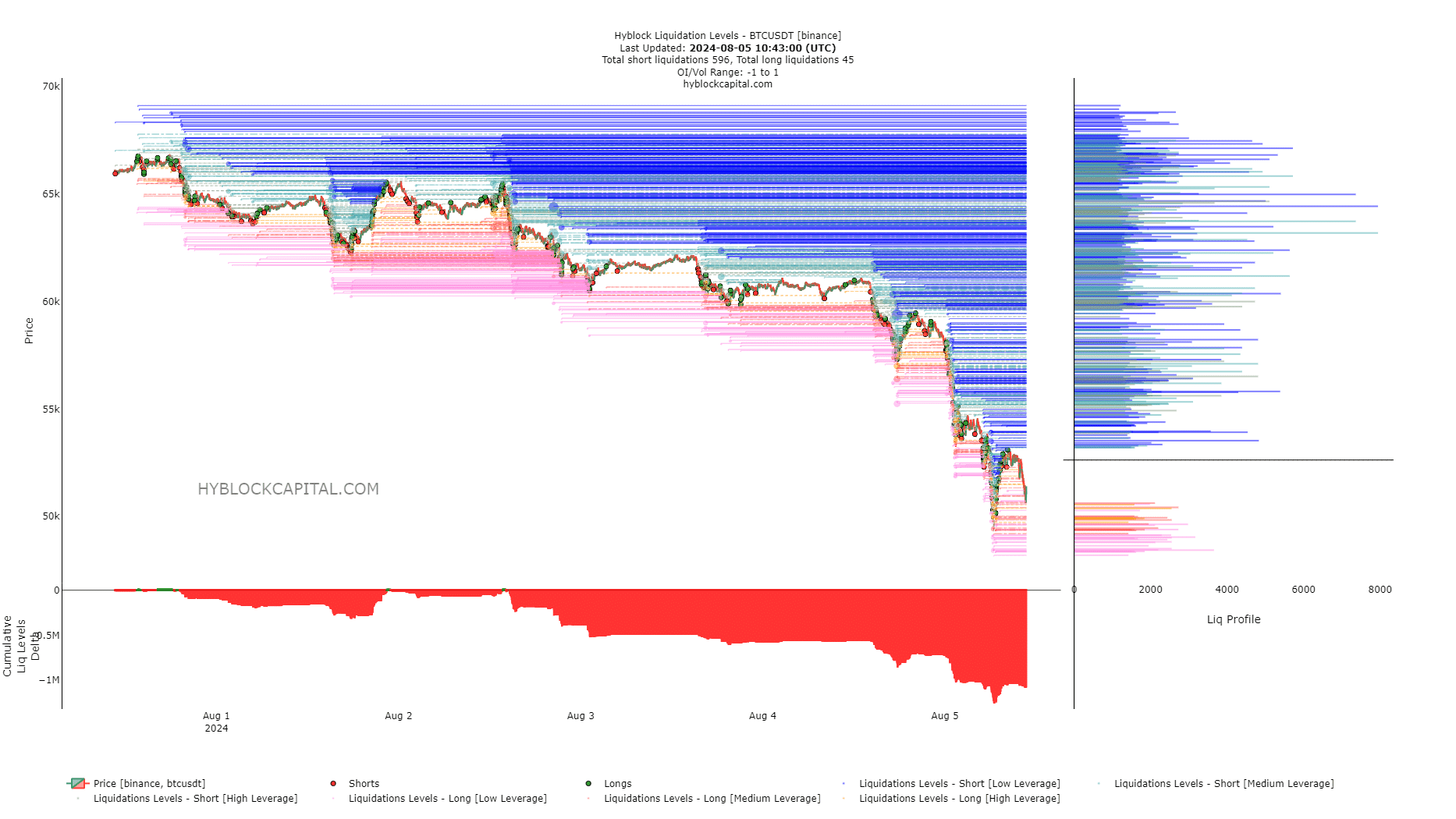

Will the late short sellers be punished for their mistimed trades?

In simpler terms, the Relative Strength Index (RSI) for today’s trading was 23, indicating that the market might be overbought or overextended. Meanwhile, as you can see in the chart above, the net liquidation levels trend was leaning more towards advantageous short positions.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This imbalance can be wiped out by a sharp price bounce.

Given the current apprehension and market turmoil, significant buying momentum could take another day or two to materialize. Should it manifest, the near-term hurdles to focus on will be around the $53,900 and $55,700 price points.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-08-06 00:07