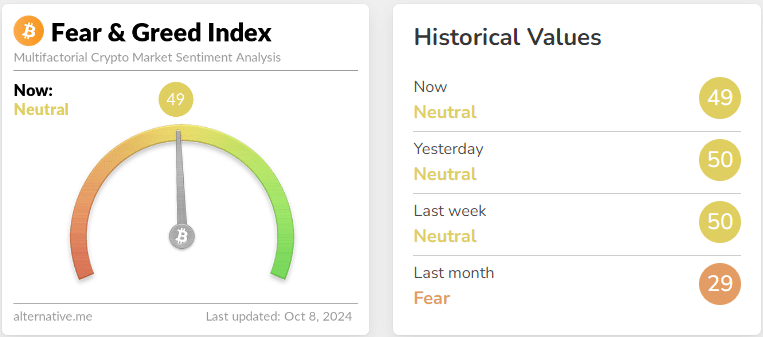

- The crypto Fear and Greed Index was not overextended in either direction.

- The Tether Dominance chart has been trending higher since April — bulls would want this to change.

As a seasoned researcher with years of experience navigating the volatile waters of the cryptocurrency market, I find myself intrigued by the current state of affairs. The Fear and Greed Index is neutral, which to my eyes reads more like “cautious optimism.” After the turbulence we saw in early September, it’s a relief to see a more balanced sentiment.

At the moment, the Crypto Fear and Greed Index indicated a neutral stance, marking an enhancement compared to the apprehensive viewpoint in early September.

The recent correction from $66.5k to $60k has not hurt the market participants too badly.

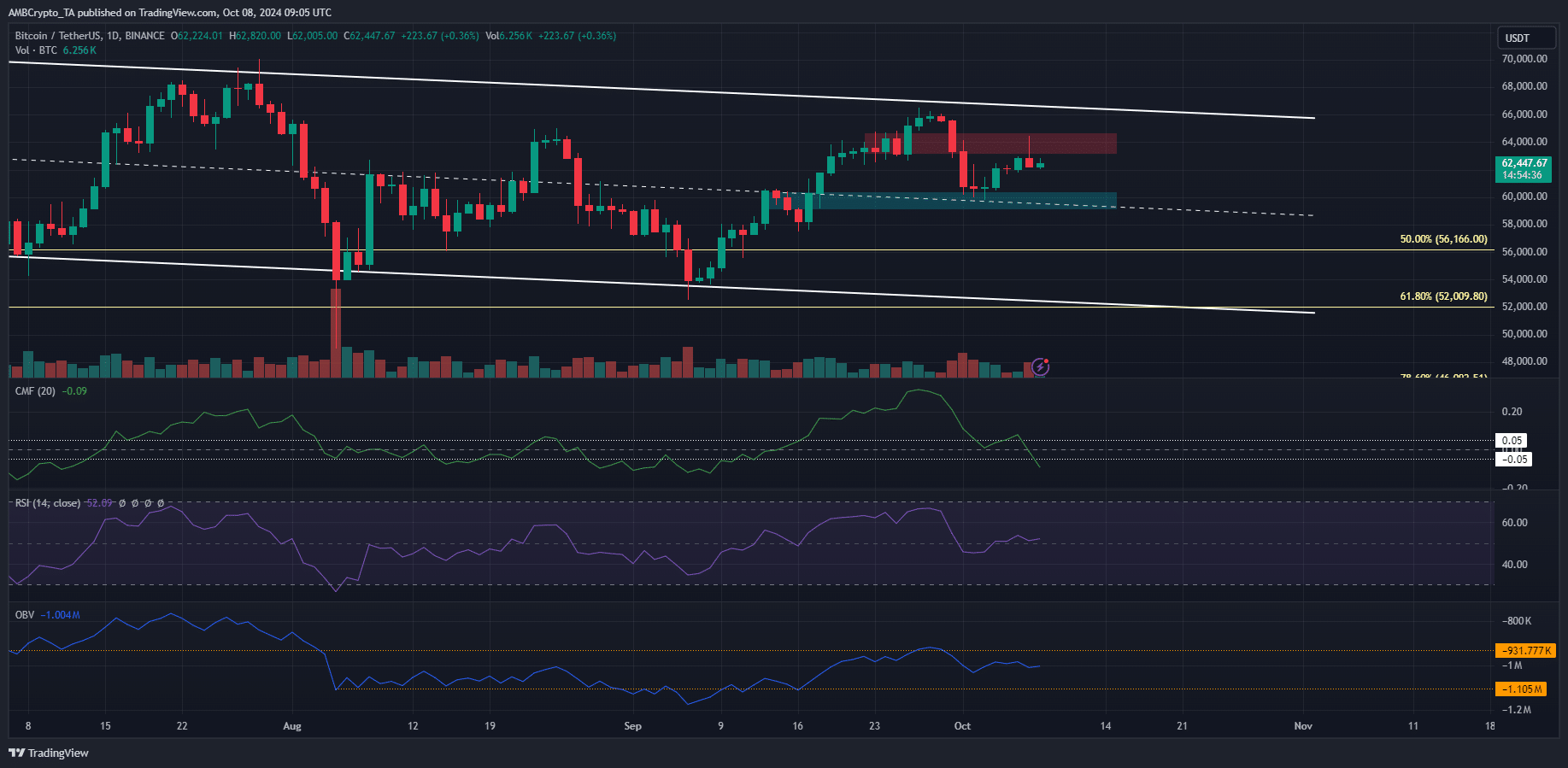

According to a recent report from AMBCrypto, there are areas around certain prices where assets may become trapped and potentially act as attractive points for other traders. The region around $66,200 continues to be a barrier that might push back any upward momentum by the bulls if we return to it again.

On the other hand, a massive bullish move was possible, based on historical trends.

Where is the crypto market sentiment at

The Bitcoin Fear and Greed Index graph indicated a balanced sentiment, which seemed reasonable considering the recent fluctuations in Bitcoin’s price over the last fortnight.

On the 18th of September, the middle point of the downward trendline (represented by white) was broken. After this, a surge came close to touching the highest points of the trendline, but it was ultimately pushed back. Since then, the $64k area has shifted from serving as support to acting as resistance.

The Cash Money Flow (CMF) displayed a value of -0.09, suggesting substantial withdrawal of capital from the market and persistent selling by firms. Additionally, the On-Balance Volume (OBV) demonstrated consistent selling over the last fortnight; however, it has experienced a slight rebound recently.

The RSI espoused a neutral outlook with its reading of 52.

Dropping prices within the range of $58,000 – $60,000 offers an attractive buying opportunity. On the other hand, if the price surges past $66,000-$67,000 and then retests those levels as support, it could be a good time to invest for the long term. This latter situation might lead to a shift in market sentiment towards excessive optimism or greed.

Findings from the Tether chart for BTC trends

The Tether [USDT] dominance trend is inversely related to the crypto market. An uptrend in this metric generally means the market is trending downward, and investors are moving to stablecoins.

In simpler terms, the 5.79% mark serves as a barrier for further growth, suggesting that USDT.D might decrease over the next few days. However, there’s a possibility of a brief increase in the price of Bitcoin in the near future.

However, the metric has trended upward since March, as captured by the ascending trendline.

In the current state of the crypto market, both long-term investors and active traders should exercise caution when setting optimistic price predictions for their assets, as they might still be intact.

Read More

2024-10-09 00:07