- The U.S. government has charged market makers with crypto fraud and manipulation.

- FBI created a token, NextFundAI, to bait the perpetrators and aid the investigation.

As a seasoned analyst with over two decades of experience in financial markets, I have witnessed numerous instances of fraud and manipulation, but the recent U.S. government crackdown on crypto market makers is undoubtedly one of the most intriguing cases I’ve encountered. The FBI’s innovative approach to create NextFundAI as a decoy token to lure perpetrators is reminiscent of a modern-day cat-and-mouse game, albeit with significantly higher stakes.

In simpler terms, authorities in the United States have accused three market intermediaries, along with 18 other individuals, of committing fraud and manipulating cryptocurrency markets. The Federal Bureau of Investigation spearheaded the investigation by devising a sting operation, creating a digital token named NextFundAI, which was used to record the suspected wrongdoings of these individuals.

As a result of an extensive probe, it was found that four companies – Gotbit, ZM Quant, CLS Global, and MyTrade – were charged with pervasive cryptocurrency fraud and market manipulation.

In response to the allegations, U.S. Attorney Joshua Levy praised the investigation as unique and served as a strong warning to investors in the cryptocurrency market.

If you attempt to deceive investors through misleading information, it’s considered fraud – end of story.

Others charged in crypto fraud

It was discovered during an examination that market facilitators were providing a service called ‘market manipulation on demand.’ This entailed artificially boosting token trade activity and subsequently selling off tokens once a larger number of users got caught up in the fabricated price surge.

As an analyst, I’ve noted that the term ‘Saitama token’ has been brought up by the prosecution team, referring to a cryptocurrency that surged to a substantial market capitalization worth billions. They suggest this as an illustration of the notorious ‘pump-and-dump’ scheme.

Consequently, the probe found 18 individuals involved, among them the heads of market brokers, their staff, and the advocates of the deceptive cryptocurrencies.

Noteworthy fact: Gotbit stands out as a prominent and bustling market maker, with a significant focus on memecoins.

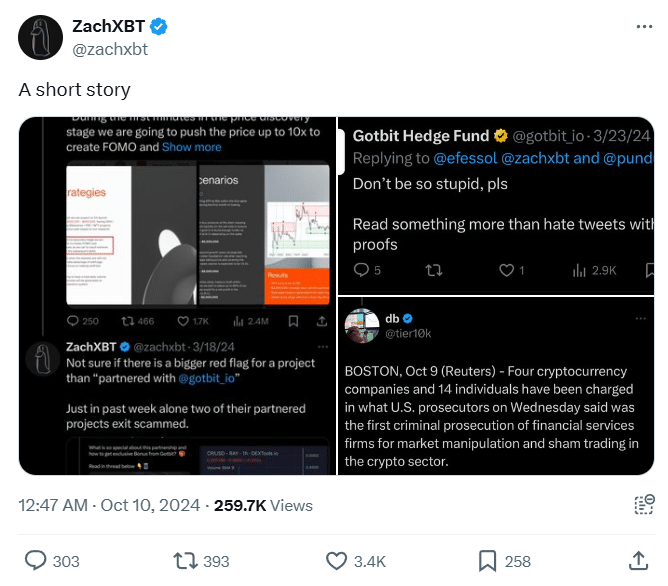

Aleksei Andriunin, the CEO of Gotbit, has been frequently active on a platform similar to Twitter, and he was highlighted by ZachXBT, a well-known blockchain analyst, last year.

Additionally, other influential figures such as Riqui Liu from ZM Quant, Baijun Ou, Andrey Zhorzhes from CLS Global, and Liu Zhou of MyTrade, were also implicated in the case.

According to reports, the U.S. authorities allegedly confiscated around $25 million and disabled multiple automated trading accounts involved in a practice known as “wash trading.

As a researcher, I’d like to clarify that any retailers adversely affected by NextFundAI or the tokens under scrutiny, such as Robo Inu, will receive reimbursement for their losses in this case.

Nevertheless, it seemed like the accusations had caused unease among some social media opinion leaders and crypto advocates. One of X’s crypto influencers and promoters, Ansem, even hinted at stepping away from his account, suggesting retirement.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-10 14:15