- Federal Reserve has initiated enforcement action against crypto-friendly Customers Bank.

- Tyler Winklevoss sees the move as an extension of ‘Operation Choke Point 2.0’ by the Biden-Harris administration.

As a seasoned crypto investor with a decade of experience under my belt, I can’t help but feel a sense of déjà vu as Operation Choke Point 2.0 rears its head once more. The Federal Reserve’s action against Customers Bank is yet another brick in the wall that seems to be systematically constructed to restrict crypto firms from accessing essential banking services.

The cryptocurrency sector has sounded an alert about the potential return of “Operation Choke Point 2.0.” This cautionary statement came following a lawsuit filed by the Federal Reserve against bank Customer Bancorp, which is known for its supportive stance towards cryptocurrencies.

In response to the recent development, Tyler Winklevoss, a co-founder of Gemini, expressed his view that “Operation Choke Point 2.0” is still in progress. He also labeled Kamala Harris’s cryptocurrency initiative as a “scam.”

Today, the Federal Reserve has affirmed that Operation Choke Point 2.0 continues unabated, shedding light on its inner workings, and debunked the notion surrounding the Harris cryptocurrency “reboot” as a fraudulent scheme.

For those not aware, Operation Choke Point 2.0 is a term used to describe alleged efforts by U.S. regulatory bodies to limit cryptocurrency companies’ ability to use traditional banking services.

The restriction on major banks regarding crypto custody services, as seen in SAB 121, was also a component of the updated version (2.0) of Operation Choke Point.

Customers Bank under scrutiny

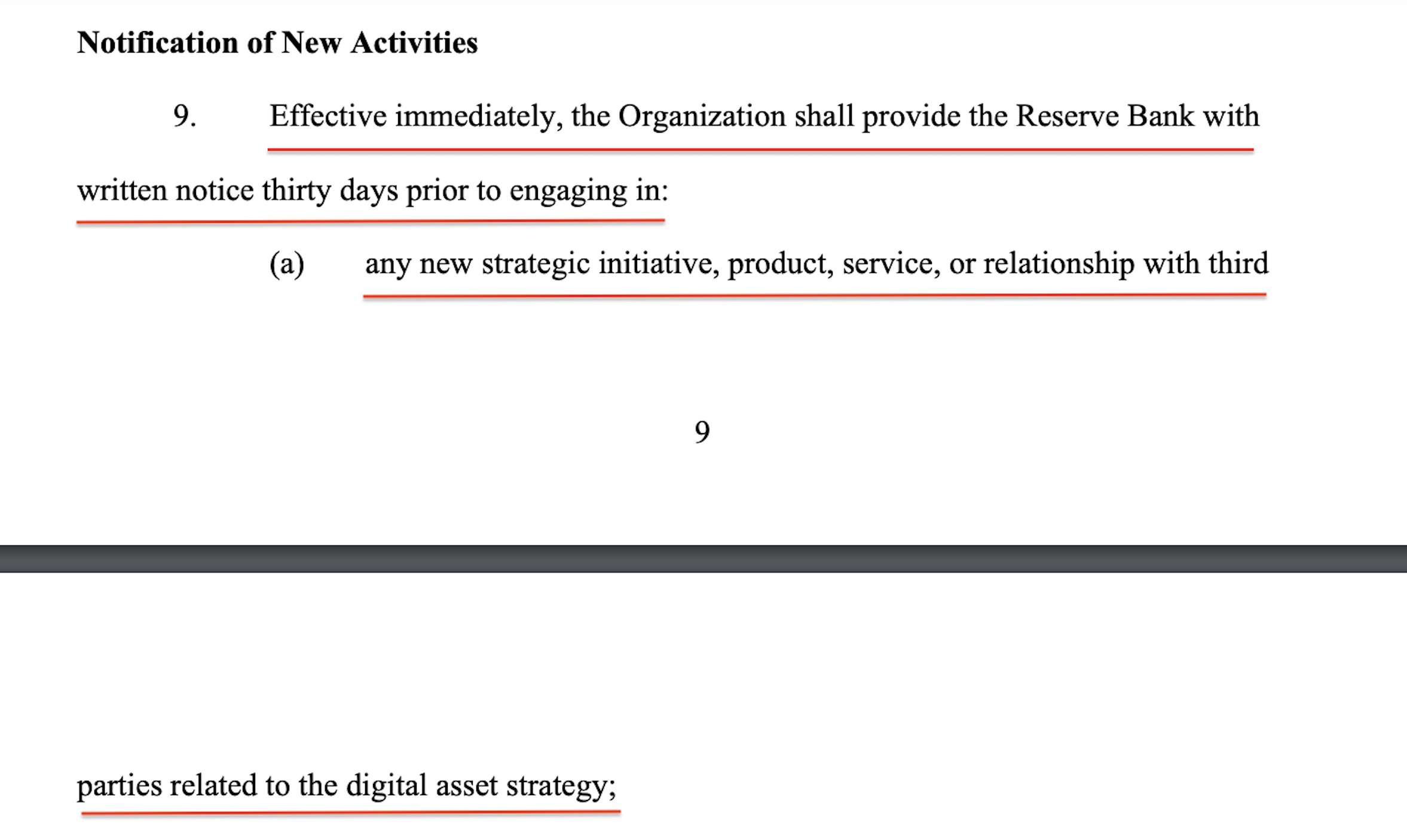

On August 8th, as stated in the enforcement action, the Federal Reserve requested Customers Bank to provide a 30-day heads-up prior to accepting any cryptocurrency company as a new client.

According to the Federal Reserve’s findings, Customer Bank exhibited “substantial flaws” in their adherence to anti-money laundering (AML) regulations, particularly in relation to their strategy for digital assets.

As per Tyler Winklevoss’s statement, the sequence implied that the Federal Reserve acted as the sole guardian or intermediary, controlling the access of cryptocurrency companies to traditional banking services.

He noted that, if it persists over the next four years, such a trend could potentially decimate the American cryptocurrency sector.

1. “Operation Chokepoint 2.0 persists vigorously under the Biden-Harris Administration. Their oppressive rule remains a concern. If things carry on as they are for another four years, the cryptocurrency sector in the U.S. could face extinction.”

A recent meeting between crypto executives and White House advisors also revealed a lack of commitment to policy change. This could fuel the fears.

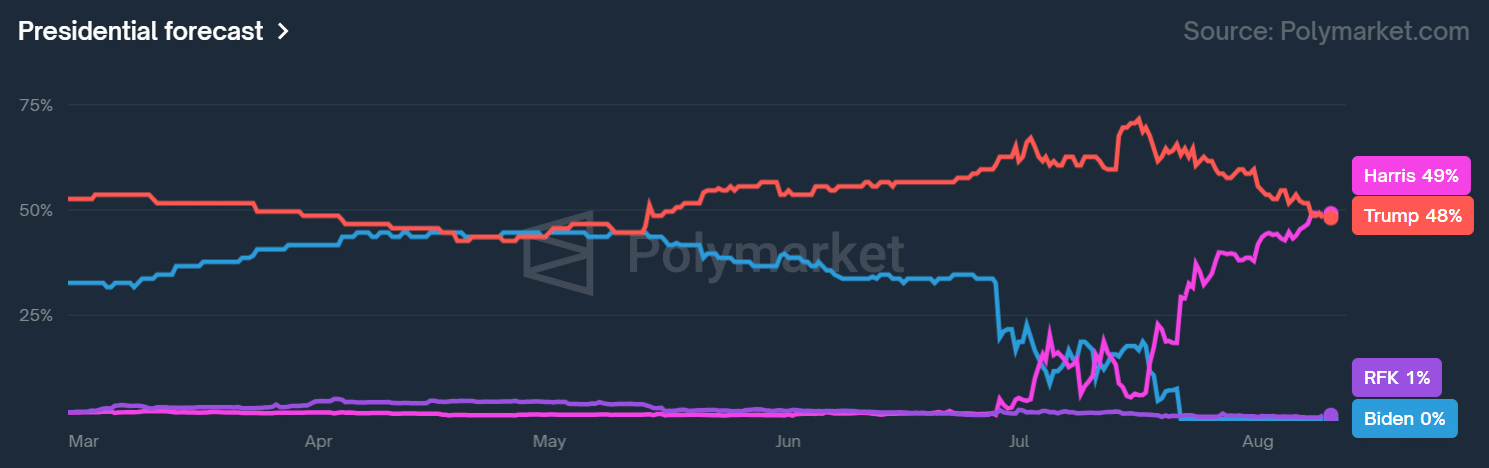

Currently, the likelihood of pro-cryptocurrency contender Donald Trump winning the U.S. elections has decreased to approximately 48%, as per the forecast site Polymarket.

Initially this week, the chances of Trump and Harris both winning were equal. However, as I write this, Harris is ahead at 49% likelihood, while Trump’s chance of victory stands at 48%.

If anything, the data showed that Harris’s potential win couldn’t be wished away.

If she wins, there’s a possibility that the perceived actions regarding enforcement from the Democratic party might continue into the new administration, as suggested by Winklevoss.

At present, the Federal Reserve is acting very cautiously due to the upcoming election. Should Vice President Harris win in November, we can expect them to become less restrained.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- PI PREDICTION. PI cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

2024-08-09 15:04