- Crypto investment products netted $2.2 billion in inflows last week.

- Bitcoin dominated the inflows amid increased chances of Trump winning the U.S. elections.

As a seasoned researcher with years of experience in analyzing financial markets and their dynamics, I have seen my fair share of unexpected twists and turns. Last week’s crypto market was no exception, with an unprecedented surge in inflows amounting to $2.2 billion. This bullish sentiment was primarily driven by the increasing odds of Donald Trump winning the US presidential elections, a fact that has intrigued me more than once.

Over the past week, there was a strong trend among cryptocurrency market investors towards taking on more risk, as evidenced by a significant influx of approximately $2.2 billion.

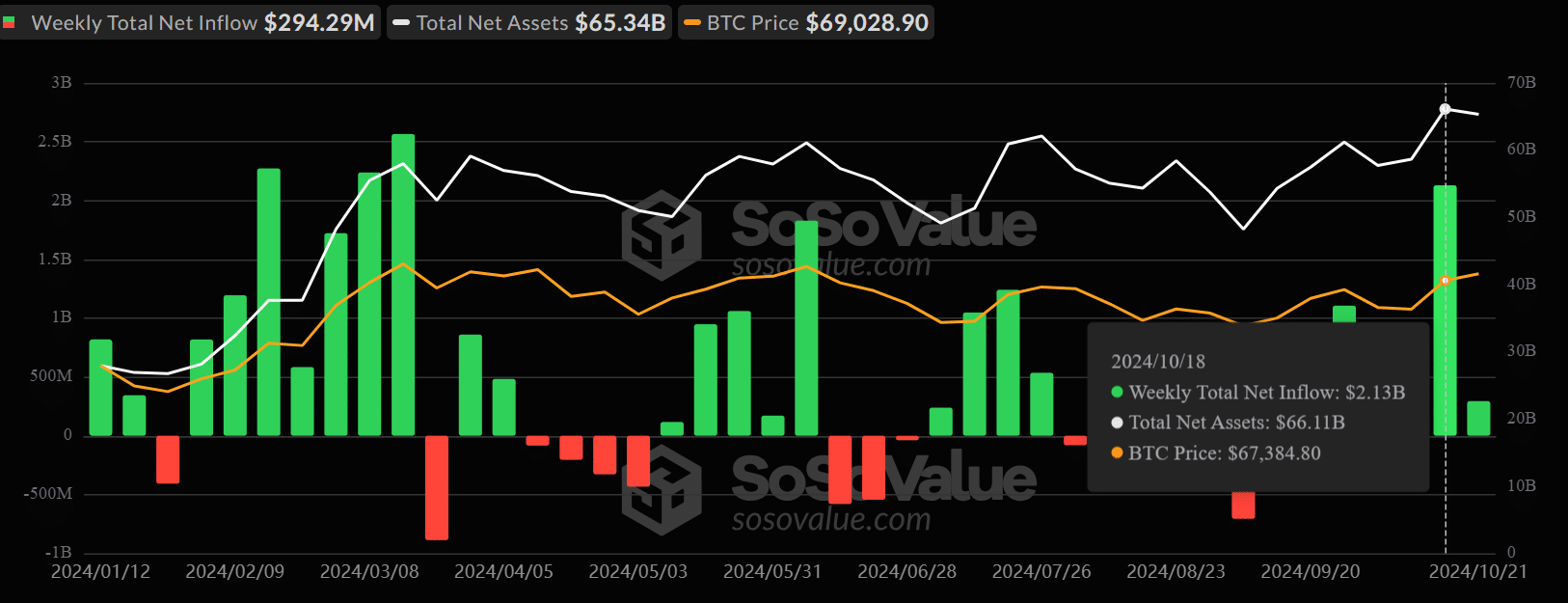

Based on information from CoinShares, this recent increase marked the largest jump since July, indicating a resurgence of optimistic feelings among investors over the last few days.

Trump’s impact on BTC

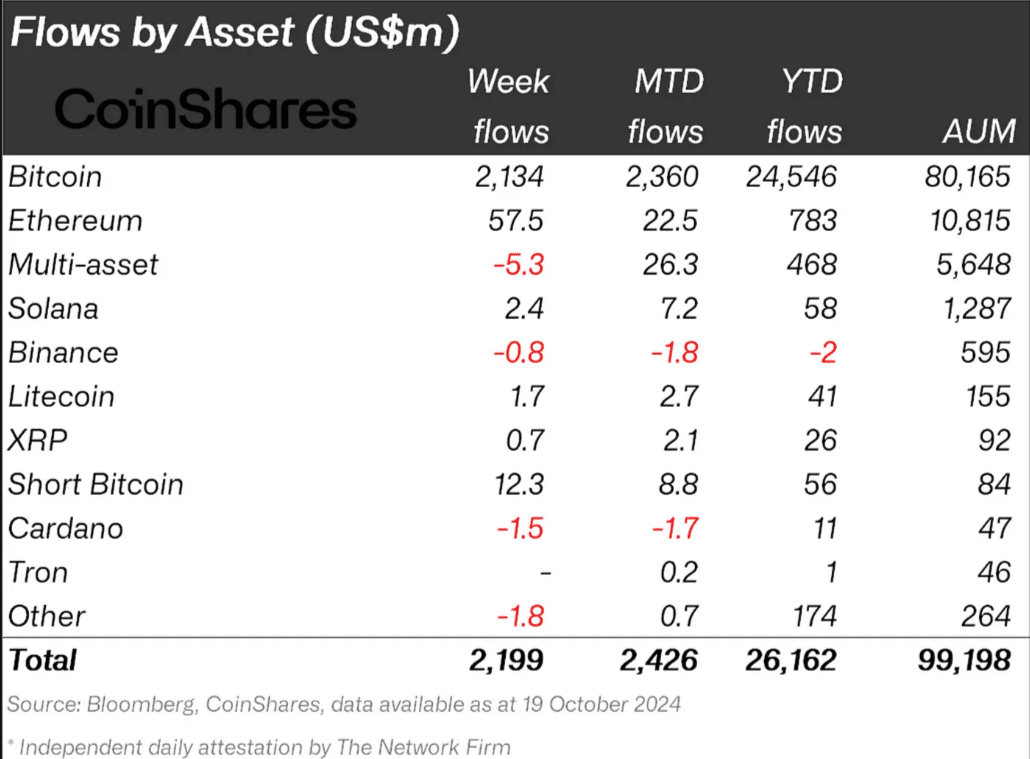

In the past week, Bitcoin (BTC) attracted approximately 99% of the total investment inflows, amounting to a significant $2.13 billion, drawing the most attention from investors.

It was clear that the substantial increases in investments had an effect on the price graphs too; the most significant global digital currency surged approximately 10%, climbing from around $62,400 to more than $69,000.

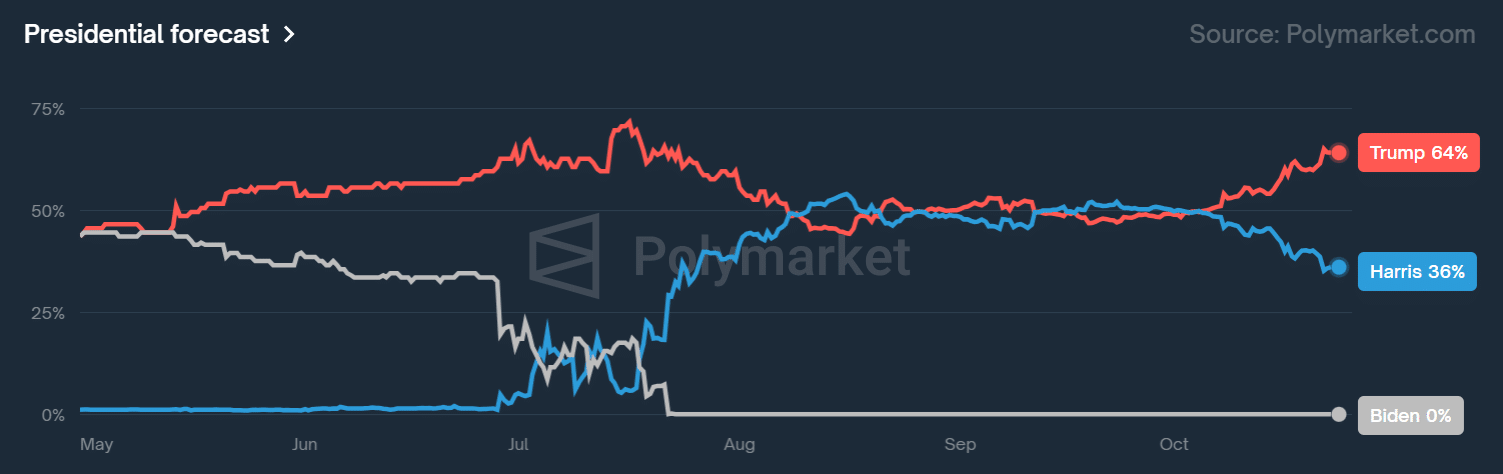

As per James Butterfill from CoinShares, the surge in market optimism can be attributed to the rising probability of Donald Trump’s victory in the U.S. presidential election. In other words, his statement suggests that the markets seem to be more hopeful about Trump winning the presidency.

It appears that people are feeling more hopeful lately due to increasing predictions of a Republican win in the upcoming U.S. elections. Many view the Republicans as being more favorable towards digital assets, which has sparked a chain reaction leading to a surge in positive market trends.

Last week marked the first time since July that betting odds on Trump’s victory at the prediction site Polymarket surpassed 60%.

It stood at 64% at press time, a 28-point lead against Kamala Harris’s 34%.

As per Min Jung’s analysis at Presto Research, the trend might persist over the next few weeks under two specific circumstances.

Should Trump’s influence persist and the Federal Reserve adopts a less stringent monetary policy, there might be a resurgence of Bitcoin’s growth in the ensuing weeks.

Additionally, robust interest in U.S. Bitcoin Spot ETFs has propelled these investments to an unprecedented level. The combined net assets they manage exceeded $66.1 billion, marking a new high.

Additionally, other alternative cryptocurrencies experienced increased activity, as Ethereum (ETH) recorded a trading volume of around $57.5 million and Solana (SOL) reached approximately $2.4 million in transactions.

As the U.S. elections approach within just about two weeks, will the upward trend in the cryptocurrency markets persist?

Indeed, the crypto trading company QCP Capital expressed optimism that the upward trend might prolong, based on their analysis of options data. In other words, they believe the positive momentum could continue.

As an analyst, I’m preparing for a potentially volatile election period. Although Bitcoin (BTC) seems to be leaning towards bullish predictions, it’s currently trading 8% below its peak. On the other hand, I’m opting for put protection for the S&P 500 in anticipation of a potential 1.8% shift following the election results.

It meant that crypto investors were optimistic about upside potential (buying call options) while the US stock market feared pullback (buying put options).

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- WCT PREDICTION. WCT cryptocurrency

2024-10-23 03:37