- Bitcoin ETFs saw significant inflows as the market reacted to potential Fed rate cuts.

- BlackRock increased Bitcoin holdings, reflecting growing institutional interest amid shifting economic conditions.

As a seasoned crypto investor with a knack for deciphering market trends, these recent developments have piqued my interest. The surge in Bitcoin ETF inflows, driven by potential Fed rate cuts, is a testament to institutional interest amid shifting economic conditions. However, Bitcoin’s struggle to break the $65,000 threshold suggests a certain level of confusion among investors regarding the impact of central bank policies on cryptocurrencies.

Over the past few weeks, there’s been a significant increase in investments in Bitcoin Exchange-Traded Funds (ETFs). As of August 26th, inflows amounted to $202.6 million, as reported by Farside Investors.

Even though there’s been an optimistic trend in the ETF market, Bitcoin itself has been finding it tough to exceed the $65,000 mark, currently trading at $62,898 following a 1.11% drop over the past day, as per CoinMarketCap data.

What’s at play?

This difference underscores a wider uncertainty amongst investors concerning how central bank interest rate decisions influence the worth of high-risk investments like cryptocurrencies and equities.

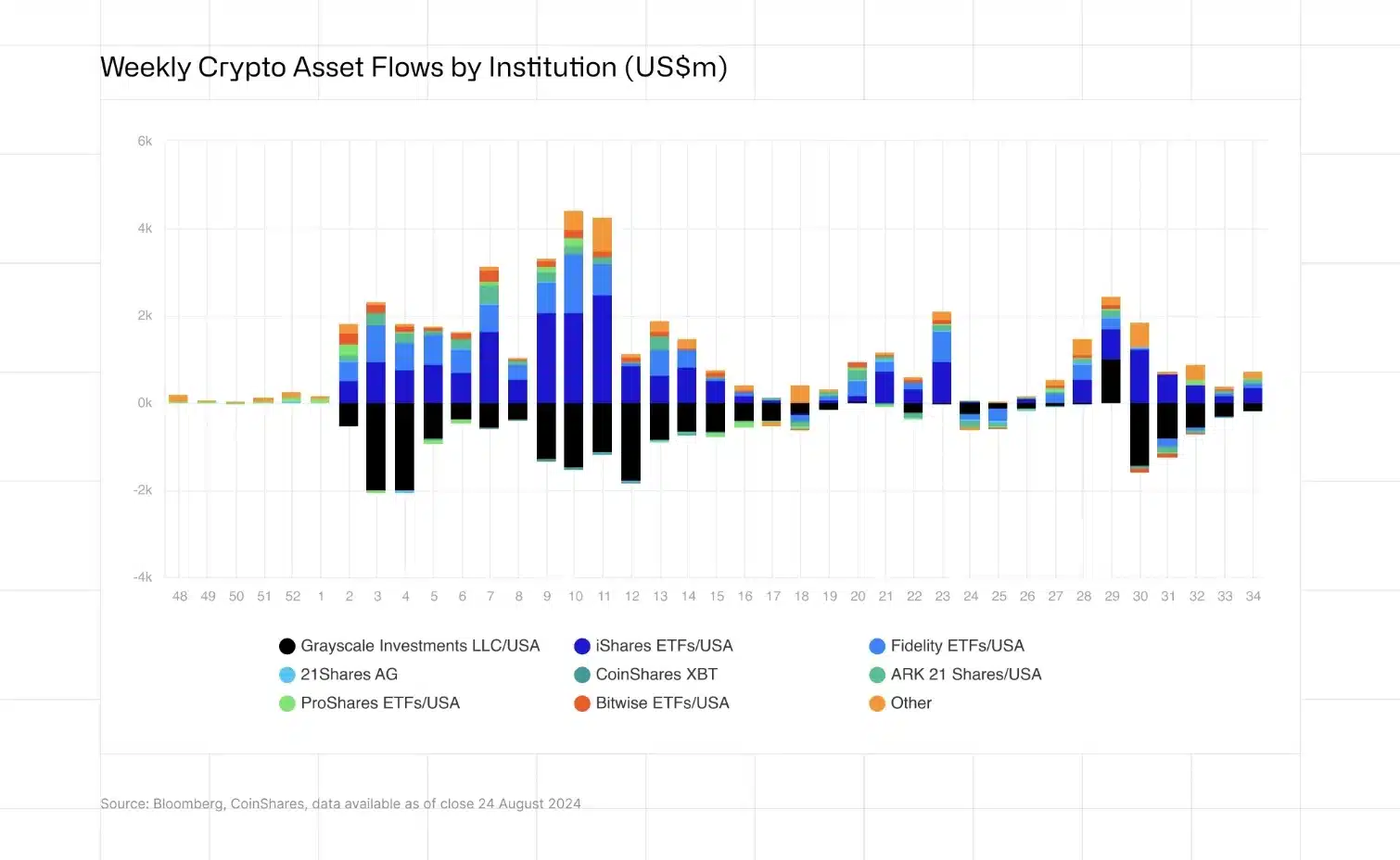

Emphasizing the dynamics within the cryptocurrency market, a recently released report dated 26th August from CoinShares, named “Digital Asset Fund Flows,” indicates…

“Over the past week, there were investments worth $533 million into digital asset investment products. This is the highest weekly inflow in five weeks.”

In response to Jerome Powell’s suggestion about a potential initial interest rate reduction in September, during his speech at the Jackson Hole Symposium, there has been a significant increase in Bitcoin Exchange-Traded Funds (ETFs).

This prospect has sparked a renewed interest in risk assets. Despite a slight dip in trading volumes compared to recent weeks, activity remained robust, with weekly trading reaching $9 billion.

Impact of Fed rate cut on digital assets

The report further stressed on the performance of Bitcoin and noted,

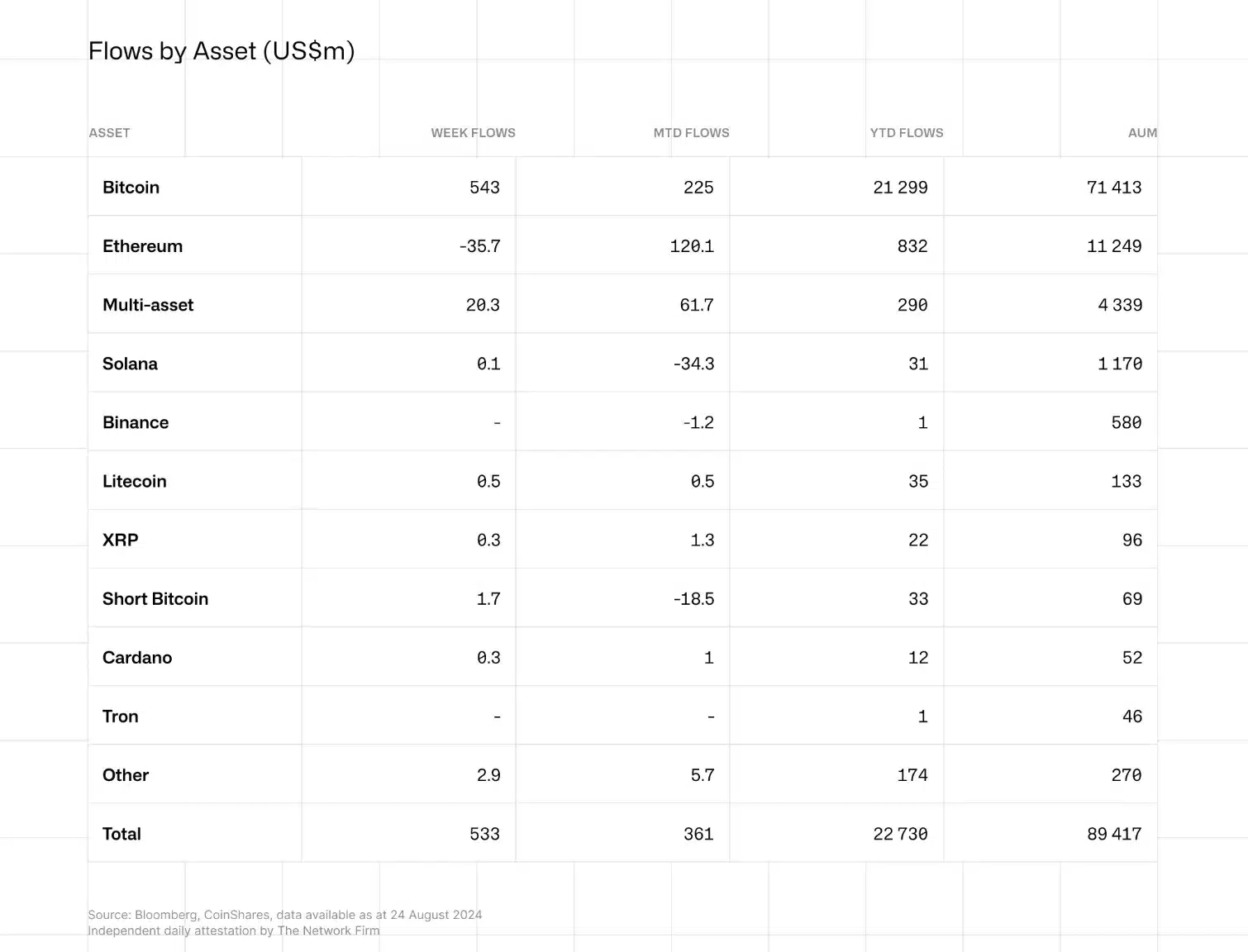

“On Friday, August 23rd, Bitcoin attracted approximately $543 million in investments, with a significant portion coming in on that day. This surge in investment can be attributed to dovish remarks made by Jerome Powell, suggesting that Bitcoin’s value may respond to changes in interest rate expectations.”

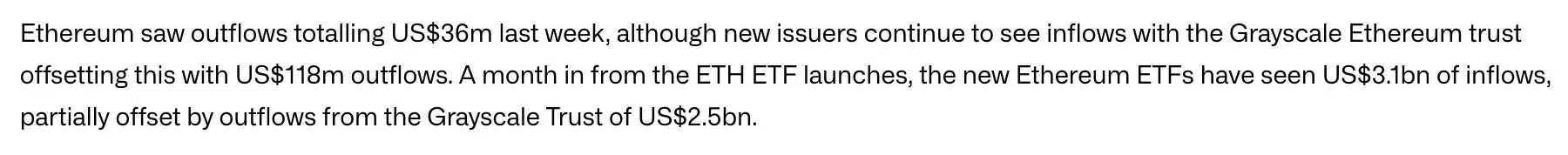

It’s worth mentioning that the report additionally emphasized on Ethereum [ETH] ETFs, pointing out substantial redemptions from the Grayscale Ethereum Trust.

Over the past month, this fund experienced withdrawals amounting to $118 million, which added up to a total outflow of approximately $2.5 billion.

What’s more to it?

Moreover, it’s projected that the Federal Reserve will lower its interest rates by about 2 percentage points within the next year and a half, bringing them down from 5.33% to 3.33%.

The expected relaxation is set to decrease the cost of loans for both households and businesses, along with asset managers. This could result in more available funds (liquidity) and a rise in potential investment options.

Consequently, it’s anticipated that the worth of digital assets will increase, primarily due to an expansion in available funds.

Seeing this coming, many institutions have started increasing and are gearing up.

Initially, it has been revealed that BlackRock has boosted the ownership of iShares Bitcoin Trust shares within its Strategic Global Bond Fund, as per a recent disclosure.

By the end of June, the fund owned 16,000 shares of Bitcoin, an increase from the 12,000 shares mentioned in May’s report, suggesting a rising interest or investment in Bitcoin.

As an analyst, I’m eagerly observing the potential consequences of the Federal Reserve’s interest rate reductions on various asset values. The extent to which these rate cuts play out and influence asset prices is still uncertain, but it promises to be a fascinating development to watch unfold.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-27 20:08