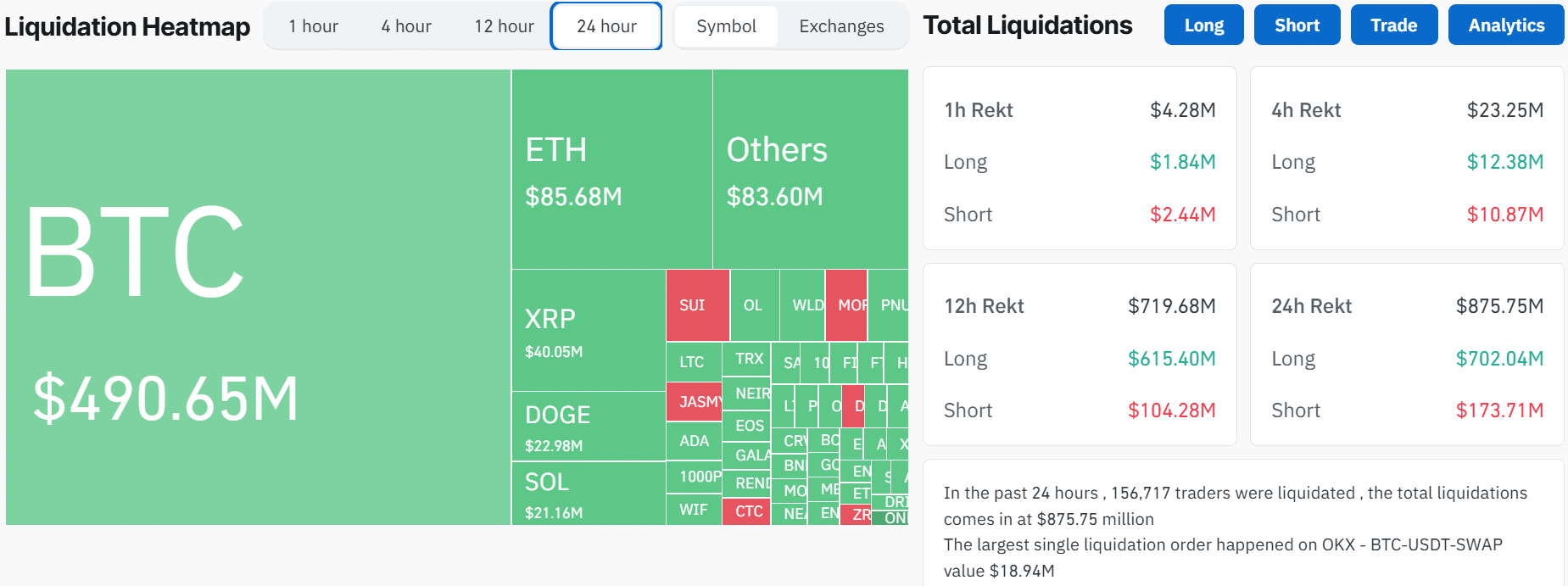

- The total liquidations across the crypto market surpassed $875 million after Bitcoin fell below $100,000.

- Bitcoin long liquidations also surged to a record high of $416 million.

As a seasoned crypto investor with scars from the 2017 bull run and the subsequent bear market, I’ve learned to expect the unexpected in this wild, rollercoaster ride we call cryptocurrency trading. The recent liquidation surge across the market, wiping out over $875 million in a day, is yet another reminder of how quickly things can change in this space.

Over the past day, I’ve witnessed a significant spike in liquidations within the crypto market, amounting to approximately $875 million. This was due to both leveraged long and short positions getting wiped out. It’s been quite some time, but this is the highest volume of liquidations we’ve seen since last year, 2021, to be exact.

According to data from Coinglass, a net amount of approximately $702 million was liquidated in long positions, whereas short positions saw a liquidation of around $173 million. This significant liquidation event impacted over 157,000 different traders.

In simpler terms, people who had placed bets on Bitcoin (BTC) increasing in value suffered the largest losses, with a total of $416 million worth of long Bitcoin positions being closed. This happened after Bitcoin suddenly became more volatile, causing its price to drop from over $100,000 to $92,000 within just four hours.

Additionally, altcoins experienced a small increase in unpredictability. The price of Ethereum [ETH] moved up and down between $3,600 and $3,900, resulting in $85 million worth of liquidations. XRP [XRP] had the third-greatest amount of liquidations at $40 million, while Dogecoin [DOGE] registered $22 million in liquidations.

This unexpected increase in completed trades and market turbulence could possibly be the result of a necessary adjustment following excessive leveraging that led to an unbalanced market situation.

Liquidations surge due to an overleveraged market

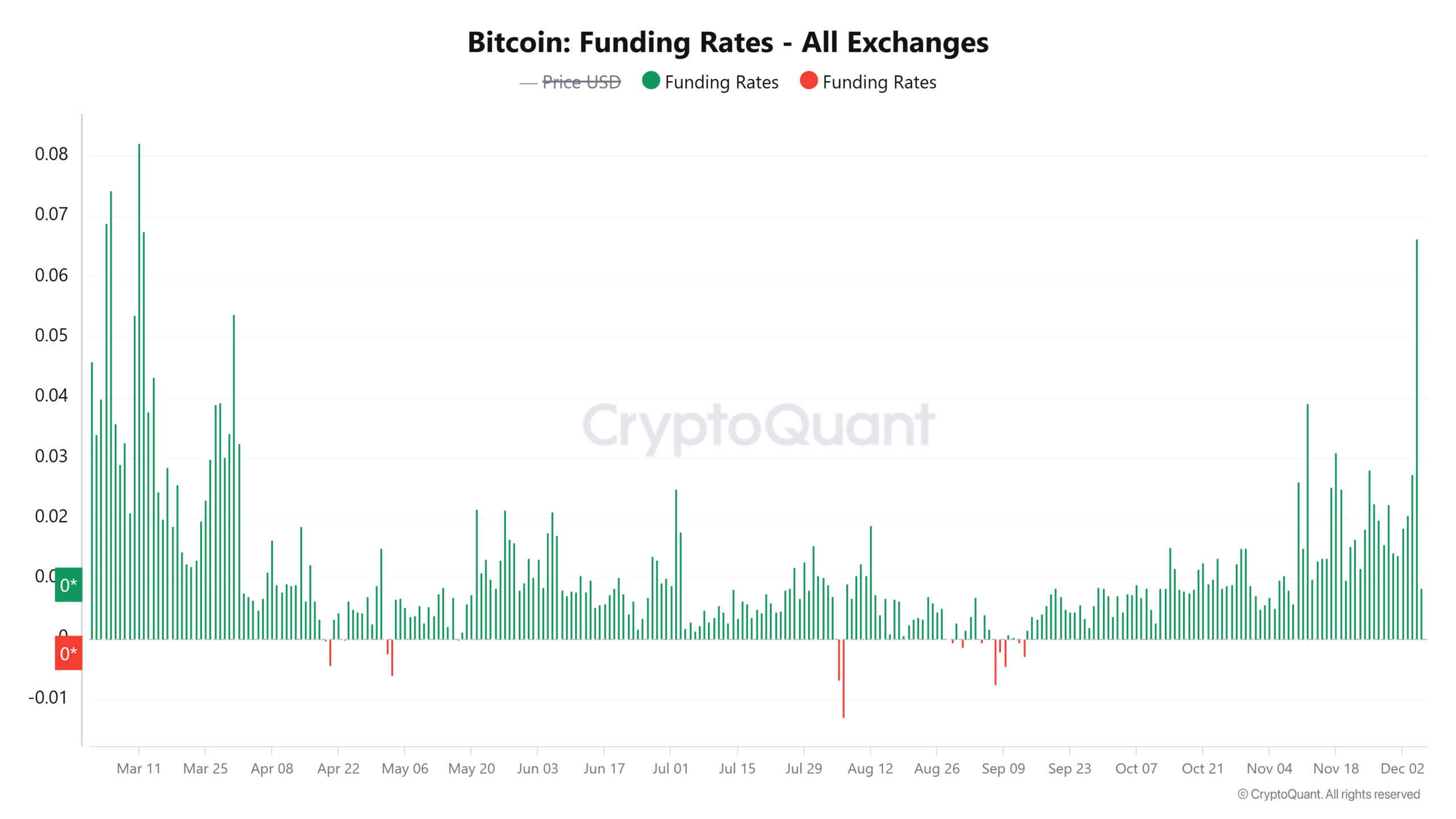

On the 5th of December, Bitcoin’s funding rates peaked at 0.0663, as indicated by CryptoQuant, which implies that long positions were becoming more prevalent compared to short positions over a span of several months.

When funding rates become excessively high or low, they often signal a significant reversal in the market’s direction that investors predict the price will take.

Consequently, as the number of long positions increased significantly, a situation known as a “long squeeze” took place. This led to compulsory selling, ultimately causing the rates for funding to decrease.

The estimated leverage ratio clearly shows the market correction. This metric recorded a sharp rise to a seven-day high, as traders increased their leverage on Bitcoin. It later declined due to overleveraged positions being closed.

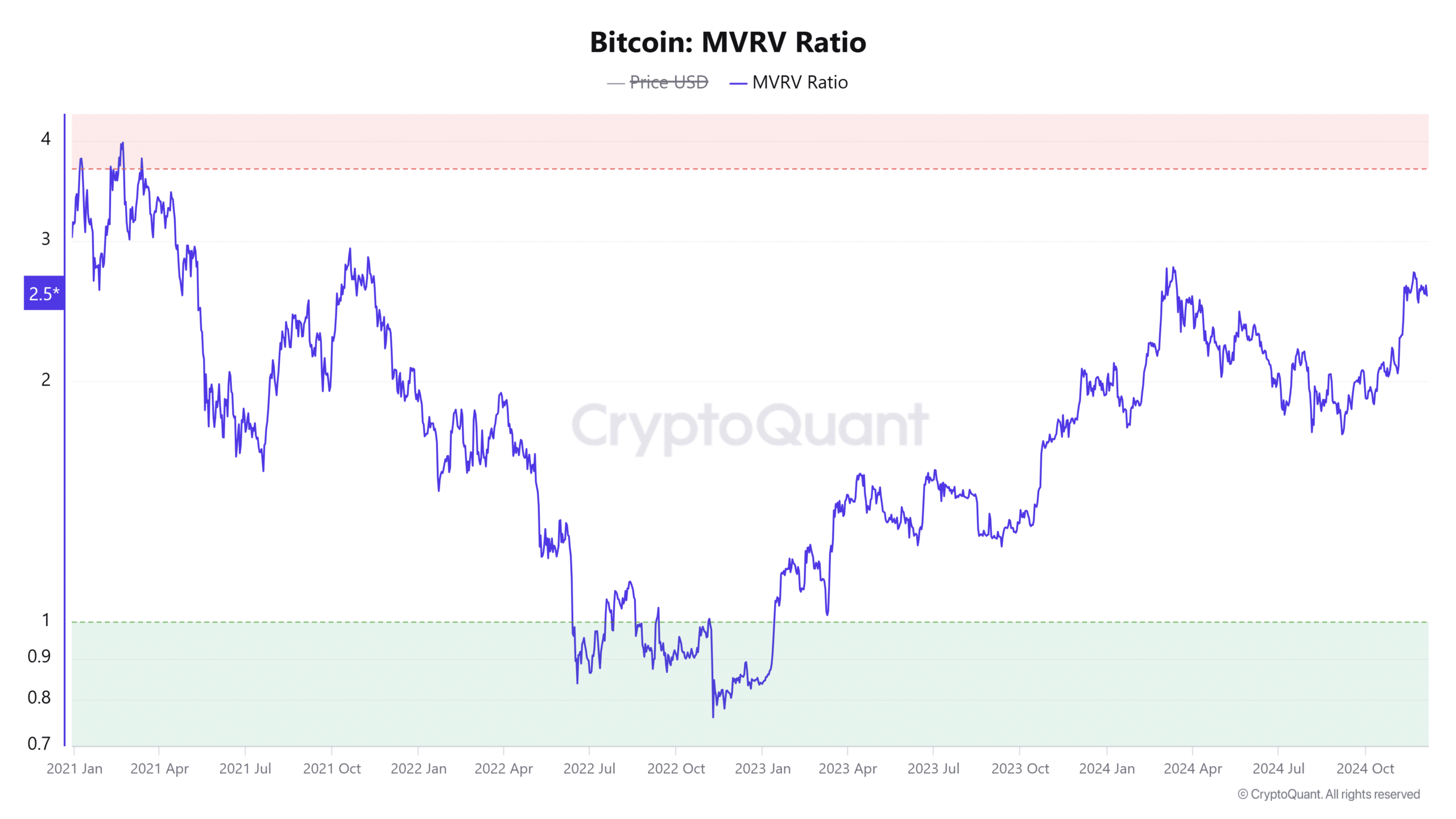

MVRV ratio shows there is still room for more gains

The Bitcoin Market Value to Realized Value (MVRV) ratio indicates that even after the recent downturn, Bitcoin has not yet surpassed its local peak in terms of market value compared to its realized value.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Currently, the Multiple of Realized Value to Price (MVRV) ratio is at approximately 2.5, indicating that Bitcoin’s price seems reasonable given its past performance. Over the past three months, this ratio has risen from 1.72 as more and more Bitcoin holders have seen their investments become profitable.

An increase in the MVRM (Market Value to Realized Value) ratio above 3.5 suggests that Bitcoin might have peaked at its current local level. As such, investors and traders are advised to keep an eye on this indicator as it nears overpriced thresholds.

Read More

2024-12-06 17:11