- Crypto liquidations hit nearly $300 million in just 24 hours, driven by Bitcoin’s sudden price surge.

- Short positions faced the biggest losses, with over $206 million liquidated as Bitcoin broke key resistance levels.

As a seasoned analyst with years of experience navigating the volatile cryptocurrency market, I can confidently say that the recent surge in crypto liquidations is a stark reminder of the inherent risks associated with trading in this space. With over $300 million wiped out in just 24 hours, it’s clear that both long and short positions need to tread carefully.

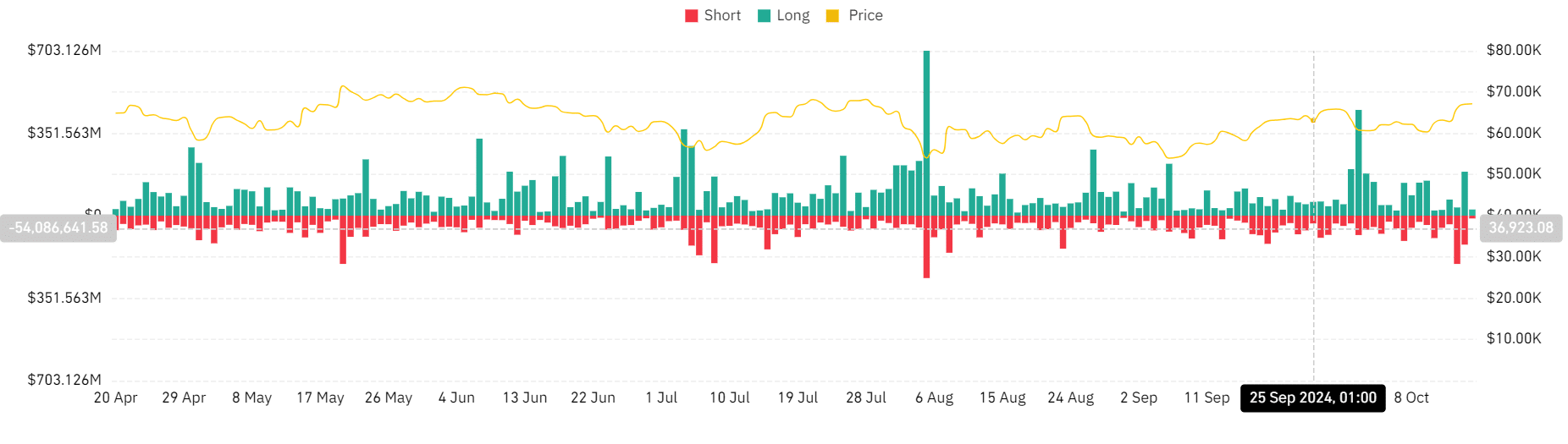

Over the last several days, there’s been a substantial amount of unwinding for both long-term and short-term investments. In fact, cryptocurrency sell-offs alone totaled close to $300 million within a single day.

The reason for the spike in sell-offs was an unexpected rise in Bitcoin’s [BTC] value, breaching a significant barrier, leading to a chain reaction of compulsory sales throughout the market.

Crypto liquidations near $300 million

According to data from Coinglass, the value of crypto asset liquidations reached nearly $240 million on October 14th.

In this scenario, short positions experienced significant losses, amounting to roughly $206 million in liquidations, contrastingly, long positions resulted in around $35 million of liquidations.

Yet, the scenario took a turn during the subsequent trading day. On that day alone, long position closures exceeded $187 million. Meanwhile, short positions were further squeezed, experiencing approximately $123 million in forced liquidations.

The sum we’re talking about here was the second biggest liquidation incident of the month, with the $500 million liquidation on October 1st being the largest.

Currently, long positions are experiencing losses, having already seen over $25 million worth of liquidations during today’s trading.

Bitcoin liquidations show strong consistency

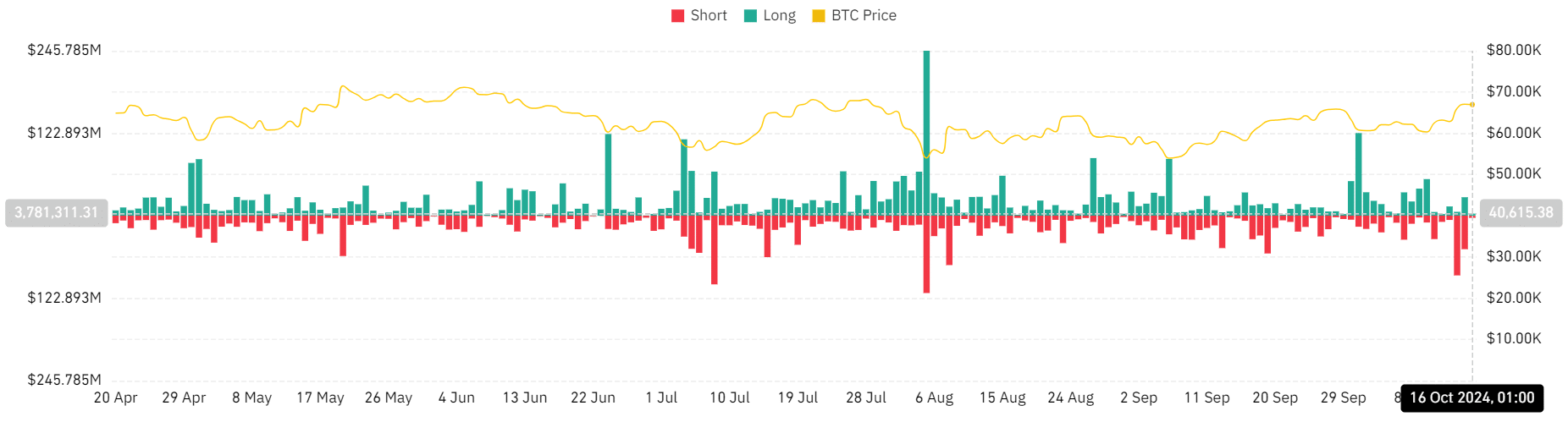

The sudden increase in Bitcoin’s price recently resulted in a chain reaction of crypto asset liquidations, particularly among those who had short positions (betting on a decrease in price). After a long spell of little price fluctuation, Bitcoin experienced a significant spike, causing these liquidations.

According to AMBCrypto’s examination of the liquidation graph, on October 14th, more than $94 million worth of Bitcoin was liquidated. The majority of this, approximately $89 million, was from short positions.

During this session, small sell-offs decreased nearly to $50 million, whereas buy-offs increased to approximately $27 million.

As an analyst, I’m observing a trend that indicates Bitcoin’s recent price escalation appears to have had a more significant impact on short traders, as the cryptocurrency’s momentum continues to grow.

Bitcoin price trends

As a researcher examining the Bitcoin market, I noticed an intriguing event on the 14th of October. The price of Bitcoin unexpectedly spiked by over 5%, leading to a substantial impact. This surge triggered massive liquidations for those holding short positions, resulting in approximately $200 million being wiped out from these positions.

Read Bitcoin’s [BTC] Price Prediction 2024-25

On the next day, Bitcoin maintained its rising trend, registering a 1% growth. In this instance, most of the losses in the liquidation market were shouldered by those holding long positions.

Currently, as we speak, Bitcoin was being exchanged at around $67,000, demonstrating a minor rise that contributed to the intricacy of the ongoing crypto market liquidation pattern.

Read More

2024-10-17 02:15