- More than $300M was liquidated from the crypto market, as prices retraced from the weekend rally.

- Bitcoin dropped from $62K to below $59K before making a slight recovery.

As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I find myself constantly amazed by the rollercoaster ride that is the crypto market. Today’s liquidations, totaling over $300M, are a stark reminder of the risks inherent in this space. The steep drop in Bitcoin’s price from $62K to below $59K is particularly noteworthy, given its recent meteoric rise.

Today saw significant losses in the cryptocurrency market, causing substantial damage to derivative traders. According to Coinglass, there were approximately $320 million worth of liquidations in the futures market at the time of writing. Traders who held long positions suffered the most, with around $285 million being liquidated.

This occurs during a significant decrease in prices, causing the overall value of the crypto market to plummet by 6.7%. Consequently, all the leading cryptocurrencies within the top 50 by market capitalization were experiencing losses as well.

As a crypto investor, I’ve seen a significant dip in the value of Bitcoin (BTC) this week, with it dropping approximately 6% to reach a low of around $58,000. Fortunately, there’s been a slight recovery, and at the moment of writing, Bitcoin is trading at $59,430.

The price of Ethereum (ETH) fell by 7.8%, now trading at around $2,430. Solana (SOL) saw a drop of 6.8%, currently valued at approximately $148. XRP and Dogecoin (DOGE) also experienced decreases of 3.7% and 6% respectively.

What caused the liquidations?

According to Santiment’s analysis, the liquidations were caused by excessive market optimism. After the rebound on the 25th of August, long positions were significantly increased, leading to a significant surge in funding rates that ultimately led to liquidation.

It’s possible that broader factors may contribute to the market volatility we’re seeing. Upcoming is what many are calling Nvidia’s most significant tech earnings report. According to CNBC, these results from Nvidia will establish a trend for the markets prior to the release of other crucial economic data next month.

Earnings reports from Nvidia often lead to market fluctuations. Should the semiconductor manufacturer exceed its Q2 earnings projections, this might trigger a surge in the cryptocurrency sector. Conversely, failing to meet expectations could potentially exacerbate existing downtrends.

Will BTC price rebound?

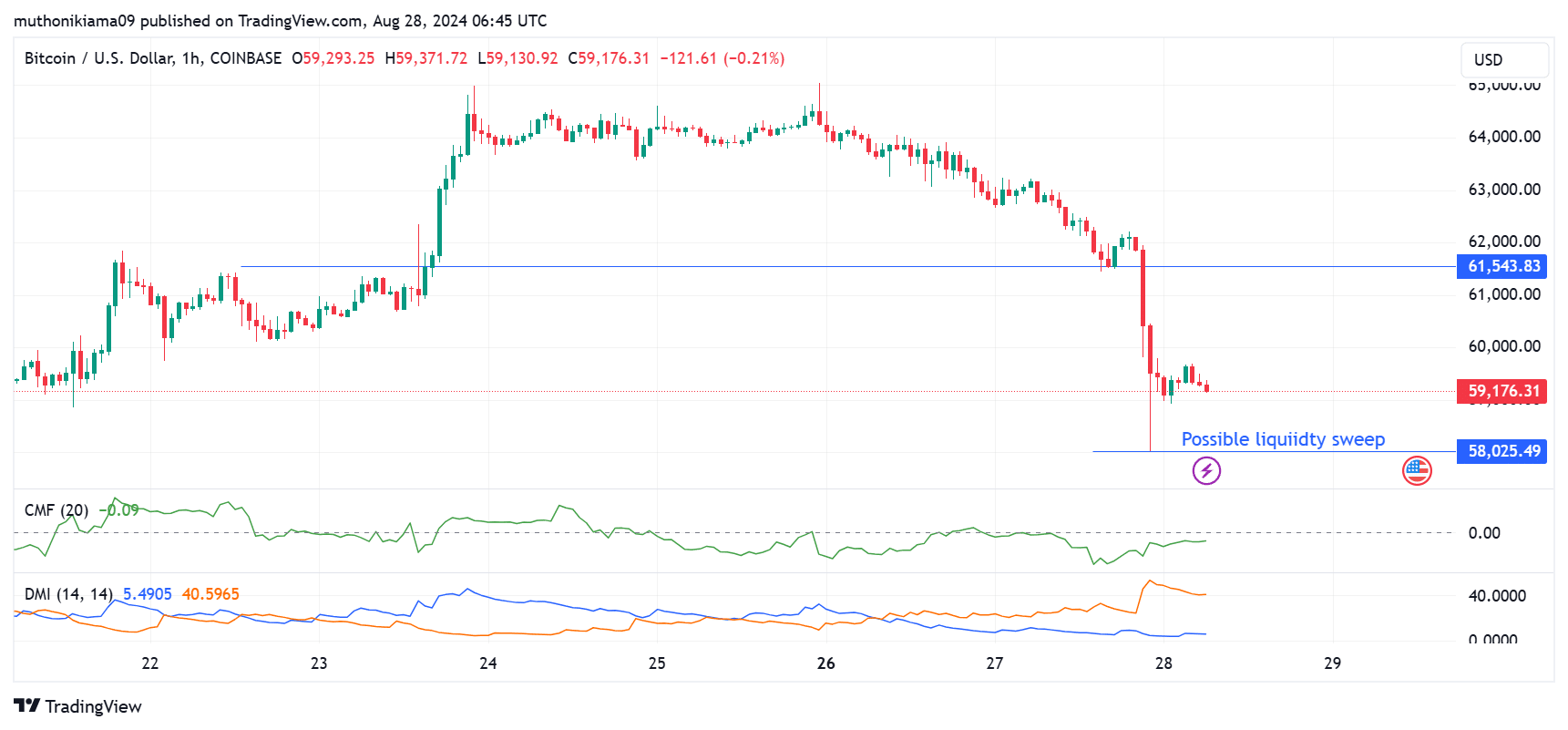

The price of Bitcoin couldn’t sustain itself above the $61,500 mark, leading to a significant drop. Prior to this, from August 23rd, Bitcoin had been trading above that level, with this support helping to fuel an upward trend.

At the current moment, the Chaikin Money Flow indicates a dominant trend of selling activity. This is because the selling pressure has overtaken the buying pressure, as evidenced by the CMF. Notably, the buying pressure waned following the upward momentum over the weekend, implying that there hasn’t been sufficient buying interest to influence the price dynamics significantly.

The evidence supporting the pessimistic viewpoint becomes even stronger when considering the Directional Movement Indicators (DMI). In this context, the Positive DI is significantly lower compared to the Negative DI, implying that the downward or bearish trend has greater strength over the upward or bullish trend.

Traders should also watch out for a possible liquidity sweep at the $58K level.

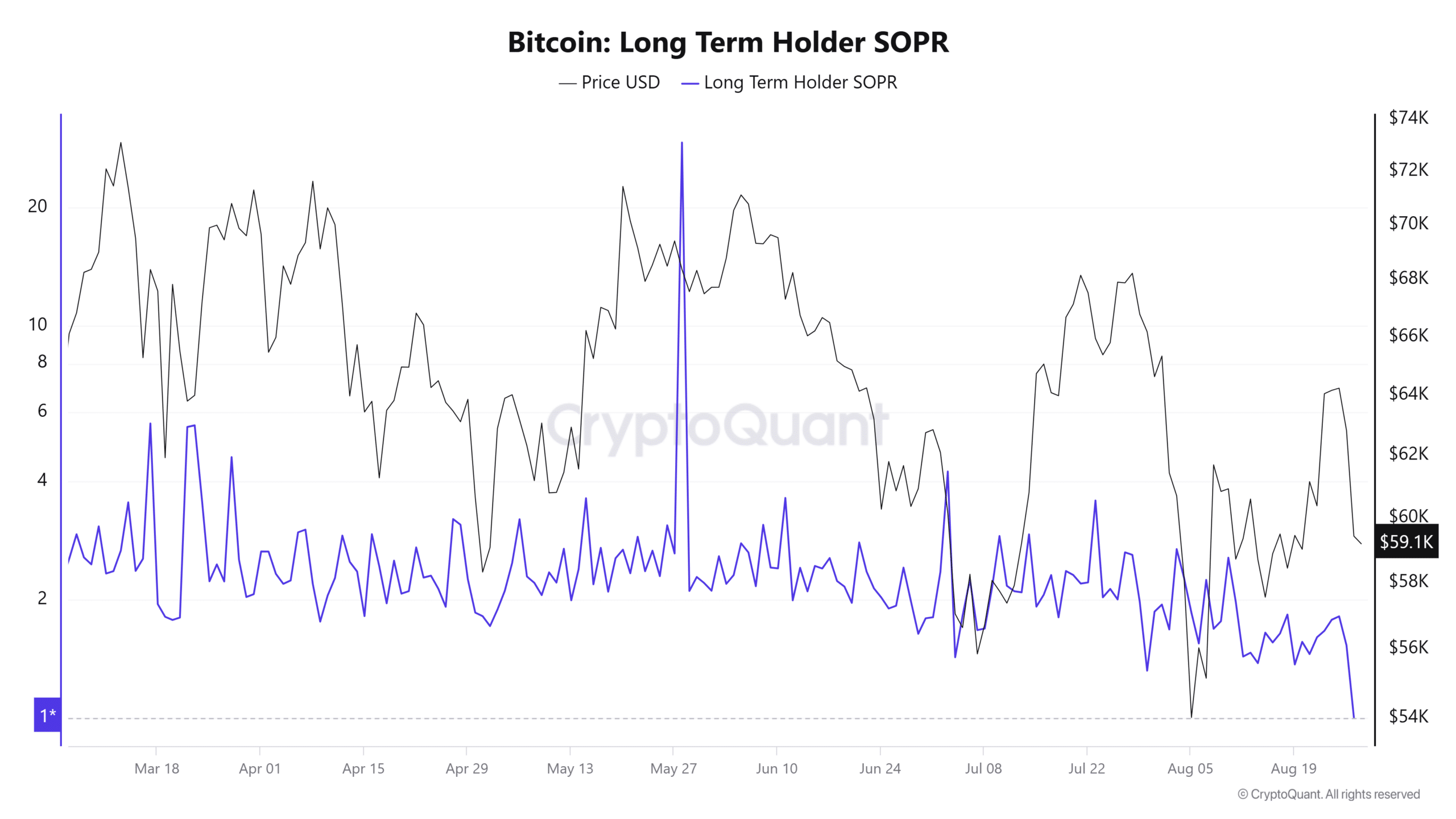

Based on on-chain analysis, it appears that the recent decline has driven long-term investors to a point where their initial investment is balanced (break-even). The last time we saw this group at this juncture was on August 5th. Following this, there was a significant upward price adjustment.

Based on my extensive trading experience, I believe that this particular metric might suggest a local bottom has been reached. This is because whenever I’ve seen similar patterns in the past, the market has usually bounced back, and I’ve managed to profit from it. So, if my interpretation is correct, we could potentially see an upturn in the price soon.

According to data from IntoTheBlock, over 3 million wallets acquired Bitcoin when its price was within the range of $58,000 to $62,000. If Bitcoin’s upward trend continues, the price point of $62,355 could serve as a significant barrier or resistance level.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

2024-08-29 01:12