- The crypto market retraced slightly as markets brace for Eurozone CPI and FOMC minutes to be released this week.

- The futures market shows increasing use of leverage, with more traders leaning towards short positions.

As a seasoned analyst with over two decades of experience in the financial markets under my belt, I find myself standing at the precipice of yet another intriguing juncture in the crypto market. The recent retracement, coupled with the looming release of key economic data and FOMC minutes, has set the stage for an exciting week ahead.

On Monday, August 19th, the value of the cryptocurrency market dipped slightly. As of when this text was written, the total crypto market capitalization had decreased by approximately 3%. The two biggest cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), were both being traded at a loss.

At the moment of reporting, Bitcoin had slipped below the significant level of $60,000 and was hovering around $58,000. Similarly, Ethereum, the leading altcoin, was exhibiting a downward trend, trading near $2,570.

Currently, the Crypto Fear and Greed Index stands at 28, indicating a predominant sense of fear in the market. Yet, with upcoming releases like the Eurozone Consumer Price Index (CPI) and the Federal Open Market Committee (FOMC) minutes, there’s potential for a shift in sentiment due to the information these data sets provide.

Eurostat predicts a rise in inflation for July, with an estimated rate of 2.6%, compared to the previous month’s 2.5%. The upcoming Consumer Price Index (CPI) data, set to be published on August 20th, is anticipated to impact the European Central Bank’s decision regarding interest rates.

The ECB started trimming rates in June before pausing in July.

For the July meeting in the United States, the FOMC (Federal Open Market Committee) minutes will offer insight into the Federal Reserve’s accommodating policy standpoint, following their decision to keep interest rates steady during the previous month.

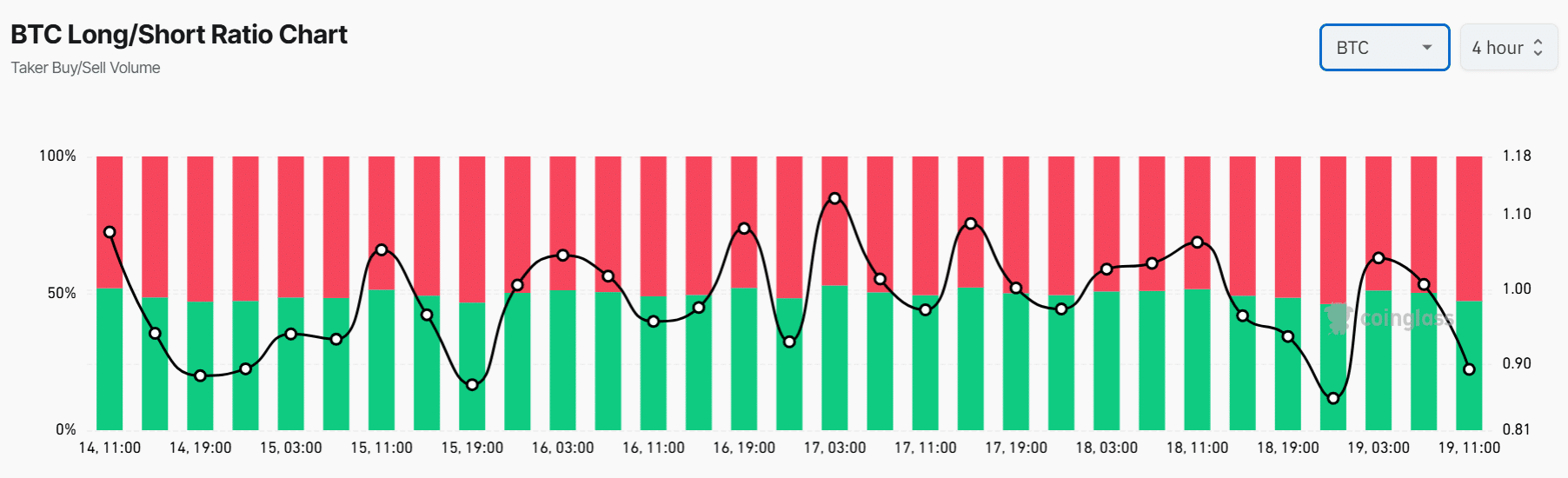

Short traders increase bets

Following the dovish Federal Open Market Committee (FOMC) meeting I recently observed, I noticed that the subsequent crypto market didn’t experience a significant surge as expected. It seems that traders are preparing their positions in anticipation of a similar outcome.

In the Bitcoin futures market, there’s been a decrease in the number of long (buy) positions compared to short (sell) ones. The long/short ratio has fallen from a neutral state of 1 to 0.89, suggesting that more traders are now taking short positions, indicating they believe Bitcoin’s price will decrease.

At the moment of reporting, Bitcoin funding rates turned negative since the Open Interest decreased slightly to approximately $30 billion, implying that long-term traders were vacating their positions.

As I delve into the intricacies of the crypto market, it’s evident that Ethereum led the pack in terms of liquidations at this point in time. Over the past 24 hours, a staggering $30 million worth of ETH was forcibly sold off, with approximately $27 million of those long positions.

1. In recent times, many long-term traders have decided to wrap up their investments as more and more traders opt for short positions. The ratio of long to short Ethereum futures trades has fallen to 0.85, indicating that a majority of 54% are now holding short positions.

As reported by CryptoQuant’s author Crypto Sunmoon, the rising action observed in the futures market indicates that the bulls are continuing their momentum.

The analyst noted that investors are beginning to take risks, which usually happens during bull markets. “The reckless use of leverage by risk-taking investors will fuel the crypto bull market,” the analyst said.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-08-20 12:07